Weighted Pipeline Revenue: A Guide to Weighted Revenue for Sales and Finance

What Is Weighted Revenue?

Weighted revenue is a sales forecasting tool that estimates your revenues by assessing the deals in your sales pipeline and their chances of closing. It assigns a probability percentage by weighting the deal in different aspects as not every opportunity ends in a sale.

Categories

Forecasting is one of the most challenging parts of a sales manager’s job. Each organization has processes and methodologies that complicate SaaS revenue forecasting and make it a tricky part of planning.

A weighted revenue (or weighted sales pipeline) helps sales managers and finance teams forecast their revenues and cash flow by providing them with a system they can rely on instead of shooting in the dark. It can also help companies find out sales stages that require the most attention from sales and marketing teams.

Get the Sales Capacity Model for Top-Line Planning

How To Measure the Weighted Sales Pipeline

Calculating the value of a weighted sales pipeline is straightforward. Multiply the value of each deal by the probability of closing to get a forecasted value. And sum up the forecasted values to get a weighted value of the overall pipeline.

For example, here’s the weighted revenue formula if you’ve got three deals in the sales pipeline.

Forecasted Revenue 1 = Deal 1 Value x Probability of Closing

Forecasted Revenue 2 = Deal 2 Value x Probability of Closing

Forecasted Revenue 3 = Deal 3 Value x Probability of Closing

Weighted Revenue = Forecasted Revenue 1 + Forecasted Revenue 2 + Forecasted Revenue 3

You need to assign higher weights to proposals more likely to close in the weighted sales pipeline report.

But how do you assess which deal is more likely to close?

You can rely on the sales stages. How many sales stages has a lead passed through? The further a deal is in your pipeline, the more likely it’ll result in you closing the deal.

For instance, you can assign a 50% chance of a deal closing if a deal is at stage four in your eight-stage sales process. Similarly, stage five will have a 63% chance.

But not all sales stages are equal. The difference between the prospecting stage and lead qualification stage is much smaller than the one between the lead qualification stage and the trial stage.

That’s why you need to define your own weights for each stage, depending on your sales data.

For example, say your CRM sales pipeline has the following deal stages:

- Prospecting

- Lead qualification

- Trial

- Proposal

- Negotiations

- Closed Won

- Lost opportunity

Based on your data, you can assign the following percentages to each stage:

- Prospecting: 10%

- Lead qualification: 25%

- Trial: 50%

- Proposal: 60%

- Negotiations: 75%

- Closed Won: 100%

- Lost opportunity: 0%

Let’s find out how these weights affect your sales pipeline revenue.

Assume you have the deals in five different sales pipeline stages:

- Deal Set 1: Prospecting — $100,000

- Deal Set 2: Lead qualification — $50,000

- Deal Set 3: Trial — $150,000

- Deal Set 4: Proposal — $80,000

- Deal Set 5: Negotiations — $60,000

Let’s plug these values into the weighted revenue formula:

Forecasted Revenue 1 = $100,000 x 10% = $10,000

Forecasted Revenue 2 = $50,000 x 25% = $12,500

Forecasted Revenue 3 = $150,000 x 50% = $75,000

Forecasted Revenue 4 = $80,000 x 60% = $48,000

Forecasted Revenue 5 = $60,000 x 75% = $45,000

Weighted Revenue = $10,000 + $12,500 + $75,000 + $48,000 + $45,000 = $190,500

This means you can assume your sales team will make almost $175,500 in the near future.

You can also look at weighted revenue on a monthly or quarterly basis by going into your CRM and filtering the data by the expected close date.

For instance, say you filtered the data in the above example by quarter and got the following:

- Prospecting — $30,000

- Lead qualification — $10,000

- Trial — $50,000

- Proposal — $20,000

- Negotiations — $5,000

You can plug these values into the formula to get the quarterly estimated revenue:

Quarterly Weighted Revenue = ($30,000 x 10%) + ($10,000 x 25%) + ($50,000 x 50%) + ($20,000 x 60%) + ($5,000 x 75%) = $46,250

Measuring the Expected Revenue

Once you have calculated your weighted revenue, you can get the expected revenue by summing up the value of won deals and your weighted revenue for the given period.

Expected Revenue = Weighted Revenue + Value of Won Deals

For instance, suppose you won deals worth $30,000 for the next quarter and have quarterly weighted revenue of $41,250, as we calculated above.

In that case, your expected revenue for the quarter would be:

Expected Revenue = $30,000 + $41,250 = $71,250

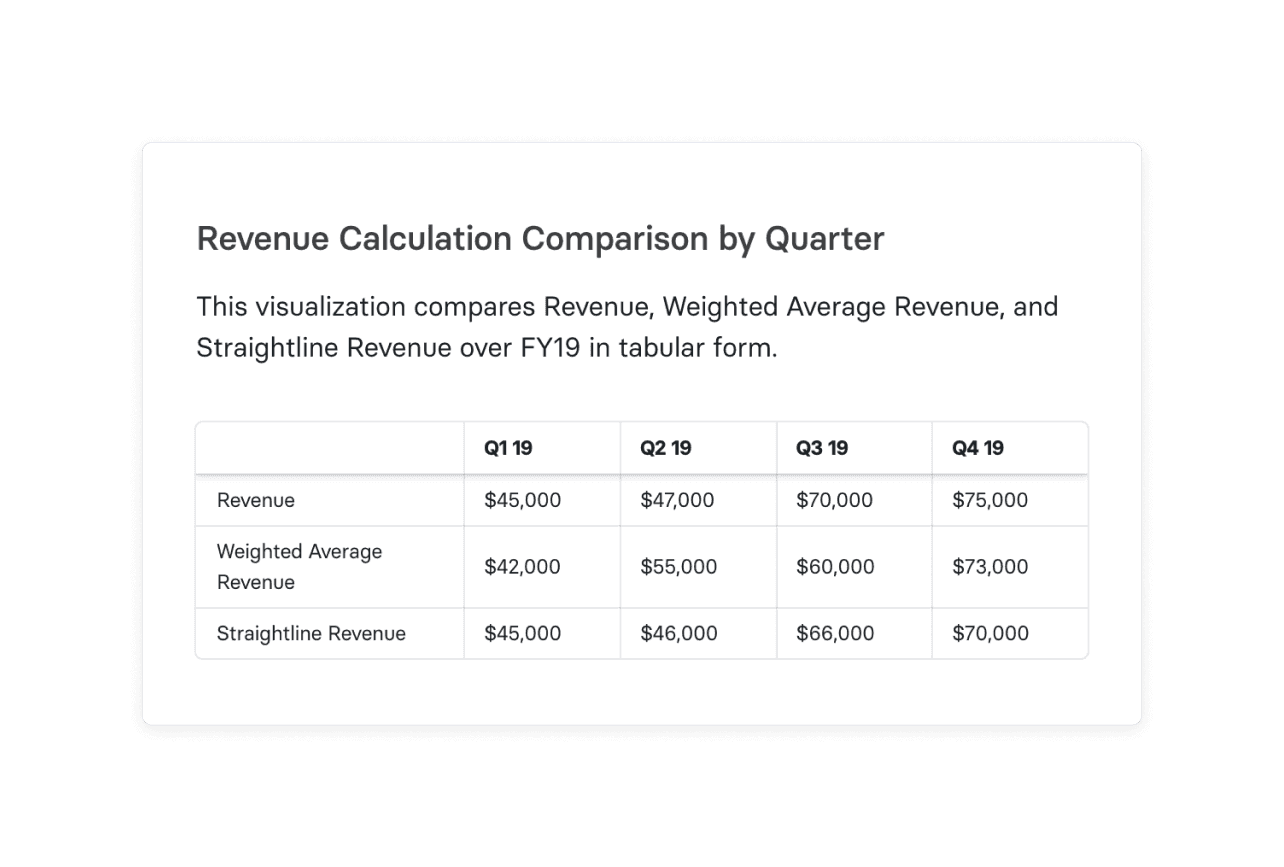

Sales and finance leaders should compare various forecasted revenue calculations (weighted average revenue and straight-line revenue) to actual revenue to better understand forecast accuracy.

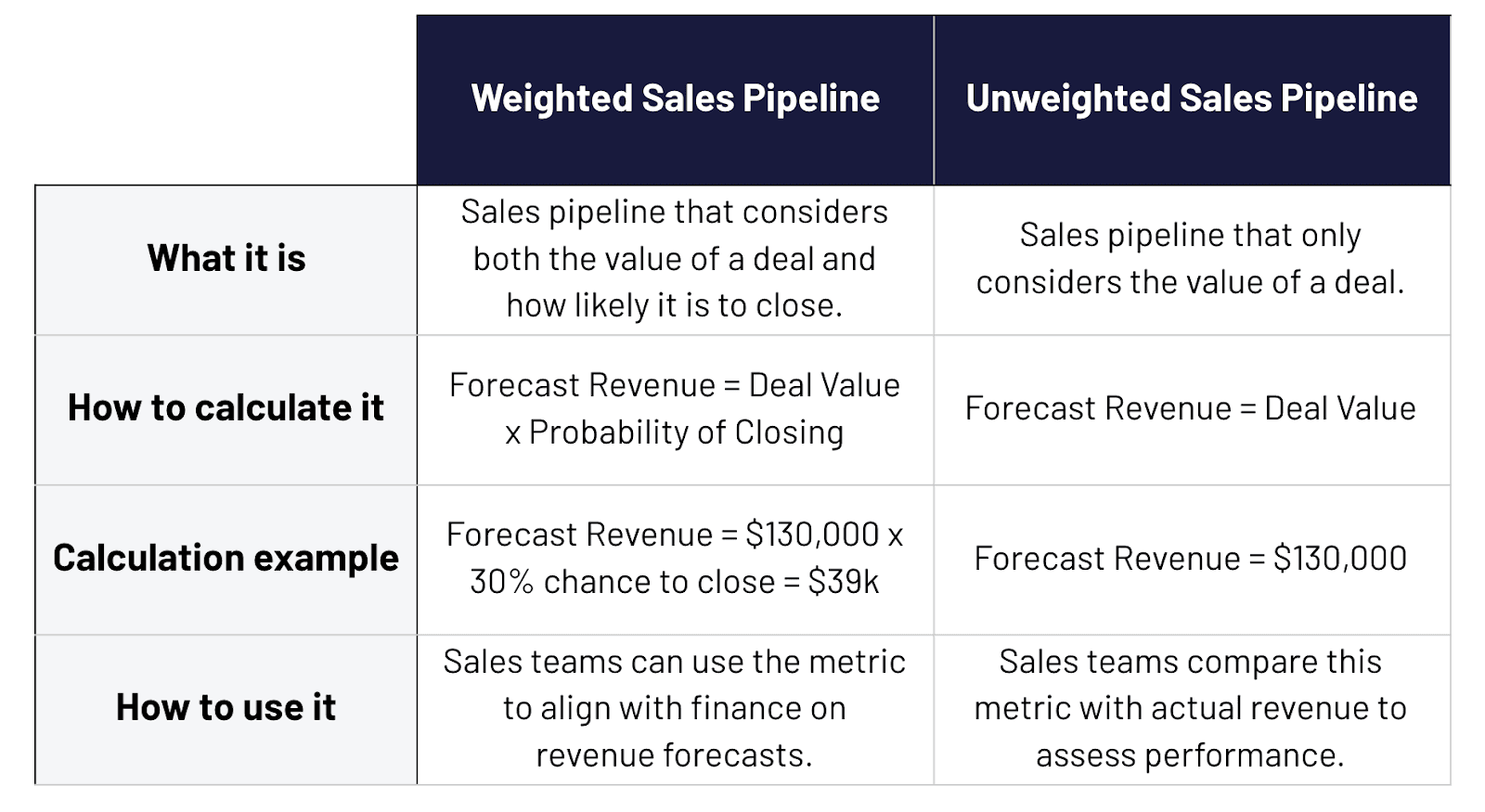

What Is the Difference Between Weighted and Unweighted Sales Pipeline?

A weighted sales pipeline recognizes that not every deal ends in a sale. As a result, it assigns a percentage to each proposal depending on where it is in the sales funnel (like the example above).

In contrast, an unweighted sales pipeline considers every deal value in full without accounting for the probability.

For example, if a deal has a value of $130,000 and a 30% probability of closing, the unweighted value of the opportunity is $130,000. The weighted value would be $39,000 ($130,000 x 30%).

What Are the Advantages of a Weighted Sales Pipeline?

A weighted sales pipeline is data-reliant, making it one of the most accurate revenue forecasting methods. Although there’s no foolproof way to forecast sales, weighted revenue is a logical estimate of the actual revenue we can expect from open opportunities.

Since weighted revenue provides accurate insights into your sales, it can help you allocate the right resources at the right time.

For example, suppose you intend to increase your company’s customer base by 20%. In that case, you can base your decision on extensive sales forecasts and allocate the necessary resources for both marketing and outbound sales to generate the necessary pipeline with the appropriate probability of closing.

What Are the Disadvantages of a Weighted Sales Pipeline?

A weighted sales pipeline may not be the best way for startups and mid-market companies to forecast revenues since it’s more theoretical than real.

A deal is binary. You either close it, or you don’t.

In our example above, we gave a 50% chance to the deals in the trial stage ($120,000), whose weighted revenue comes out to be $60,000. What happens if you don’t close the deal? You’ll be at a higher risk of missing your expected quota.

A weighted sales pipeline also doesn’t account for various elements that can complicate a deal, such as the sales team’s performance or repeat business.

How to Get More Accurate Sales & Revenue Forecasts

When To Use a Weighted Sales Pipeline

A weighted revenue gives companies an overview of their entire sales pipeline, but it’s not the best solution for every organization. It works well for businesses that have a wide range of opportunities at every stage of their funnel and need a simple way to forecast potential sales. The longer your sales cycles are, the more value a weighted sales pipeline delivers.

A good way to use a weighted sales pipeline is to have guidelines that establish what a legitimate risk is and what isn’t. For instance, if you assign a deal a 75% chance of closure, define what 75% means.

In other words, does the customer have a budget? Does your product fit the customer’s needs? Is the customer aligned with what you offer? Have they bought from you in the past?

Having guidelines to assign a probability can be an excellent way to mitigate risk.

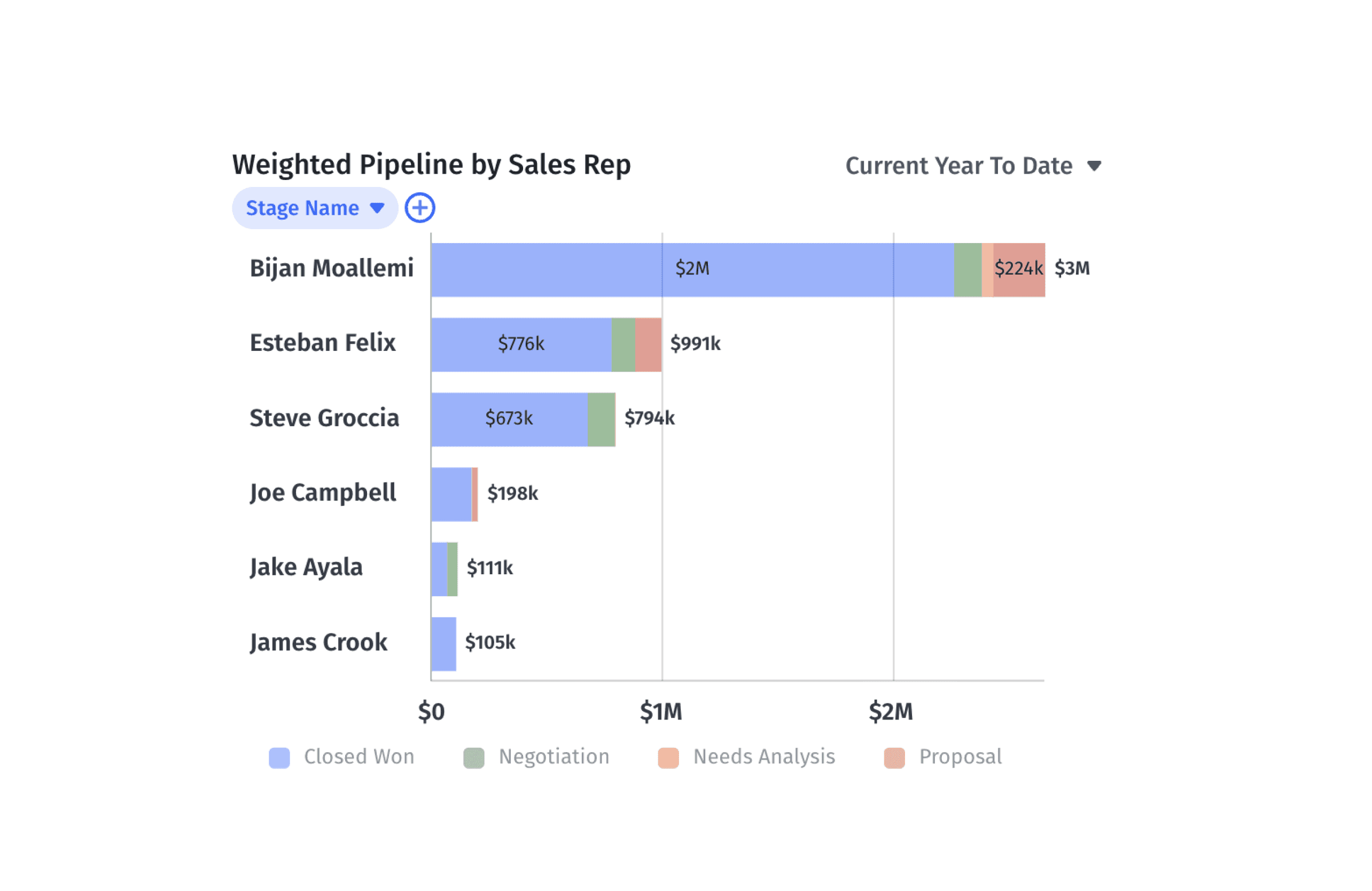

Get More Revenue Metrics in Real Time from Mosaic

Weighted pipeline is just one of the many metrics you’ll want to pull from your CRM when making strategic financial decisions. There are a host of other sales funnel metrics that can help you forecast your top-line growth more accurately.

But CRM-based metrics like bookings, monthly recurring revenue (MRR), annual recurring revenue (ARR), and pipeline become far more valuable when you integrate them with data from other core systems of record like your ERP, HRIS, and billing systems.

Want to learn how integrating all of these systems can help you become a more strategic finance leader? Reach out for a personalized demo of Mosaic.

Weighted Sales Pipeline FAQs

What is a weighted pipeline?

Weighted pipeline revenue is an approximation method used to forecast future earnings by evaluating deals in your sales pipeline and their chances of completion. It assigns each deal an individual probability percentage while taking into account factors that could alter its outcome, acknowledging that not every opportunity can lead to sales.

How do you calculate weighted sales pipeline?

What is the difference between weighted vs. expected revenue?

Explore Related Metrics

Own the of your business.