Customer Lifetime Value (CLV or LTV)

What Is Customer Lifetime Value?

Customer lifetime value is the estimated amount of money received from a customer over the entire length of their relationship with a business. CLV, or LTV, tells you exactly what you need to know about how well your product resonates with your customers, what you’re doing well, and which areas need improvement. It’s a critical metric for calculating the return on acquisition costs and understanding the long-term outlook of your business model.

Categories

Every customer who buys your product represents the beginning of a potentially beautiful new relationship—and as with any budding romance, you’re probably wondering, “How much does this person like me (i.e., my product or service)?” “Will we burn hot and fast or long and slow?” “Can we grow together?” “Will their friends and family like me?” Luckily, there’s a way to gauge which customer relationships deserve to be nurtured and which were doomed before they began — no awkward conversations or gossip brunches required. It’s called customer lifetime value.

Table of Contents

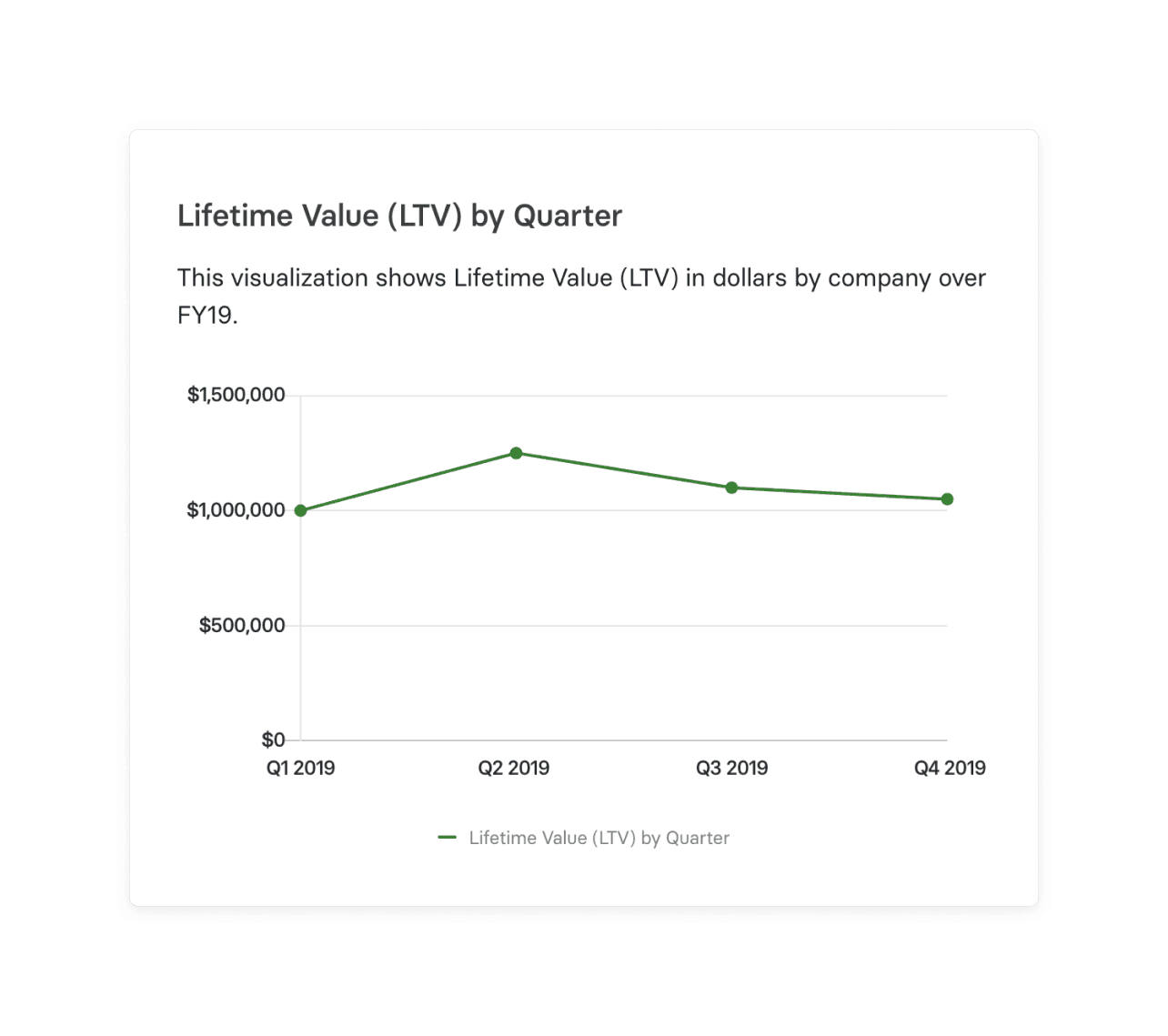

How Do You Calculate Customer Lifetime Value?

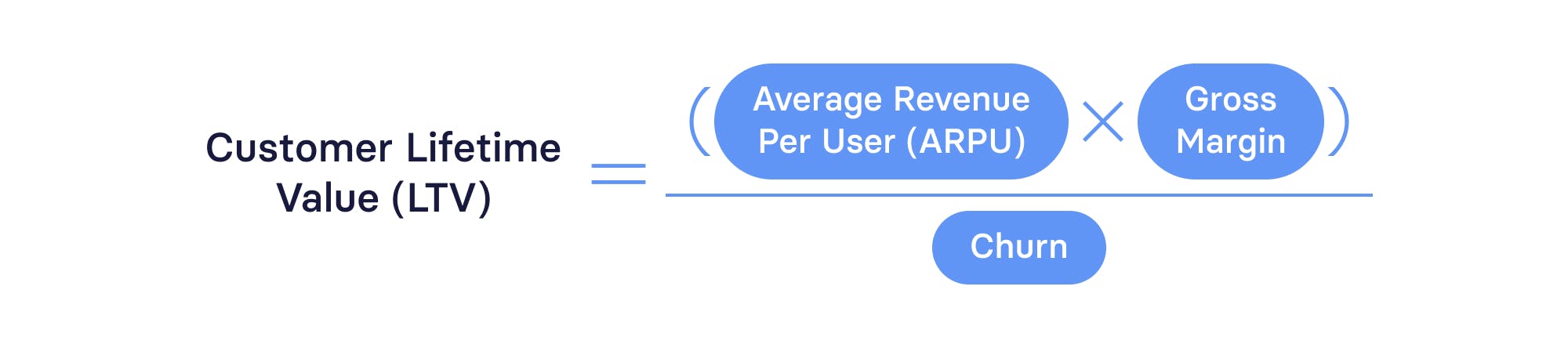

You calculate customer lifetime value by multiplying your average revenue per user (ARPU) by gross margin and dividing that number by your churn rate.

While there are more complex ways to look at LTV, this basic customer lifetime value formula focuses on three primary inputs:

- ARPU. The average revenue per user for your customer base over a given time period (e.g., one year).

- Gross margin. Your net sales revenue minus cost of revenue shows your profit margins across the business.

- Churn or attrition rate. The percentage of customers who stopped using your product or service in the given period. It’s the inverse of your logo retention rate.

By this calculation, it’s no surprise that the longer a customer continues to buy your product or service, the greater their lifetime value becomes.

Customer Lifetime Value Calculator Tool

Your Customer Lifetime Value

$0

Customer Lifetime Value Example Calculation

Average Revenue Per User (ARPU): Suppose a service has an ARPU of $120 per month.

Gross Margin: The gross margin for this service is 80%. This means that after subtracting the cost of delivering the service, 80% of the revenue is retained as profit.

Churn Rate: The churn rate, which represents the percentage of customers discontinuing their service each year, is 5%.

Using the basic LTV formula:

LTV= $120 x 80% / 5% = $96 / 0.05 =$1,920

Therefore, the LTV for a customer in this example is $1920. This figure represents the net profit that is expected to be generated, on average, from each customer over the duration of their relationship with the service.

What’s the Difference Between CLV and LTV?

There’s no material difference between the terms “CLV” and “LTV” (or even CLTV). These acronyms all refer to customer lifetime value which is a useful financial ratio that can be used to analyze a company, and are often used interchangeably. For many companies, usage of each term often comes down to an agreed-upon preference (ours is LTV).

However, some companies will distinguish between CLV and LTV in terms of granularity. In those cases, LTV refers to the average customer lifetime value across the entire customer base, whereas CLV refers to lifetime value for an individual account.

We view that kind of granularity as a drill-down view of the same metric, so we refer to customer lifetime value as LTV in all cases.

Why Does Customer Lifetime Value Matter?

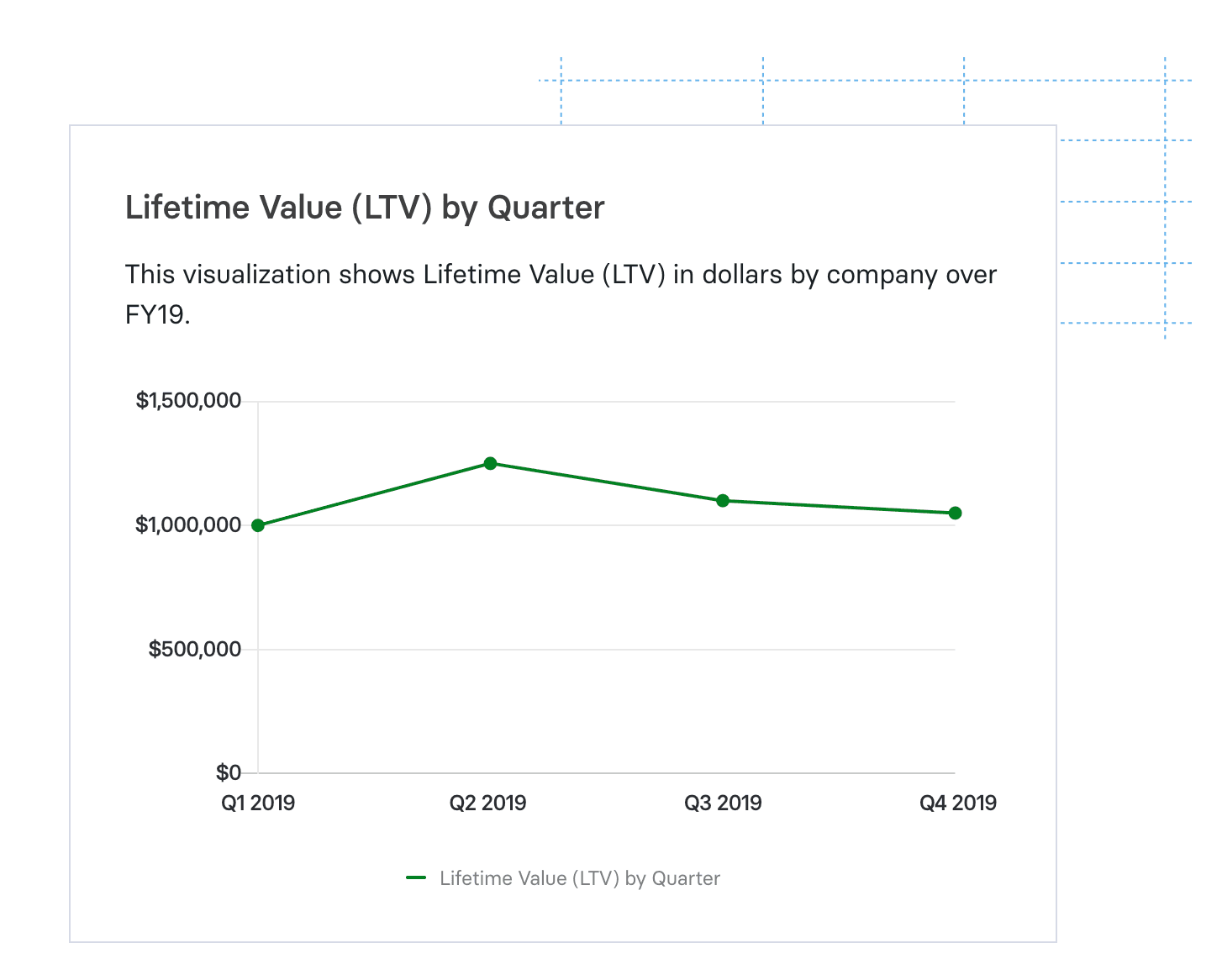

Customer lifetime value is an extremely important metric in SaaS because it tells you the total revenue you can expect a customer to generate over the course of your relationship together.

While finance teams don’t directly impact the customer experience, your ability to accurately calculate the lifetime value of a customer can help partners in the C-suite, product, sales, marketing, and customer support understand a few important things.

- Calculating customer lifetime value can give executives insight into the long-term viability of the business model.

- Understanding the value of customer relationships helps CS and support justify the costs of new initiatives like loyalty programs or investments in automation that could streamline processes and improve overall customer satisfaction.

- Seeing LTV according to customer segments can help marketing refine their strategies for targeting new customers with upcoming campaigns. And it can help sales improve cross-sell strategies for accounts that are most valuable to the business.

- Visibility into the lifetime value of current customers can help forecast and plan more accurately for the future. It helps you understand the true business impact of modeling out improved customer retention rates and assumptions of longer customer lifespans.

Tried and Tested Ways to Improve LTV

SaaS companies can live and die by their ability to build momentum with their customer bases. While top-line growth gets so much attention, you also have to show that you can retain those customers and create a sustainable business.

To that end, there are three primary levers you can pull to improve LTV.

Invest in Customer Success

Perhaps the strongest lever you can pull to increase LTV is improving customer retention. It costs a whole lot more to acquire new customers than to retain existing customers. That‘s why performing a customer retention analysis and investing in customer success can be critical. This could mean improving communication about upcoming feature releases, lowering the time to resolution for support tickets, or increasing the customer onboarding experience — anything that could potentially increase customer loyalty.

Raise Your Prices

The most basic way to increase LTV is to raise your pricing. Boosting average order value (in ecommerce) or annual contract value (in SaaS) gives you more revenue per customer, assuming all else remains equal. But there are diminishing returns. You always have to balance pricing with the value your product delivers to customers.

Build Price Escalations Into Your Contracts

You can increase LTV by adding more customization to your SaaS pricing strategy. Creating add-on features and escalation factors for product usage can naturally increase net revenue retention — which in turn increases LTV.

LTV is a highly-nuanced metric, which means there are many more ways you could potentially increase it for your business. However, the three options listed here are among the most basic because they tie directly to the metrics you use to calculate LTV.

Why Tracking LTV Used To Be So Difficult

The truth is: Tracking LTV is hard. Obtaining metrics to define something as ethereal as customer sentiment requires a lot of data. You’ll need to track when your customer purchased your product, the length and price of their contract, and related upsells, downgrades, and renewal rates. You’ll also want to filter it all by vintage and product line, so you can see how seasons, time periods, and offering types impact your customer relationships.

That’s a lot of customer data throughout the customer lifecycle from various touchpoints, and it probably lives deep within your CRM in less-than-accessible places and less-than-intuitive formats. It takes a good deal of human power to pull, scrub, input, and analyze all that deep-down data. You’ll also want to overlay it on your customer acquisition cost (CAC), so you can really start optimizing your business for long-term sustainable growth.

The obvious issue here is that there’s never been a tool that can produce the LTV metric for you—it has typically required a maddening amount of manual analysis and number-crunching in spreadsheets, and the process can be time-intensive and error-prone.

But don’t worry. There’s hope.

How to Calculate Lifetime Value (Without Taking Years Off Your Life)

Mosaic connects to your CRM and automatically collects, normalizes, and calculates your customer LTV. It even groups customers by cohort and product line, so you can track the effectiveness of specific sales and marketing efforts and pin down the most valuable customer journeys and milestones — all in real-time.

Having a solid (and current) understanding of your LTV can help your business identify successful strategies for customer onboarding and retention, as well as common customer stumbling blocks, which helps you plan for smart, sustainable growth and boost your bottom line.

Want to learn how Mosaic can help you automate LTV calculations and put this critical metric in context with the other metrics that matter most to your business? Request a personalized demo today.

Customer Lifetime Value FAQs

What is the formula to calculate Customer Lifetime Value?

The CLV formula is (Average Revenue Per User * Gross Margin) / Churn Rate. This means that the customer lifetime value calculation favors a higher ARPU and gross margin, as well as a lower churn rate. The best customers that can ultimately lead you to negative churn are high-value customers with a longer than average customer lifespan.

How do you increase Customer Lifetime Value?

What qualifies as a high CLV value?

Explore Related Metrics

Own the of your business.