SaaS companies, especially small businesses that are scaling quickly, often have general and administrative (G&A) expenses that shoot through the roof. Sometimes, the number is as high as 30% of operational costs, often because of rapid growth and continuous investments in the business.

These companies are either not spending wisely or not allocating their funds properly to match the growth rate. But when you consider economies of scale, as a SaaS business rakes in more revenue, its G&A expense should ideally take up a smaller piece of the revenue.

Here’s the problem: When you’re unclear about categorizing expenses in your P&L, it’s like trying to complete a jigsaw puzzle without looking at the picture on the box. You’re trying to fit pieces together based on vague assumptions rather than the actual design.

The best strategic finance functions act as a compass for the business, and the only way to do that is to have a clear view of each piece of the financial planning and analysis (FP&A) puzzle. Get started by cleaning up your G&A expense categorization and tracking.

Table of Contents

What Are General & Administrative Expenses?

General and administrative (G&A) expenses include those from back-office functions like accounting, finance, HR, and legal as well as overhead costs, fixed and semi-variable, that don’t directly fall under a specific business function. Properly categorizing G&A expenses in SaaS is crucial because it affects your bottom line, especially as the business grows.

Aside from the headcount-related costs for accounting, legal, finance, and HR, G&A covers indirect costs and business expenses like rent, utilities, non-department-specific payroll, insurance, travel, professional services like accounting and legal fees, and expenses related to maintaining business licenses.

On the flip side, expenditures tied to direct operations or front-office business functions aren’t considered G&A. For example, research and development (R&D), hosting services, selling expenses, marketing costs, and customer success aren’t included in this category.

G&A Expense Categories

Some parts of your G&A are fixed costs, while others are semi-variable. This mix gives you flexibility, making G&A a prime area to explore when aiming for financial efficiency. By closely examining these costs, you can pinpoint where to save and ensure you’re using your resources best.

Fixed Expenses

As mentioned above, some general and administrative costs are fixed, meaning you’ll incur these costs even if you’ve paused business activities, acquiring new sales or customers. For example, say you don’t sign any new accounts in November. You’d still need to cover the office rent and utilities, plus continue offering services for existing customers.

Semi-Variable Expenses

Some G&A expenses fluctuate based on your company’s specific needs, such as changes in business activity — these are semi-variable expenses. However, these costs don’t necessarily have linear changes based on business activity. Instead, they fluctuate based on the investments you choose to make.

For instance, acquiring a state-of-the-art projector might enhance in-house meetings or client presentations. Still, it’s unrelated to the functionality or efficiency of your software solution. Starting with these costs is a good idea if you want to trim expenses and improve cash flow.

Start Using Our Chart of Accounts Template

Why G&A Expenses Are Important for SaaS Businesses to Deeply Understand

In SaaS finance, accounting poses unique challenges compared to traditional businesses, mainly because of the subscription-based model. If you throw in miscategorized G&A expenses, you risk overlooking chances to cut unnecessary costs or preserve revenue, especially during growth phases when budgets are tight.

Moreover, the quality of your insights hinges on your data’s accuracy. So, if you’re not clear about where your expenses belong, including G&A, your data analysis could lead you astray, potentially guiding your business off course.

In simple terms, G&A expenses are crucial for CFOs and finance teams to understand the financial health of your SaaS startup. They help manage funds, reduce costs, and sustain revenue throughout growth.

How to Calculate G&A Costs

Calculating G&A costs begins with identifying the types of expenses it covers. Once you’ve identified the expenses that belong under this category, you can gather the data for a specified timeframe, such as monthly or annually, and add them up to get the total G&A costs.

For instance, let’s say your company had a total revenue of $500,000 for August. Your G&A expenses included rent, non-departmental salaries for executives or admin, utilities, office supplies, insurance premiums, and travel expenses unrelated to sales.

So, your total G&A expenses were as follows:

G&A Costs = Rent ($10,000) + G&A Salaries ($100,000) + Utilities ($2,500) + Office Equipment ($1,500) + Insurance Premiums ($2,000) + Travel Expenses ($3,000) = $119,000

You can also view your G&A expenses as a percentage to track variations over time or compare the percentage to industry benchmarks — divide the total G&A expenses by total revenue (or operational expenses) for the specified period and multiply the number by 100. For August, your G&A percentage would be as follows:

G&A % = Total G&A Costs ($119,000) / Total Revenue ($500,000) x 100 = 23.8%

4 Ways to Reduce G&A Costs

Trimming G&A costs is highly beneficial for SaaS companies; it frees up funds that can be channeled into crucial areas like product development or customer acquisition. Plus, fine-tuning these expenses enhances operational efficiency, leading to better profitability. Here’s how you can reduce your G&A costs:

1. Track Your G&A Costs Closely

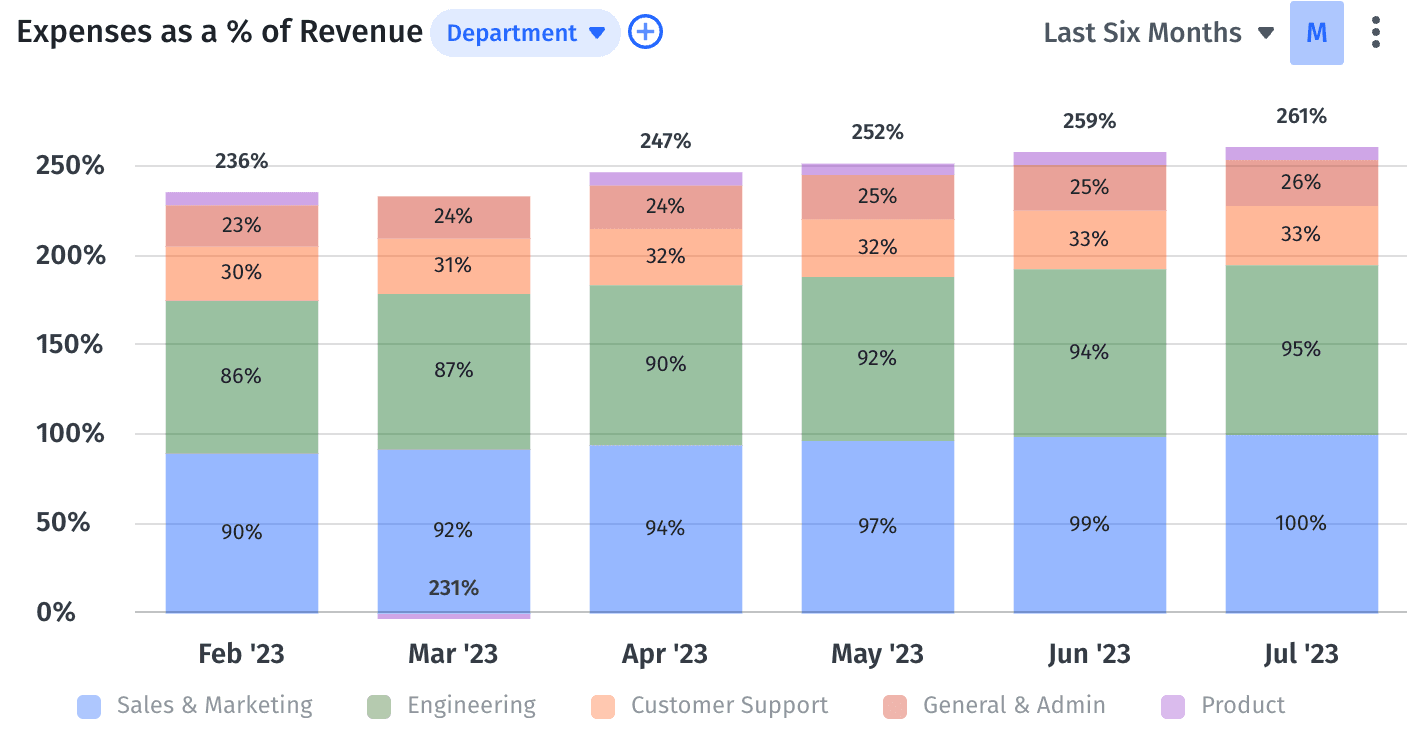

As mentioned earlier, once you’ve rightly categorized your G&A costs, pay attention to the numbers — it might reveal patterns, such as seasonal expenses or significant variations that need a closer look. When you have your G&A percentage, you can compare the number with other SaaS companies or track progress toward an internal benchmark.

2. Audit Your Costs Over Time to See Where Your Money Goes

Regularly checking G&A expenses can highlight areas of waste or overlap in your day-to-day operations. By spotting these unnecessary line items, you can streamline the company’s operations and improve its bottom line. Additionally, a clear grasp of G&A expenses ensures that your financial choices are grounded in comprehensive and precise data.

3. Use FP&A Software to Highlight & Eliminate Financial Redundancies

A common FP&A best practice is to use FP&A software like Mosaic, which can automate much of the categorization process, and make it easier to track expenses over time and even create visualizations to spot patterns or outliers. Mosaic was made with SaaS businesses in mind, so you can track your G&A expenses and other key metrics in real time.

4. Implement Spend Controls

Before you can control spending, you need to understand where the money is currently going. Once you’ve reviewed your G&A expenses, take measures to control spending. Some methods include setting transparent budgets, introducing approval workflows for costs exceeding a certain cap, limiting unnecessary travel and entertainment expenses, and negotiating with vendors for better terms or discounts.

Gain Complete G&A Expenses Visibility With Mosaic

SaaS business owners and finance teams understand the urgency of immediate financial insights, especially in a market where products evolve rapidly. This is where Mosaic steps in, with real-time G&A expense tracking and financial analysis.

If you’re wrestling with the intricate maze of SaaS finance, look no further: Mosaic is the comprehensive financial analytics solution you need. It nails down precise financial projections and gives users a clear view of how changes in G&A expenses have a direct impact on the bottom line.

Mosaic comes packed with easy-to-use templates you can whip up in no time to peek at your G&A expenses in handy financial dashboards, as well as gain deeper insight into other financial statements. Ready to turn your insights into collaborative reports that rally the whole team? Mosaic helps ensure everyone’s on track to meet those growth targets. Dive into the reason behind the numbers with user-friendly, clear visuals.

If you’re excited to shape your company’s financial story in minutes, request a personalized demo of Mosaic.

G&A Expense FAQs

What does G&A stand for?

G&A stands for general and administrative expenses in financial planning and analysis (FP&A). Typically, G&A includes day-to-day costs for back-office functions like human resources, accounting, finance, and legal as well as other expenses like rent, utilities, non-departmental payroll, business licenses, etc.

Are wages and salaries included in G&A costs?

What is the difference between G&A and operating expenses?

Is G&A a fixed or variable cost?

What is the difference between G&A and SG&A?

Own the of your business.