Categories

Sacrificing profitability for rapid growth is a classic SaaS startup strategy. But that doesn’t mean you need to take on an unsustainable hyper growth-at-all-costs mindset.

The SaaS Rule of 40 gives you a benchmark to drive growth sustainably. Knowing how to calculate it helps you measure the health of your SaaS business and maximize valuation

Table of Contents

Why is the Rule of 40 important in SaaS?

According to Techstars Co-founder Brad Feld in 2015, the Rule of 40 says that a healthy SaaS company has a combined growth rate and profit margin of 40% or more. For example, you could grow 40% quarter-over-quarter with a profit margin of 0%. By that definition, there are times when losing money isn’t a problem at all.

This makes the Rule of 40 one way to balance tradeoffs between revenue vs. profit: investors may consider an unprofitable business healthy if it generates enough revenue as a tradeoff. If your company’s growth rate is 60% or more, you could lose 10% or 20% and still be “healthy.” But the SaaS Rule of 40 isn’t the right benchmark for every company.

When Should You Track the Rule of 40?

Generally speaking, the Rule of 40 is more reliable for mature companies than young ones in the SaaS industry.

Young companies with venture capitalist backing have volatile Rule of 40 numbers. You’re trying to hit the T2D3 path to $100 million in revenue. And a few big customer signings could put your growth rate at a high level that’s unsustainable. Or, you may invest heavily in R&D as well as sales and marketing to find product/market fit and achieve rapid growth. That limits profitability in the early days. But fast-growing companies could capture enough market share to make short-term losses worth it.

As growth slows and your company matures, you need to strike a better balance. But what does “mature” mean in this context?

According to Feld, “mature” means the stage in a company’s life cycle where you are hitting at least $1 million in monthly recurring revenue (MRR). For his Techstars Co-founder David Cohen, it means having annual recurring revenue (ARR) of $15-$20 million. And for others, it means having closer to $50 million in annual revenue. Focusing too heavily on the Rule of 40 in the early stages of your SaaS business can lead to strategic missteps.

Experienced SaaS executive and investor Dave Kellogg has said that “many companies target R40 compliance too early, sacrifice growth in the process, and hurt their valuations because they fail to deliver high growth.” The Rule of 40 may not be a perfect metric. But as companies grow, it can be a valuable SaaS benchmark for sustainability. And it’s especially important to track if you’re gearing up for a new round of venture capital funding.

How To Calculate the SaaS Rule of 40

Calculate the SaaS Rule of 40 by adding growth rate percentage to profit margin for a given time period. You can see the quick Rule of 40 formula below.

Getting your Rule of 40 number isn’t difficult. It’s a simple formula. But if you want an accurate calculation, you need to make sure you’re using the right inputs for your key drivers—growth and profit.

SaaS Rule of 40 Calculator

Your Rule of 40 Number

0 percent combined

Find the Right Revenue Growth Input

MRR is the best growth metric for the Rule of 40 calculation because the majority of SaaS revenue comes from subscription pricing models. But MRR isn’t a generally accepted accounting principle (GAAP) value. It doesn’t show up on financial reports as a GAAP revenue metric.

For easy access to MRR, you need to focus on accruals in financial statements. Amortization extends MRR across a full 12 months. That gives you a standardized baseline for quarterly Rule of 40 tracking. And it allows you to pull MRR straight from your profit and loss (P&L) statements for your calculations.

Another option for the growth input is to use total revenue instead of recurring revenue. According to Ben Murray, “The SaaS CFO,” total revenue growth may make more sense if subscription revenue accounts for less than 80% of your total. For example, if professional services make up 30% of your revenue, limiting Rule of 40 calculations to MRR or ARR could lead to inaccuracies.

Choose an Accurate Profit Measurement

The right profit measurement for the Rule of 40 will depend on your SaaS business model. But your EBITDA margin is usually the best option.

EBITDA is a non-GAAP revenue metric that stands for earnings before interest, taxes, depreciation, and amortization. It’s a great way to measure profitability for software companies leveraging cloud services to deliver their products.

When you use a service like AWS or Azure to deliver your product, your cost of goods sold (COGS) increases alongside revenue. You have high margins because you don’t need to account for things like equipment purchases or hardware asset depreciation. And that’s why EBITDA works as a measure of gross margin.

But if you aren’t using cloud services to deliver products, you may need a different profit measurement. Other options are EBIT (earnings before interest and taxes), free cash flow, net income, or net operating income. Check out our page on operating income vs EBITDA to learn more.

The Benefits of Tracking Rule of 40

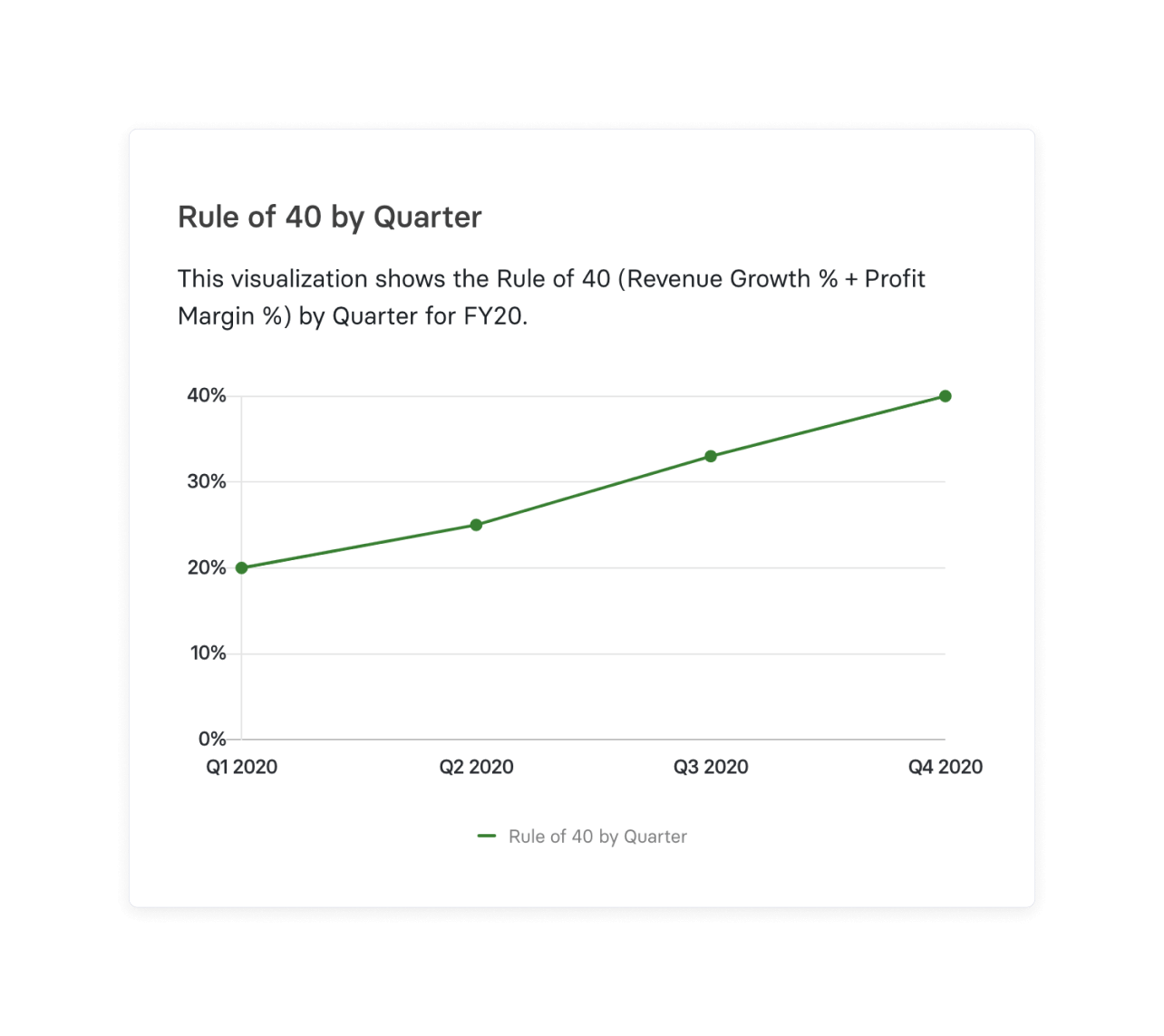

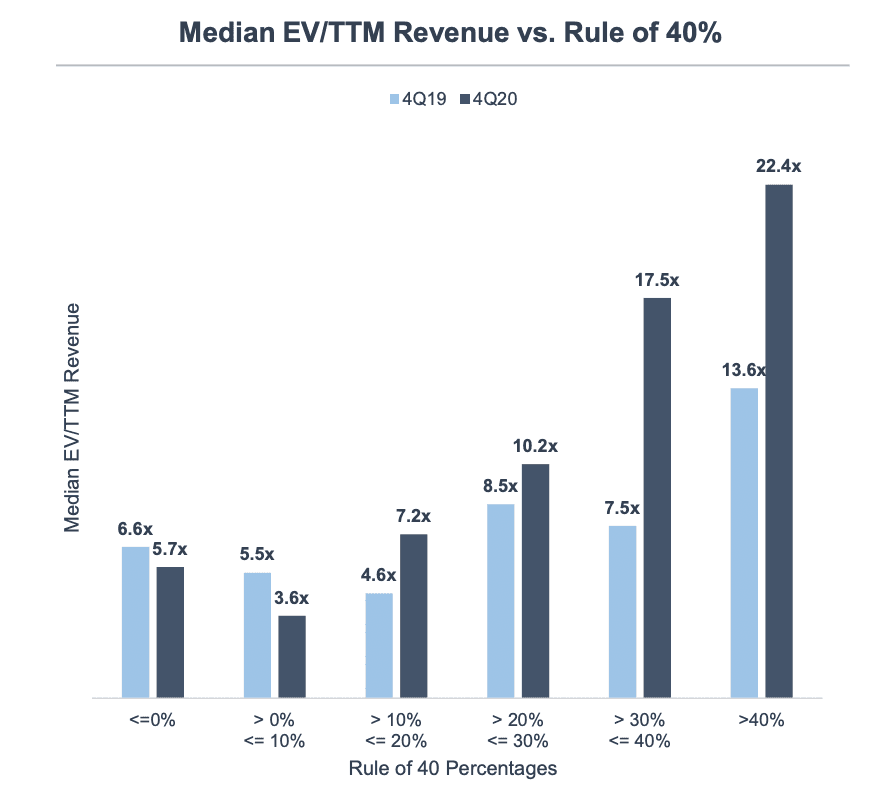

The main benefit of tracking Rule of 40 is that it gives investors a benchmark to measure your business. Hit it quarter after quarter, and you might be able to increase valuation for funding rounds or an eventual IPO. The Software Equity Group found a clear correlation between a valuation and the 40% rule of thumb. It highlighted public SaaS companies like Zoom, Twilio, and Datadog as examples of companies that beat the Rule of 40. Those companies saw valuations skyrocket because of it. The graph below shows what could happen to SaaS valuation if you exceed 40% in your Rule of 40 calculation consistently.

Here, meeting or exceeding the Rule of 40 leads to enterprise values at much higher revenue multiples than for companies that fall short. Even a slight dip under 40% could result in a 5x difference in your company’s valuation.

These companies made the Rule of 40 work for them and reaped the rewards. There’s a lot more that goes into maximizing your company’s valuation than complying with the Rule of 40. But having a strong balance between growth and profitability is a great way to earn investor trust and maximize your valuation.

An Easier Way to Track SaaS Rule of 40 and Benchmark Business Health

If it was so easy to generate a high profit and drive rapid growth, everyone would do it. The SaaS Rule of 40 gives a reasonable benchmark. But startups run into trouble with the Rule of 40 and other efficiency metrics and operational KPIs like the SaaS quick ratio when they rely on them too much as a framework for success. You also need a strong handle on your unit economics to plot a path forward for sustainable growth and profitability. That includes crucial SaaS financial metrics like customer acquisition cost (CAC), customer lifetime value (LTV), churn, cash flow, etc.

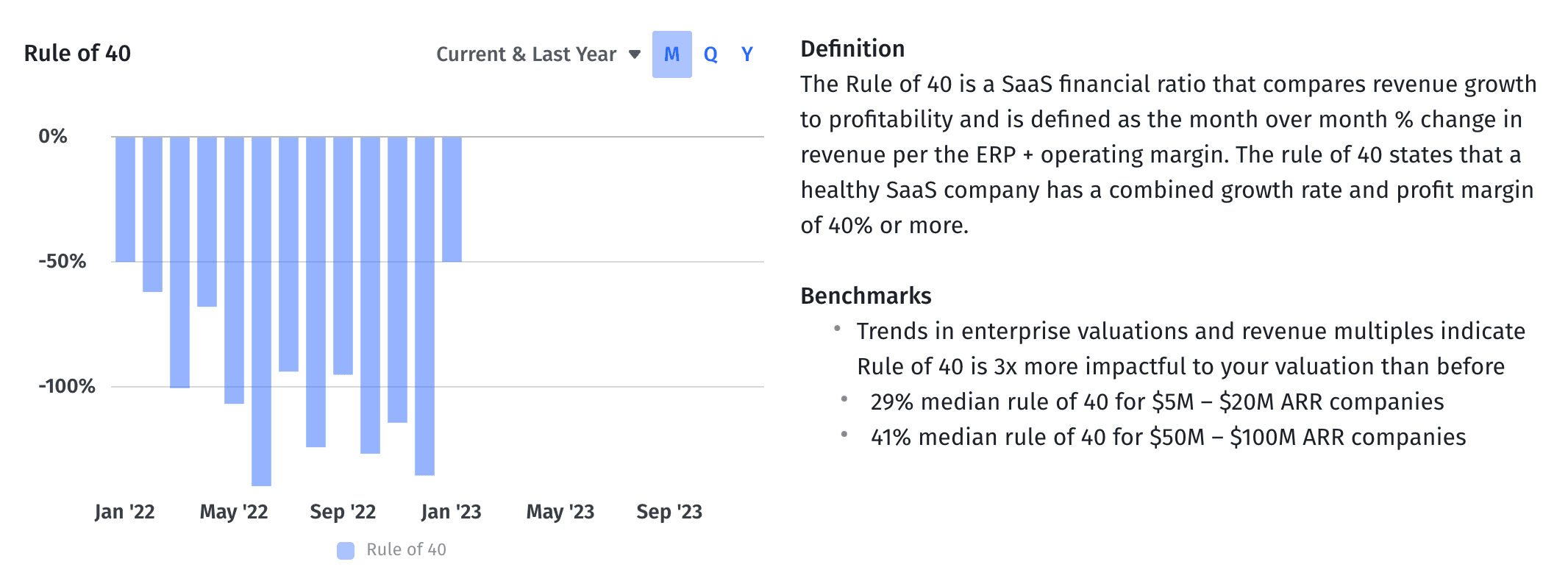

Mosaic automatically calculates all these important metrics for you. It gives you real-time visibility into growth rate and profitability as well as other critical financial metrics. Our platform pulls financial analytics data from your most important business systems. That means you spend less time collecting data and more time figuring out how to grow quickly with increased profitability.

In Mosaic, you can pull different levers in your forecasts with a few clicks and see how they’ll impact your balance between growth and profitability. And you can model different scenarios to solve complicated strategic challenges.

The health of your SaaS business is too important to only track with a quarterly or annual Rule of 40 calculation. Get a free demo of Mosaic to learn how to get a more comprehensive overview of business health and chart a path to balancing growth and profitability.

Rule of 40 FAQs

How do you calculate growth rate?

To calculate growth rate, you first need to choose a metric and a period of time you want to calculate growth for. You could, for example, choose to calculate your MRR growth rate over 12 months. Once you’ve selected your metric and time period, you subtract the value at the beginning of your time period from the value at the end of it, then divide that total by the value at the beginning of your time period. Finally, you multiply the result by 100 to get a percentage.

Let’s say you wanted to know your MRR growth rate over the last 12 months. Your MRR 12 months ago was $100,000. Your MRR this past month was $500,000. To calculate your growth rate, you would subtract $100,000 from $500,000 to get $400,000. You would then divide $400,000 by $100,000 to get 4 and multiply by 100 to get a growth rate of 400% YOY.

How do you calculate profit margin?

What is the Rule of 40 in SaaS?

What is a good SaaS company growth rate?

Explore Related Metrics

Own the of your business.