Revenue Backlog

What is Revenue Backlog?

Revenue backlog refers to revenue that’s still unrecognized or unbilled in subscription businesses. It includes revenue of all types that a company expects to get from contracts it has already signed, but that they have yet to invoice for or receive.

It’s easy to mix up revenue backlog with deferred revenue. However, revenue backlog isn’t tied to a specific period — it’s based on contracted revenue. Even though revenue backlog isn’t usually a part of financial reports, investors often look at this metric to understand the company’s long-term financial viability and guide valuation.

Categories

Table of Contents

Revenue Backlog vs. Deferred Revenue

Although revenue backlog and deferred revenue (sometimes called unearned revenue) might seem similar, they are distinct metrics offering unique insights. Let’s break them down.

Differences between revenue backlog and deferred revenue

| Future revenue from contracts signed but not yet fulfilled | Revenue received or invoiced but not earned as services are yet to be delivered | |

| Recognized as revenue when the service is delivered | Initially recognized as a liability, then gradually recognized as revenue as services are delivered | |

| Not yet billed or received | Received or billed, but not yet earned | |

| A forward-looking metric not shown on the balance sheet | Shown as a liability on the balance sheet |

Deferred revenue is typically associated with subscriptions and is revenue that you’ve received or invoiced for but that hasn’t yet been earned. Until the company provides the service, deferred revenue is shown as a liability on the balance sheet. For example, imagine a customer pays $1,200 upfront for a yearly subscription to your software at $100 per month. At the end of the first month, you still have $1,100 as deferred (unearned) and $100 as earned revenue. As you provide the service each month, $100 moves from deferred to earned revenue (revenue recognition) thereby lowering the liability on the balance sheet.

On the other hand, revenue backlog is unrecognized revenue, as in money a company expects to get based on subscription agreements or contracts it’s signed but hasn’t billed yet, usually because the service hasn’t been provided. For example, if your company signs a new customer in April for $240,000 for a two-year project starting in May, spread over 24 months, the whole $240,000 is considered revenue backlog. This shows the money you expect to receive over the next two years for the project.

Some SaaS businesses use the Bookings metric to highlight the total value of revenue or ARR they expect to earn in future periods. Since revenue and ARR are lagging indicators, bookings and the revenue backlog can show more forward looking signals about the momentum of a business. These metrics show the value of signed customers without the time elements associated with revenue recognition.

Revenue backlog is not recorded on the balance sheet but plays a role in a company’s revenue forecasting. Investors, particularly in SaaS, look at this metric to understand a company’s financial health, future value of active subscriptions, and growth potential.

Calculating Revenue Backlog

Frankly, there isn’t a one-size-fits-all revenue backlog calculation or formula. Generally, you calculate the revenue backlog for each ongoing contract by subtracting the recognized revenue from the total contract value.

If you don’t have access to a strategic finance platform like Mosaic, calculating revenue backlog can be a bit of a tricky manual task. Start by listing all your active contracts that still have revenue to be recognized, along with the annual contract value (ACV) of each.

Next, subtract the revenue that’s already been recognized for each contract. Essentially, this recognized revenue is the amount billed and earned as the services are delivered. Now, you’re left with the revenue backlog for each contract. Add these up to get your company’s total amount of revenue backlog.

Here’s how that might look as a formula, but remember, the actual calculation might vary based on your company’s revenue streams:

Let’s look at a hypothetical example with Company A, which has three active contracts: The first contract has an ACV of $100,000 and recognized revenue of $40,000; the second contract has an ACV of $150,000 and recognized revenue of $60,000; and finally, the third contract has an ACV of $80,000 and recognized revenue of $20,000.

In this case, the revenue backlog would be as follows:

Total Revenue Backlog = (100,000 – 40,000) + ($150,000 – $60,000) + ($80,000 – $20,000) = $210,000

In other words, the revenue backlog for contract one was $60,000, contract two was $90,000, and contract three was $60,000. Ultimately, Company A’s total revenue backlog added up to $210,000.

3 Best Practices for Managing Revenue Backlog

Now that you understand the nuts and bolts of revenue backlog, let’s talk about how to make the most of these insights. Below, we share three best practices to manage revenue backlog effectively:

1. Stick to the Same Method of Calculation to Ensure Accuracy

Consistency is key when it comes to getting your revenue backlog right. Calculating your backlog in the same way every time allows you to see if your revenue is growing or shrinking over a period of time. Plus, being consistent and transparent in how you report these numbers builds trust with people who have a stake in your business, like investors.

But here’s the thing: in practice, keeping up this consistency can be pretty tedious, especially when calculating revenue backlog manually. It gets even trickier as your company grows and your finance team evolves, as someone new to the company may not calculate metrics the same way as the previous person who handled them.

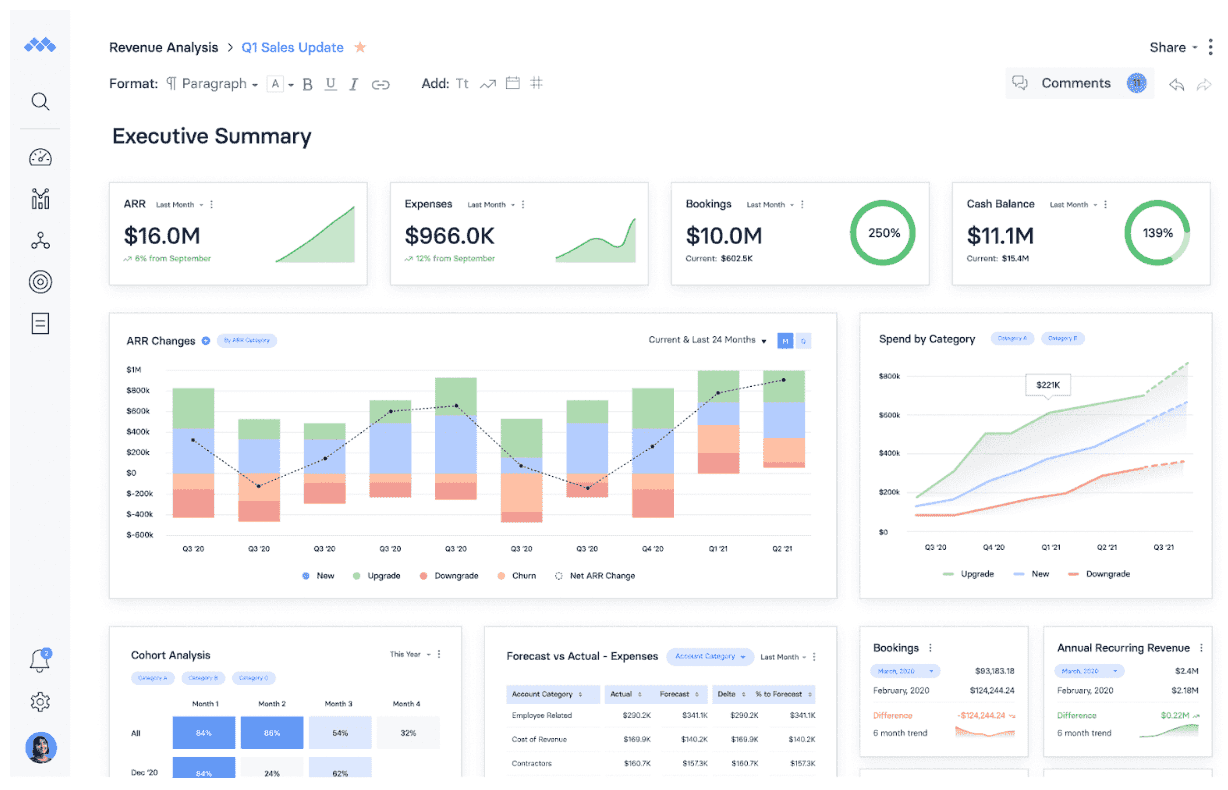

This is where Mosaic can help. Mosaic’s Metric Builder comes with 150+ out-of-the-box metrics specific to SaaS businesses and lets you create custom metrics on top of that. Once you set up your metrics in Mosaic, they pretty much run themselves, so your team can spend more time understanding the numbers and what they mean for your business instead of getting bogged down in the details of calculating them.

2. Regularly Monitor and Update Revenue Backlog to Avoid Redundancy

Regularly monitoring and updating your revenue backlog is essential to keep your cash flow forecasts and business decisions accurate. Suppose you don’t stay up-to-date with new contracts, renewals, and changes in existing contracts. In that case, you risk making decisions based on outdated projected revenue that doesn’t accurately reflect your business’s current situation.

The good news? Mosaic simplifies this process. Metric Builder updates metrics in real-time by pulling in data from different sources, such as your ERP, HRIS, CRM, billing system, and data warehouse — thanks to Mosaic’s comprehensive list of integrations. So, you’re always working with the most current and complete information.

3. Look at Granular Details to Draw Deep Insights

To better understand the numbers, break down your revenue backlog into detailed segments, such as by customer, contract length, and service type. A thorough analysis can offer deeper insights into revenue sources, helping you quickly spot opportunities and potential risks.

For instance, a solid, consistent revenue backlog may indicate bright growth potential for the business. Still, if the revenue backlog remains high for an extended period, it could also suggest the company is having trouble fulfilling orders. On the flip side, if revenue backlog decreases, that could indicate that there might be a cash crunch unless new customers are signed on. In any case, looking at the granular details of your revenue backlog can help you understand your company’s patterns and plan accordingly.

Mosaic is designed to help SaaS finance teams understand the “why” behind the data. With Metric Builder, it’s easy to sort and view your metrics, including revenue backlog once it’s set up, by various segments — this level of detail offers granular insights into different aspects of your revenue. Moreover, Mosaic has stunning templates and financial dashboards that make it easy to view the data visually and share your company’s financial narrative with different stakeholders in the most impactful way.

Easily Track Revenue Backlog and Other SaaS Metrics with Mosaic

While revenue backlog isn’t a must-have metric, it can be handy when assessing or demonstrating the company’s financial prospects. However, any metric in isolation only tells part of the story. With Mosaic, SaaS companies can easily track revenue backlog and view all other crucial metrics in tandem, truly understanding what’s happening with the business.

Request a personalized demo of Mosaic to see how it simplifies metric tracking for SaaS teams.

Revenue Backlog FAQs

Is revenue backlog relevant for all types of SaaS businesses?

Yes, revenue backlog is a relevant metric, albeit not mandatory, for all types of SaaS businesses, as it provides valuable insight into future revenue streams and helps in financial planning and forecasting.

How often should revenue backlog be reported and reviewed?

How can Mosaic help manage revenue backlog?

Explore Related Metrics

Own the of your business.