Categories

Table of Contents

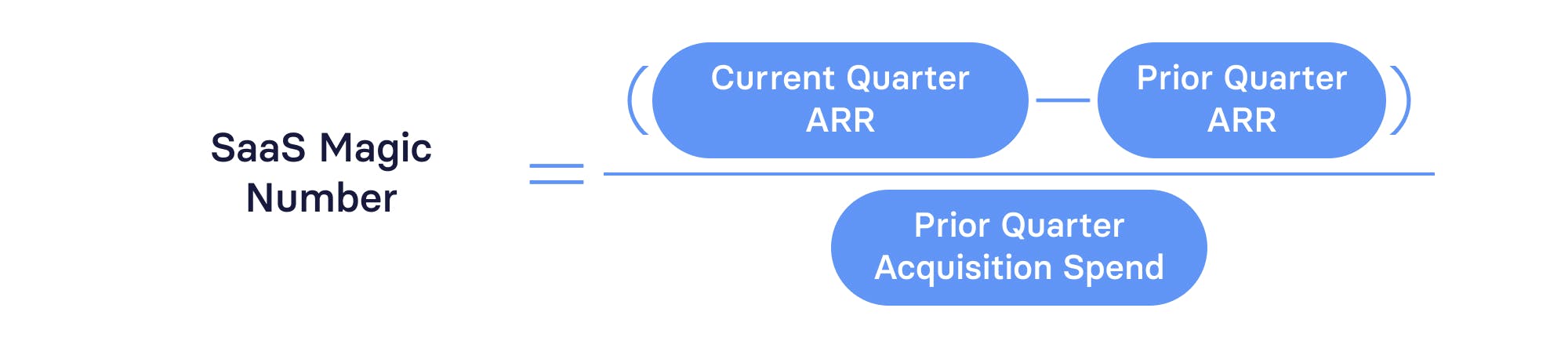

How Do You Calculate the SaaS Magic Number?

You can calculate the magic number for your SaaS business by subtracting the last quarter’s annual recurring revenue (ARR) from the current quarter’s ARR and dividing by your total customer acquisition cost (CAC) (your total sales and marketing spend) from the previous quarter. The magic number is an important ratio used to analyze a company.

The primary SaaS magic number equation uses quarterly revenue numbers for the calculation. But you can use monthly recurring revenue (MRR) to come up with your magic number on a monthly basis or calculate it on an annual basis, depending on your average sales cycle.

Regardless of the approach you take, the calculation gives you a high-level understanding of sales efficiency. The calculation combines new ARR/MRR and renewal revenue to provide a more holistic understanding of business growth rate. But if you need to get more granular with renewal and upgrade performance, you can couple your magic number calculation with other financial metrics like net revenue retention.

SaaS Magic Number Calculator

Your SaaS Magic Number

0

Why Does the Magic Number Matter?

Your magic number matters because it can help you determine the efficiency of your sales and marketing engines over a period of time and can tell you when to invest more or less in those engines.

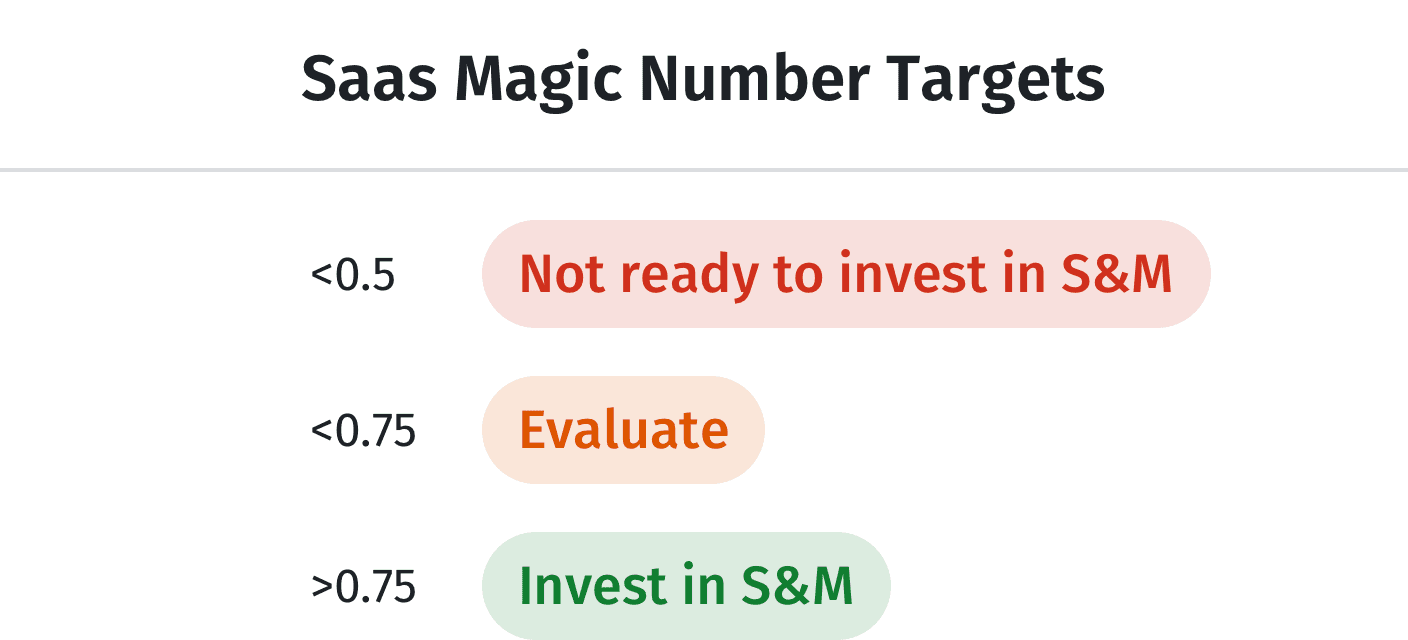

The easiest example is a magic number of 1. If your magic number is 1, that means you’ll pay back the previous quarter’s sales and marketing spend (the denominator of the SaaS magic number equation) from the incremental revenue generated over the next year (the numerator). You can look at that efficiency metric in the context of your business and decide whether or not to increase S&M spend. But if you’re looking for typical benchmarks, there are 3 thresholds to consider, shown in the image below.

How to Interpret Your Magic Number

When analyzing your magic number, consider what each of these SaaS magic number benchmarks tells you about your sales efficiency:

What it Means When Your Magic Number is Less Than 0.5

A magic number this low typically indicates that something is wrong with your business model. Your total SaaS cost-to-serve might be too high. Your SaaS product might not resonate with target customers. Maybe your churn rate is unusually high because of a lack of product maturity, causing a dip in ARR. Or, maybe you’re investing so much in acquiring new customers without a SaaS pricing strategy that’s able to make up for the spend. When you have a magic number less than 0.5, you likely have to continue working on your product-market fit.

What it Means When Your Magic Number Less Than 0.75

This is the main threshold to consider for magic number. If you’re approaching the 0.75 mark, you’re on the right track with sales efficiency. However, whether or not you should increase marketing investment or add to your sales team at this level depends on the context of your business. Look at your cash runway, free cash flow, and gross margins to determine whether or not more growth investments make sense.

Get the Sales Capacity Model for Top-Line Planning

What it Means When Your Magic Number Greater Than 0.75

A magic number over 0.75 should give you the green light to build out the sales and marketing strategy and functions. You reach this level when you’ve proven product-market fit and acceptable CAC payback periods. At this stage, you’ve likely trimmed your monthly payback number to a reasonable level and can handle increasing marketing spend in areas like content marketing, digital advertising, and SEO. While a magic number of 1.0 may be ideal, you should feel comfortable after exceeding the 0.75 benchmark.

When investor Lars Leckie popularized the magic number as a sales efficiency metric in 2008, he said:

“Fundamentally, the key insight is that if you are below 0.75 then step back and look at your business, if you are above 0.75 then start pouring on the gas for growth because your business is primed to leverage spend into growth. If you are anywhere above 1.5, call me immediately.”

No SaaS financial metrics are perfect on their own, and magic number is no exception. But these are still effective benchmarks to keep track of.

The magic number is a widely used formula for SaaS companies at all different stages. However, it’s especially valuable for telling the story of sales and marketing efficiency behind strong revenue growth in early-stage startups. Having this kind of context can make or break your pitch for a new round of venture capital.

But if your magic number is not where you want it to be, don’t worry. There are plenty of ways to improve this metric. Try optimizing your ad spend or refining your customer persona, so you’re targeting the right buyer. You can purchase sales automation tools that increase your outreach and automate follow-ups to help reduce sales and marketing costs as well.

A Better Way to Track Your Magic Number

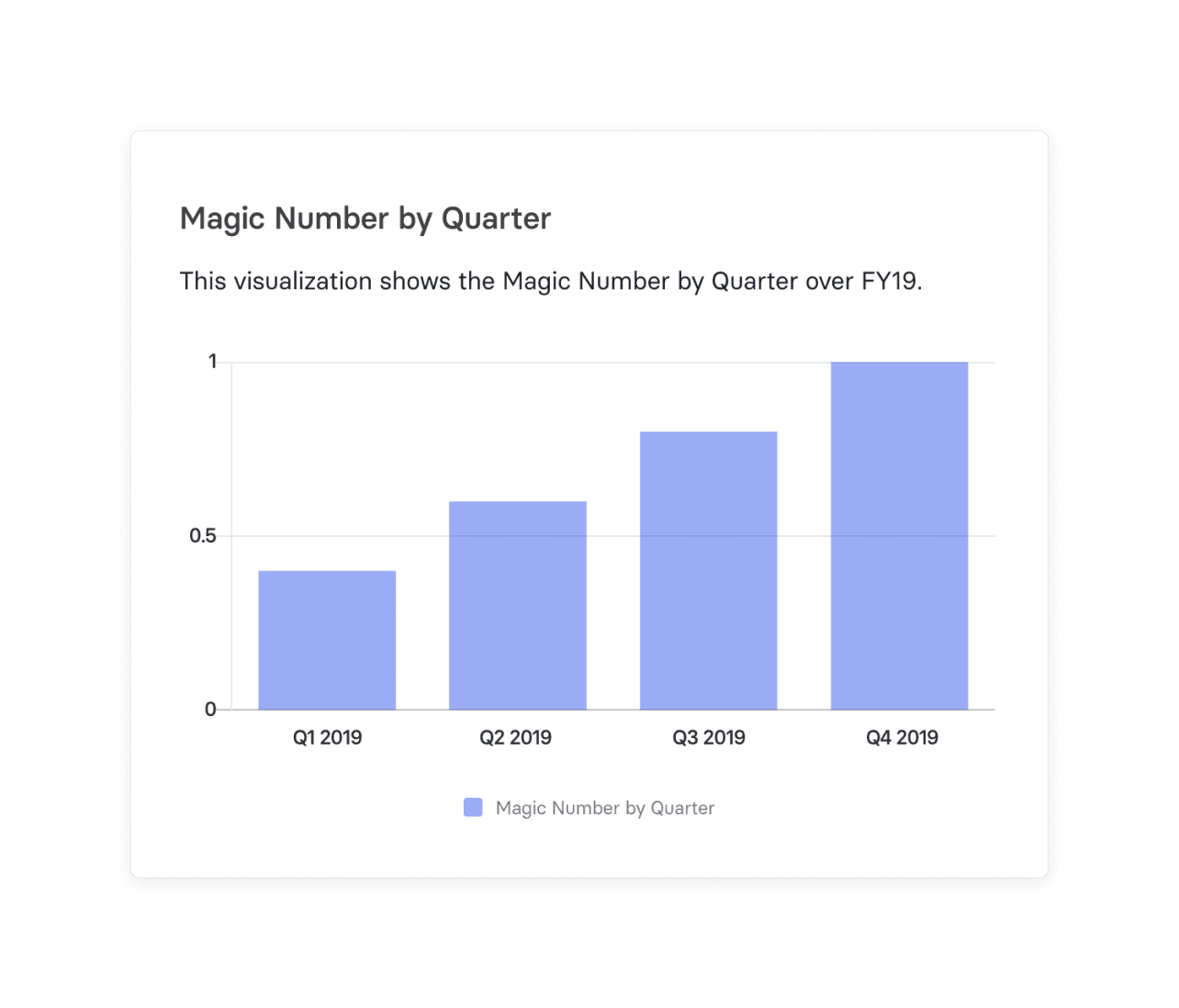

Historically, tracking your magic number took manual effort, and as soon as you pulled financial data down into Excel and calculated it, it was already stale. With Mosaic, you get a SaaS magic number calculator that enables you to track your magic number in real-time, which means you can know exactly when to dial up your marketing spend to reach more people or when to reduce spend for safety.

Seeing your magic number is helpful, but even more powerful is the ability to quickly swap out different components of the calculation to get a different view of your company’s financial health.

For example, you may want to look at your Bessemer CAC ratio as a comparison to magic number. This efficiency metric focuses only on new customer acquisition and gross margins in relation to CAC. It’s closely related to the magic number and gives you another SaaS benchmark for evaluating your ability to sustain more marketing expenses. Similarly, you could add a CAC payback period chart in Mosaic to view that metric side-by-side with magic number. The more context you can get, the better.

Why Your SaaS Business Needs More Than a Magic Number

Much of the work of sales and marketing teams can seem like pure magic. The way your sales team satisfies its quarterly quotas just in time to meet your bookings goal seems like some sort of sorcery. And the uncanny ability of marketing functions to serve up the perfect ad at the perfect time—that’s straight-up ESP.

Luckily, the finance team doesn’t have to understand how marketing is always able to offer customers a perfectly timed, personalized solution or how sales always finds new ways to close deals. But you do need to do a little magic of your own: You need to be able to measure how efficiently sales and marketing are helping the business grow—and to do it, you need to know your magic number.

But the magic number isn’t actually all that magical. It’s a useful snippet, but looking at individual SaaS KPIs will never tell the full story of your business. You need to be able to see a complete picture of the company’s performance, in one place, in real-time, at any time. And that means keeping a finger on the pulse of every SaaS metric that matters to your business.

Mosaic plugs into all of your financial data-generating tools, normalizes that data, and automatically calculates all kinds of useful metrics. It gives you insight into metrics like the SaaS rule of 40, CAC, lifetime value (LTV), average revenue per customer (ARPU), and cost of goods sold (COGS) or cost of revenue. You can easily experiment with different inputs, tweak your calculations to better map to your business KPIs, and share your findings cross-functionally with clean, clear representations. No manual data pulls, no error-prone calculations, no dizzying financial dashboards, just a holistic view of your financial efficiency and financial outlook. (That’s magic.)

How Strategic Finance Software Can Help CFOs and Finance Teams

SaaS Magic Number FAQs

What is a good magic number in SaaS?

As a best practice you should try to achieve as high a SaaS magic number as possible. Anything above 0.75 is strong, while anything below 0.5 is a sign of inefficiency in your sales process or business model. If your magic number is between 0.5 and 0.75, you may want to allocate resources to different growth areas.

How do you increase your SaaS magic number?

How do you calculate sales efficiency in SaaS?

What is the sales magic number?

Explore Related Metrics

Own the of your business.