Financial forecasts and projections are often thought to mean the same thing. And if you’re a privately-held company, it might be fine to view them that way. But they do have subtle differences that matter — especially if you’re a publicly-traded company that has to comply with financial standards.

This guide will help you understand the difference between financial forecasts vs. projections and when each can help you communicate with stakeholders.

Table of Contents

What Are Financial Forecasts?

A financial forecast presents the future impact of a company’s operations on its three financial statements based on the planned course considers your SaaS company’s planned course of action and shares its influence on finances.

According to the Public Companies Accounting Oversight Board (PCAOB), financial forecasts are:

“Prospective financial statements that present, to the best of the responsible party’s knowledge and belief, an entity’s expected financial position, results of operations, and cash flows.”

The figures on the forecasted income statement, balance sheet, and cash flow statement should rely on expected actions to the best of your company’s knowledge if your planning and forecasting efforts are properly synced.

Forecasts include relevant financial assumptions you expect to hold true over the forecast period. You can use financial forecasting software to automatically roll those assumptions forward period over period.

Financial Forecast Example

Say you expect your SaaS company’s annual recurring revenue (ARR) to increase by 15% over the next year due to a new affiliate program and sales campaigns.

You base your forecast (a 15% increase) on reasonable knowledge of how a large affiliate network and sales campaigns can improve sales volume.

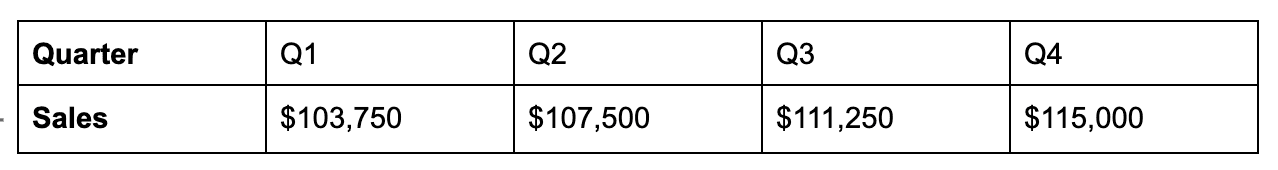

Here’s what your sales increase might look like, assuming your sales at the previous year’s end were $100,000:

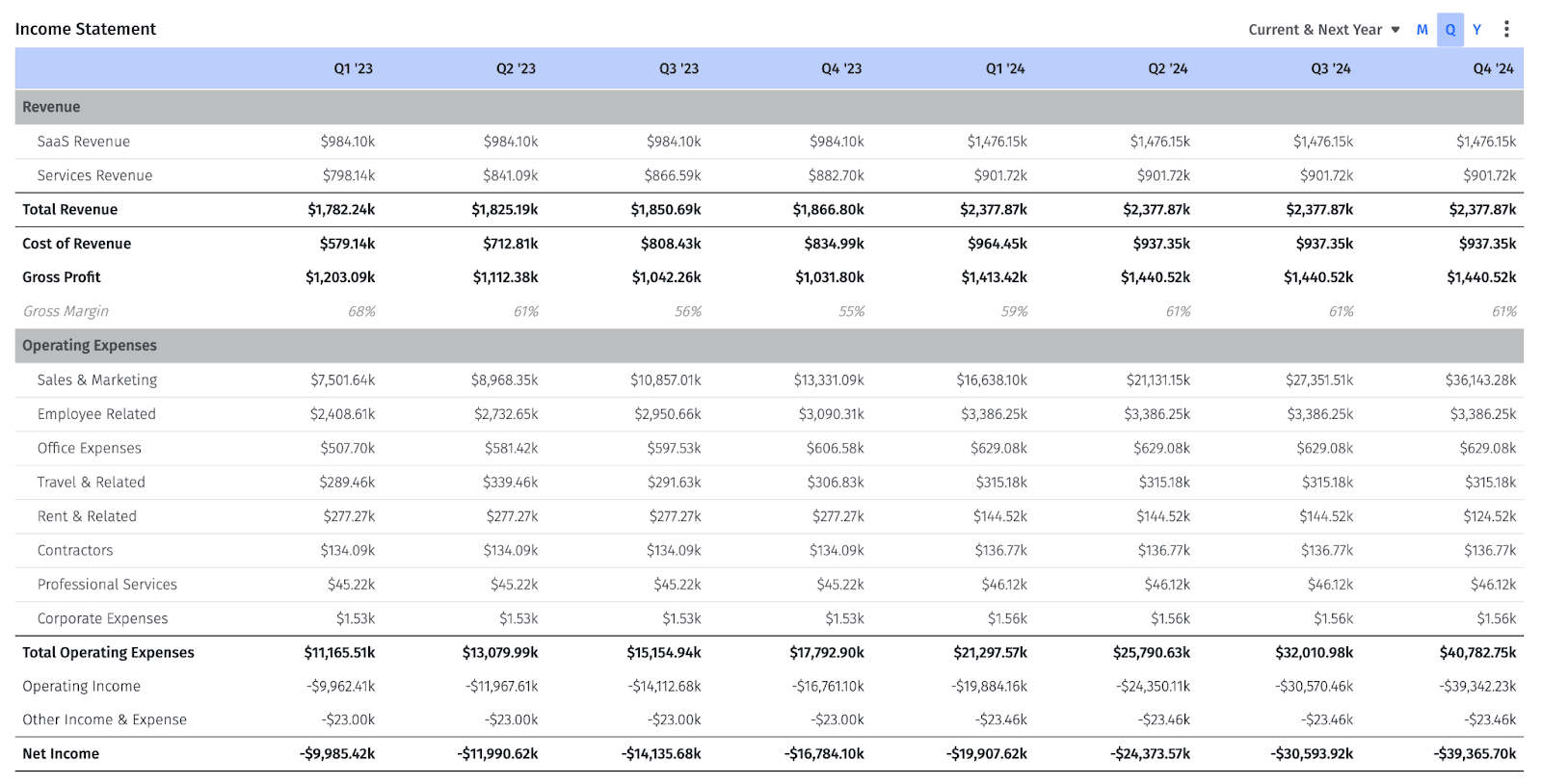

This is an overly simplified example of revenue forecasting — your revenue is likely to grow at a varying pace across quarters. And top-line revenue is just one line item in a financial forecast. In reality, your forecasted income statement will look like a standard report but with dates extending out into the future like below:

What Are Financial Projections?

Financial projections are prospective financial statements (also known as pro forma financial statements).

The PCAOB defines financial projection as:

“Prospective financial statements that present, to the best of the responsible party’s knowledge and belief, given one or more hypothetical assumptions, an entity’s expected financial position, results of operations, and cash flows.”

Note the main difference in the definition — financial projections rely on hypothetical assumptions. It means that even if you don’t necessarily expect a situation to play out, you can look at your financial statements under those circumstances.

This is why financial projections are an excellent financial planning tool and CFO resource. They help CFOs use historical data, industry data, and their own judgment to extrapolate financial information based on hypothetical future events. As a result, they aid decision-making by letting you better prepare for likely outcomes.

Financial Projection Example

You can think about financial projection examples as scenario analysis examples. Sales headcount planning is the easiest way to see how this works.

You’ll determine a baseline revenue forecast for your business. And in that forecast, you might assume a certain pace and volume of AE hiring to fuel your sales capacity model. But what do your financials look like if you over- or under-hire according to plan? You can create financial projections to communicate the impact of different scenarios to your partners in the business.

If you currently have two AEs with quotas of $600,000 per year, your baseline scenario is a top-line forecast of $1.2 million. Your forecast is to add 10 more AEs with the same quotas, so your best-case financial projection is to hit $7.2 million ARR if everyone hits 100% attainment.

You might also create a projection where the assumption is 80% attainment, where your fully-ramped AEs only bring in $480,000 in revenue.

Financial projections let you stress test your numbers. Ask the what-if questions to properly map out all the potential outcomes of your growth plans.

Key Differences Between Financial Forecasts vs. Projections

Now that we’ve gone over the basic definitions of financial forecasts and projections, we can dive deeper to make the distinction between these two terms even clearer. Here are the primary differences between forecasts vs. projections:

Flexibility in Assumptions

You create financial forecasts on a best-knowledge basis. Put simply, you must focus on the most likely outcomes without bias.

In contrast, projections allow more room for tweaking your assumptions. With projections, you can better understand how a decision or external factor will influence your business’s financial health.

For example, you can project your company’s financial statements to see how factors like exchange rates or political instability in your target markets will impact your SaaS business. This process allows stakeholders to prepare risk mitigation strategies.

Short Term vs. Long Term

Typically, you make forecasts for the near future as a longer time frame risks a loss of accuracy.

On the other hand, you can have short- or long-term projections based on your decision-making needs. You can even test the same hypothesis over different periods for added insights.

Use Cases

Investors and stakeholders use forecasts to get the financial picture that the management thinks is most likely. Moreover, external parties don’t have access to internal decision-making and financial projections, so forecasts are their only option.

In contrast, you use projections internally to assess such things as the viability of investments and the payoff from introducing a new product. They’re only accessible to your management and unavailable to the public.

Use Financial Modeling Software to Build Better Forecasts & Projections

When To Use Forecasts vs. Projections

When you need to validate hypotheses or understand how different internal and external variables will impact your finances, use projections. They allow greater flexibility without having to stick to a most likely scenario. You can also use projections as part of scenario analysis, or employ driver-based planning to understand and simulate the effect of key drivers on your business outcomes

On the other hand, use forecasts when you need to share information about the company’s financial future with an external entity.

For example, lenders may want to look at your startup or small business’s historical financial statements and forecasts before approving a loan. You’ll need to provide a forecast (the most likely financial trajectory) of your business, not projections.

Financial Forecasts and Projections in Mosaic

Traditionally, forecasts and projections required finance teams to pull up a spreadsheet, build a model, and manually input financial data. However, you can create forecasts and projections within minutes thanks to Mosaic, a complete financial management solution for SaaS companies.

Mosaic automatically collects your financial data, so you won’t have to enter any numbers. This lets you focus on fine-tuning your forecasts and projections instead of mundane tasks like data migration.

With Mosaic, you also get various financial dashboards. These dashboards present information visually, letting you make smart decisions through better insights into your financial efficiency and other metrics.

If that sounds interesting, get a personalized demo and see how you can have more control over your business’s finances.

Forecasts vs. Projections: FAQs

What is the difference between forecast and budget?

A budget is a framework for the financial goals you want to achieve. In contrast, a forecast shows your expectations of what might happen.

A budget and forecast also differ in content. The budgeting process involves identifying business goals, such as the ARR or expense ratio you want to achieve this year. Forecasts include realistic expectations on if and how you will meet the goals in your budget.

What are the types of forecasting?

What are projected statements?

Own the of your business.