Contribution Margin

What Is Contribution Margin?

Contribution margin is the excess revenue of a product remaining after paying variable costs related to producing it. It shows how much each product “contributes” to covering fixed costs and, once those are paid, profit.

Variable costs include any costs that scale with the number of sales made, such as marketing costs, sales commissions, onboarding costs, and cloud hosting fees.

Direct costs include costs necessary for the development of the product — think research and development — as well as product maintenance costs like customer success or technical support.

Categories

Table of Contents

Contribution Margin vs. Gross Margin

Contribution margin is best understood by comparing it with gross margin, the most commonly used profitability ratio found on your income statement. The difference between your gross margin and contribution margin is that gross profit margin considers fixed costs as part of your cost of goods sold (or COGS), while contribution margin does not. Contribution margin only considers variable costs, along with any other costs that can be tied directly to the product.

The problem with the gross profit ratio (or gross margin) is that your fixed costs aren’t going to change based on how many units of a product you sell. Nor will they typically vary by product line. That means gross margin doesn’t provide a granular view of the efficiency of a particular product’s go-to-market strategy, while contribution margin does.

How To Calculate Contribution Margin

To calculate your contribution margin, you’ll need to add up all costs tied to the product, including:

- Total variable costs

- Research and development

- Customer success

- Hosting costs

- Costs for third-party software used in the product

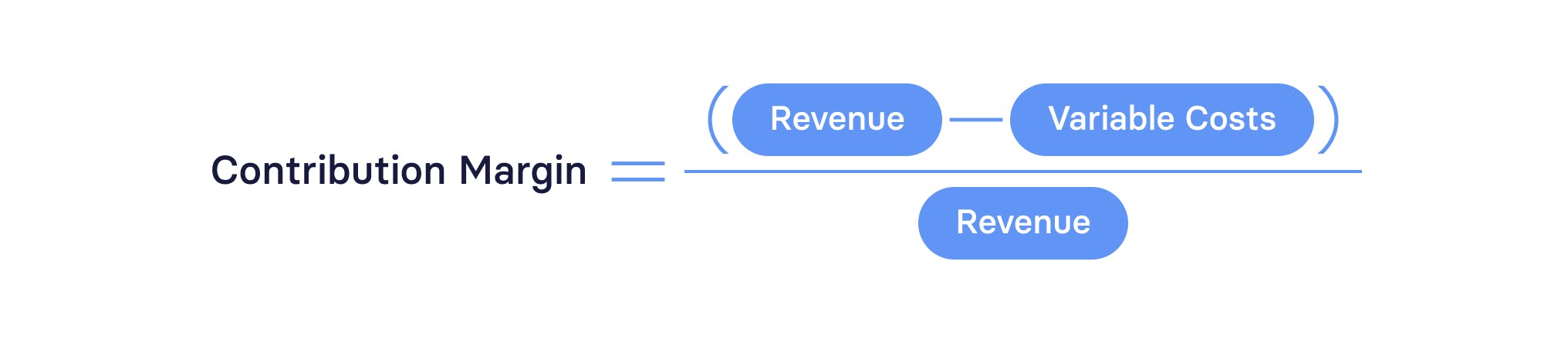

The contribution margin formula is:

Your contribution margin can also be expressed as a contribution margin ratio. To get your contribution margin ratio, simply multiply your contribution margin by 100.

Contribution Margin Ratio Calculator

Your Contribution Margin Ratio

0%

What’s a Good Contribution Margin in SaaS?

There’s no exact number for what your SaaS contribution margin should be. It depends on how many products you have, what stage your company is at, and how much profit (if any) is coming from other products.

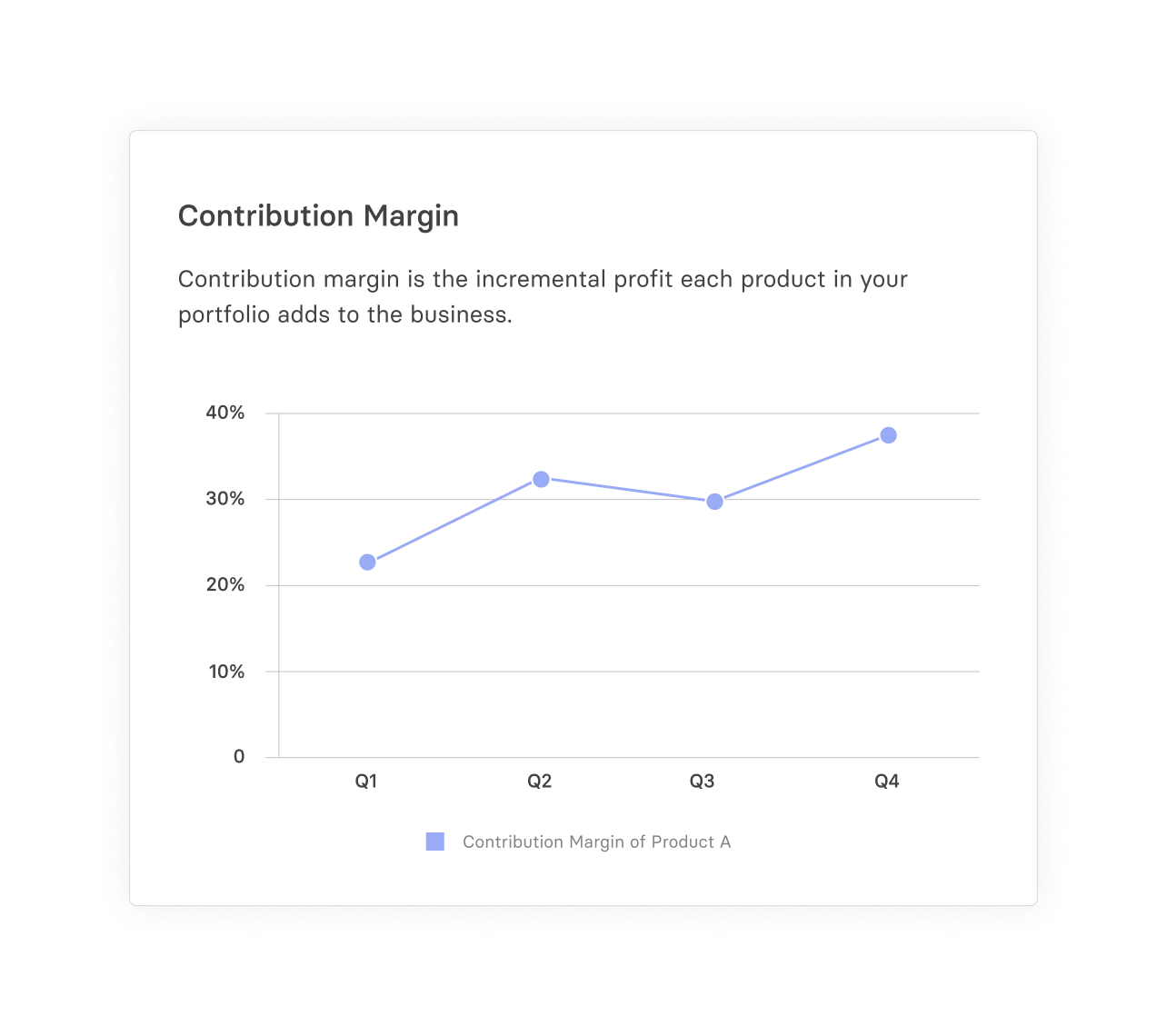

Depending on the above, it can be acceptable to have a low or negative contribution margin when you first roll out your product. After all, customer success costs can be quite high in the first year, and SaaS startups can be operating with high net burn. What you need to consider is how it’s trending over time. One evaluation showed that developed SaaS companies had negative contribution margins in the first year but achieved a positive margin by the third year.

Mosaic will then perform the contribution margin calculation for you, representing it in beautiful, data-rich dashboards that quickly communicate which products are contributing the most toward profitability.

Why Contribution Margin Matters for SaaS

Contribution margin is a sometimes overlooked ratio that’s ideally suited to measuring a SaaS company’s profitability.

This is the case for two reasons:

- As they grow, SaaS companies are often juggling multiple products, testing PMF across customer segments. Unlike gross margin, contribution margin can be applied to individual products, providing a snapshot of how effective each product line is at driving revenue.

- The ultimate goal of a SaaS startup is to hit your break-even point and, eventually, become profitable. A positive contribution margin shows you that a product is paying for its own costs. When your combined contribution margin is positive, and it offsets your fixed costs, you’ve reached a place of profitability.

So, by showing you the direct relationship between individual product lines and overall profitability, contribution margin helps guide your entire SaaS strategy from resource allocation to product pricing.

Contribution margin not only matters for SaaS — it’s crucial.

Contribution Margin in Context

While contribution margin is one of the most important financial ratios to analyze a SaaS company, it’s not the only profitability metric you should pay attention to. Your gross profit ratio is still relevant for valuation, as is the SaaS rule of 40.

The traditional dichotomy looks at gross profit vs. net profit. In contrast to contribution margin, gross profit includes fixed costs as part of cost of goods sold. Net profit is your bottom line — it’s your total revenue minus all expenses, including fixed and variable costs, taxes, and interest. In other words, net profit is the number that tells you if you’ve actually achieved profit.

SaaS FP&A teams should use gross profit and net profit to evaluate the financial position and sustainability of the entire company, but contribution margin to evaluate specific product lines and how those are contributing to eventual breakeven.

Rethinking LTV With Contribution Margin

Maximizing customer lifetime value (LTV) is a top priority for SaaS companies, and the CAC:LTV ratio is important for measuring marketing ROI.

Typically, LTV is calculated using gross profit. But gross profit doesn’t consider the ongoing costs — for example, customer support — that go into retaining a customer. Because of this, you should use contribution margin to get a clearer picture of the net profitability of a customer.

From there, you’ll get a more accurate view of the true ROI of CAC:LTV — this is especially relevant for SaaS companies, where customer retention is the name of the game.

The Role of Contribution Margin in Strategic Decision Making

Contribution margin is a financial analysis tool that acts as a guidepost for some of your most important SaaS business decisions: which products to invest in, which customer segments to focus on, and how to price your products.

Informing Product Strategy

Contribution margin provides a granular view of your product and the effectiveness of its go-to-market strategy. It’s accurate to think of contribution margin as a profitability assessment per product. In this way, it acts as a guide to which products to cut out and which to prioritize.

Beyond that, contribution margin can act as a guide to pricing strategy for individual products. If the contribution margin of a product is low, and you can’t cut related expenses, you’ll know you need to consider raising your selling price. But if you can’t do that without retaining customers, the product may not be sustainable.

Taking a wider view, you need to look at how contribution margin per product compares to your fixed expenses. If it’s barely putting a dent in them, that product may not be worth keeping. But all this depends on your long-term strategy. To understand if a product is worth offering, you need to consider your total contribution margin across all products.

Also, keep in mind that a low contribution margin doesn’t necessarily mean a product is unsustainable. You may simply need to reevaluate your go-to-market strategy or find ways to reduce costs.

Contribution margin also serves as a guide to scaling efficiency of a product. Ideally, as you scale, your contribution margin ratio shouldn’t change all that much. But if you do see a large spike, you’ll know to investigate and discover inefficiencies — perhaps you need to rethink your hosting plan, or reevaluate vendor contracts.

Importantly for SaaS, you can also use contribution margin to evaluate different pricing tiers for your products.

Budgeting and Financial Planning

Since contribution margin shows profitability per product line, it forces you to rethink your cost structure — that is, it gives you a more granular view of how each expense is contributing to company growth. For example, you may have a product that isn’t driving a lot of sales revenue, but is costing a lot in customer support. To achieve your ultimate goal of profitability, those customer support costs may be better spent elsewhere.

Contribution margin can also be used to structure sales commissions — for example, you may incentivize higher margin with higher commissions.

Getting a handle on contribution margin leads to more accurate revenue projections, which lead to better budgets. You can then put that revenue back into marketing and customer support costs for products with high contribution margins.

Overall, contribution margin helps you identify products that are driving growth and shift your budgets accordingly.

Best Practices for Maximizing Contribution Margin in SaaS

Maximizing contribution margin means reducing variable expenses and boosting product revenue. Evaluate your costs and revenue efficiency across each product line.

Proactively Manage Spend

As you scale, any inefficiencies in web hosting costs will become more and more apparent. If you have fairly consistent usage, you may want to switch to reserved instances. But it’s also good to pre-empt spikes in costs by thinking about how your infrastructure expenses will scale over time. For instance, will your business be able to sustain a usage-based model? If not, you may want to move your AWS to autoscaling.

Next, reevaluate your contracts with third-party software providers. Think about the efficiency of each provider. Are they providing value that justifies the costs? If not, consider shopping around for alternatives. Just like hosting costs, you should project these, too — forecast by vendor spend to understand how these costs will scale over time.

Monitor Key Revenue Metrics

Your primary revenue drivers are your customers, and the key to understanding them is customer cohort analysis.

Customer attrition is costly — reducing it is a highly effective way to optimize revenue.

Streamline the customer onboarding process so new clients get value out of the product fast. Be proactive — reach out and discover the most common issues they’re experiencing.

Constantly keep eyes on customer success metrics like net promoter score and retention rate per product line in order to test and optimize new retention strategies. Time-based cohort analysis can help you see just where certain segments of customers begin to downgrade or churn, so you can investigate why.

Another way to optimize revenue is through revenue expansion. If you have a customer segment with very high net revenue retention, for example, it may be time to consider upselling.

Mosaic’s Approach to Contribution Margin

Contribution margin is a crucial metric for SaaS companies that guides strategic decision-making. But you need to understand it in context. Mosaic helps you visualize your contribution margin in relation to financial models.

Visualizing Contribution Margin

Every company’s means of calculating contribution margin will be different. With Mosaic’s Metric Builder, you can select which expenses go into your contribution margin.

Integrating Contribution Margin Into Strategic Planning

As crucial as contribution margin is, it’s just one part of your overall strategic plan. You need to view this number in the context of revenue forecasts, headcount plans, and SaaS-relevant metrics.

That means building SaaS financial models. Mosaic connects with your ERP, CRM, HRIS, and SaaS billing software to create a complete picture of your company based on real-time data.

But how do you relate contribution margin to these models?

The answer is to think of your contribution margin as a barometer — a way to stress test your models. For instance, maybe you’re considering launching a new digital marketing campaign. You plug the appropriate spend into your model and, as a result, see your contribution margin decrease significantly. Is your cash runway long enough to handle the strain? What effect is this having on your profitability roadmap?

Contribution margin is directly connected to your primary goal: profitability. Therefore, you should always consider contribution margin when building models. This way, your models will guide strategic decision-making in the right direction.

Contribution Margin FAQs

What makes contribution margin a critical metric for SaaS companies?

At a SaaS company, your long-term objective is to breakeven and become profitable. At the same time, you may have more than one product. Contribution margin gives you a clear view of how each product is contributing toward profitability.

When you understand individual product revenue vs. profit, it’s easier to know which products to prioritize.

How can businesses improve their contribution margin over time?

What are the challenges in calculating contribution margin correctly?

Explore Related Metrics

Own the of your business.