Projected Revenue & How To Calculate It In SaaS

What is Projected Revenue?

Projected revenue is an educated guess about the amount of money a business expects to make in a given time frame, such as the next month, quarter, or year. It’s a key piece of the puzzle in financial planning, budgeting, and making strategic decisions about where to allocate resources.

Categories

Projecting revenue from diverse streams like monthly subscriptions, annual contracts, and one-time purchases is incredibly challenging yet utterly essential — it influences everything from a SaaS company’s valuation to its ability to make intelligent strategic decisions.

SaaS businesses that nail revenue projections set themselves on a steady and predictable growth trajectory. Yet accurate revenue projections are often like a mirage in the desert, tantalizingly close but always a little out of reach.

The point of revenue projections isn’t to be 100% accurate 100% of the time — that’s just unrealistic. But the sooner you get disciplined about creating detailed and reliable revenue projections, the better off your business is going to be.

Table of Contents

Why SaaS Companies Need to Project Revenue Effectively

First, let’s clear up two terms that often get mixed up: revenue forecasting and revenue projections.

Similar to sales forecasting, revenue forecasting is all about estimating the future revenue a company expects to rake in during a specified period, and it’s based on past data and trends.

On the flip side, revenue projections come into play during “what-if” analysis scenarios — this is when you estimate potential revenue under different sets of assumptions and conditions. It’s critical for managing cash flow, securing funding, wisely allocating resources, planning and budgeting, determining the company’s valuation, and handling risks.

This is a subtle difference, so it’s common to see projections and forecasts used interchangeably as terms for predictions of future performance. But for the sake of this explainer, we’ll focus on the technical “revenue projections” term.

Revenue projections, such as revenue run rate, act as a form of financial guidance for publicly traded companies. As these are fully matured companies, corporate finance teams essentially use revenue projections to communicate to investors what they might anticipate regarding future earnings.

However, revenue projections are equally crucial in the earlier phases of a company’s life cycle. Here’s why: In the beginning, SaaS companies typically incur substantial upfront costs for customer acquisition, software development, and infrastructure, all while the revenue from those customers gradually trickles in.

Accurate revenue projections are crucial to overcoming startup cash flow challenges and establishing a solid foundation for success. It assists in pinpointing the most profitable products or services, directing the company’s efforts, and devising strategies to avoid potential risks, in addition to the following reasons:

Get the 2024 Financial Planning Blueprint

Build Investor Confidence

For a SaaS company with VC backing, hitting the intended milestones between funding rounds is crucial to secure that next chunk of investment. Nailing your revenue forecasts and hitting your targets time after time shows investors you’ve got a handle on things and that their money is in good hands.

And when investors are happy with your company’s performance, they’re more likely to fund future rounds to support company growth.

Support Expense Planning

Expense planning directly impacts your company’s cash flow, profitability, and growth trajectory.

And in any big-picture planning, the starting line is your revenue projections. By playing out different scenarios to gauge how much money you expect to bring in, you can form the foundation for the rest of your financial plan, including how much you’ll need to spend to hit those targets (spend forecasting).

As you know, a mismatch between your expenses and revenue could potentially result in the company running out of cash. So, if your revenue projections are all over the place, the rest of your plans will go out the window.

Enable Agile Decision-Making

Precise revenue projections are vital to making well-informed strategic decisions and ensuring stable and predictable company growth. The more smoothly and accurately you can churn out revenue projections and forecasts, the easier it is to switch up strategies when needed.

Consider revenue projections like reforecasting quarterly or even monthly when the market’s playing hardball. Based on the actuals from the last month, where do you think you’ll land by year-end? How does that stack up against your original plan? And, most importantly, what’s your game plan to bridge the gap?

Your projected revenue can equip you to address these questions well in advance, steering clear of potential roadblocks before they morph into real problems.

How to Create SaaS Revenue Projections

Finance teams often rely on linear regression, moving averages, or exponential smoothing to calculate revenue projections — usually using spreadsheets. However, just because Excel can handle the customized nature of topline planning doesn’t mean it’s the best for the task.

Spreadsheets have been the go-to for finance folks for decades. But, let’s face it: they get messy, are prone to errors, and can quickly become complex with the never-ending maze of cells and formulas.

The resources you pour into pulling data from source systems, tweaking intricate webs of financial assumptions, and adjusting models based on unexpected or urgent requests rob you of the time you could spend on more strategic work.

Enter Mosaic’s Topline Planner. It gives finance teams the best of both worlds — the adaptability of spreadsheets and the real-time data for a growing company looking to increase market share rapidly.

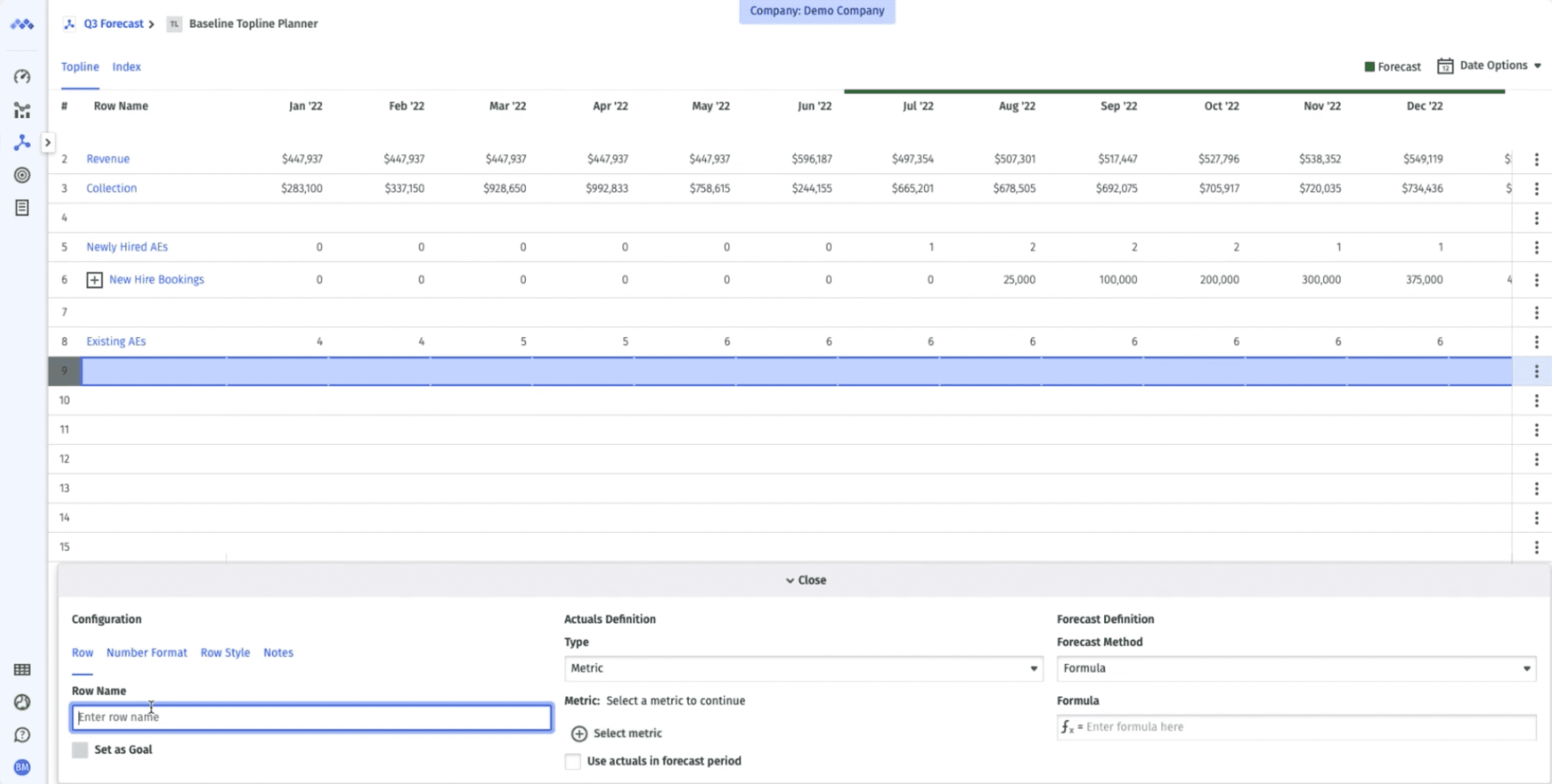

Create and maintain custom revenue forecasts using elements unique to your business. The cloud-based grid fuses on-demand metrics with user-friendly, intuitive formulas for a seamless financial modeling experience.

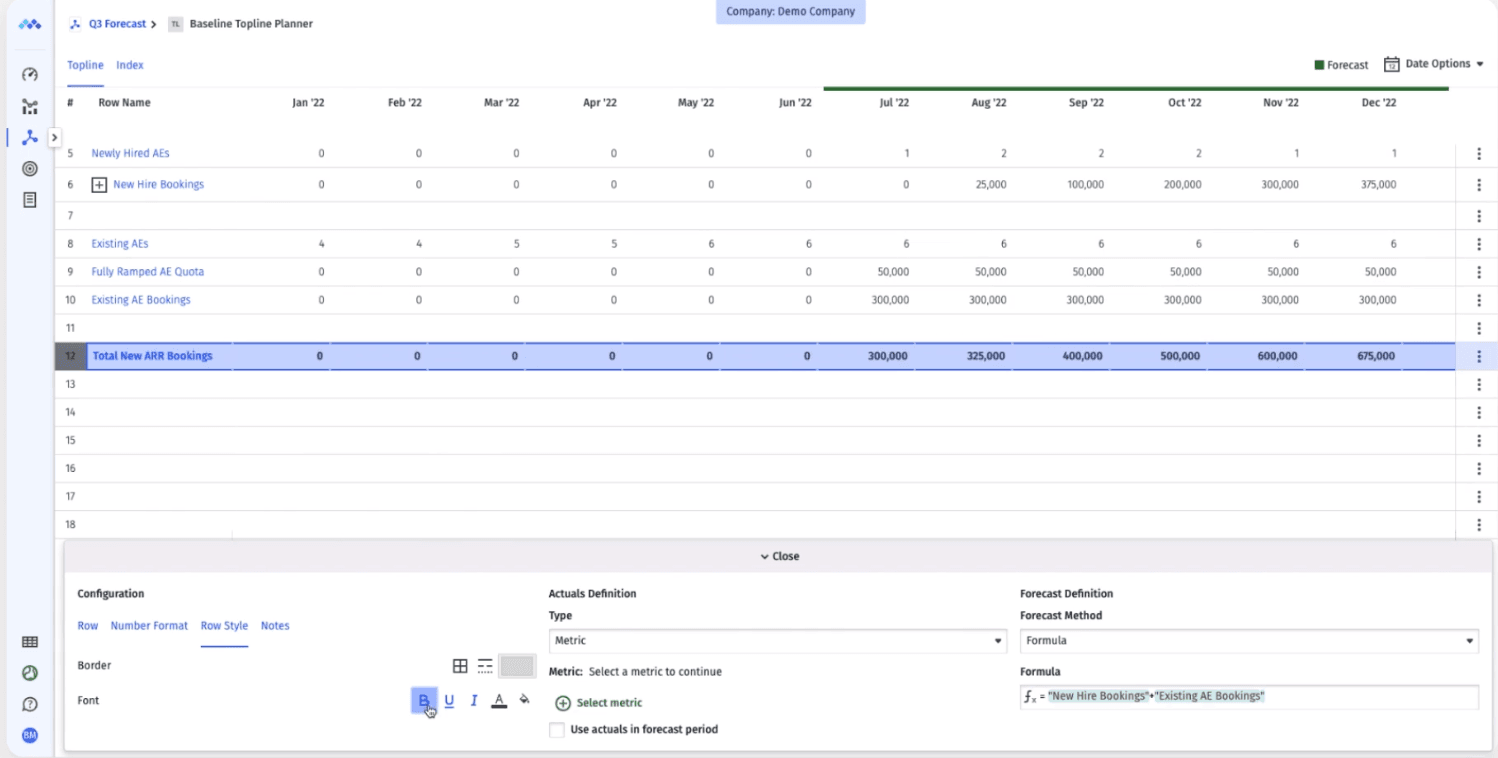

You can use different startup cash flow forecasting methods and build out various revenue projection models within Mosaic. Here’s a walkthrough of the sales capacity model, combining annual recurring revenue (ARR) from both new and existing sales rep/account executives, to give you an idea of how it works.

Create a Baseline with Sales Rep Performance and Headcount Data

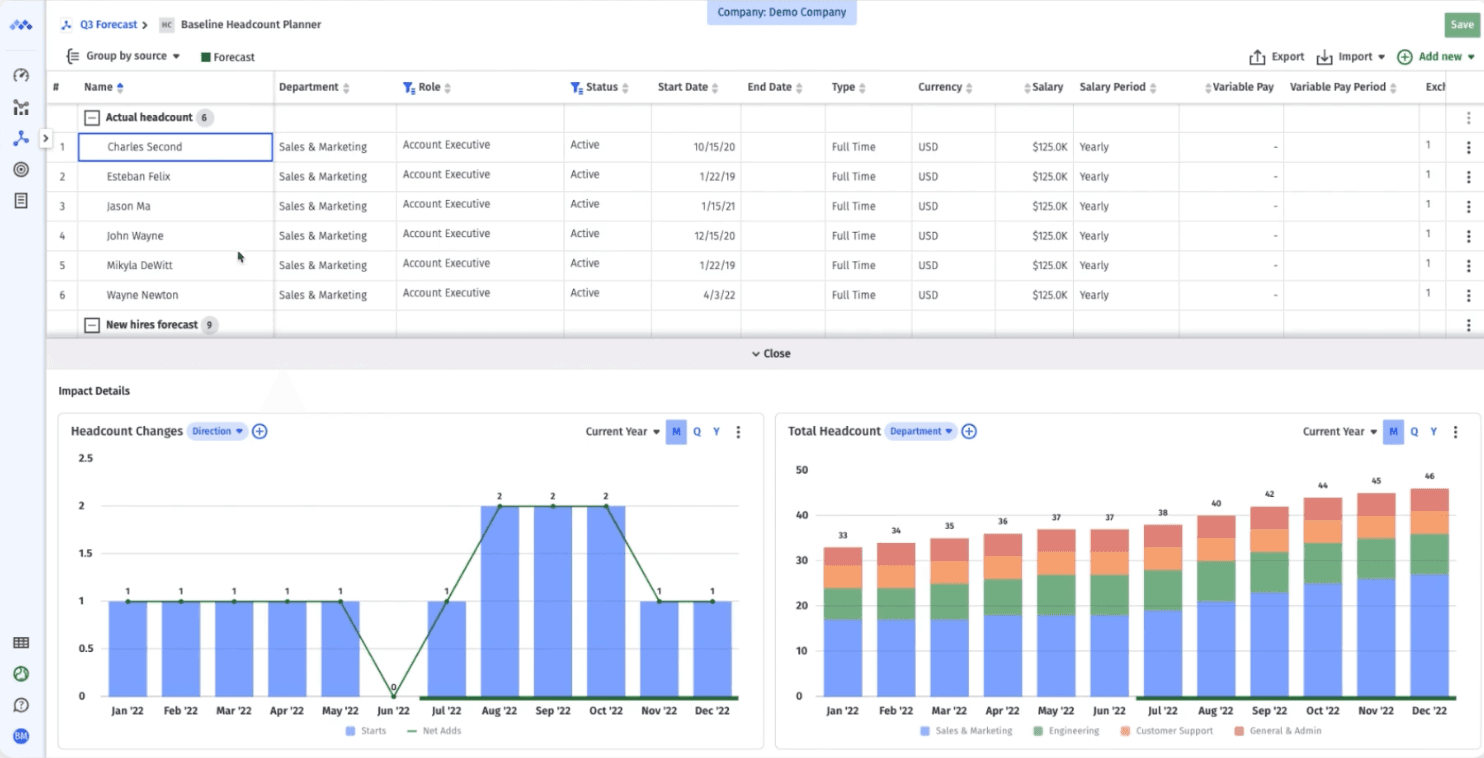

This revenue projection model starts by estimating ARR to be generated monthly by each account executive. Assuming your CRM setup is clean, you can construct a precise sales ramp waterfall to drive booking projections based on your sales headcount plan.

First, you’ll want to check the headcount planner to ensure that all current account executives are dynamically imported through HRIS integration. Although there is an option to adjust the headcount planner, shift your focus back to the topline planner if everything appears all right.

Create Assumptions for Expected ARR Per Account Executive

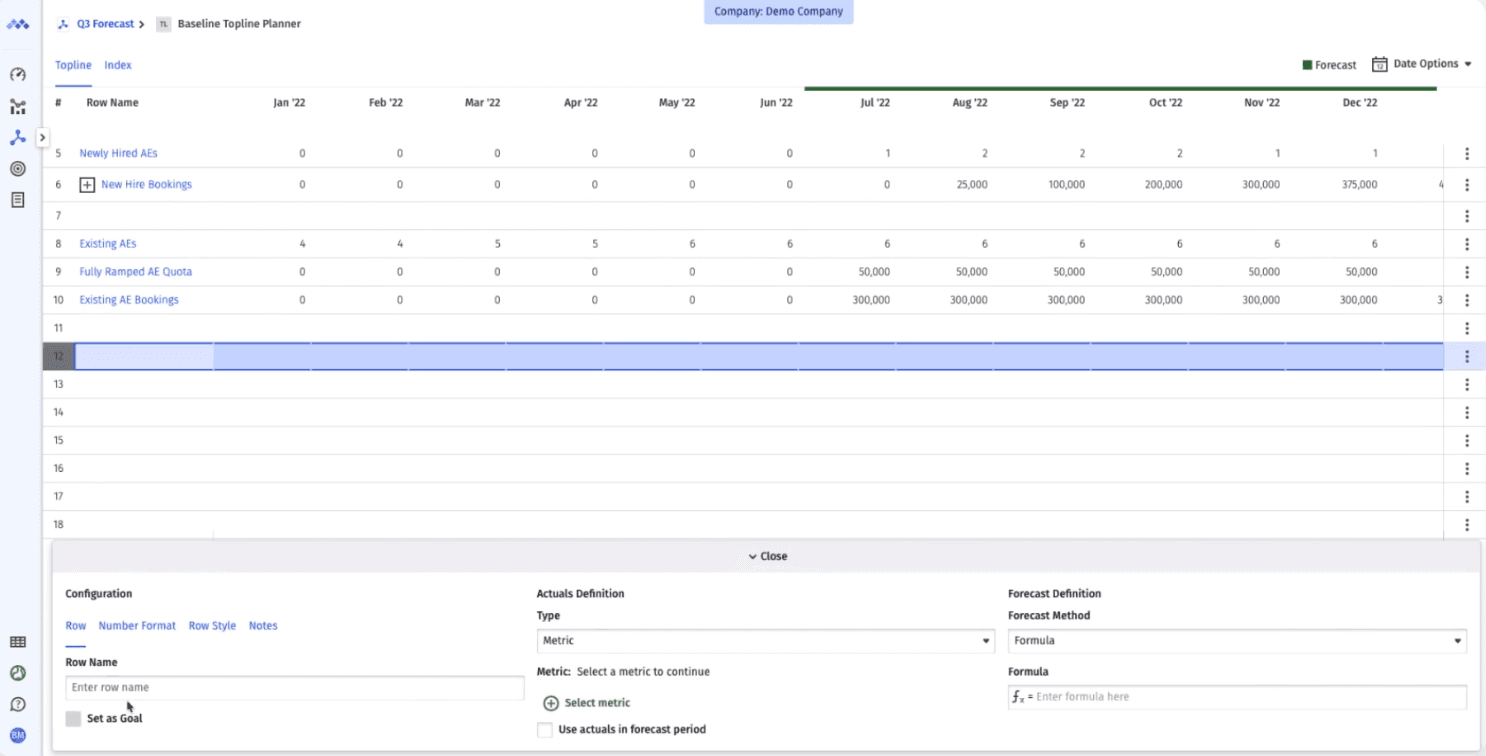

Since the account executives are fully ramped, they are expected to achieve a quota of $50,000 every month based on last year’s numbers. Project this value forward for the next year.

The next row will display the total ARR generated by existing account executives — this number is calculated by multiplying the number of existing account executives by the fully ramped quota. You should now see a row summarizing all the ARR.

Model New Bookings Using Your Established Assumptions

The calculations in this step will depend on your business plan. Once you add that summary row, you can give it a new name and then add a formula in your topline model to add the new account ARR with the existing account ARR.

Now, you’ve got a crystal-clear summary of the total ARR bookings all your new and existing account execs are expected to rake in over the next 18 months.

To double-check your forecast accuracy, try building a SaaS bookings, billings, and collections model — it’s a great way to give those numbers a once-over from a top-down perspective.

How Mosaic Enables Accurate Financial Projections

Revenue planning should be easier, and that’s exactly why we built our Topline Planner to balance the flexibility of spreadsheets with the power of real-time business system integrations. With Mosaic, you can amp up your speed and accuracy in revenue forecasting by tapping into a a variety of features:

- Metric builder offers direct connections to a metrics catalog that’s full of on-demand financial metrics

- Intuitive formulas with auto-complete features

- Sheet-like formatting for that familiar spreadsheet flexibility

- Metric cross-referencing for more dynamic forecasting

- Simple scenario planning to quickly see how different assumptions affect your business

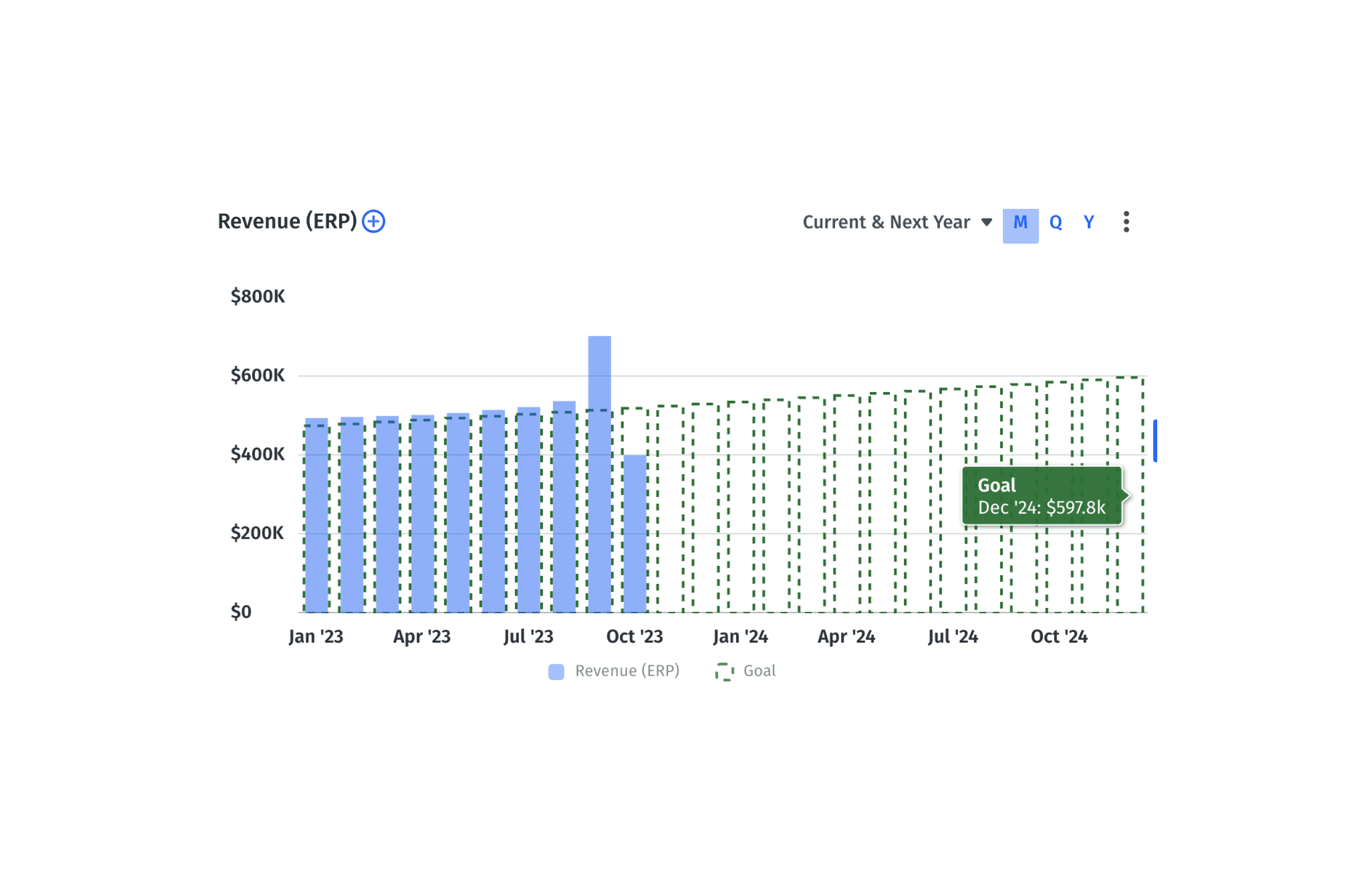

- One-click goal setup for easy tracking of your historical performance in the Analysis Canvas dashboards

Reach out for a personalized demo and discover how Mosaic can make forecasting revenue a breeze.

Projected Revenue FAQs

Is a revenue projection the same as a forecast?

Although revenue projection and revenue forecast go hand-in-hand, they are different concepts.

Forecasts are financial predictions you anticipate will remain valid throughout the forecasting period, such as the fiscal year. A financial forecast outlines the anticipated effects of a company’s operations on its three financial statements, taking into account the planned actions of your SaaS company and highlighting their financial implications.

On the other hand, financial projections are based on speculative assumptions, meaning that you can examine your financial statements under specific “what-if” scenarios, such as best or worst case, even if you don’t necessarily expect those situations to occur.

Can you calculate projected revenue in Excel?

What is the difference between projected and actual revenue?

Explore Related Metrics

Own the of your business.