What EBITDA Means in Finance

What is EBITDA in Finance?

EBITDA, or “Earnings Before Interest, Taxes, Depreciation, and Amortization,” is a key profitability metric that measures a company’s earnings from its operations, leaving out things like interest, taxes, and costs tied to wear and tear of assets.

By sidelining factors such as financing costs and asset depreciation, EBITDA provides insights into the operational health of a business.

Categories

While EBITDA is most commonly used as a non-GAAP measure of earnings for public companies, private VC-backed companies may track it as well.

In the private sector, you’ll see EBITDA margin appear as a variable in the SaaS rule of 40, which says that your growth rate percentage and percentage of profitability should add up to at least 40%.

But whether you’re a public company creating quarterly earnings reports or a SaaS startup trying to tell a story about growth efficiency, EBITDA can be an imperfect proxy for profitability. Understanding when (and when not) to use it and how to calculate it is critical for any growth-stage or late-stage company.

Table of Contents

How to Calculate EBITDA + Example

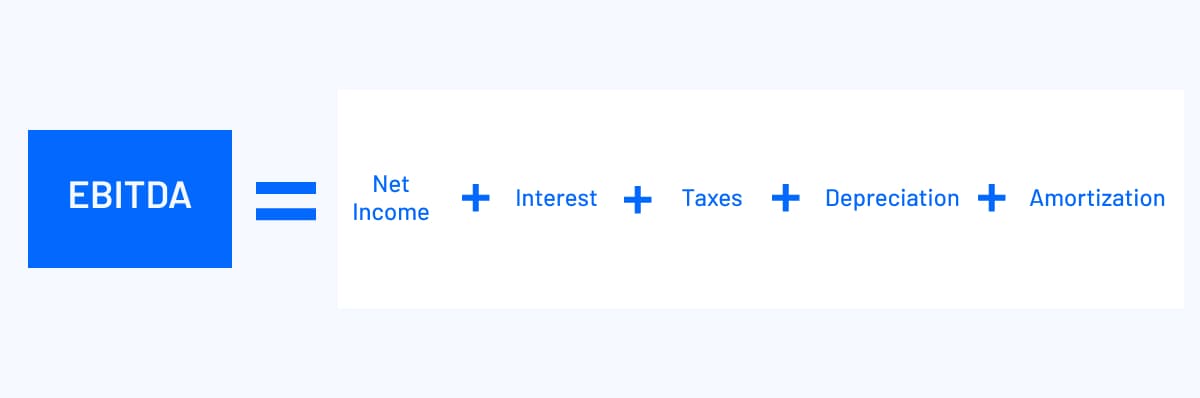

To calculate EBITDA, start with your company’s net income (total earnings or losses). Add interest expenses and any earnings from investments, then factor in taxes (like income tax). Finally, include depreciation for tangible assets like equipment and amortization expenses for intangible assets. You’ll find this metric as a line item on the income statement.

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

Although EBITDA is calculated the same way it might be for a company in any industry, it’s particularly important for SaaS businesses because of the industry’s unique revenue recognition from subscriptions and capital structures.

Say your net income was $1.25 million from the total $10 million revenue from subscriptions this year. You also had an interest expense of $200,000 from an existing loan and paid $300,000 in taxes. Finally, you recorded $100,000 in depreciation of office equipment and spent $150,000 for amortization on software development costs and patents.

Now, you can calculate your EBITDA:

EBITDA = $1.25 million + $200,000 + 300,000 + $100,000 + $150,000 = $2 million

When Using EBITDA Makes Sense

SaaS valuation is often complex, involving dynamic market conditions and nuanced considerations. Depending on the unique situation, you might look at different metrics to assess the company’s financial performance.

EBITDA can be particularly useful in certain situations:

- If you’re scaling up, EBITDA could show you if your investments (growth decisions) in areas like marketing or infrastructure are paying off efficiently.

- Many lenders highly value EBITDA, so meeting their benchmarks could open the way for future financing.

- If you want better insight into cash flow, EBITDA sidelines non-cash expenses like depreciation and amortization, providing a clearer view of operating margins.

- Finally, SaaS businesses with seasonal variations can discern operational trends without unnecessary financial noise like interest, tax, or asset purchases.

On the flip side, EBITDA can cause you to make the mistake of taking in only the good and leaving out the bad, meaning your value could be great, but you’re depleting resources faster than you should.

What SaaS Companies Need to Know About EBITDA

Understanding the difference between revenue and profit is crucial; while seeing high revenue is great, it doesn’t always mean your business is thriving. Say you’re pulling in massive revenue but the profit, after accounting for expenses like customer acquisition and capital expenditures, tells a more nuanced story. EBITDA might not catch that since it brushes off expenses like depreciation and amortization (it’s important to understand the difference between EBITDA vs operating income first). So if you’re pouring all your cash into scaling your business, EBITDA can mistakenly put you in the green because it doesn’t factor in those costs.

Additionally, not everyone uses EBITDA the same way. Business owners, investors, and advisors may look at their separate EBITDA calculations and mistakenly think they’re comparing apples to apples. But since GAAP hasn’t formally defined EBITDA usage, businesses can get creative. And without standardization, if you try to compare the values, the result would be chaos and confusion from misalignment.

Alternatives to EBITDA

Bottom line: While EBITDA can offer valuable insights into SaaS businesses, it’s important to remember that it doesn’t account for capital expenditures, changes in working capital, or other cash outflows. So it shouldn’t be considered as the ultimate profit measure. Instead, consider it with other financial metrics to get a comprehensive picture of a company’s operational performance.

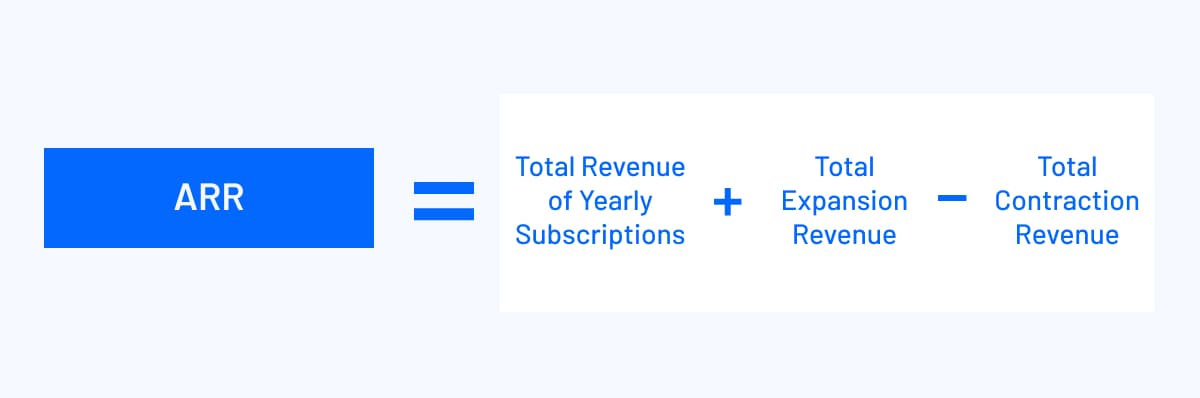

Annual Recurring Revenue

Annual recurring revenue (ARR) is a critical metric used by SaaS businesses to evaluate and forecast revenue from customers every year. When customers are willing to commit to a product long-term, it’s a sign of a successful business with a strong product/market fit.

To calculate ARR, you multiply the monthly recurring revenue (MRR) by 12. For example, if a SaaS company has 100 customers, each paying $50 monthly, the MRR is $5,000. The ARR would then be $60,000.

ARR can be a better metric to focus on in many contexts, especially during the early stages or periods of rapid growth.

For instance, if you’re forecasting future cash flow to understand the steady state of the revenue stream, ARR is more helpful. Additionally, EBITDA doesn’t give you insight into customer churn or retention, so ARR might be a better metric to consider in those cases. ARR can also tell more about a company’s growth rate, particularly when measuring annual or month-over-month value.

Gross Profit

Gross profit tells you how much money your SaaS company makes from its core service after accounting for the direct costs of delivering that service. It’s calculated by taking your sales revenue (or net sales) and subtracting your cost of goods sold (COGS), such as hosting costs, third-party service fees, support and customer success costs, or maintenance costs.

A solid gross margin is usually a good sign, as it means there’s enough cushion to cover operating expenses and invest in growth while still achieving profitability.

Free Cash Flow

Unlike EBITDA, free cash flow (FCF) is a metric that accounts for cash outflows that support operations and maintains capital assets (capital expenditures). It’s calculated by subtracting capital expenditures from the operating cash flow.

FCF is a strong indicator of financial health and flexibility as you get an idea of how much cash you have left over after paying all the bills and reinvesting in operations — it’s why FCF is considered in many SaaS valuation models.

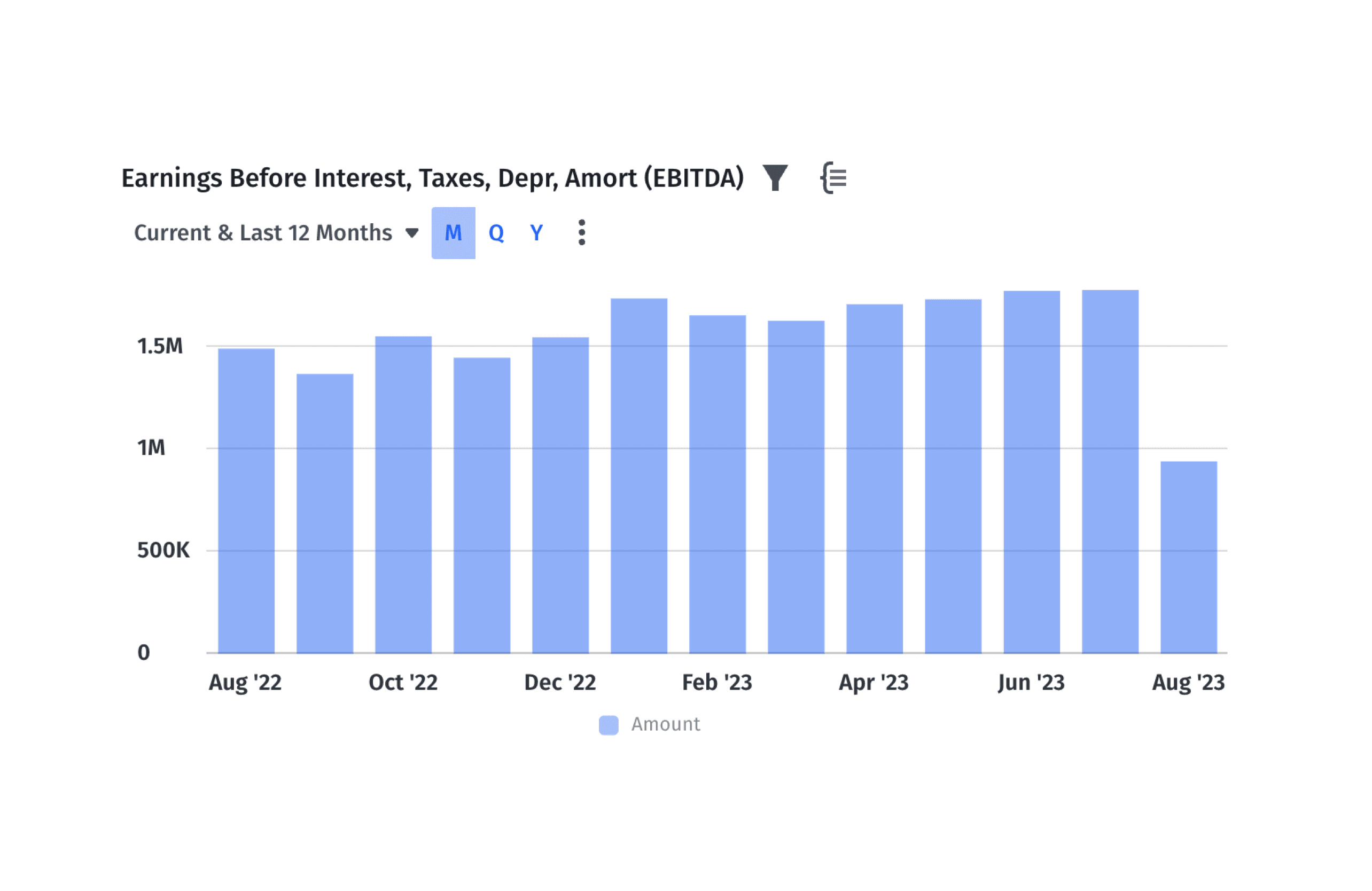

How to Calculate and Understand EBITDA in Mosaic’s Metric Builder

Mosaic’s Metric Builder lets finance teams design metrics that resonate with their specific business needs. While Metric Builder provides standard SaaS metrics right from the start, we know each business has its unique financial perspective — whether it’s a distinct lookback period or specific cost considerations.

Metric Builder makes it easy to customize calculations for complex, non-standard metrics like EBITDA, paving the way for informed decisions — without the hassle of intricate coding or unreliable spreadsheets. Metric Builder champions simplicity with its no-code interface.

Metric Builder can help you unlock financial clarity and turn those insights into dynamic reports that foster company-wide collaboration.

If you’re ready for a deep dive into your company’s growth story, request a demo of Mosaic today.

EBITDA FAQs

Is EBITDA the same as Gross Profit?

No. EBITDA and gross profit are not the same metrics. While both metrics can help assess a company’s profitability, they look at various aspects of the financial statement and serve different purposes.

EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It offers insight into a company’s operational efficiency without unnecessary distractions such as tax expenses, interests, and asset performance. EBITDA formula is as follows:

EBITDA = Net Income + Interest + Taxes + Depreciation + Amortization

On the other hand, gross profit refers to the profit made by a company after deducting the costs associated with providing its services, including making and selling the product. Gross profit is calculated by subtracting your cost of goods sold from net revenue.

Gross Profit = Net Revenue − Cost of Revenue

Is EBITDA important in the SaaS valuation process?

How can Mosaic help with EBITDA calculations?

What is tax provisioning?

Explore Related Metrics

Own the of your business.