Gross Margin

What Is Gross Margin?

Gross margin, also called gross profit ratio, is the percentage of income a company is left with after subtracting the cost of goods and services (COGS) or cost of revenue, which are costs directly tied to getting your products out into the market. Compared to net profit margin, which takes into account all expenses, the gross margin focuses primarily on direct costs associated with production.

It tells you how much money you get to keep for every dollar you bring in. For example, a gross profit margin of 75% means you’re keeping 75 cents for every dollar you bring in, while 25 cents is what’s being spent on your product. This metric is critical for business owners to assess the financial health of their operations, especially when considering their income statement.

Categories

While gross profit ratio seems like a fairly straightforward metric to evaluate revenue vs profit, cost of revenue is a critical variable that will vary greatly from company to company depending on the industry and business model. For manufacturing businesses, for example, these costs often include production costs such as raw materials.

For SaaS businesses, cost of revenue typically includes things like:

- Web hosting services through Amazon Web Services (AWS), Microsoft Azure, or another provider

- Additional cloud computing costs, including performance monitoring

- Merchant payment processing fees

- Any costs associated with software licenses that directly relate to product development or delivery

- Payroll costs for employees and programs directly involved in customer support

- Professional services costs and any travel related to product implementation and support

- Development costs for building, including engineering salaries

These are the direct costs that contrast with overhead costs, which shouldn’t factor into the gross profit ratio.

There are no hard-and-fast rules for what to include in your cost of revenue, which is why it can be so difficult to get this part of the calculation right. However, no matter what industry you’re in, your gross profit ratio shouldn’t factor in operational costs like sales commissions, marketing expenses, or administrative costs.

Table of Contents

How Is Gross Profit Ratio Calculated?

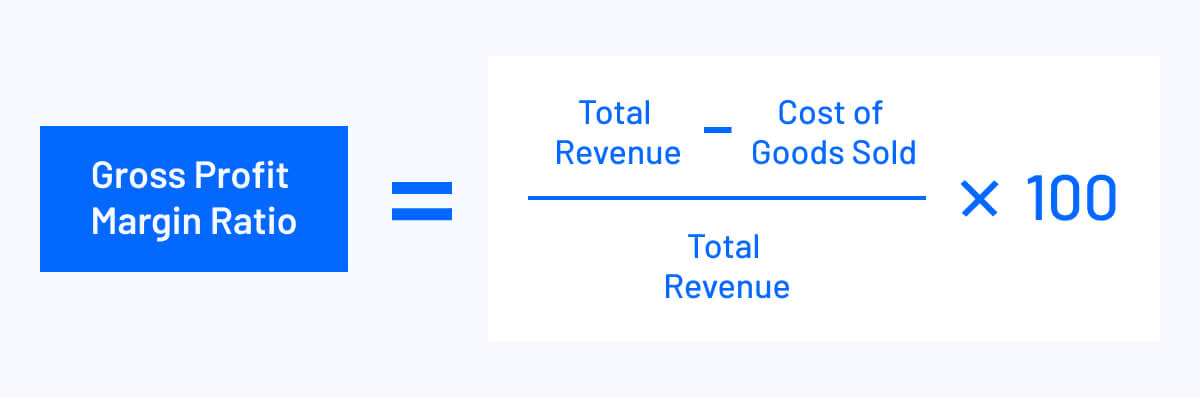

You can calculate gross margin by subtracting the cost of goods sold from your total revenue, dividing the result by your total revenue, and then multiplying by 100 to create the gross profit ratio. This is different from the net margin, which includes other expenses, and the operating profit margin, which factors in operational expenses.

For example, if you’re an SaaS company with revenue of $1.5 million and your COGS is $360,000, your gross profit margin is 76%.

- $1,500,000 – $360,000 / $1,500,000 = 0.76 x 100 = 76%

Why Does Gross Profit Margin Matter?

Gross profit ratio is one of the most fundamental ways to evaluate profitability. It tells you how efficiently your company is operating and aids in making important business decisions. A gross profit margin that’s too low can signal to company leaders that they need to cut how much they’re spending on their product or that their prices aren’t high enough. A gross profit margin that’s high can help indicate to company leaders that it’s a good time to expand or reinvest in the company.

In addition to being a key metric for company leadership, gross profit margin is also important to investors, VCs, analysts, and those looking to acquire other SaaS companies. It aids them in SaaS valuation when deciding whether or not to invest in or purchase a company. It also helps them understand a company’s scalability since higher gross profit margins or higher profit rates allow companies to invest more in their product and marketing efforts to boost growth.

What Is Considered a Good Gross Profit Margin?

Understanding why gross profit margin is important and how it’s calculated is good, but it means little without context. It’s a significant benchmark for measuring the financial health of a company. SaaS companies should achieve a gross profit margin of 75%, and anything below 70% may raise concerns for financial advisors, investors, VCs, and analysts.

Companies that went public between January and September of 2020 had an average gross profit margin of 76.6%, while companies surveyed for KeyBanc’s 2021 SaaS survey had a median gross profit margin of 73%. SaaS companies that are best-in-class typically have gross profit margins that range from 80% to 90% or even higher.

Gross profit margin varies widely by industry and is much higher for SaaS companies than for companies in other industries because the cost of goods sold is much lower than it is for other industries. For example, the average gross profit margin for the auto and truck industry is 9.04%, for restaurants and dining it’s 27.60%, and for household products, it’s 50.87%.

What Challenges Do Companies Face Tracking Gross Profit Margin?

Getting your gross profit margin wrong can have major negative impacts — both when making decisions as a company and in the case of investors, VCs, and analysts who are evaluating your company. One significant issue companies face when calculating gross profit margin is not understanding what should be included and excluded from their COGS, which can be trickier for the SaaS industry than others.

If your COGS aren’t thoroughly defined and documented, it can throw off your gross profit margin results and cause leadership and investors to make decisions based on bad data. Accidentally including a line item in your COGS that should be in your operational expenses will make it appear as if you have a lower gross profit margin than you truly do. Conversely, if you include something in your operational costs that should be in your COGS, it will push your gross profit margin higher and make it seem as if you are performing better than you truly are.

Understanding where expenses fit within your organization is crucial to getting your COGS correct, so it’s important to make sure everyone on your team knows what qualifies a line item to be included in COGS. For example, if you have a customer service team that only works in aiding existing customers, the expense of that team would fall under COGS. However, if your customer service team also contributes to sales activities, they would fall under sales and marketing, which are operational expenses.

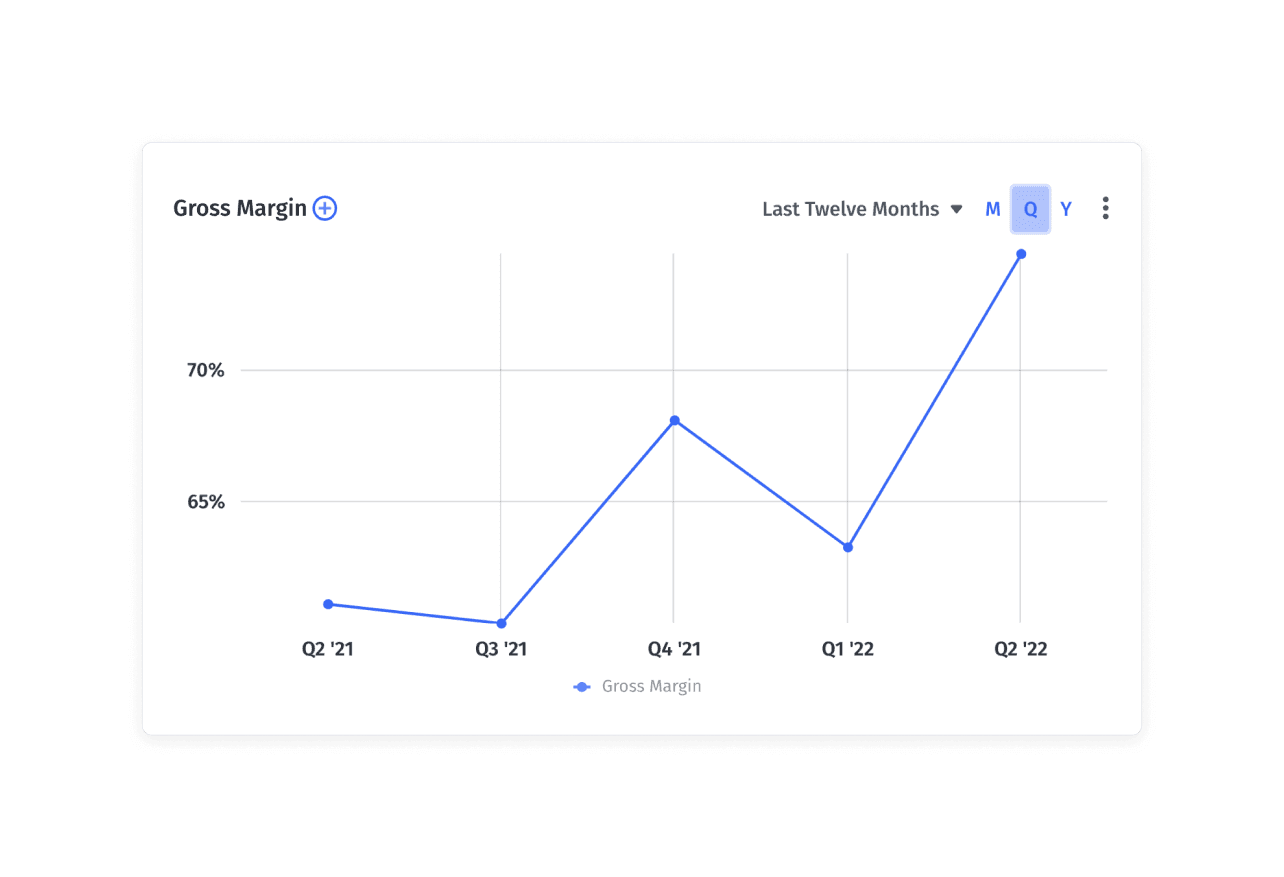

Another difficulty in tracking gross profit margin is the possibility of human error when doing calculations if your process is manual. Using spreadsheets to track such figures makes it easy to make typos, copy-paste errors, or miss cells. Automating your financial analytics processes can help make sure that you avoid such errors and never have to worry about unintentional, and possibly embarrassing, mistakes. Additionally, using an automated strategic finance platform can make it quick and easy to visualize gross profit margins over time.

Use Your Gross Profit Margin Data to Tell Your Company’s Story

A thorough understanding of your company’s gross profit margin allows you to dive deeper into the company’s financial data by providing a direction in which to look when considering what improvements should be made. It also aids you in evaluating what your company is doing well and how you can maximize growth.

With gross profit margin, you can show investors where you’ve come from and how you got there, along with how you can use that information to scale your business. Using compelling stories that are driven by data, you can showcase your strategic value and help others connect with your business.

Learn how Mosaic can help you automate your financial data collection and streamline your analytics processes by requesting a personalized demo.

Build a Compelling Boardroom Narrative with Custom Reporting

SaaS Gross Margin FAQs

How does gross margin differ from net profit margin?

While gross margin focuses on direct costs or the costs of producing a product, net profit margin takes all expenses, including operational and overhead costs, into account.

Why is the gross margin important for business owners?

How do production costs and raw materials affect gross margin?

Do different industries have different gross margin benchmarks?

Explore Related Metrics

Own the of your business.