The traditional cash flow forecast isn’t designed for SaaS startup founders, entrepreneurs, and CEOs to understand easily. It’s a puzzling mess of GAAP accounting and financial statements that obscure weaknesses in your cash flow plan. Instead, you need a cash flow forecast you can actually make sense of — one that makes it easier to plan for high growth and liquidity.

Cash is every company’s most important resource. No matter what you’re building, how high your SaaS valuation is, or how strong your business model seems, a few missteps in planning could shorten your cash runway — the amount of time your business has before it runs out of money. That’s why it’s so important for startup founders and finance leaders to build the most accurate cash flow forecast possible and get a clear picture of how growth plans will impact bank balances, i.e., your net cash flow.

But making sense of your short- and long-term cash position is easier said than done. Cash is king. And ultimately, startups need a simpler forecasting process that keeps up with the pace of business change.

Table of Contents

What Is a Cash Flow Forecast?

A cash flow forecast is a projection of how much money you’ll have in the bank after accounting for income and expenses over a given period of time. Your actual cash flow forecast presents an estimate of your future bank balances based on the money going in and out of your business.

In addition to payables and receivables from your balance sheet, a cash flow forecast also includes line items like revenue, payroll, depreciation, and other expenses from your income statement. All of this information makes your cash flow forecast a critical tool for financial planning and understanding how changes in your strategic plans will impact your runway.

At the most basic level, the point of a short- and long-term cash flow forecast is to make sure you understand whether you have enough cash to keep your business up and running. But a great forecast does more than just confirm that you have enough working capital to tackle your bills and pay employees.

It should also help you think through strategic challenges, such as finding ways to extend your runway and deciding when to raise your next round of funding (and how much to raise). And if done well, the forecast can also prevent you from dealing with negative cash flow or shortages.

Types of Cash Flow Forecasting

There are two main ways to build your cash flow forecast — the direct method and the indirect method.

- Direct method. A direct cash flow forecast typically focuses on short-term projections (90 days or less). It uses known/anticipated transactions to provide an accurate view of cash flow for a specific forecasting period.

- Indirect method. An indirect cash flow forecast uses historical data from balance sheets and profit and loss (P&L) statements to project a startup’s long-term cash position. As a vital component of P&L management, the indirect method is a common part of budgeting processes. Startup leaders run cash flow projections using this method to see how strategic plans will impact bank balances. However, it’s less accurate than the direct method because it extends further into the future, and there is less established history at most startups.

Business leaders typically look at cash flow forecasts at the end of each month. However, startups and small business owners can benefit from daily or weekly reviews of cash flow because they evolve so rapidly.

Cash Flow Statement Must-Haves for Clean Projections

A reliable cash flow statement is the basis for any effective forecast. Before you try to forecast cash inflows and outflows in your business, make sure you nail down the basics of this piece of the traditional three-statement financial model.

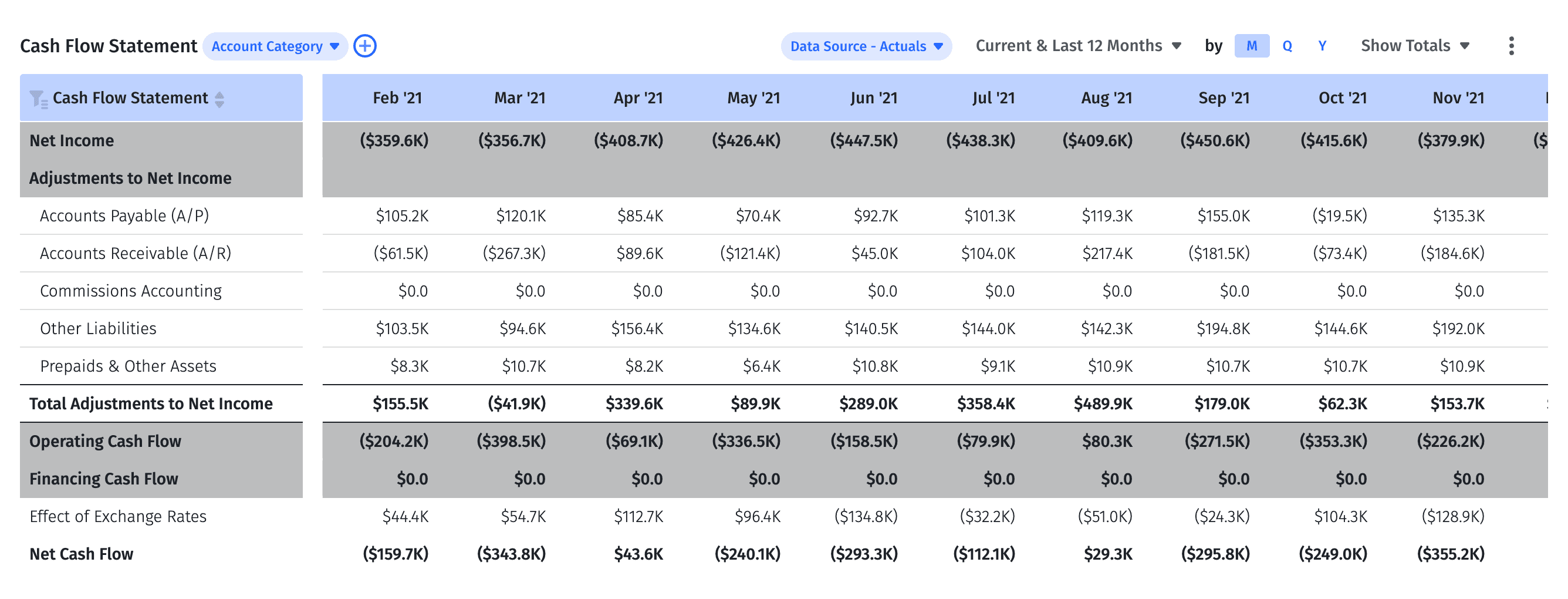

A high-level cash flow statement includes insight into the accounts that impact net operating income and cash flow from operating activities, including:

- Accounts payable. The amount of money you owe across expense accounts from operating activities.

- Accounts receivable. The income you gain from invoices that customers pay for your products and services.

- Commissions accounting. The fees you owe to account executives on the sales team for commissions on closed-won deals.

- Other liabilities. Expenses you owe outside of accounts payable, including loans, deferred revenue, and payroll.

- Prepaids and other assets. Asset accounts, including office equipment and computers, depreciation of that equipment, and any prepaid expenses.

These are the account categories that you project forward in a pro forma cash flow statement. And while it may seem like a simple act of calculating changes in balance sheet accounts, that’s a massively tedious process if you’re running weekly or even monthly cash flow forecasts. As a result, many CFOs and their teams fall into a few common cash flow forecast pitfalls.

Create Accurate Forecasts & Models with Real-Time Data

The 3 Common Pitfalls of Startup Cash Flow Forecasts

Startup businesses fall into common pitfalls with cash flow projections and forecasts because founders and CEOs aren’t necessarily focused entirely on finance. You know it’s important to have a firm grasp of your cash flow metrics. But that doesn’t mean you’re going to become an expert in generally accepted account principles (GAAP) overnight to be able to build the kind of cash flow plan a dedicated finance team would.

The reality is that cash flow planning isn’t easy under any circumstance — even if finance happens to be your area of expertise. That’s why running out of cash is one of the top reasons startups fail. Avoid the following mistakes to stay in control of your cash flow.

1. You Only Plan for the Ideal Scenario

Often, startup leaders who take a DIY approach to cash flow forecasting with an Excel template or some accounting software stop short of achieving the ideal scenarios for payables and receivables. Assuming cash inflows and cash outflows will follow the perfect circumstances in your head can lead to problems with budgeting and mapping out a strategic business plan.

Your cash flow forecast has to account for more nuance than the ideal scenario includes. For example, what if you assume your Salesforce payments can be broken out over the course of 12 months, but, in reality, you have to pay for twelve months upfront? Or, what if one of your customers runs into trouble and can’t pay their invoice? These would be major hits to short-term cash flow management that could derail strategic plans.

It’s difficult to create a cash flow forecast that accounts for all the nuances and variabilities that can impact your bank balances on a daily, weekly, and monthly basis. But, having deep visibility into a wide range of potential scenarios is crucial to startup success.

You need a more accessible way to manage and update your cash flow forecasts so you can analyze potential issues and see how they impact your runway.

2. Your Cash Flow Forecast Is Separate From Your Financial Models

One reason startups experience funding shortfalls is that their cash flow forecasts and projections don’t align with headcount plans, expense forecasts, sales rep quota capacity plans, and other financial models that help run the business. This happens when the financial assumptions you make in the model don’t match up with the reality of the changes in your bank account.

You might build your SaaS financial model on the assumption that 100% of your customers will pay you on a monthly basis. But in reality, you may end up negotiating different terms depending on the customer. What if 80% of your customers pay monthly, 10% pay annually, and 10% pay upfront? If you adjust your cash flow forecast without also updating the financial model, you can end up with blind spots in your strategic plans.

The best cash flow forecasts align fully with the financial models you use to project overall business performance and map out growth strategies. To gain this alignment, you need access to real-time financial data from all of your business systems.

3. You Take a Hands-Off Approach to Cash Flow Forecasting

The easiest way for startup founders and CEOs to handle cash flow forecasts is to hire someone to build them in a first-class way — but that doesn’t mean you should remove yourself from the process entirely. Maintaining total visibility into cash flow forecasts and projections will help you make more effective, strategic, and informed decisions.

Even if you don’t build the cash flow forecast yourself, you should be able to make changes to project how strategic plans will impact cash flow. Having the flexibility to run what-if scenario analyses is critical.

What if all of your customers started paying 12 months in advance? What if half of your customers run late on their invoices? What if new vendors or creditors expect quarterly repayments? If someone else is managing your cash flow plans, and you don’t fully understand the forecasts, you could end up making decisions that put your runway at risk.

Having an accountant or finance pro build your cash flow forecasts is great. But you need to be part of the process if you want to stay in control of cash flow.

How To Forecast Startup Cash Flow with Mosaic

Startups need both short-term (the direct method) and long-term (the indirect method) cash flow forecasts to effectively understand where dollars are coming in and where dollars are going out of the business.

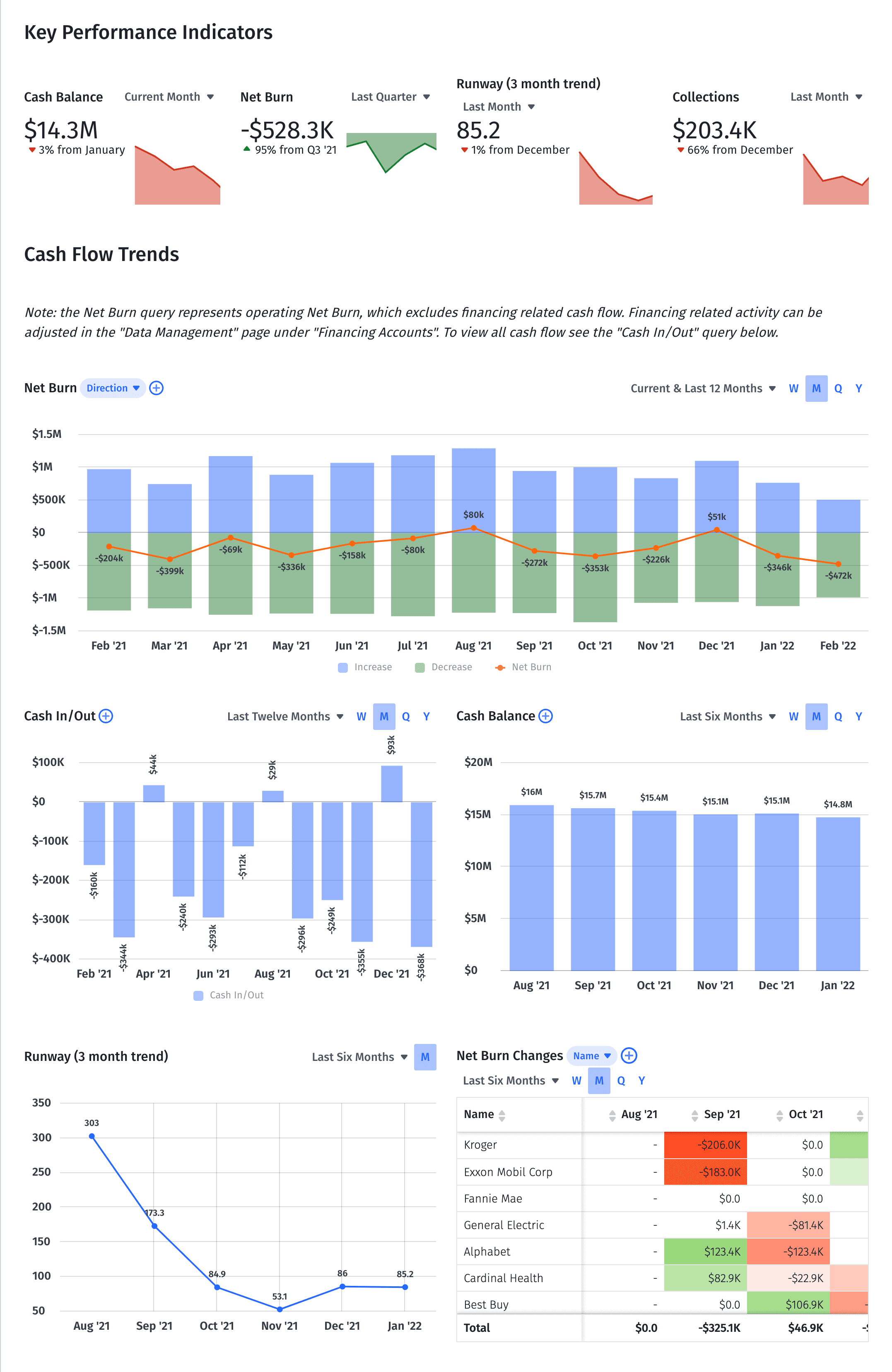

The short-term side of startup cash flow forecasting is less about modeling and more about getting real-time visibility into key performance indicators and trends. That’s why Mosaic provides an out-of-the-box financial dashboard template for cash flow analysis that automatically stays up-to-date with the latest actuals from your ERP integration.

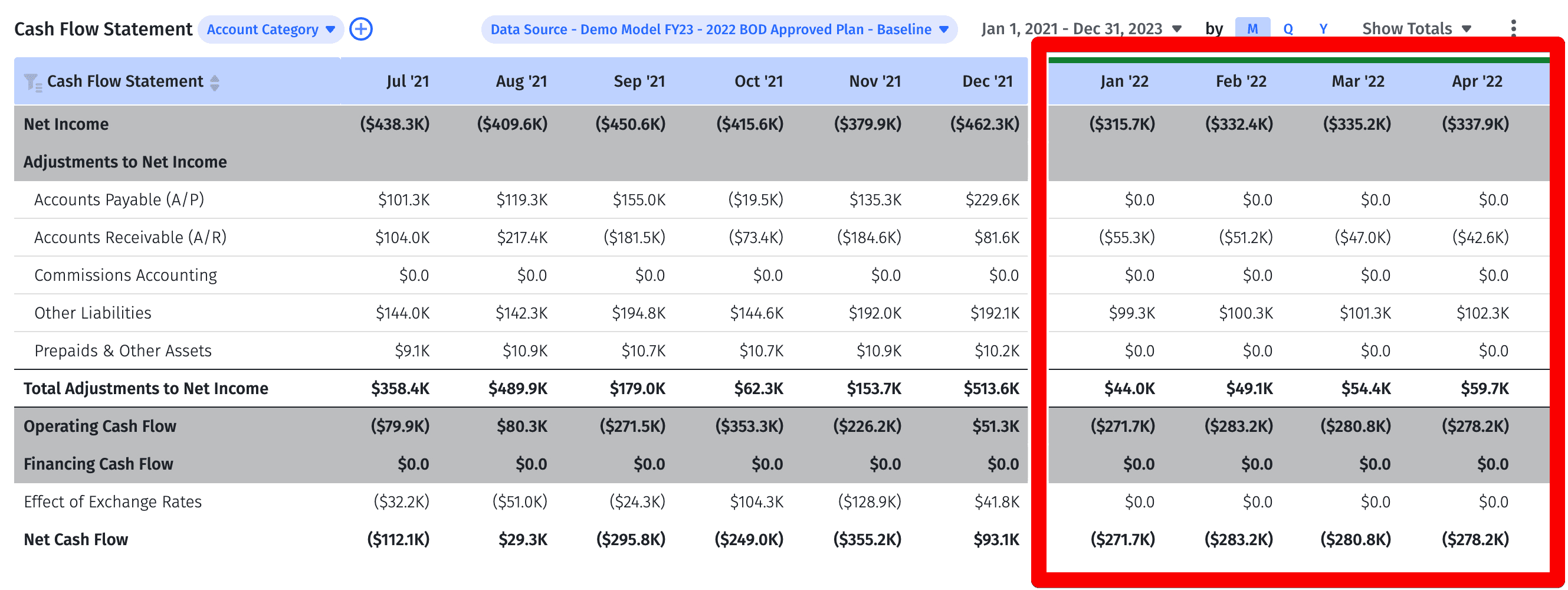

Once you have a short-term view of cash flow, you can look further into the future and model out a pro forma cash flow statement.

Mosaic ties all the components of a financial model together to automatically create a cash flow forecast based on the various ways your decisions will impact your cash balance in the future. The steps included in modeling a startup cash flow forecast include:

- Forecasting headcount for various departments and using driver-based planning to map out future expenses from equipment purchases, software purchases, payroll, and more.

- Planning vendor payments as the company grows and tying that to cash impact on runway.

- Calculating changes in your balance sheet forecasts in terms of cash impact so your pro forma cash flow statement stays up-to-date.

The result is a cash flow forecast you can overlay on your financial reports.

It’s Time for a More Modern, Forward-Looking Cash Flow Planning Process

Mosaic turns traditional cash flow forecasting and planning into a more flexible, transparent process that gives startup founders and CEOs more control over their runway. Instead of getting lost in a complicated mess of GAAP cash flow statements and financial model spreadsheets, you get a unified visualization of your business finances that is always up-to-date with real-time data.

And unlike other financial modeling software solutions, our strategic finance platform makes cash flow planning more accessible to all business stakeholders — not just the finance or accounting team.

Mosaic gives you the flexibility to quickly model new scenarios and see how strategic plans will impact cash flow. Model cash flow by vendor to see how decisions to invest in new systems will impact your runway. Or, analyze different scenarios to see how changes in customer billing schedules will impact the amount of cash you have to increase headcount or expand your product line to a new market. In Mosaic, all it takes is just a few clicks.

Also, looking at historical cash burn is important. However, the typical backward-looking process of studying past reports to project future cash flows isn’t enough for modern startups and new businesses. In the end, you need clear visibility into how today’s strategic decisions impact your runway tomorrow, next quarter, and beyond. And that’s where Mosaic’s cash flow forecasting software makes life easier for startup leaders.

If you want to learn more about how easy it is to manage and plan your cash flow and build a rolling forecast in Mosaic, get a demo and see how the platform works.

Cash Flow Forecast FAQs

How often should you do a cash flow forecast?

Companies should typically do cash flow forecasts at least monthly, but startups and new businesses can benefit from even weekly forecasts as the company may evolve rapidly.

What are the key components to include in a cash flow forecast?

What factors should be considered when creating a cash flow forecast?

What is free cash flow?

Own the of your business.