How Deferred Revenue Works in SaaS Businesses

What Is Deferred Revenue?

Deferred revenue is unearned revenue, meaning it’s payment from customers for goods or services they will receive in the future. In SaaS, customers typically pay upfront for subscriptions, be it monthly, quarterly, half-yearly, or annually.

However, based on accounting principles, revenue recognition should occur when services are delivered, not when payment is received. For services not yet delivered the amount is recorded in the balance sheet as deferred revenue and not recognized. You would only record the revenue as services are provided each month.

Categories

In the financial world, owning a service or product in the future is considered a liability, just like any other debt. With SaaS, since the services are subscription-based and get used over time (like a year-long software subscription), not all the payment is “earned” right away. The rest gets labeled as deferred revenue — until all the services have been provided.

Think of deferred revenue as a handy metric that gives you a glimpse into how your SaaS company might perform down the road. During the month-end close process, that stashed-away deferred revenue gives you a peek into your future. For example, if you have consistent, growing deferred revenue for upcoming months, it’s safe to assume your business is gearing up for a growth spurt.

Conversely, if deferred income seems to be dwindling, it means subscriptions aren’t being renewed. By glancing at those numbers, you get a heads up on customers churning, giving you time to switch gears on your business strategy if needed and save your startup cash flow.

Table of Contents

The Importance of Deferred Revenue for SaaS Businesses

Accurately recording and tracking deferred or unearned revenue can help your SaaS business:

- Get a clear snapshot of the company’s financial obligations, with a more accurate representation of fiscal health

- Forecast and understand future cash flow, getting insight into renewal rates and customer churn based on deferred revenue

- Prove the company’s ability to obtain long-term business from customers, thereby earning investors’ trust

- Manage liabilities by tracking the company’s obligation to deliver services in the future, ensuring the business doesn’t overcommit or overspend

- Gain a clearer understanding of net income

The complexity of ASC 606 can make it tricky to accurately track deferred revenue in SaaS, but once you have this data, you can use it to improve financial analysis and modeling and make better strategic decisions for your business.

How Strategic Finance Software Can Support CFOs & Finance Teams

How to Record and Account for Deferred Revenue

In accrual accounting (as opposed to cash basis accounting), payments and expenses are credited, whereas income earned is debited. On the balance sheet, you’ll list deferred revenue as a liability, not an asset, because you still have an obligation to deliver services to customers through the end of the subscribed period. According to generally accepted accounting principles (GAAP), you “owe” your customers until you deliver on that promise.

Let’s break this down using an example to illustrate the difference between typical revenue logging and deferred revenue in the context of SaaS.

Imagine a store that sells shoes. Say the store sold 100 shoes in January at $20 each, totaling $2000. Here’s how that revenue might be logged (as debit) in the balance sheet:

- Current Assets (Accounts Receivable from the Shoes): $2,000

- Current Liabilities: $0 (no obligation to customer beyond initial transaction)

Alternatively, let’s compare a SaaS business where customers pay an annual subscription fee of $120 upfront to access the software for the whole year. Here’s a simple example of how that might be logged in the balance sheet at the end of the month if a single customer signs up for an annual subscription in January:

- Current Assets (Accounts Receivable from Upfront Payment): $120

- Current Liabilities (Deferred Revenue for 11 Months of Service): $110

As the company has merely earned $10 worth of subscriptions in January ($120 – $110), only that amount is recognized as actual revenue. Deferred revenue from subscriptions isn’t usually considered long-term and is hence listed under current liabilities.

It’s important to note that this becomes more complex when you factor in ASC 606 and the revenue recognition principle. Even SaaS businesses that sell annual contracts can’t always divide the contract amount by 12 to recognize revenue. For example, set-up fees might be recognized in the first month if those are a separate line item on the contract.

GAAP-compliant recording of deferred revenue provides a smoother picture of your company’s financial health on the income statement. But deferred revenue is just one side of the accrual accounting method. Your financial statements must also apply the same principles to expenses — recording them as they’re incurred, rather than when cash exchanges hands.

Deferred Revenue Examples

Here’s a simple example of deferred revenue:

If a customer pays you $1,200 for a yearly SaaS subscription in January, you’ve yet to “earn” this since a full year’s service remains. Let’s say this contract is for a single product charged at a flat rate. By the end of January, $100 becomes earned revenue, and the remaining $1,100 is noted as “deferred revenue” in the balance sheet. Monthly, $100 shifts from deferred to earned, leveling out by the end of the year.

Now let’s look at a slightly more complex example:

Let’s say your SaaS business signs a new customer for a year-long subscription beginning January 1st. You charge them a $100 initial set-up fee and $100 per month for a single product, bringing the total to $1,300. Because this customer pays for a year up-front, you give them a 10% discount, bringing the total amount paid to $1,170.

At the end of January, your deferred revenue total would be $1,170 minus $180, or $990. If you hadn’t offered a discount, you would have recognized $200 in revenue in January ($100 for the initial set-up fee and $100 for the first month of the product), but with the discount, you can only recognize $180 for the first month.

How to Track Deferred Revenue in Mosaic

With Mosaic, tracking deferred revenue is streamlined, thanks to its data mapping feature. Essentially, this involves singling out specific accounts in your general ledger labeled as “deferred revenue accounts.”

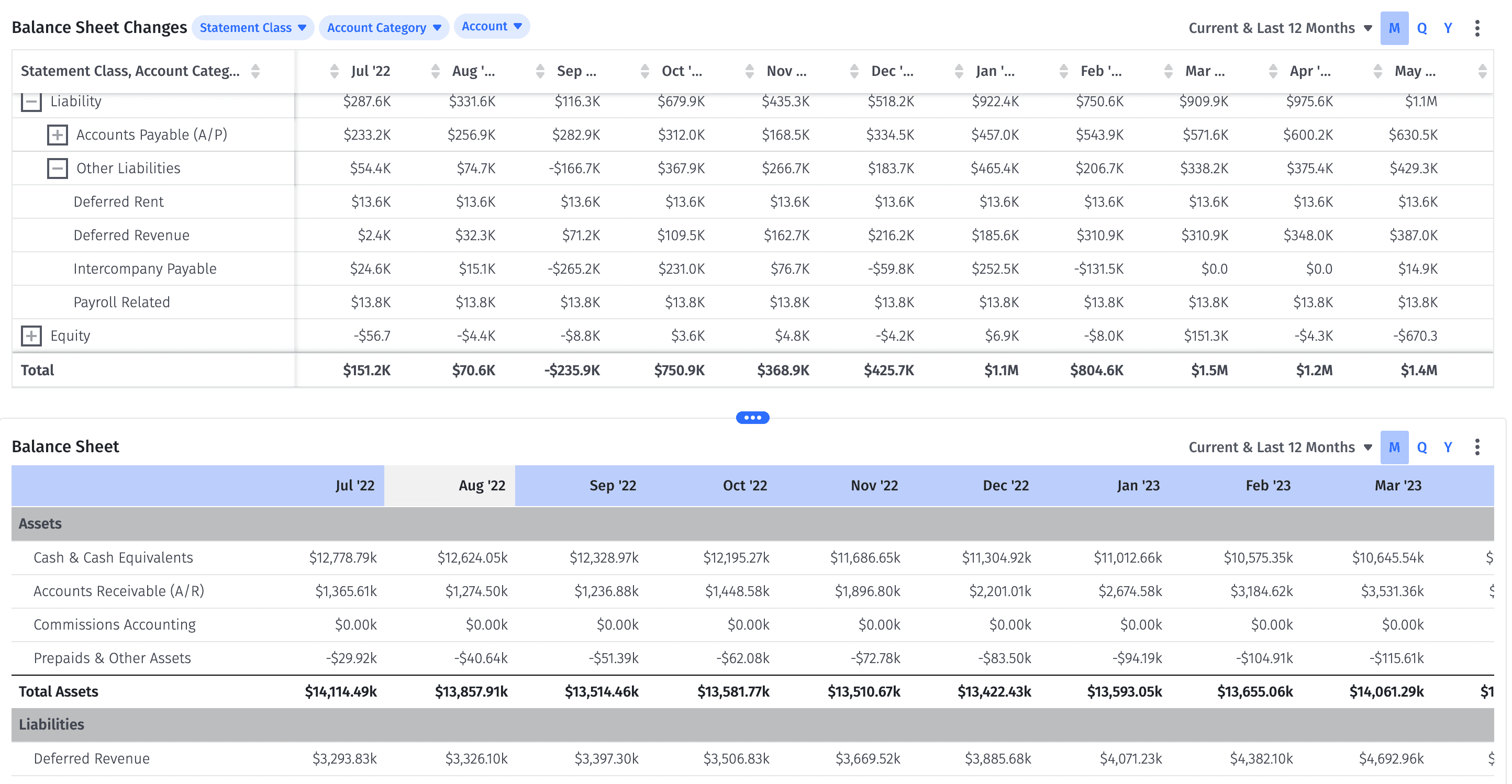

Why’s this important? By spotting these accounts, Mosaic can slot deferred revenue in the right boxes across the platform, ensuring accuracy. Think balance sheets, metrics, or other financial statements. Plus, it sharpens your financial modeling.

Additionally, Mosaic’s Topline component, part of the Topline Planner, calculates total deferred revenue by comparing billings with actual revenue. Using “Topline Allocation,” you can adjust how deferred revenue is distributed among the identified accounts.

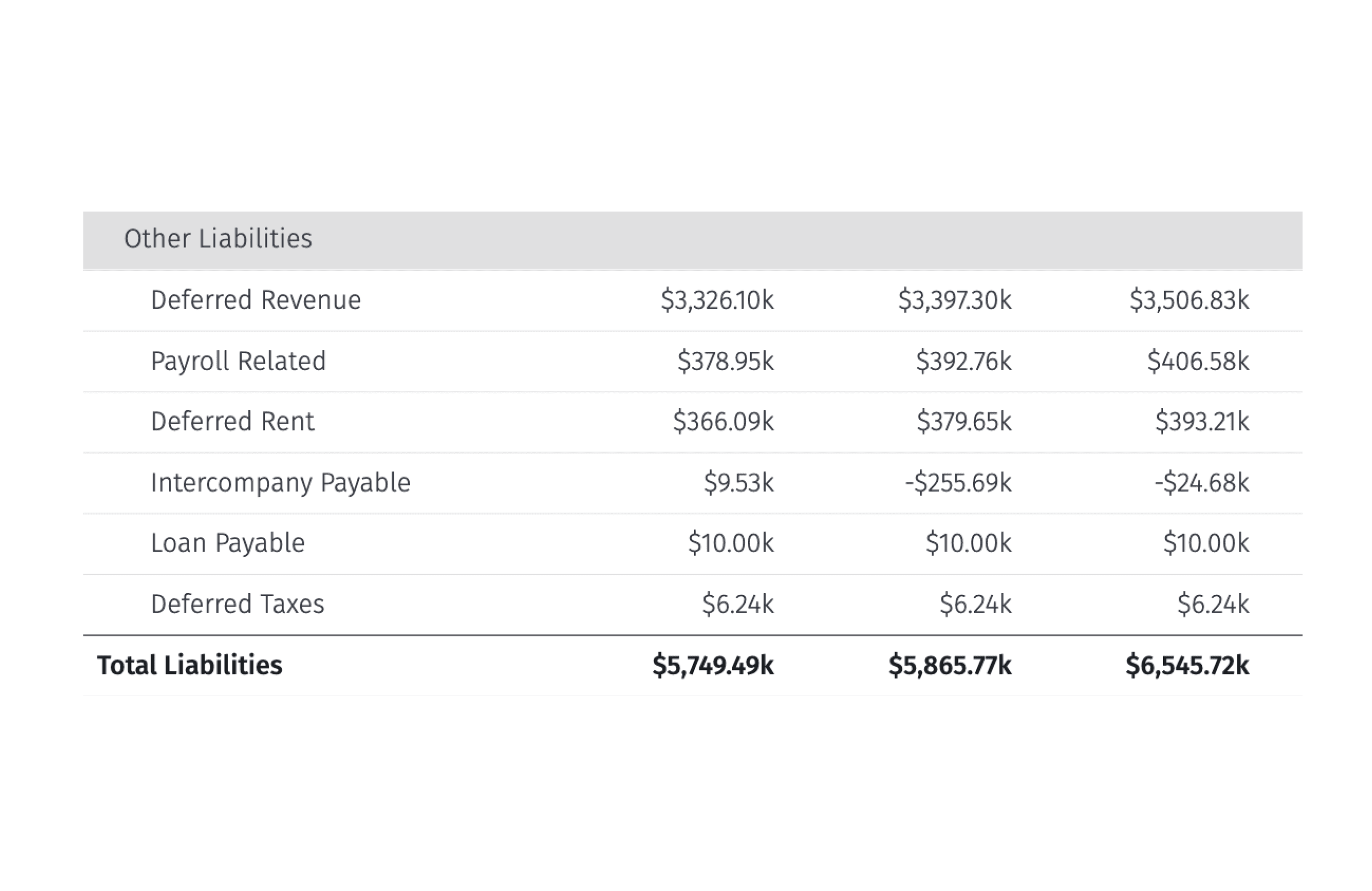

Once set up correctly, just pull up your balance sheet in Mosaic, and there it is, your deferred revenue neatly presented. For a better visual, here’s a handy image:

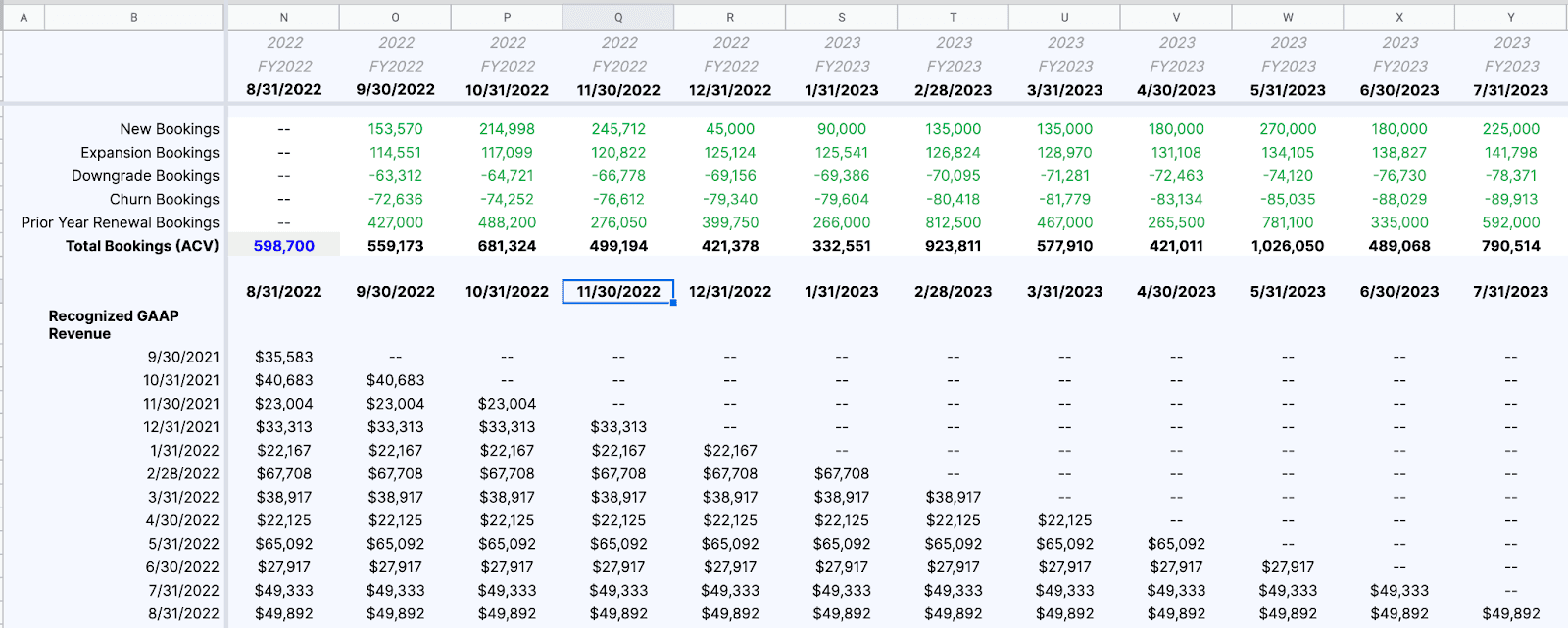

With Mosaic, you can project your deferred revenue into the future, too. Since accounts receivable and deferred revenue are tied to your billings and collections outputs from your topline component, Mosaic automatically calculates the ending balance for these accounts. It streamlines the whole process, ensuring you always have a clear view of your finances. You can create a SaaS revenue waterfall chart or ARR bridge with cohorts and more.

Get the Bookings to Revenue Waterfall Template

Simplify Accounting & Revenue Tracking for Your SaaS Business with Mosaic

Navigating the waters of deferred revenue doesn’t have to be a puzzle. With Mosaic, you’re not just managing numbers — you’re unlocking powerful insights from your accounting software tailored to your SaaS business. Dive deeper with our integrated dashboards and turn raw data into actionable business strategies.

Book a demo with Mosaic today.

Deferred Revenue FAQs

Is deferred revenue a liability or an asset?

Deferred revenue should be recorded as a liability in the balance sheet. As the business still owes services to the customer, the revenue isn’t “earned” yet. As services are provided each month according to the subscription terms, deferred revenue will move from liabilities to assets as accounts receivable.

What is the difference between deferred revenue and accrued revenue?

What is the opposite of deferred revenue?

How do you record deferred revenue?

Explore Related Metrics

Own the of your business.