Why Cash Runway Matters, How to Calculate it & Make it More Efficient

What Is Cash Runway?

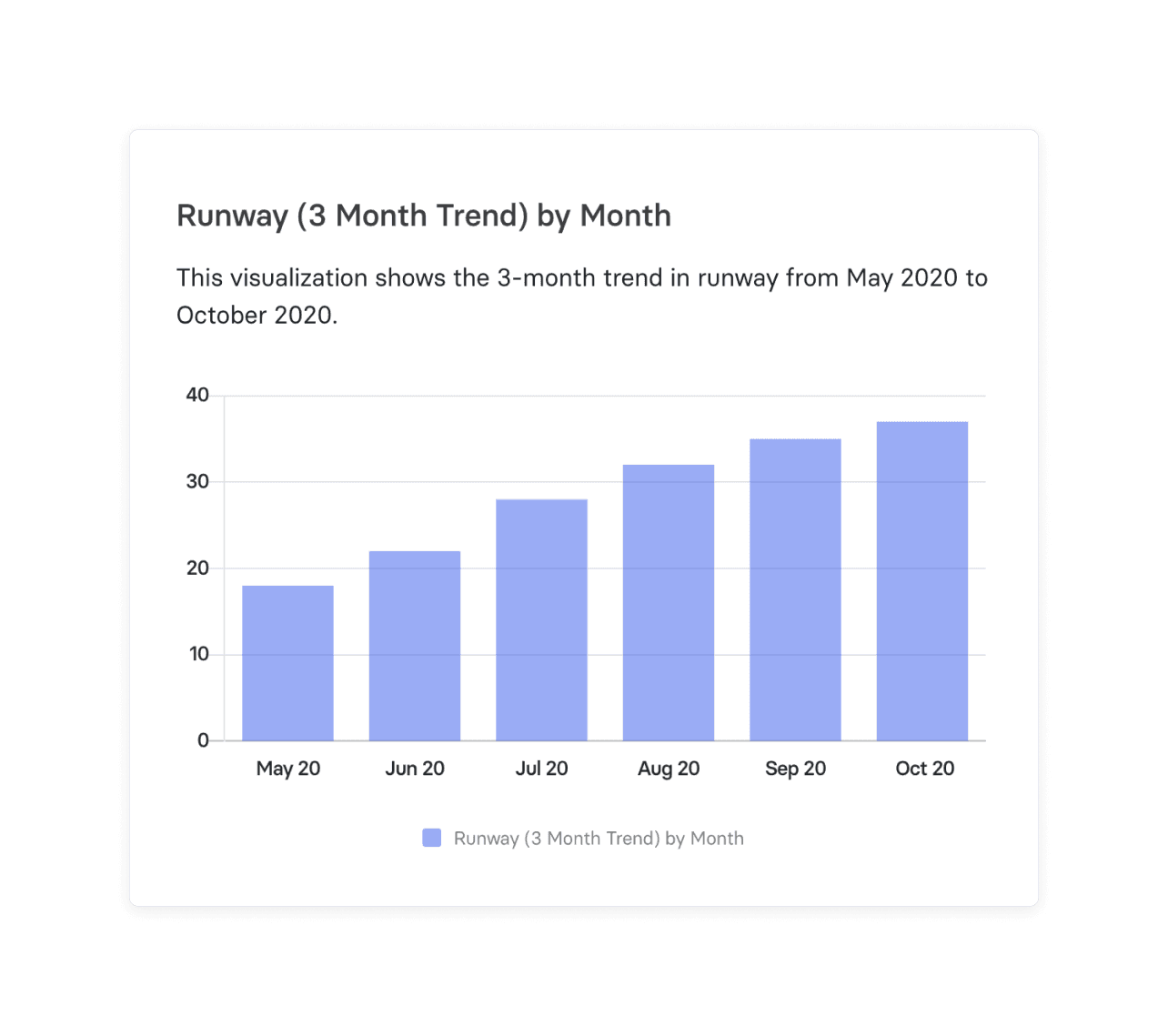

Runway is the amount of time, in months, a business has before it runs out of cash. For companies growing through venture capital, it’s an at-a-glance metric that shows the number of months you have left before your cash balance hits $0. While you may see people talking about different types of cash runway — company cash, team cash, and founder cash — CFOs and finance teams typically look at this metric on a holistic basis for the company.

Categories

Table of Contents

How Do You Calculate Cash Runway?

There are two ways to calculate runway. The first is to divide your total cash by your company’s average monthly net burn (the difference between cash in and cash out).

The second is to divide your total cash by your company’s expected future monthly burn rate. This is the recommended method for companies expecting material changes in the business, such as investments, lump sum payments, or increases in headcount or operating expenses.

Cash Runway Formula

The typical cash runway formula is the first option — your total amount of cash divided by average monthly cash burn rate.

As an example, consider a company that recently raised a Series A and has $20 million in the bank. Over the last three months, their net burn has been $700k, $750k, and $800k, respectively. That gives the company a three-month net burn trend of $750k.

Given those numbers, the runway calculation would be:

$20 million in cash reserves / $750k average net burn = ~26 months of runway

Want to swap out these numbers for your own? Use the calculator below.

Cash Runway Calculator

Your Cash Runway

0 months

4 Reasons Why Cash Runway Is Important

In recent years, an early-stage startup could get by with a cash runway rate of 15-18 months after their first fundraise. But in the context of a market downturn, investors view best-in-class companies as those with closer to 25+ months of runway.

As you try to maintain that benchmark, keep these four reasons why cash runway visibility is crucial for business success in mind.

It shows how long you have before needing another round of funding.

The most important reason to track cash runway is to help you understand how much time your business has to achieve its next milestone before it needs additional funding. Cash is the lifeblood of your business and runway is the metric that explains how much longer you have to live.

It can highlight inefficiencies in your business.

Consistently tracking cash runway and understanding trends in how it changes will help you see when inefficiencies start to negatively impact your business. If your net burn rate is accelerating in recent months and you’re getting concerned about how much longer you’ll have enough money to operate, it’s time to dig in and understand spending on a deeper level.

It instills confidence in your investors.

Runway is an easy metric to understand and gives investors an at-a-glance view of where your business currently stands. The longer your runway is, the longer you have to iron out any issues in the business. Growth is almost never linear, but runway helps you stay in the game longer to overcome hurdles.

It can show you that you have room for bigger investments.

VC-backed startups have to burn cash to grow quickly — even if they’re operating efficiently. That’s why having a massive runway isn’t exactly a good thing. If you have a runway of 30 or 40 months, you’re well above the best-in-class norm. And that tells you that you have room to burn more cash to grow faster. You don’t want negative cash flow to get out of control, but you have to balance growth with efficiency.

The Anatomy of a Strategic Finance Function

The Challenges of Calculating Cash Runway

Businesses evolve every day—and that includes their spending. Where your business spent money last month might be totally different than this month. Maybe you’ll need to ramp up your marketing spend to reach more buyers or hire more engineers to build new features or open a new office. Or maybe your videographer will crash the company drone into a billboard (again).

Too often, companies base their runway calculations on historical data that doesn’t account for contingencies or future growth. Static metrics and KPIs like this can be misleading indicators of your future cash position. You might determine, based on last month’s spend, that you have 18 months of cash runway, conduct business accordingly, and then find out the hard way that, due to an uptick in spending, you now have only nine months of runway left. In other words, misinterpreting your runway can be a fatal business error.

On top of that, it can be hard to predict your cash outlays, as they often look different from the expenditures in your accounting records. You might pay upfront for one year of software licenses, but only see 1/12 of that number in the software expense line on your P&L statement. Or maybe you accrue employee bonuses monthly, but pay them 12 months later. The point is, while a detailed understanding of every expense does exist within your company, that understanding is collective—it’s spread out over many accounts, teams, and departments. It’s hard to see the complete picture of every dollar’s activity when there are hundreds (if not thousands) of monthly transactions across multiple bank accounts, credit cards, and software platforms.

And all of the above is needed just to track the expense side of your business. What about incoming cash? For your existing customers, it’s vital to know how much they owe you, how quickly they pay their invoices, and how much you have yet to collect. For new customers understanding how quickly your bookings and pipeline turn into cash collections is critical to understanding how long your runway will last.

How to Track Cash Runway More Efficiently

Let’s be clear: Having a good grasp on your small business runway does involve understanding historical spend and collections. But it also requires projecting and planning for future spend and future collections. You should have an informed view of what’s happened historically while also factoring in what might happen next month, next quarter, or next year.

So what goes into how to calculate runway? In the past, to do this well, you needed complicated Excel models—several of them, if you wanted to plan for different scenarios. Not only is creating and maintaining these a huge time suck, but interpretation is usually only understood by the folks who built the model, leaving the rest of the business with no choice but to accept the models at face value.

Or…

Mosaic Can Automatically Calculate Your Cash Runway Rate

Oftentimes, a runway for startups is a moving target. It changes as your business changes, which is daily. To navigate it properly, you need a compass that can constantly guide you in the right direction as the landscape around you shifts.

Mosaic plugs into all of your financial systems to aggregate, categorize, and calculate your cash inflows and outflows. Not only does Mosaic automate your runway calculations and keep them up to date in real time, the software also helps you build forward-looking, scenario-based financial models which show how future plans will affect your runway.

While others are playing checkers, calculating their runway using blunt historical averages, Mosaic allows you to play chess by dynamically calculating your runway

Cash Runway FAQs

Why might a company need additional capital, even with a reasonable cash runway?

Even with a decent cash runway, a company might need additional capital to fund growth initiatives, such as product development, market expansion, or hiring. Also, unexpected expenses or market downturns may necessitate additional funding.

How does gross burn rate impact cash runway?

How often should a company calculate its cash runway?

Explore Related Metrics

Own the of your business.