Gross Sales vs. Net Sales

What Are Gross Sales?

“Gross sales” refers to your company’s total sales for a specific period before making any subtractions for expenses, overhead, or taxes.

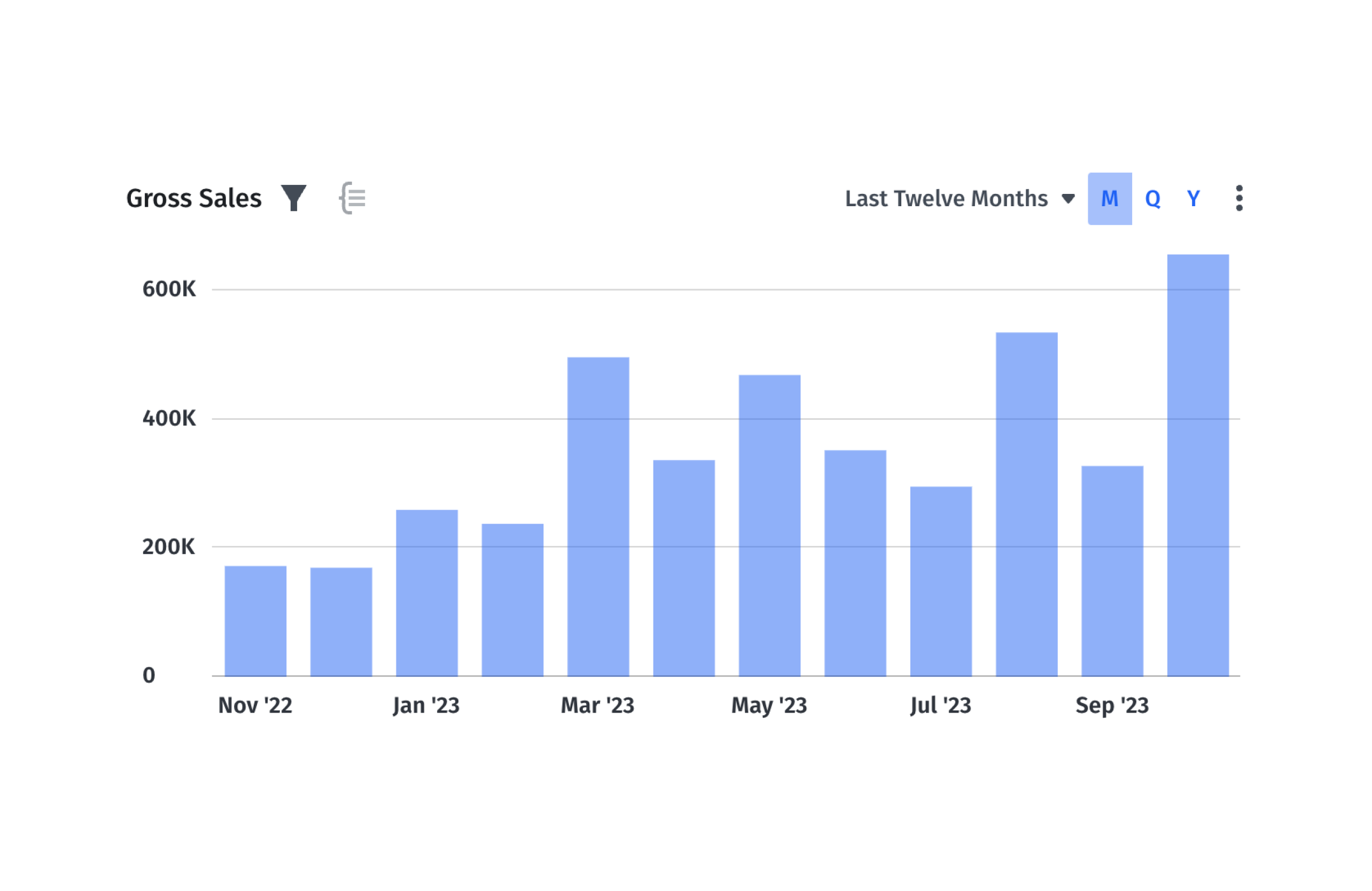

Gross sales is typically discussed in relation to net sales in the retail industry. This metric is necessary as a top-line reflection of your company’s sales revenues over time and to detect trends in consumer spending.

While gross sales (also known as gross revenue) often appear on financial statements, keep in mind this metric won’t include cost of goods sold (COGS), so it can only give you a limited view into the financial health of your organization.

Categories

Table of Contents

How to Calculate Gross Sales

Gross sales is a big-picture metric that’s straightforward to calculate. You simply need to multiply the number of products you’ve sold by the product’s price. The gross sales formula looks like:

number of products sold x price of products = gross sales

Alternatively, you can add up all your paid invoices for the specific period of time you want to monitor.

For example, let’s say your retail shoe company sold 1,000 pairs for $20 each during Q1 of this year. If you want to find the gross sales for Q1, you simply multiply these two sums:

1,000 products x $20 for each pair of shoes = $20,000 in gross sales

What Are Net Sales?

Net sales refers to your total sales — your company’s gross sales — over a specific period after deducting sales allowances, sales discounts, and customer returns.

Gross sales and net sales are often closely compared to one another. That’s because the gap between gross and net sales can reveal a lot about your profit margin. If your net sales closely follows your gross sales, you have a higher profit margin, and vice versa.

Typically, net sales has its own line item in the direct cost section of your company’s income statement. Sometimes, organizations will also have dedicated lines for gross sales and cost of sales in the same section for a more detailed breakdown.

While net sales does account for discounts, sales returns, and allowances, it doesn’t include COGS, various administrative expenses, or general expenses.

How to Calculate Net Sales

To calculate your net sales, you’ll first need to add up your gross sales (as outlined above). Then, to find your net sales, just subtract three specific types of expenditures from your gross sales. The formula looks like this:

net sales = gross sales – allowances – sales returns – discounts

To understand this in real-world terms, let’s refer back to our shoe company. Let’s say in Q1, the company has $10,000 in gross sales, $500 in returns, $1,000 in discounts, and $1,000 in allowances. You can plug those data points into our formula to calculate your shoe company’s net sales for Q1:

$10,000 gross sales – $1,000 allowances – $500 sales returns – $1,000 discounts = $7,500 net sales

Gross Sales vs. Net Sales: Differences and Similarities

These two financial metrics are basic building blocks for many teams looking for a high-level perspective of their sales (and potential profits). That’s why gross and net sales are often tracked together. Despite their pairing, the two metrics have quite a few differences and corresponding similarities.

Gross Sales vs. Net Sales: The Similarities

Although gross and net sales are separate metrics in financial reporting, the two still share some similarities.

Some teams monitor the two in relation to each other in order to keep an eye on their margin. For example, if your net sales suddenly drop while your gross sales stay steady, that could indicate an issue (i.e., a large spike in product returns over a quarter due to a dip in product quality).

While gross sales gives you insight into your company’s revenue that’s generated by your sales organization, net sales can offer more insights into how well the sales team’s approach is working. When monitored hand-in-hand, the two metrics can help you determine how well the sales team is doing and point to some ways they can improve (like offering fewer discounts and price reductions to improve net sales).

Gross Sales vs. Net Sales: The Differences

These two metrics work in conjunction with one another, but they have plenty of differences as well.

Firstly, gross sales is an important metric, but it doesn’t offer much data about your company’s profits or cash flow. Teams then often use this metric to calculate other crucial metrics that offer deeper insights into the financial health of the organization (like net sales).

On the other hand, your net sales figure provides more in-depth data points with which you can identify potential problems. Because net sales accounts for allowances, discounts, and sales returns, you can also get some idea about company profits.

For example: Let’s say your marketing and sales teams worked together to promote a buy-one-get-one deal on your product — and it works. Orders flood in. Because of all of these sales transactions, your gross sales will likely spike. But because of the heavy discount, your net sales number could drop through the floor. That’s a key indicator that this BOGO discount could be severely cutting into your profits.

When to Use Net vs. Gross Sales

Gross sales is most often applied to the retail industry in relation to net sales. The sales, marketing, business operations, and finance teams in a retail organization can benefit from monitoring these metrics. As aforementioned, the two can give leaders insight into how the sales team is performing, identify potential problems with discounts or returns, and data on how much a marketing campaign is directly impacting sales.

However, SaaS businesses don’t use either of these metrics to track their sales and profits. Instead, many SaaS companies lean on gross profit and gross margin instead. These metrics offer better insights into profitability and make it easier for SaaS leaders to optimize their various streams of revenue.

Mosaic’s Metrics Builder Can Provide The Real-Time Data You Need

As aforementioned, gross and net sales are most often used to gauge the financial health of retail organizations. The bottom line is that this data isn’t relevant for SaaS companies—but the right tool can effectively track the financial metrics that do matter. That’s where Mosaic’s Metrics Builder can help.

Your SaaS business is unique, which is why Metrics Builder helps you calculate and monitor the custom success metrics that move your business forward. Seamlessly calculate customer-centric data like retention rates, or customer acquisition costs broken down by ideal customer profile, vertical, product, or market segment. Or closely follow your company’s capital efficiency with tailored cash metrics.

Whatever your needs, Metrics Builder makes it easy to quickly build and visualize tailored metrics to use in reports, dashboards, and models — all without any coding required.

Ready to give your success metrics a makeover? Request a demo.

Gross Sales and Net Sales FAQs

What is the difference between gross sales and gross margin?

Gross sales and gross margin work as two separate metrics that give you different insights into your company’s financial health.

Gross sales is a big-picture metric that only reveals your company’s total sales for a specific timeframe without subtracting any expenses. To calculate it, you can either count up all your paid invoices or follow this formula:

number of products sold x price of products = gross sales

On the other hand, gross margin goes beyond superficial sales numbers to tell you how much your company is actually making. Essentially, the gross margin indicates how much revenue you have left after deducting the cost of goods sold (COGS).

The formula looks like this:

gross margin = net sales − COGS

Your gross margin is typically expressed as a percentage of the revenue your company retains after subtracting COGS. So, for example, if your company keeps $.50 of every dollar in revenue, your gross margin is 50%.

Is gross sales the same as revenue?

Does net sales include taxes?

What’s the difference between net sales and profit?

Explore Related Metrics

Own the of your business.