Revenue Per Employee

What Is Revenue Per Employee?

Revenue per employee (RPE), also called revenue per headcount, is an efficiency ratio that tells you the revenue every full-time employee generates on average. It does not account for outsourced work or contractors. For example, if your revenue is $100,000 and you have 10 full-time employees working for you, your RPE is $10,000.

Categories

Maximizing RPE isn’t as simple as just keeping your team lean while growing top-line revenue. Depending on the market you operate in, you may naturally be a more headcount-heavy business.

Unlike net profit margin, which you’re trying to maximize at all times, you should always be contextualizing and benchmarking your revenue per head against comparable companies and internal trends to see where you stand and whether or not you need to improve.

Read on to learn everything you need to know about RPE.

Table of Contents

3 Reasons Revenue Per Employee is Important for Businesses

The revenue per employee ratio is a valuable headcount metric that helps you understand both the efficiency of your business and the overall performance level of your workforce.

But beyond these general benefits, here are a few other reasons why RPE is an essential metric to monitor:

1. Justifies Aggressive Headcount Plans

Employee costs, including labor costs from salaries and benefits, often form the largest portion of a company’s cost structure — especially in SaaS tech companies. These companies are labor-intensive, meaning that growth strategies are often largely tied to the number of people you can bring on to support departmental initiatives. That’s why effective headcount planning and strategic budgeting can be the difference between the next unicorn startup and one that misses its revenue goals. And it’s one reason RPE is such a valuable metric.

These companies can look at RPE to see if headcount plans and revenue goals are in alignment. If annual revenue significantly exceeds employee costs, you may decide to get more aggressive with hiring plans.

2. Benchmarks Workforce Performance

You can compare your RPE with RPEs of similar companies and your historical data to better understand workforce performance and productivity.

Comparing RPE with similar companies in your industry lets you know how your employees perform compared to other companies’ human capital. Meanwhile, the trend in RPE within your company tells you whether your operations have improved over time. That might mean getting better at hiring quality talent, ensuring employees are in the right positions and levels, finding ways to better engage the workforce, or focusing your headcount plans only on essential hires.

3. Contextualizes Headcount Metrics

Like any key performance indicator (KPI), revenue per head is only as valuable as the context you put it in. When combined with the right financial metrics and headcount metrics, you can gain strategic insight into your company’s financial efficiency and performance.

For example, in a vacuum, a spike in RPE would be a good sign for your company. But if the cause is a sudden spike in employee turnover or a round of layoffs, you know there’s more to the story. As long as you understand the “why” behind your RPE numbers, you can set proper target ranges for your org as it grows and matures.

How to Get Unique Insights Into Headcount for Workforce Planning

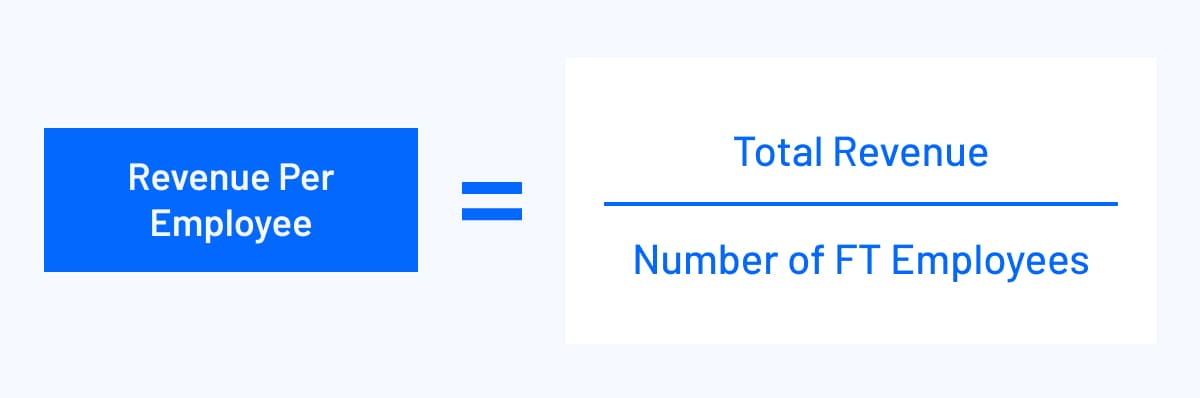

How to Calculate Revenue Per Employee

The revenue per employee formula is fairly simple. You divide your company’s revenue by the current number of employees to get the RPE.

For example, if company A generates $1 million in total revenue during 2022 and has 100 full-time employees during the year, company A’s average revenue per employee will be:

Revenue Per Employee = $1,000,000 / 100 employees = $10,000

You can generally find this information for competitors on their financial statements or annual reports if they’re a public company.

The formula uses two figures: the company’s total revenue and the number of employees. In other words, a change in either of these will affect the RPE:

- An increase in the total revenue increases the RPE

- An increase in the number of employees decreases the RPE

What Is a Good Revenue Per Employee in SaaS?

A “good” revenue per employee benchmark depends largely on the size and maturity of your business. But according to Jason Lemkin, Founder of SaaStr, most SaaS companies need to level off at the $250k to $300k in revenue per employee range to go public and operate as a cash flow-positive business.

Lemkin looked at examples like Zoom, which IPO’d at $300k per employee, and Samsara, which IPO’d at roughly $300k per employee. But he also noted that Expensify, with its largely product-led business and large pool of contract workers, reached as high as $1 million per employee when it went public.

Between 2017 and 2022, earlier-stage startups could get away with having much lower RPE because funding was so readily available. But as the market shifts away from growth-at-all-costs to a focus on growth efficiency, you should try to operate in that $250k to $300k per employee range as early as possible if you want to be in the upper echelon of VC-backed organizations.

What Influences Revenue Per Employee?

Several factors affect your RPE. You have control over some of these factors but not others.

Industry

The industry is the most important factor. When you work in an industry that requires highly skilled employees, you need to pay them well. For example, if you’re a technology company, you hire developers, security experts, and engineers — each of which demands a higher salary.

Your employee costs differ from media companies, manufacturers, or lean DTC businesses.

That means you need to compare RPE only with firms in the same industry to avoid misinterpreting your RPE. Comparing your RPE with a company in a different industry can be misleading.

Company Life Cycle

Your startup may not generate enough (or any) revenue during the initial months. But you will need to pay salaries if you have employees. This means you might have a negative RPE.

Does that mean you should scale back and work with fewer employees?

No.

As your company grows, you’ll start generating higher revenue. Over time, the growth in your revenue will negate the cost of your human capital, and you’ll see your RPE start climbing.

Put simply, during the growth phase, compare your RPE with your previous RPE instead of another company’s RPE.

Employee Turnover

A high employee turnover rate can skew your RPE.

Momentarily, your RPE will increase due to employee turnover since the number of employees will decrease.

But you’ll have to actively hire new employees to backfill positions if you’re dealing with employee turnover issues. Onboarding new employees comes with additional costs, which means your net income will drop.

You might also train the new employees, which means you’ll spend extra time training them without an immediate productivity improvement.

3 Ways to Improve Revenue Per Employee

If your RPE has decreased over the past few quarters, act quickly.

Here are things you can do to improve your RPE.

1. Bost Employee Retention

Onboarding new employees can become a drag on productivity.

Increasing employee retention lets you gain momentum over time, consequently letting employees generate high revenues year over year.

If your RPE drops from its previous average, put finance and human resources on the job together and develop a strategy to regain your RPE.

2. Support Information Mobility

Information mobility refers to how easy or difficult it is for everyone in your company to access the information they need.

You need high information mobility if you want higher RPE. In other words, if your employees can’t access the information they need to resolve their problems, your system has a major bottleneck that reduces employee productivity.

Your employees are idle when they wait for a supervisor or support team to resolve their immediate concerns. Reduce this idle time and focus on revenue-generating activities to increase your RPE.

With finance’s growing involvement in company-wide data architecture and transparency, you have more power than ever to impact information mobility and drive these productivity gains.

3. Revamp Pricing Strategies

Aside from increasing top-line revenue by signing new customers, companies can increase revenue by revamping their pricing strategies.

When your SaaS pricing strategy properly aligns with the value you provide to customers and also includes levers for natural contract increases, you’ll start to see the snowball effect of net revenue retention increasing RPE.

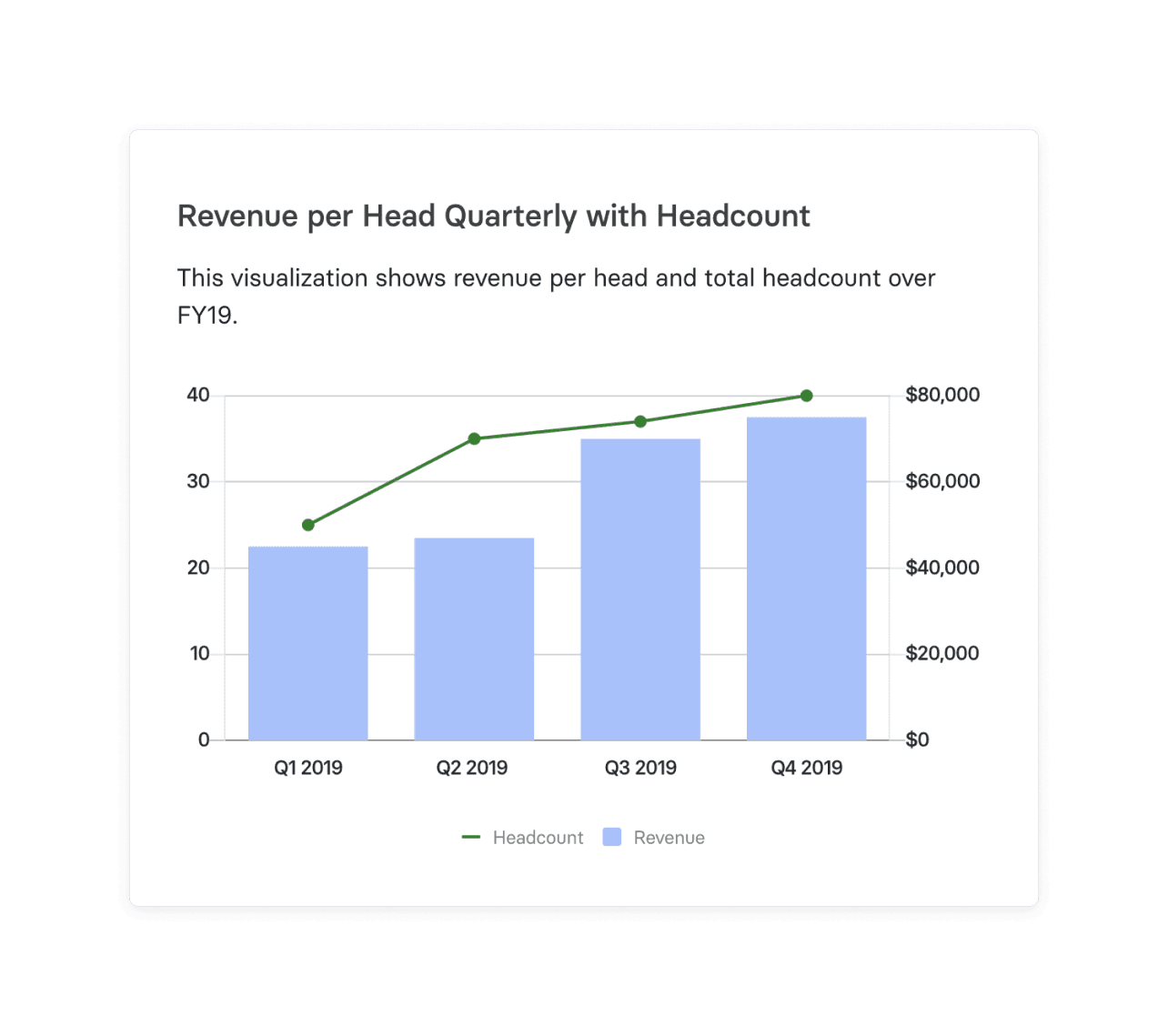

Track Revenue Per Employee with Mosaic

While the formula for revenue per employee is simple, calculating the metric and contextualizing it with other headcount and revenue metrics isn’t always easy. Because the necessary data is spread across your HRIS, CRM, and ERP systems, you risk making the calculations with stale data after the time it takes to collect and aggregate all the information.

Mosaic integrates with your most critical source systems to give you real-time insight into a wide range of headcount metrics, go-to-market metrics, and SaaS efficiency metrics.

If you want to learn how real-time financial data can enhance your decision-making and help you be a more strategic business partner, schedule a personalized demo today.

Revenue Per Employee FAQs

What type of ratio is revenue per employee?

Revenue per employee is an efficiency ratio used to measure the average revenue generated by each full-time employee. It helps you evaluate productivity and how efficiently your workforce is generating profits for the company.

What is a good salary to revenue ratio?

What is ARR per employee?

Explore Related Metrics

Own the of your business.