Whether you’re preparing for a financial audit, planning future funding rounds, or just supporting strategic decision-making in your business, you need to know your company’s financial health like the back of your hand. Your financial statements account for every dollar in and out of the business, setting the foundation for strong financial reporting

But to take your financial reporting and analysis to the next level, you need to know how to make each financial report come alive for your audience. Something like outcome-based reporting can be crucial by helping you find a common language for the department manager working through ways to improve operational efficiency and the venture capitalist wanting to invest in the business. You need to know the “why” behind the numbers and how they can lead to proactive decision-making that impacts the business’ efficiency and growth.

Here’s how your business benefits from deeper financial reporting and analysis.

Table of Contents

What Is Financial Reporting?

Financial reporting is the analysis of a company’s net income, expenses, and cash flow over a period of time, whether that’s monthly, quarterly, or annually. CFOs and finance teams track revenue and spend trends to assess how the company can optimize and improve operational efficiency and cash flow.

The basic building blocks of financial reporting are your three financial statements, which follow necessary accounting, taxation, and legal requirements. Any company in the United States follows generally accepted accounting principles (GAAP), which are set by the Financial Accounting Standards Board (FASB). U.S.-based companies must also send financial reports to the U.S. Securities and Exchange Commission (SEC) on a quarterly and annual basis. Companies outside the U.S. and China adhere to International Financial Reporting Standards (IFRS).

Why Is Financial Reporting Important?

Beyond government compliance and tax provisioning, financial reporting is a crucial part of the financial management process that provides the foundation for understanding a company’s financial performance. Analyzing your financial statements — both to align with GAAP and in ways that are unique to your business — allows you to piece together your company’s entire growth narrative and dive deeper into the numbers, which leads your business partners and executive leaders to strategic insights.

Here are a few of the key reasons financial reporting beyond the basic compliance requirements is important:

Leads to better decision-making

Financial reporting helps you show the numbers in a digestible way and surface questions and insights for department leaders. Those department leaders use your observations to look for opportunities to optimize systems and processes and maximize operational efficiency.

Track your cash flow

Cash is king, and the point of financial reporting is to better understand your cash inflows and outflows and free cash flow from every angle, and how you’re trending toward profitability.

Maintain transparency

Financial reporting helps you create a consistent, transparent narrative around the numbers for investors, board members, and internal stakeholders. These reports highlight capital efficiency and help improve forecast accuracy on the path to future growth and sustainable profitability. They also create the foundation for your board deck, from your market position to your revenue model to your cash flow forecast, giving board members a cross-functional view of the company’s overall finances and plans to scale.

Monitor and manage debt

Monitoring any changes regarding current assets, current liabilities, and owners’ and shareholders’ equity in the company stock sets you up to manage or foresee debt alongside sustainable company growth.

Create Best-In-Class Reporting to Keep Stakeholders Informed

Types of Financial Reports and Use Cases

There are four basic types of financial statements and reports that give you visibility into the company’s finances and create a foundation for custom reporting that drives strategic insights internally.

Balance Sheet

The balance sheet is a snapshot of the company’s net worth at a specific point in time. Line items detail assets (like beginning and ending balances for accounts receivable), liabilities (any debts and outstanding accounts payable), and equity.

Your balance sheet lets you know the cash impact on operations. Knowing your financial health on a short-term basis allows you to conduct stronger balance sheet forecasting, which leads to more effective planning around cash burn and proactive decision-making when it comes to company goals.

Income Statement

our income statement, also known as the profit and loss (P&L) statement, is a crucial tool for P&L management. It summarizes your revenue and expenses during a specific period, providing insights into the financial health of your business.

Your income statement answers two important questions: Can the company continuously generate revenue? And can it do so profitably? This is how you can answer questions about top-line vs. bottom-line growth.

Collaborate with your sales and marketing team to point out trends or opportunities for improvement within the sales funnel or pipeline. And for bottom-line growth, you’ll collaborate with department leaders across the company to identify opportunities to improve overall efficiency.

Cash Flow Statement

Also known as your statement of cash flows, your cash flow statement measures how well the company generates cash, including cash flow from operating activities, over a specific period of time to pay its debts and fund its operating expenses and investments, such as an office building or equipment.

Investors and venture capitalists are eager to know how a company spends and saves its money. When you conduct a cash flow analysis, you gain deeper insight into how cash moves in and out of the company, which impacts liquidity and helps you understand the company’s runway. This information sets executive leadership up for successful board decks and pitches, which continue to build the company’s reputation and impact your SaaS valuation for future funding rounds.

Statement of Changes in Equity

Your statement of changes in equity, or statement of retained earnings, report how much money the company keeps after paying out to any stockholders or owners.

As your company grows, the statement of changes in equity will gain more importance if the company offers equity to employees or investors. There may be time stipulations toward cashing out equity or buying more after a certain period of time, which will impact how much the company keeps and can reinvest in the business over time.

How Different Departments Within a Business Use Financial Reporting

Your financial analysis provides ample opportunities to distill numbers into a shared language between you and other department leaders. Here are a few ways different departments gain insight into their operational efficiency.

Drive Cross-Collaboration Initiatives

Your product, sales, and marketing teams need to understand how their department goals and initiatives align with each other and speak to the company’s larger goals. For example, if marketing plans a specific campaign for a new product feature, your engineers need to ensure they deliver on time, and sales reps and customer support reps need to ramp up on product knowledge. This all takes time and money to complete.

The sooner marketing can start to promote the feature, the better — this campaign may be the one to finally snag potential customers and get them to move through the sales funnel quicker. Or, current customers may upgrade their services for the feature. (This, of course, depends on your pricing model.) Department leaders can find ways to support each other through any learning curves, which cuts down on ramp time to learn about the product feature. And they can also time any marketing campaign to ensure optimal return on investment (ROI).

Help Determine Department Budgets

Department leaders know what tools and resources they need to perform their day-to-day responsibilities. Having department leaders understand how their department spend impacts the business’ financial performance and overall goals is crucial to setting up strong budget allocation practices.

Department leaders can reference historical data across financial statements to determine what tools are absolutely critical and where there may be opportunities for more affordable options. You can also collaborate on resource and headcount planning, which drives proactive foresight and decision-making when it comes to sustainable growth.

Assess Impact from Resources

Each department leader must understand how their work ties into company goals — and part of that is through understanding how to measure the impact of spend on revenue.

Perhaps the marketing team requires freelance writers for a few articles — how did those articles perform, and did they bring in any potential customers? Or perhaps the marketing team requests more money for a particular ad campaign to run longer — they should be able to justify this by demonstrating a satisfactory return on ad spend. Even when the impact may result in a loss, it allows an opportunity for departments to determine a better strategy for next time.

Cut Unnecessary Spend

Income and cash flow statements gather information on company spend, which you can highlight for each department. From there, department leaders can review their tools to see what they can cut or scale back on, such as team activities or inactive seats on a specific platform.

Custom Financial Reporting and Analytics with Mosaic

Financial reporting and analysis can take hours, if not days, to sort through the various spreadsheets and communication across multiple departments and channels — and that’s just to get the baseline financial statements.

When you need these reports on a monthly or quarterly basis, you can’t afford to lose time to manual data manipulation and reconciliation when you should be customizing those baseline reports to drive conversations toward agile, strategic insights.

Mosaic integrates with your source systems that allows you to focus on timely financial reporting and analysis. Mosaic syncs with your source systems and updates automatically so that finance has access to the most accurate numbers whenever you need them. By keeping track of actual numbers in real-time, you lay a foundation that allows executive leadership to make better-informed business decisions.

Mosaic offers custom financial reporting and analysis features to unlock your financial storytelling skills. Custom reports go beyond the basic compliance requirements to help you tell the company’s narrative with the full scope of your financial and non-financial data in mere minutes. Here’s how you can create custom financial reports in Mosaic.

How to Create Custom Financial Reports in Mosaic

Mosaic offers two ways to create custom reports. You can begin with a prebuilt, GAAP-compliant report template for a specific category, such as an executive summary, sales performance, or SaaS metrics. Or, you can create a report from scratch. Either way, Mosaic helps you make a report truly yours.

You can watch our video on how to create custom financial reports in Mosaic in under three minutes, and can reference the written instructions below.

To create a report from a prebuilt sheet:

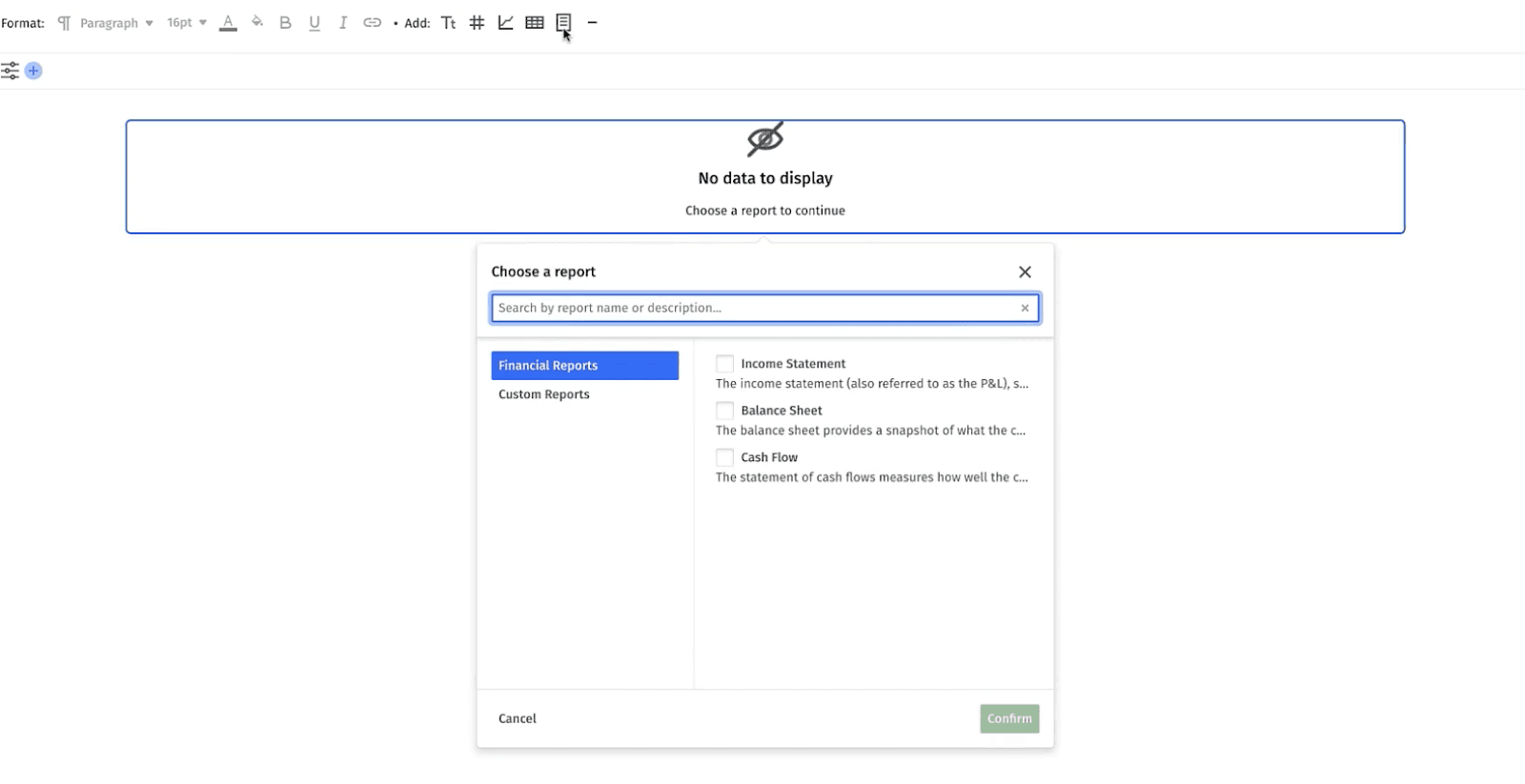

1. Choose which prebuilt financial report you want to start with — your income statement, balance sheet, or cash flow statement.

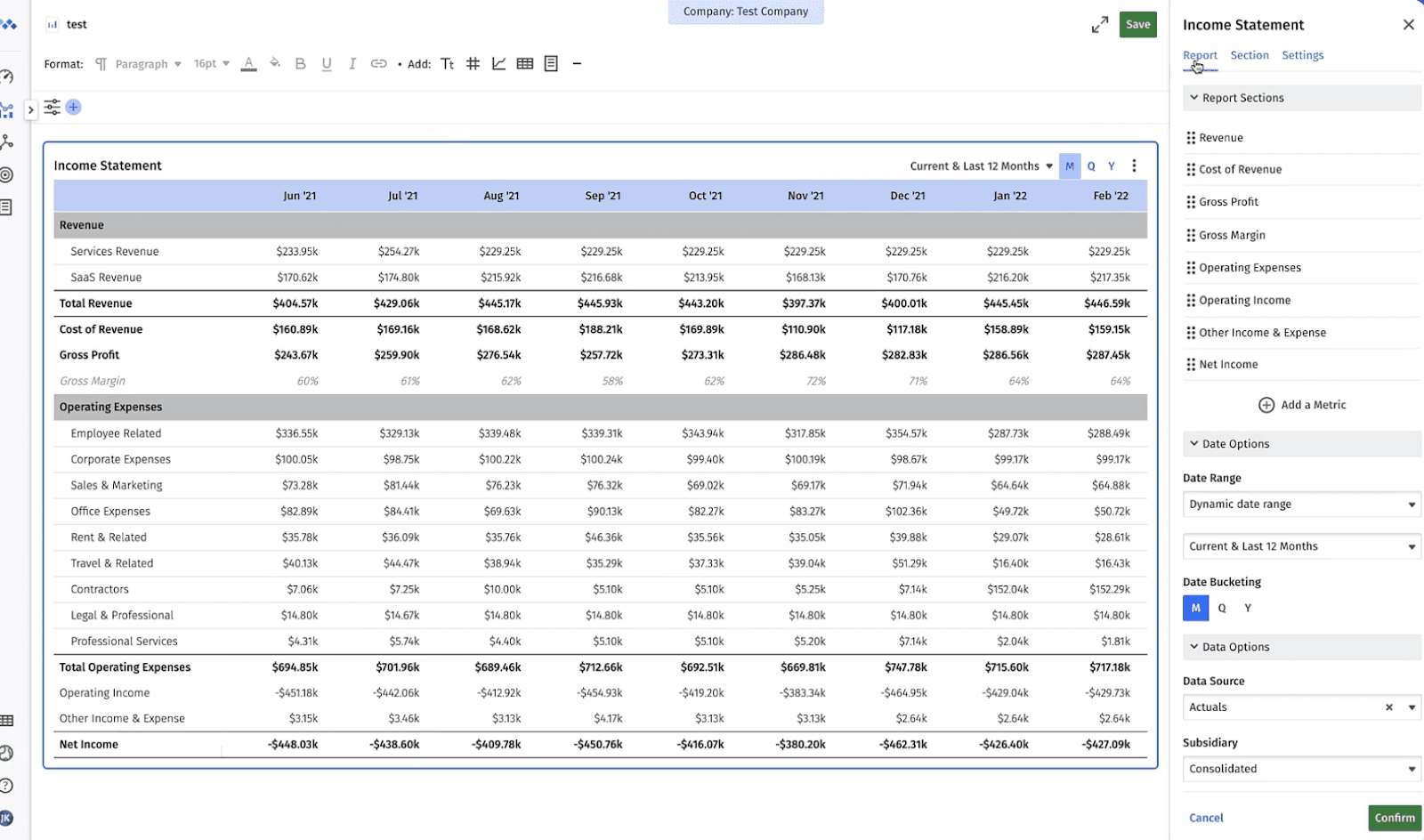

2. Use Mosaic’s customization features to change settings across the entire report or in individual sections.

Whether changing the entire report or an individual section, the settings allow you to configure table formatting, number formatting, row and column colors, data filters, included metrics, and more. And the “settings” tab allows you to change report titles and column spacing.

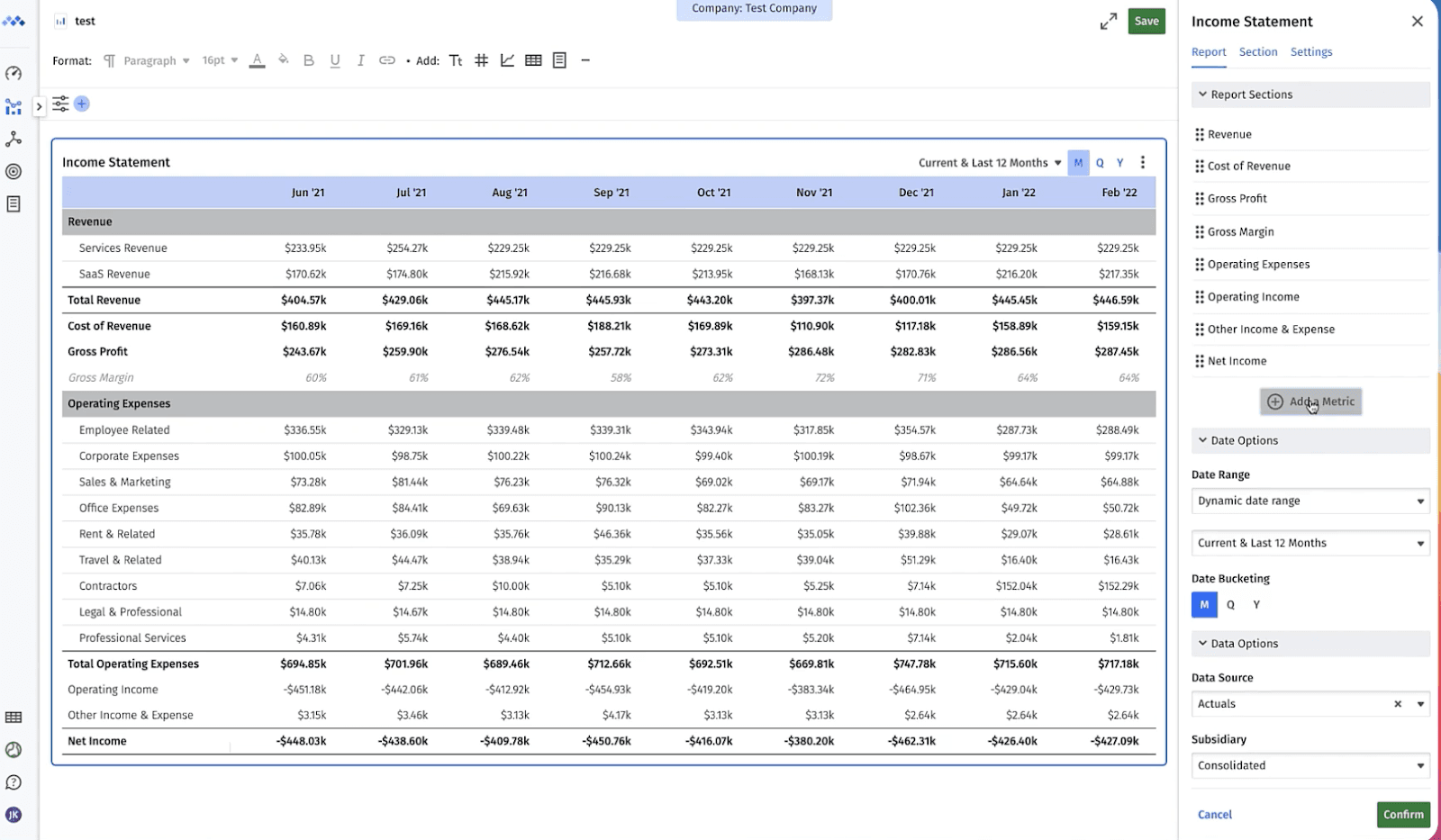

3. Add metrics to the financial report to customize the story you want to tell about your business. In the reports tab, you can add metrics by selecting from a variety of out-of-the-box metrics preloaded in Mosaic.

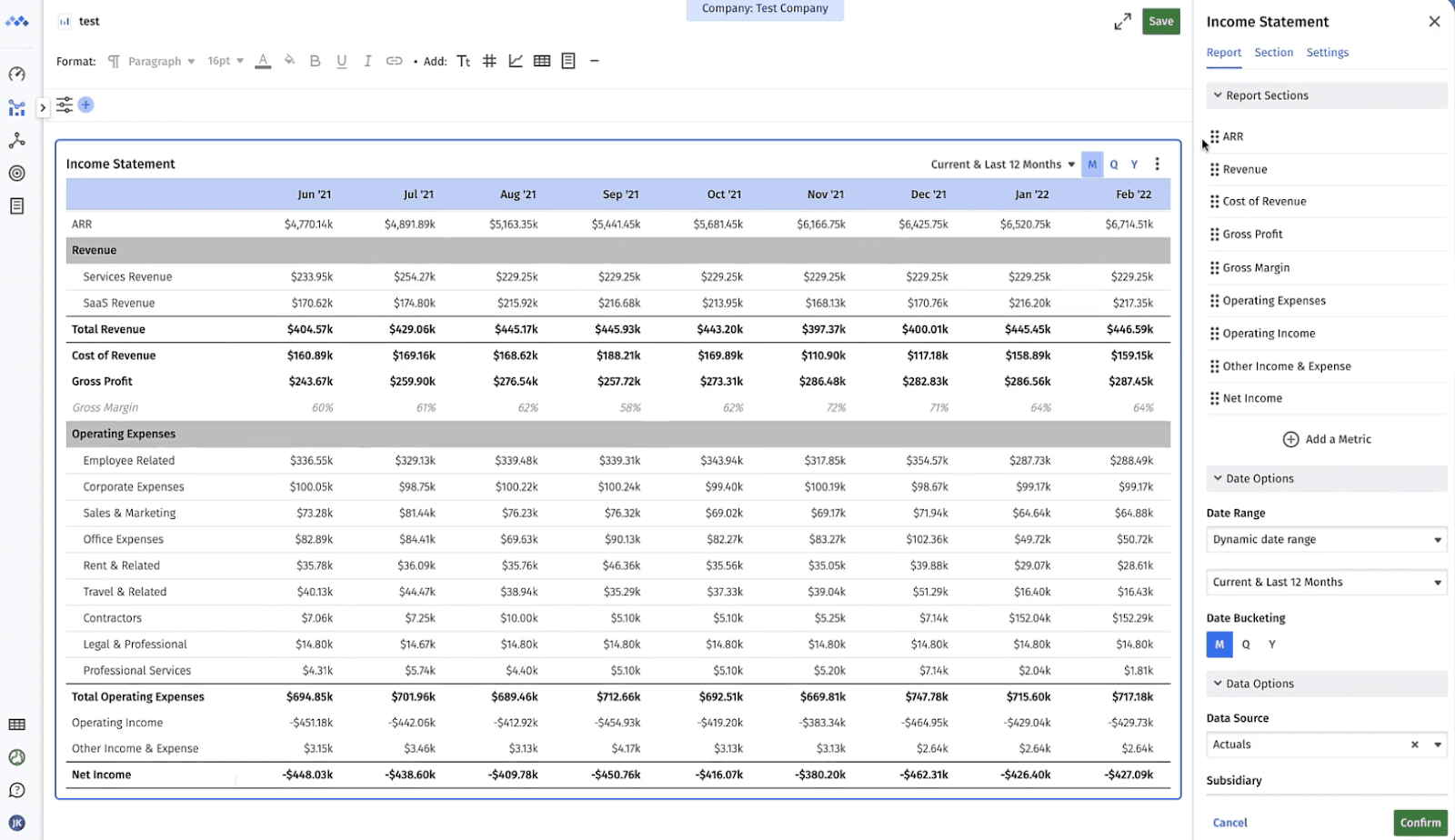

4. Drag and drop the main metric categories for the report to align with the narrative. For example, if you’re adding ARR to your income statement, you can add it above your revenue line to give a better sense of top-line growth (outside the bounds of GAAP compliance).

To create an entire report from scratch:

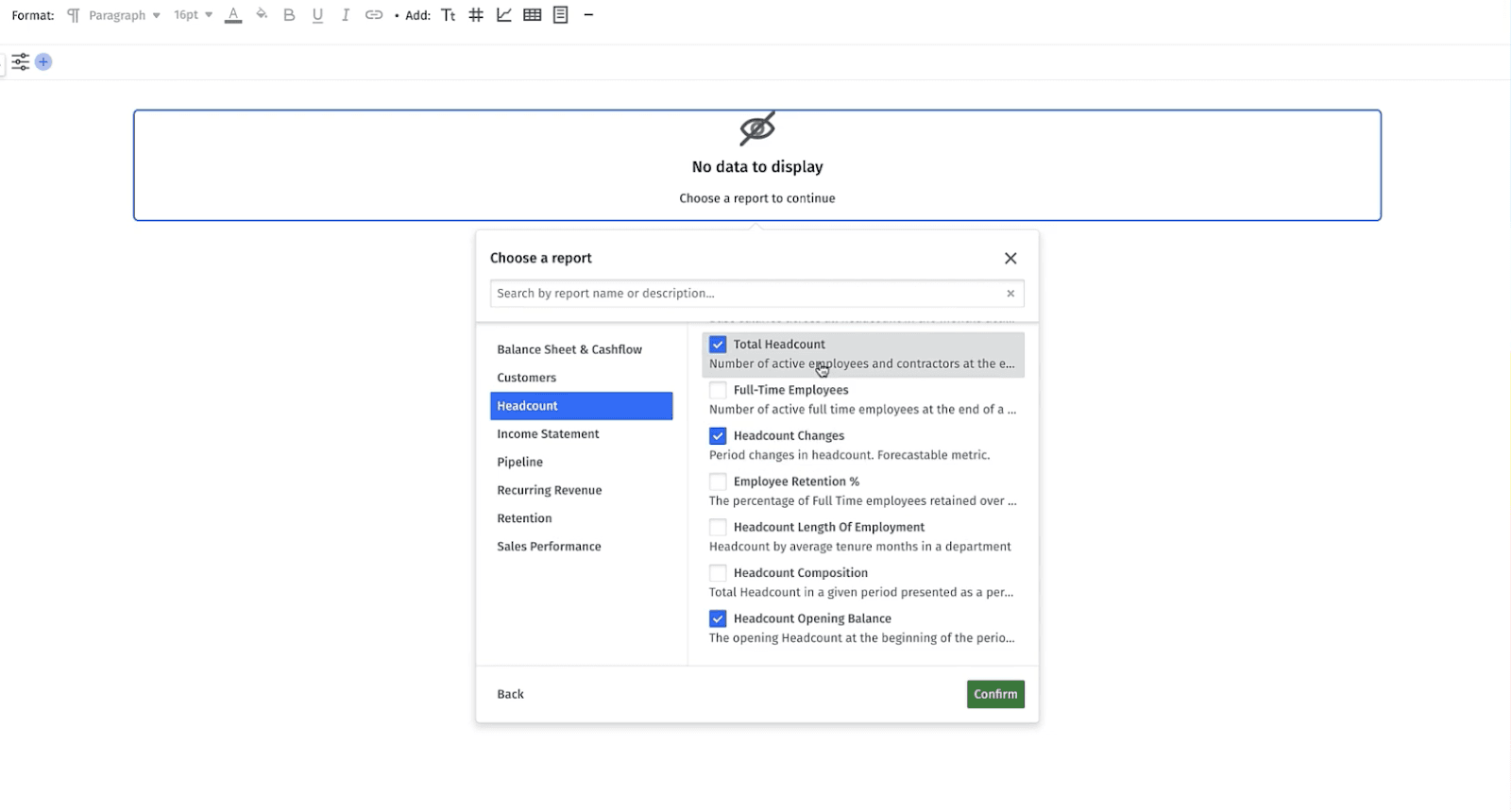

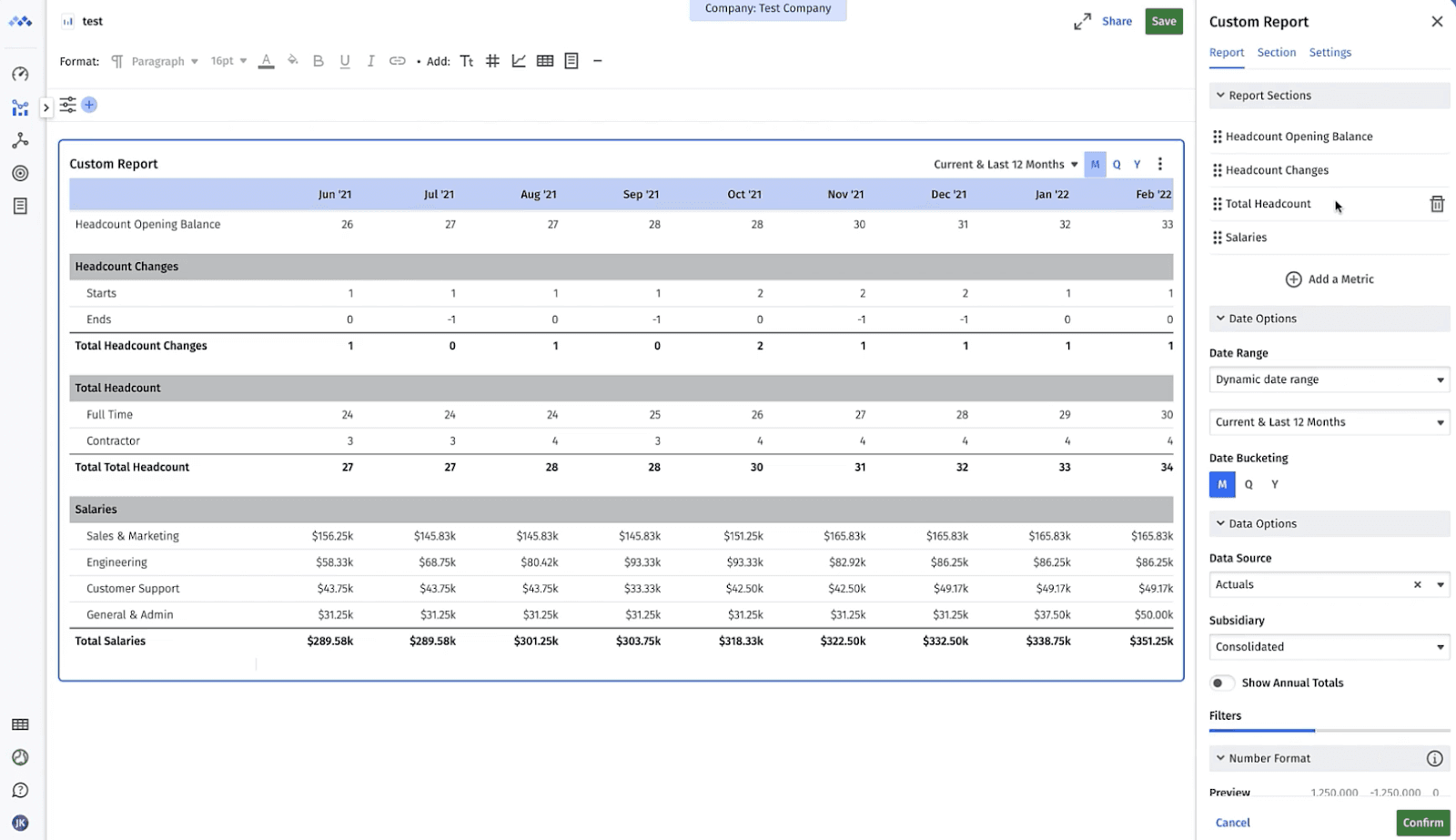

1. Add a new report in Mosaic and select the “Custom date-based report” option. Choose the metrics you want to include in the financial reporting format. For example, you can create a headcount report with metrics like total headcount, headcount changes, and salaries.

2. Configure your metrics, sections, and report formatting with the same steps previously listed.

In this case, you might want to add drill-down options to different sections. For example, you could show salaries at the role level to get a better understanding of headcount budget allocation across departments.

Save Time and Drive Strategic Decision-Making from Your Financial Reporting and Analysis with Mosaic

With Mosaic’s finance automation capabilities, you can gather your financial and non-financial data in real-time to make more robust financial reports that lead to proactive decisions that impact the company’s profit and growth sooner.

Request a personalized demo today to learn about custom reports and more.

Financial Reporting FAQs

What is real-time financial reporting?

Real-time financial reporting is an enhancement of your financial reporting processes in that you can pull up-to-date financial information almost instantaneously. Through financial reporting software and financial automation, your source systems (ERP, CRM, HRIS, and billings system) are automatically updated in real time, so that when you consolidate a report, you have accurate data.

What is financial reporting software?

What is the difference between financial accounting and financial reporting?

What is the difference between financial reporting and regulatory reporting?

What is SEC financial reporting?

Own the of your business.