Categories

Net income is the best indicator of a company’s profitability because it shows the total amount its shareholders earned during a given period.

But there’s more to net income than what meets the eye. For example, did you know that the dividends you pay to preferred shareholders are not an expense and don’t impact the net income?

Keep reading to learn everything businesses need to know about net income.

Table of Contents

How to Calculate Net Income

The net income calculation involves taking total revenue and subtracting all expenses, including depreciation, amortization, and interest expenses.

Here’s the net income formula:

If you want to break the formula out further, it becomes:

Net Income = [Revenue + Other Income] – Cost of Goods Sold (COGS) – Operating Expenses – Other Expenses – Interest – Taxes

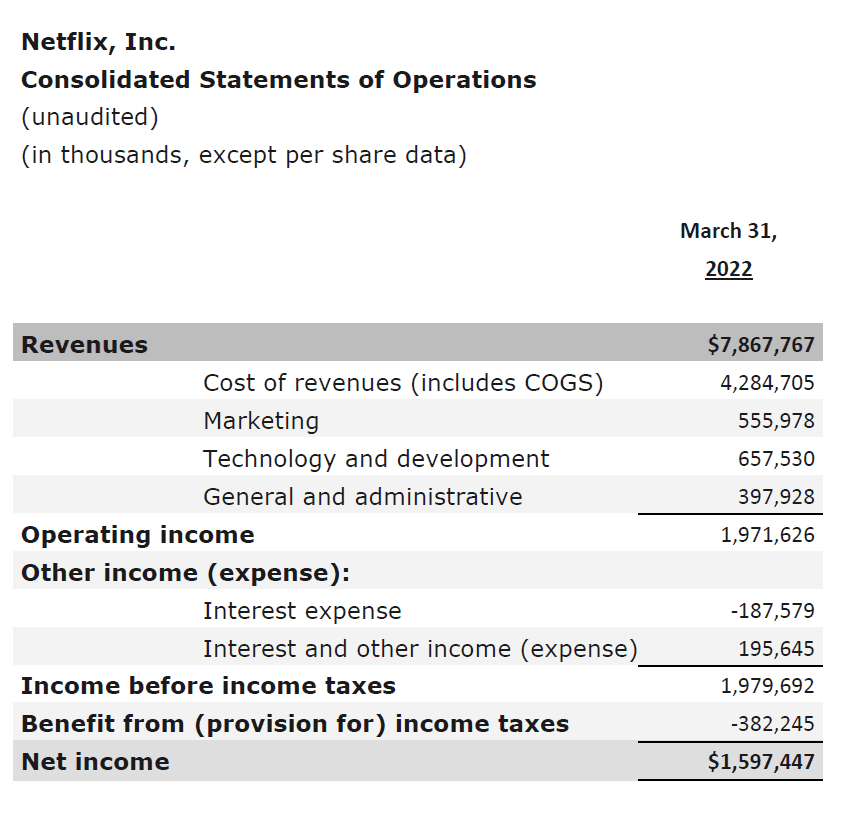

Let’s use Netflix’s income statement as an example:

Netflix’s income statement from Q2 2022. Courtesy of Netflix.

The statement starts with Netflix’s revenue for the quarter. It then subtracts the cost of revenues (which includes the cost of raw materials or COGS), marketing expenses, administrative expenses, and technology expenses to get the net operating income.

Then, you see other expenses and incomes (which includes just the interest expense and income in Netflix’s case). Finally, it deducts the taxes.

The net income is the last line item in the company’s income statement. For more information on this check out our page on revenue vs. profit.

Plan for growth with our Financial Planning Blueprint.

3 Reasons Net Income Is Important for a Business

Net income (or net profit) is key to several decisions you make as a business. Here are some examples of net income’s importance:

1. Determine Trends Toward Profitability

VC-backed startups and high-growth companies aren’t looking at their bottom line and expecting to see a profit. In most cases, you’re turning a net loss as you fuel growth with venture capital and trying to capture as much market share as possible on your way to an IPO.

But paying attention to trends in net income can help you understand whether your company is on a path to profitability even when you’re burning cash. Because even though you aren’t expected to be profitable now, it’s always the end goal for a business.

2. Monitor Financial Health

Net income helps you monitor your business’s financial health — especially as a public company. If your net income is consistently low, you need to see where you’re leaking money.

Besides that, a low net income also translates into other financial issues.

For example, a company that has issued cumulative preference shares accumulates a liability if it’s unable to pay dividends every year.

This means that once net income stabilizes, the company will need time to pay off the preference share dividends before it can pay dividends to equity shareholders.

The more accurate you can be in your revenue forecasting, the easier it is to build predictability in your financials and proactively address issues that would negatively impact net income.

3. Plan for Growth

Companies in high-growth industries like SaaS need money to sustain growth. They retain a part of the net income and transfer it to an account called retained earnings for growth.

A company’s net income tells you how much money you can transfer to retained earnings and reinvest in the business.

Track Net Income & Other Key Metrics with Strategic Finance Software

Net Income Limitations: 3 Things to Be Aware Of

Let’s check out the net income figure’s limitations to better understand your business’s net earnings.

Here are some limitations you need to know:

1. Effect of Accounting for Non-Cash Expenses

Expenses like depreciation and amortization aren’t cash expenses. You don’t pay money for those expenses. While they play a valuable role in accounting, they often skew the net income figure.

This is especially true if the value of your assets decreases. For example, suppose your certified public accountant (CPA) recommends that you revalue your asset from $10,000 to $7,500. In that case, you’ll see a $2,500 expense on your income statement (and the asset’s value will reduce by the same amount on the balance sheet). However, you won’t pay that $2,500 to anyone.

In other words, non-cash expenses will decrease your net income but won’t affect your earnings outside the books.

2. Multiple Assumptions

Accountants use assumptions across financial statements that might skew your net income. Asset depreciation is a common example of this for companies that own manufacturing equipment or sell physical goods.

Business owners looking to minimize their company’s income tax liability often opt for a big depreciation expense on their tax books to decrease their net income in the books.

In contrast, a company looking for investors may use a lower depreciation expense on their accounting books to inflate the net income.

3. No Fix Correlation with Cash

If your net income is $100,000 in a year, does that mean you generated $100,000 in cash during that period of time?

Not exactly.

Due to accrual accounting, your total net income differs from the cash your business generates during a period since accrual accounting enables companies to record revenue or expenses before the actual exchange of cash.

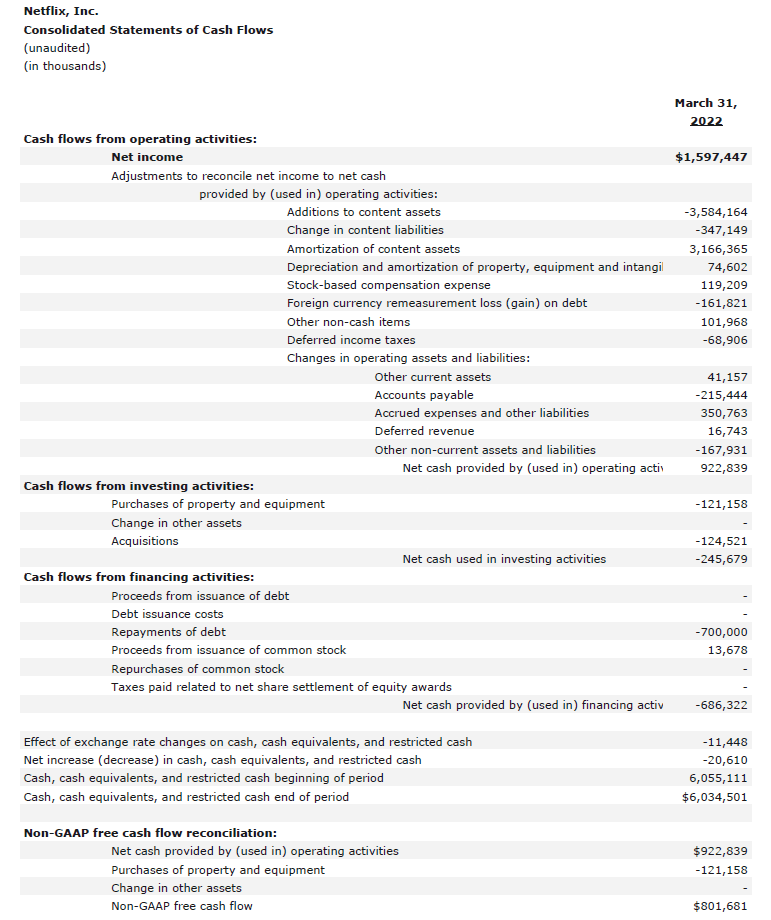

This is where you have to cross reference your income statement with your cash flow statement. For example, look at Netflix’s net income versus the cash flow:

Netflix’s cash flow statement from Q2 2022. Courtesy of Netflix.

Notice how the cash flow starts with the net income.

The cash flow statement is essentially a reconciliation between the net income and the cash generated by the business.

Other Financial Terms Commonly Mistaken for Net Income

Net income is not the only type of profit that appears on the financial statements. You’ll see gross income, EBITDA, and EBIT as well. And if you’re looking at the tax books, you’ll also encounter taxable income.

Gross Income

Gross income (or total income) appears at the beginning of the income statement. It’s calculated as:

As a SaaS company, you can calculate the gross profit by deducting the costs of providing the service from the total revenue.

For example, you can calculate the gross profit by deducting expenses like the cost of servers and payments made to freelance software developers from the revenue.

Gross profit is a measure of financial efficiency that helps you understand how effectively your company provides its services.

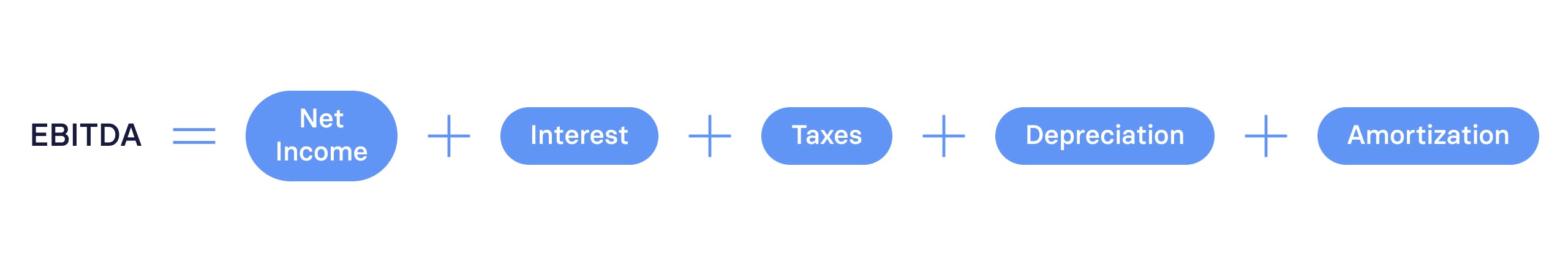

EBITDA

EBITDA is an abbreviation for “earnings before interest, taxes, depreciation, and amortization.”

It’s calculated as:

With EBITDA, you can see a company’s profitability without the effects of tax provisions, cost of financing, and capital expenditure.

The U.S. GAAP, SEC, and IRS don’t require companies to show EBITDA on their financial statements.

But many companies include EBITDA on their financial statements since it’s commonly used for the valuation of a company. For example, investors often use EV/EBITDA to compare companies and find promising investment options.

For SaaS valuation, investors typically rely on revenue multiples, so EBITDA isn’t as helpful in the context of SaaS companies.

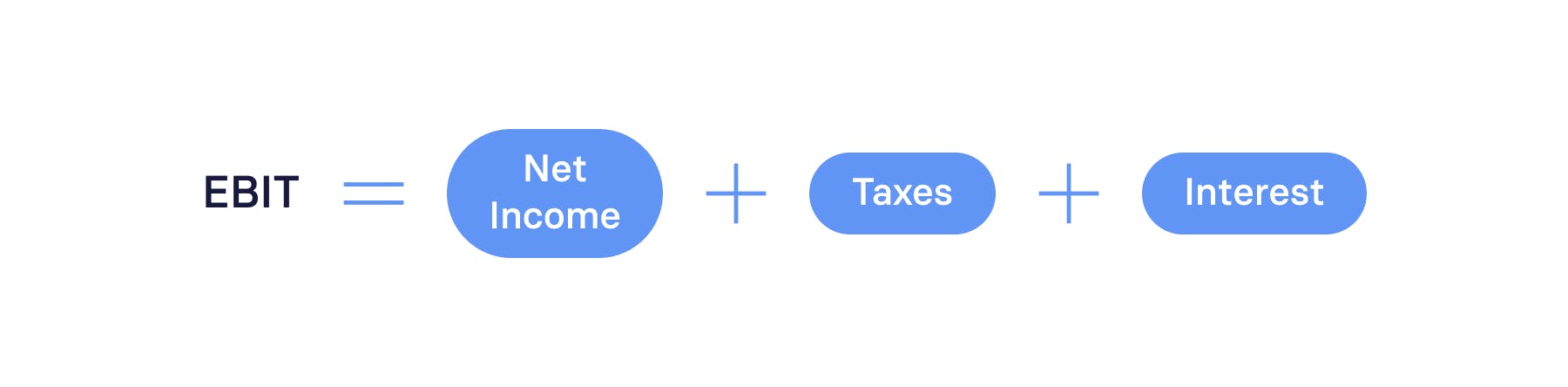

EBIT

EBIT is an abbreviation for “earnings before interest and taxes.” It is calculated as:

EBIT helps you understand how efficient you’re at managing your business. For instance, if you’ve got a low EBIT but a high gross income, you’re spending too much on administrative expenses. And you need to look for alternatives.

Like EBITDA, companies don’t need to show EBIT on their financial statements.

However, many do share it since EBIT is also used for valuation. EV/EBIT is a common EBIT valuation metric.

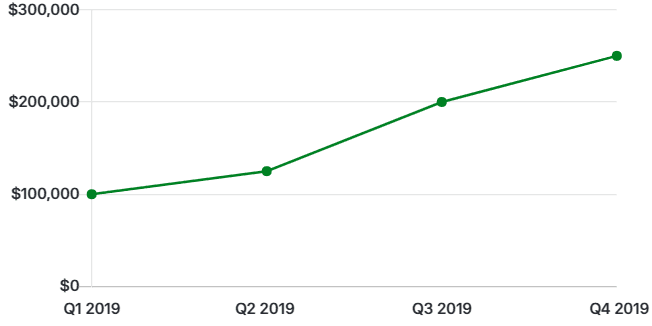

Monitor Net Income with Mosaic

Net income helps you track the amount of money your business earns over a certain period. If the net income is consistently low, act quickly and focus on reducing your total expenses.

However, Excel spreadsheets won’t cut it, even if you’re a small business or early-stage startup. You need a real-time tool to track sales revenue, operating costs, and net income. That’s where Mosaic comes in.

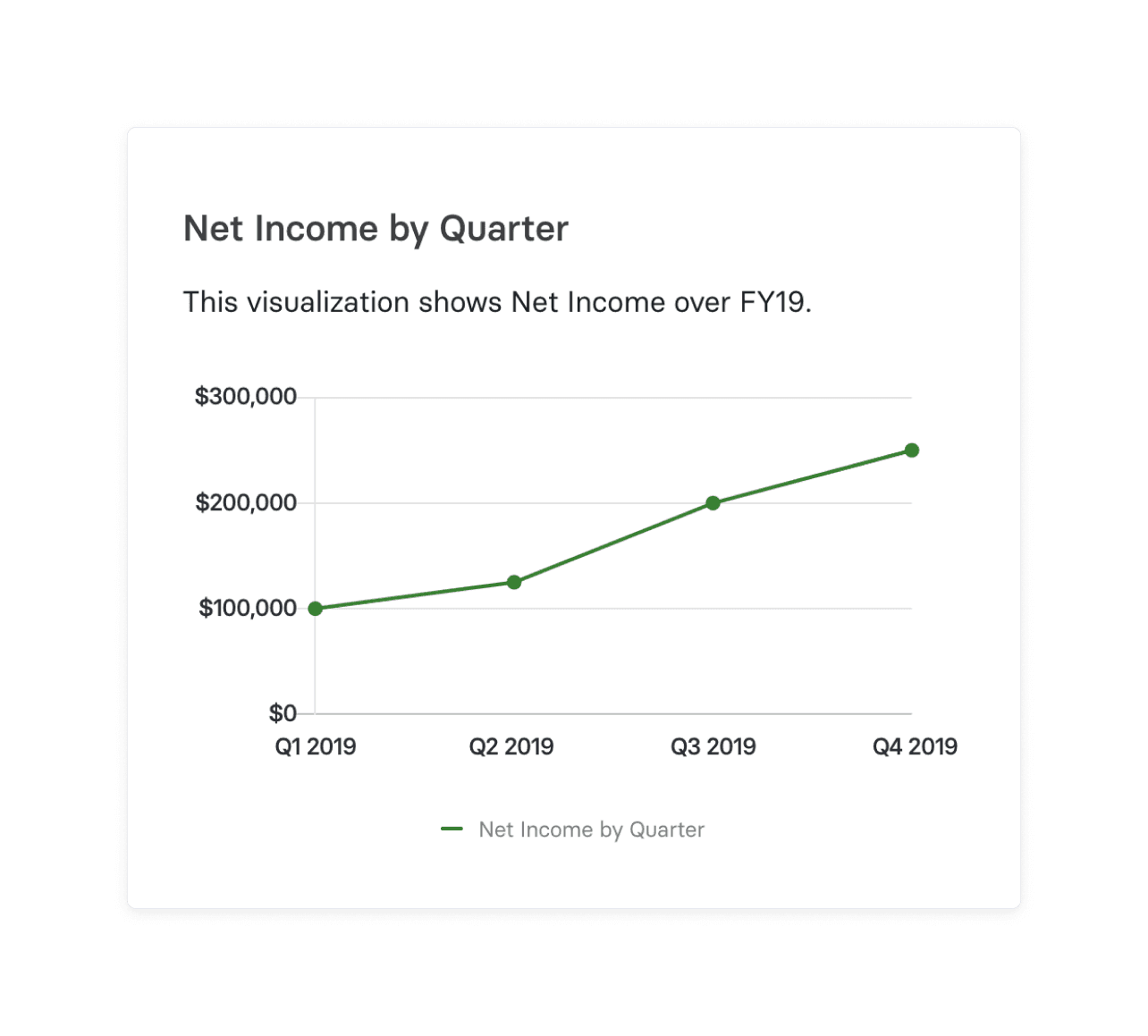

With Mosaic, you can easily track top and bottom-line growth. For example, you can monitor net income by quarter and visualize your net income’s growth over time.

You don’t need to enter this data into Mosaic manually. Mosaic integrates with your ERP and CRM and automatically pulls relevant data to provide actionable data.

Reach out for a personalized demo of Mosaic today to learn how you can streamline metric calculations and improve financial analysis.

Net income FAQs

What is net vs gross income?

In business, net income is the final amount of remaining income a company has after all expenses, including taxes and payroll, have been deducted. Gross income, on the other hand, is the amount of total income before such expenses are deducted. See our article on gross vs. net profit for more info.

Is net income before or after taxes?

What is the difference between net operating income and net income?

What is the difference between net profit and net income?

Explore Related Metrics

Own the of your business.