Understanding RPO in SaaS: A Quick Guide

What is Remaining Performance Obligation (RPO)?

A relatively new financial metric in SaaS, Remaining Performance Obligation (RPO), refers to the total contracted revenue from services or products yet to be delivered to customers and not yet recognized as revenue by the company.

RPO consists of deferred and unbilled revenue (recognized in upcoming periods), providing visibility into future earnings and supporting financial planning.

Categories

RPO is a broad concept that includes both the backlog of contracted but not yet invoiced revenue (unbilled) and deferred revenue — the latter being revenue that’s been invoiced but not yet recognized because the services have not been delivered. Both components involve non-cancellable contractual obligations.

In terms of financial reporting, although RPO is not typically listed on the balance sheet or income statement, it’s often disclosed in the notes of financial statements or earnings releases to provide insights into future revenue recognition.

As The SaaS CFO, Ben Murray, explains, “[RPO] originated from the new revenue standard in ASC 606. Public companies must disclose their RPO as per ACS 606-10-50-13 – Transaction Price Allocated to the Remaining Performance Obligations.”

While public companies are mandated to disclose RPO, private businesses can also benefit from monitoring this metric. Investors rely on RPO to assess a company’s revenue performance and future growth potential.

Table of Contents

Origins of RPO

RPO came into existence following a specific accounting update, Accounting Standards Update No. 2014-09 or ASC 606, titled “Revenue From Contracts With Customers.” With this new standard, public companies, for annual periods starting after December 15, 2017, were mandated to report more clearly on revenue recognition through this metric.

As explained previously, RPO consists of two parts: deferred revenue and revenue backlog. Deferred revenue is money already received but not yet recorded as income because the service or product is still to be delivered — it’s a liability until the services have been delivered. Backlogs, however, are future earnings from ongoing contracts that haven’t been billed yet but are guaranteed to come in (non-cancellable).

According to standard accounting practices under Generally Accepted Accounting Principles (GAAP), reporting deferred revenue is a must. However, RPO takes it further by including the non-billed portion of the total contract value, offering a more comprehensive look at a company’s future earnings.

The introduction of RPO under ASC 606 represents a significant evolution in financial reporting, as it not only enhanced transparency into a company’s revenue expectations but also complemented existing metrics to enable more informed decision-making by investors, analysts, and other stakeholders.

RPO Formula + How to Calculate

To calculate RPO, you need two essential pieces of information: the deferred revenue balance and unbilled amounts from multi-year contracts.

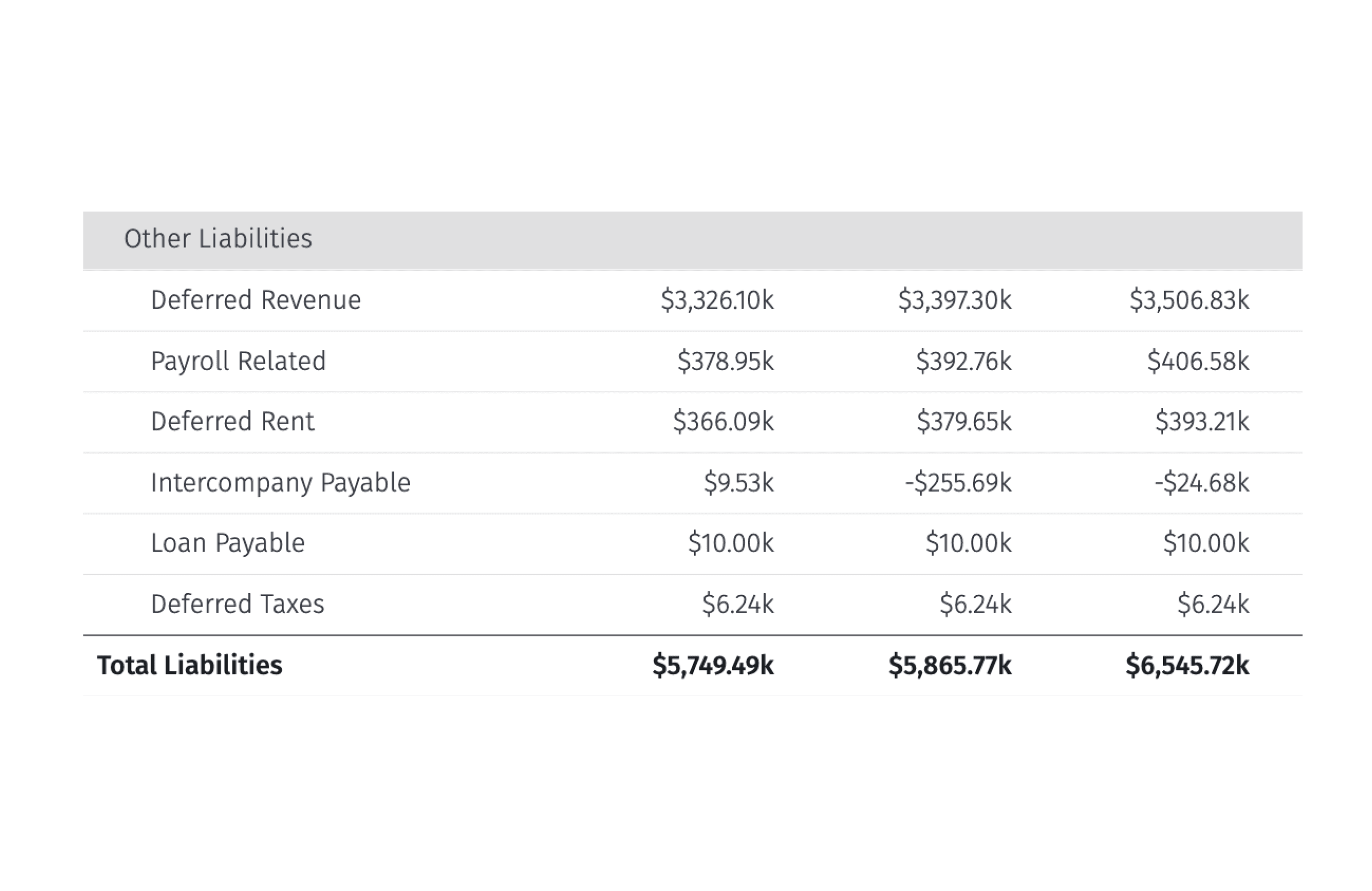

Firstly, deferred revenue is located in the liabilities section of the balance sheet. This amount is updated monthly as the company fulfills its contractual obligations. Unbilled revenue amounts, on the other hand, are tracked contract by contract and represent revenue that hasn’t been invoiced yet under active customer contracts. The sales team typically logs these as bookings within the company’s CRM software.

RPO = Total Deferred Revenue + Total Backlog

In the SaaS industry, multi-year contracts where customers pay upfront or periodically are typically common. However, because companies deliver the service over an extended period, they recognize this revenue over the duration of the contract, not when the payment is initially received.

This surfaces a key difference between deferred revenue and backlog. The distinction hinges on whether the company charges the customer for the entire contract duration upfront or invoices them periodically (monthly or quarterly) throughout the contracted period.

An Example of RPO

Let’s consider two different customer scenarios, each with a distinct type of contract.

Customer A, for instance, has a three-year contract valued at $36,000, with $12,000 billed yearly in advance. After completing the contract’s first year, $12,000 becomes deferred revenue for the upcoming year, and another $12,000 is considered backlog for the final year, as it hasn’t been invoiced yet.

Switching gears to Customer B — they hold a two-year contract valued at $24,000, billed at $1,000 monthly. There is no deferred revenue since six months have passed, and the customer is billed monthly. However, the $18,000 due for the remaining 18 months is considered as backlog.

In this case, the RPO would be as follows:

RPO = Total Deferred Revenue ($12,000 from Customer A + $0) + Total Backlog ($12,000 + $18,000) = $42,0000

In real-life scenarios, your RPO might vary as it is influenced by the specifics of each customer contract and other factors like discounts and contract modifications.

RPO vs. Other Key SaaS Metrics

As the SaaS CFO explains, RPO provides additional revenue context beyond traditional financial metrics. It’s instrumental in projecting future revenue, offering insights into the anticipated income streams from current contracts.

That’s not all. RPO helps assess product alignment with customer needs and underscores the significance of multi-year contracts, highlighting their impact on financial stability. Finally, RPO supports the standardized tracking of deferred revenue, bookings, and unbilled revenue, promoting consistency and transparency in financial reporting and revenue management.

However, to accurately calculate and get the maximum insights from your RPO, it’s crucial to know the distinction between this important metric and other key metrics.

Billings vs. RPO

SaaS bookings represent the total value of newly signed contracts, capturing the entire income agreed upon at the time of signing, even before any payment is made or received. So, the total contract value (TCV) is recorded upfront, regardless of whether the service delivery spans multiple years.

On the other hand, RPO includes both unrecognized revenue that’s been billed but not yet earned and unbilled revenue that’s contracted but not yet invoiced. This metric offers a more comprehensive view of the revenue yet to be recognized and recorded in the financial statements.

Annual Recurring Revenue vs. RPO

ARR, or annual recurring revenue, refers to the revenue you can expect over the 12 months from ongoing customer contracts, leaving out one-off and variable fees. It combines full-year and shorter contracts, like monthly or quarterly, converted to an annualized figure.

In contrast, RPO captures the outstanding value of all active contracts that haven’t yet been billed or recognized as revenue. It encompasses the total contracted revenue pending recognition, irrespective of whether the contract spans three, five, or more years, providing a broader view of future earnings.

Deferred Revenue vs. RPO

Deferred revenue is unearned revenue, meaning it’s considered a liability (until recognized) as payment has been received for services customers will receive in the future. For example, when a customer pays $1200 upfront for a yearly monthly subscription valued at $100.

RPO includes deferred revenue and unbilled amounts under contract but not yet invoiced. So, it represents the total future revenues a company is expected to recognize from its existing customer contracts.

Annual Contract Value vs. RPO

Annual Contract Value (ACV) represents the average yearly value of a customer’s contract. For instance, if a customer has a 10-year contract worth $10 million, the ACV would be $1 million per year.

Unlike RPO, ACV offers a snapshot of annual earnings from subscriptions without considering the total contract duration or unbilled amounts.

How to Monitor RPO in Mosaic

The challenge of monitoring RPO isn’t that the formula is particularly complex — there are just two variables to combine. Rather, the problem is having the kind of visibility into your numbers to maintain a clear view of deferred revenue and backlog so you can understand RPO in the moment.

That’s a tall task for teams that take weeks to close the books each month and calculate their metrics after aggregating data in spreadsheets. But Mosaic’s integration with your source systems makes it easy to track metrics like RPO in real time.

Connecting your ERP and CRM to Mosaic ensures all customer contract data and invoicing data flow together seamlessly. And with that data readily available, you can use Metric Builder to create your RPO formula. You can see an example of that process here:

RPO is just one metric you might want to track to better understand revenue and cash flow. But it means very little without the context of your other critical SaaS metrics.

If you want to see how you can build and analyze every metric that matters most to your business with real-time data, book a demo for a walkthrough of Mosaic today.

Remaining Performance Obligation FAQs

What is RPO, and why is it important for SaaS companies?

Remaining Performance Obligation (RPO) combines deferred revenue and backlog, including unbilled revenue. This metric is crucial in SaaS, showcasing future revenue potential and offering enhanced financial transparency for informed strategic business decisions.

What brought about the need for RPO in financial reporting?

How does Mosaic assist in RPO calculation and management?

Are there penalties for misreporting or miscalculating RPO under ASC 606?

Explore Related Metrics

Own the of your business.