Revenue Run Rate

What Is Revenue Run Rate?

Revenue run rate, or sales run rate, is a financial metric that projects current revenue in a given period over a future period of time to give businesses a baseline understanding of future earnings. Companies can use weekly, monthly, or quarterly revenue data to extrapolate their annual income and inform strategic planning.

Categories

Not to be confused with annual recurring revenue (ARR), the revenue run rate helps new companies project how much they can expect to earn in a year, among other things. But it’s not right for every situation and comes with its own set of limitations.

For fast-growing companies, the more recent the historical data, the more accurate this projection may be. In other words, if you’re gaining more customers and generating more revenue week over week, only the most up-to-date information will produce an accurate revenue run rate.

Also, the revenue run rate is less accurate if there are any upcoming changes to your company, like a new product or pricing structure.

Other caveats to consider when analyzing the accuracy of your revenue run rate include:

- Seasonality: The revenue run rate doesn’t do a good job of accounting for seasonal fluctuations. The run rate assumes an even distribution of income throughout the entire year, which is often not the case.

- One-time sales: The revenue run rate over-weighs one-time sales in a specific period. A large one-time purchase can throw off your saas revenue forecasting.

- New product release: Sales typically naturally increase and then drop off as you release a new feature or product. Your revenue run rate may be inaccurate if you use data immediately after a product release.

- Contracts up for renewal: The revenue run rate can’t account for contracts that may be ending or up for renewal. Put differently, if you’re approaching a period where many of your customers must either renew or leave their contracts, the revenue run rate won’t account for churn rate and may overestimate your potential total revenue (especially if your renewal rate is low).

Table of Contents

How to Calculate Revenue Run Rate

To calculate the revenue run rate, take the total current revenue in your given period and divide that by the total number of days in that period. Multiply the result by 365 to find the annual run rate.

Since this calculation produces an annual figure, this is also known as data annualization.

Revenue Run Rate Examples

To get a sense of what your revenue run rate calculations might look like, here are some examples:

Suppose you’re a new email marketing SaaS business. And in the last week, you generated $14,000.

To find how much your company might make in a year at this rate, divide this number by 7 days to get $2000. Then, multiply that number by 365 for the days in the year to get $730,000.

In other words, your annual revenue run rate is $730,000.

You can also find your annual revenue run rate by multiplying the revenue in your given period by the number of said periods in a year. You can do so on a monthly basis or after the first quarter.

Suppose the same business generated $60,000 in revenue in one month. To find your revenue run rate, multiply the $60,000 number by 12, the number of months in a year.

You’ll get $720,000. Put differently, your annual revenue run rate with this method is $720,000.

How Revenue Run Rate and Annual Recurring Revenue (ARR) Are Different

Since the revenue run rate is an annualized revenue projection, it is often confused with the annual recurring revenue (ARR). But they are different metrics.

The annual recurring revenue (ARR) is the total annual contract value (ACV) of subscriptions in a SaaS business. In other words, it only accounts for revenue you can reasonably assume due to customer contracts. ARR is more commonly used than revenue run rate since it is a more stable predictor of revenue.

However, ARR can’t show the complete picture of your revenue since it excludes one-time purchases and fees. So it is usually only used by companies with a subscription model.

Businesses often use ARR to show growth rate over time by comparing each year’s recurring revenue.

| Annual revenue based bookings from subscription sales. | Projecting future revenue for non-annual contracts or non-subscription revenue streams. | Any business and business model can use the revenue run rate metric. | |

| Annual revenue based bookings from subscription sales. | Gauging the top-line health of the business and forecasting revenue. | ARR only applies to SaaS businesses due to subscription models. |

When to Use Revenue Run Rate

So why would you calculate your revenue run rate? There are several scenarios:

Projecting Future Revenue

An estimate of your yearly revenue is a useful planning tool for finance teams and businesses to benchmark against. It can help determine if there will be enough cash to cover planned endeavors.

Early-stage SaaS companies typically see as much as 68% growth in their first year, or 4.4% growth in monthly recurring revenue (MRR) each month.

Frequently calculating your revenue run rate can also help you track growth and more accurately predict your company’s performance.

Securing Funding

A huge part of running a successful business is simply being able to prove financial health and success. The revenue run rate can give a more approachable projection that can indicate positive future financial performance and success to investors.

In other words, along with your cash flow, net revenue retention, expenses, and other projections, you can use the revenue run rate to convince a potential investor to put money into your business.

Track Strategic Change

Before you make significant strategic, financial, or product changes, calculate your revenue run rate. Your revenue run rate can act as a baseline figure to see whether the changes increased the revenue.

For example, suppose you want to introduce a new product that may be more expensive to produce but could draw in a new business segment. Tracking your overall revenue changes will help you visualize whether introducing the new product affects your income.

Manage Resources

Tracking projected annual sales helps you manage necessary business operations. With an idea of how much volume your business will handle, you can stay on top of your inventory, secure enough employees, and more.

Forecasting Revenue, Cash Flow & Spend with Strategic Finance Software

How to Track Revenue Run Rate with Mosaic

Knowing your revenue run rate can be incredibly useful, especially if your company is new or growing rapidly. Despite its usefulness, it’s easy to overlook it without the proper financial forecasting software.

Mosaic makes it simple to track this and other important financial metrics. Here’s how:

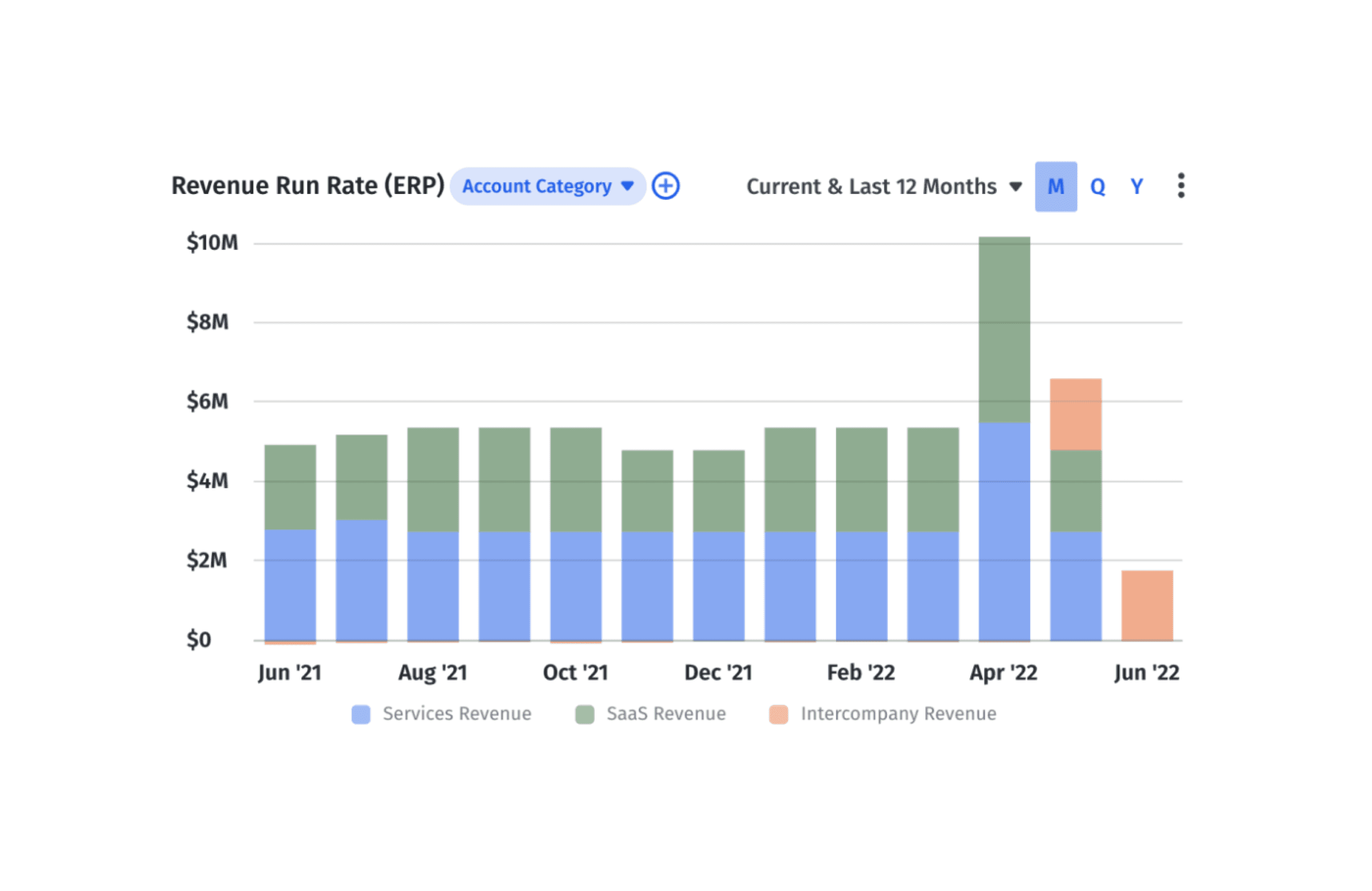

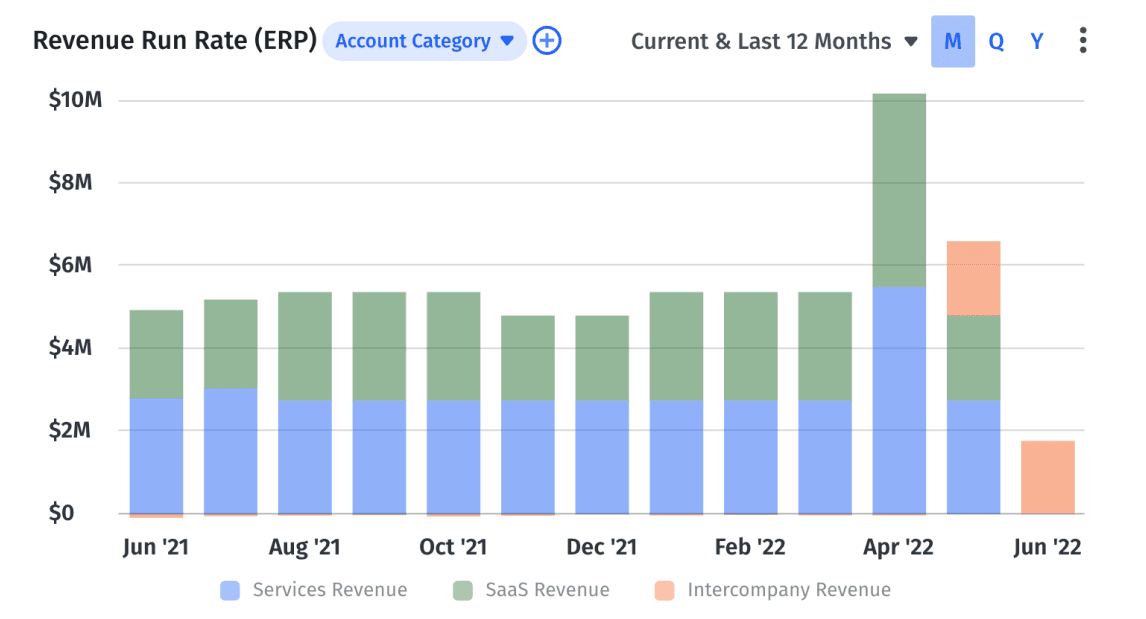

At a glance, pull up a real-time visualization of your company’s revenue run rate.

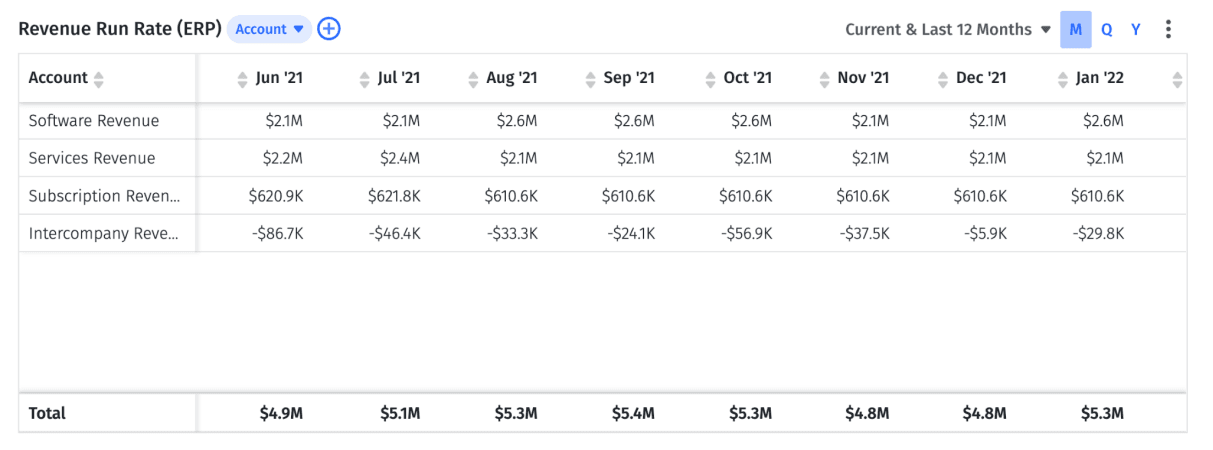

Dive deeper into your financials by breaking the revenue down by category. If you have multiple entities, endeavors, or subsidiaries, you can still get a clear picture of where your revenue stands. You can see the exact numbers coming from software, services, subscriptions, and subsidiaries.

A complete picture of your business’s finances requires many data points, and the revenue run rate is just one useful metric among those for financial reporting. Because it doesn’t account for seasonality, one-time sales, or planned changes to your go-to-market strategy, you’ll want to contextualize it with additional top-line metrics and sales performance metrics.

Mosaic helps your business track everything in one place with little effort. Request a demo to see how the real-time financial visualizations take your business strategy to the next level.

Revenue run rate FAQs

How is revenue run rate different from ARR?

Revenue run rate (RRR) and annual recurring revenue (ARR) are different in that ARR includes only recurring revenue while RRR includes any revenue. ARR is used for subscription-based purchases during a period of time and does not include one-time purchases.

What is the formula for revenue run rate?

What is a good revenue run rate?

Explore Related Metrics

Own the of your business.