Cost to Serve Analysis: A Guide for SaaS Startups

What is Cost to Serve?

Cost to serve (CTS) is a measurement of how much it costs a business to meet or surpass customer needs. CTS is a vital yet often overlooked SaaS metric encompassing the broad expenses of delivering your product line to customers.

Cost to serve can help you balance your cost and pricing structures and ensure your decisions are financially viable. By grasping the true cost of serving various customer segments, you can better optimize your pricing strategy to maximize profitability.

Cost to serve expenses include account management costs, software upgrades and maintenance, and customer success, among others.

Categories

Cost to serve is an overlooked gem that often eludes even seasoned finance leaders’ radars. As the SaaS CFO mentions, this metric might not always be top of mind, but digging into it can reveal valuable insights.

A cost to serve analysis helps your business see all the expenses of delivering their software to customers. By understanding costs involved, you can price your product just right, ensuring you’re not just breaking even but pocketing some profit, too.

In challenging market conditions, every cent counts, and companies often find themselves in a squeeze to maintain profitability and growth. So, a cost to serve analysis becomes crucial for businesses aiming to scale efficiently. If your company’s cost to serve isn’t aligned, you could steer yourself towards a shrinking runway at an alarming pace.

Table of Contents

How to Innovate Without Increasing Cost to Serve

Optimizing innovation without hiking up your cost drivers can seem like a tightrope walk for SaaS companies. However, with strategic thinking and a bit of creativity, it’s entirely possible.

As your company grows, it’s essential to decrease your cost of service, be it through economies of scale, by streamlining processes, or leveraging technology in smarter ways. Here are some tips to get you started:

Adopt Lean Thinking Across the Org

Facilitate a culture where each department embraces lean thinking — from the go-to-market function all the way to product, CS, and G&A. Analyze retention and product data to better understand what is currently driving the most value for customers and uncover opportunities to maximize ROI. Partnering with department leaders on this kind of analysis ensures you’ll spend resources developing features that resonate with your customers, avoid feature creep, and reduce needless business costs.

Rethink Budget Allocation for Greater Scalability

Don’t give in to the tendency for departments to move toward a one-to-one relationship between headcount increases and scale. As you work with departments that impact cost of service, push them to allocate their budgets in more scalable ways rather than defaulting to new hires. For example, maybe you’ll hear an engineering leader wants to start reusing more code to save money, time, and over-developing. Can you help them work out what that budget would look like compared to hiring more engineers to support existing infrastructure?

Champion the Customer in Every Decision

Frequently gather feedback from users to understand which features of your product work and which don’t. In many companies, these responsibilities may lie solely with the customer success team. But you can help create a culture where it’s everyone’s responsibility to champion the customer. If everyone deeply understands customer demands, each department will prioritize high-impact areas that can help keep cost of service low.

Review Cloud Usage

Cloud optimization can keep your costs in check, so ensure your cloud usage matches your business needs to avoid overpaying for excess capacity. Auto-scaling, reserving instances, or moving to serverless architectures can result in significant cost savings and potentially faster deployment. This is a project that Ajay Vashee, former CFO of Dropbox, supported as the company prepared for IPO. Moving out of the public cloud and onto private infrastructure ultimately doubled the company’s gross margins and helped drive a successful IPO.

How to Calculate and Analyze Cost to Serve

There isn’t a one-size-fits-all formula to calculate the cost to serve. The calculation depends on your business and the chosen scope.

Understandably, it can be tough to narrow down which expenses count toward the cost of service, so think about which resources you would need to support your existing customers when you take growth out of the picture.

Break those expenses down into two types:

- Direct costs such as customer success headcount, customer support headcount, product maintenance and upgrades, and cloud infrastructure

- Indirect costs such as research and development (R&D) involving bug fixes and feature maintenance, general and administrative (G&A) expenses like rent, utilities, and payroll or even software expenses that support self-serve support, customer marketing initiatives like dinners and events, and sales involvement in upsell and renewal processes.

Although cost to serve generally doesn’t include fixed costs, you could consider expenses like rent (prorated for the period) to get a more comprehensive view.

Your total cost of service is a sum of all the expenses involved in bringing your product to the market — from product development and operations/support to sales and marketing. However, you won’t include any costs related to new business acquisitions.

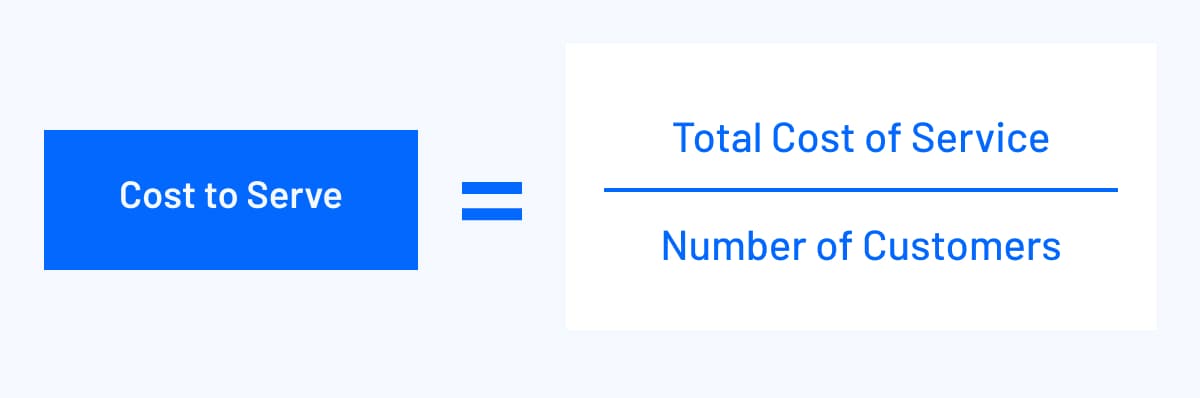

Divide the total costs by the number of customers to understand the cost for each individual customer. This number can help you identify variations between customer segments and understand if (and why) some might be more costly to serve than others.

Cost to Serve (Per Customer) = Total Cost of Service / Number of Customers

During decision making, this information lets you choose a pricing strategy to maximize your business’s profits.

Mosaic is a game changer when you want to dive deep into metrics like average cost of service. With the Metric Builder, you can tailor your calculations for spot-on accuracy. Plus, you can see how the cost to serve stacks up against other metrics, like average revenue per account, helping you nail your pricing strategy.

Cost to Serve Example

Imagine you run a SaaS company that offers business task management software. In the 12 months, your direct costs were $357,000, broken down as follows:

- Customer support, including salaries, software (CRM and helpdesk), and training: $165,000

- Maintenance and upgrades such as quality assurance costs: $127,000

- Cloud hosting and database costs: $65,000

Your indirect costs totaled $165,000, of which $80,000 was from R&D spent on bug fixes, $60,000 from G&A expenses serving existing customers, and $25,000 from marketing expenses from retention campaigns.

Your total cost of service is the sum of direct and indirect costs.

Total Cost to Serve = Direct + Indirect Costs = $357,000 + $165,000 = $522,000

Assuming your company had 10,000 active subscribers, your cost to serve each customer last year was as follows:

Cost to Serve (Per Customer) = Total Cost of Service/Total Number of Customers ($522,000/10,000) = $52.20

Benchmark your cost to serve against competitors or industry averages, look for trends to evaluate the performance of your business, and figure out a pricing strategy that will help you be competitive while remaining profitable.

What Cost to Serve Doesn’t Tell You + Other Metrics to Fill in the Gaps

Although the cost to serve offers valuable insights, it’s not a catch-all metric that affects your bottom line. Since cost allocations depend on the chosen scope, you may forget to factor in other significant expenses that impact customer profitability.

For instance, SaaS often involves dynamic costs, such as cloud infrastructure, that fluctuate based on usage. This variability can make the cost to serve metric less predictable. Moreover, the cost of service is only one side of the picture.

Avoid oversimplification and misguided decisions by considering other metrics like customer acquisition cost (CAC), customer lifetime value (CLV), and annual recurring revenue (ARR) to give you a more holistic view of the business.

Get a Real-Time Overview of Your Most Important SaaS Metrics in Mosaic

Juggling various SaaS metrics can be a handful. Time is hard to come by when you’re trying to turn data into actionable insights, particularly while running a startup. Often, finance teams are left between a hard and a rock place, either burning out trying to analyze all the data or deciding which metrics to skip.

But you can avoid this conundrum. Metrics are the heartbeat of your business, and with Mosaic, analyzing and tracking them becomes a breeze.

With Mosaic, you can effortlessly pull in all that financial and operational information. Mosaic does all the grunt work of data collection, helping you view all your financial data in one place. The best part? You can see the outputs in real-time as you build your metrics. Once done, you can use those metrics in a financial dashboard or an expense dashboard, reports, and models to get past, present, and future views through Mosaic.

If you’re curious to see how Mosaic can turn the complex task of a cost to serve analysis into a breeze, giving you a clear view of your costs and more, request a demo.

Cost to Serve FAQs

What is the difference between cost to serve and cost of goods sold?

In the SaaS context, cost of goods sold (COGS) refers to the direct costs of delivering the software to your customers while cost to serve (CTS) encompasses the broader expenses of delivering and servicing a product for customers beyond direct production or delivery costs.

SaaS COGS often includes cloud hosting expenses and salaries for the team supporting the software, such as customer support and engineering handling bug fixes. Calculating the cost of goods sold is straightforward in a traditional retail or manufacturing environment as it involves supply chain costs, tangible products, and stock keeping units (SKU). In SaaS, however, it’s the total of direct costs, which often varies from one company to another.

Cost to serve (CTS) encompasses the broader expenses of procurement, delivering, and servicing a product for customers beyond direct production or delivery costs. It includes indirect expenses such as account management and software upgrades. To calculate your cost to serve each customer, you’d add your direct and indirect costs of serving existing customers during a given period and divide it by the total number of customers.

What is an example of cost to serve?

What are the main drivers of cost to serve?

Explore Related Metrics

Own the of your business.