What Is Customer Attrition in SaaS? Definition & Formula

What Is Customer Attrition?

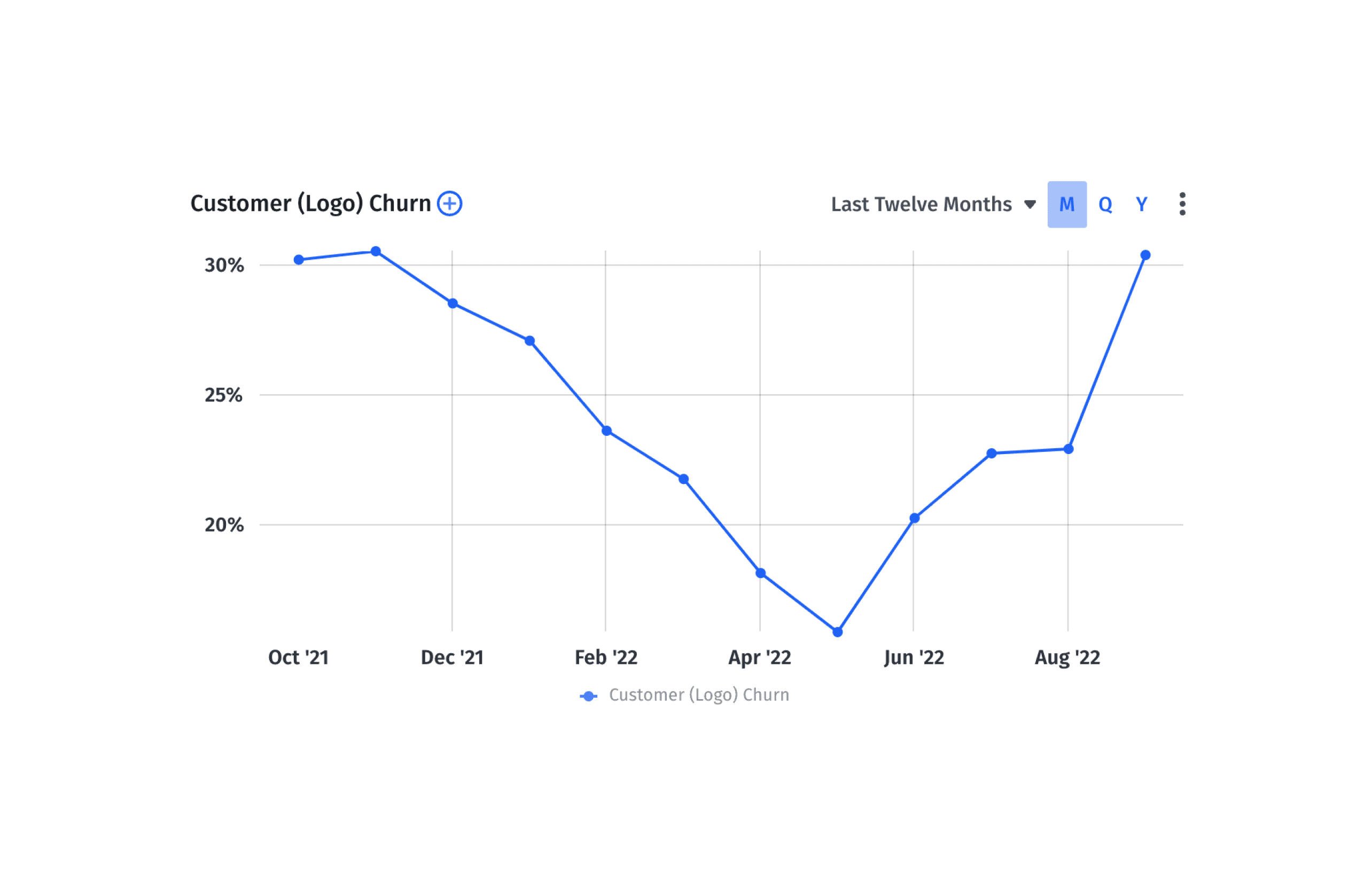

Customer attrition refers to the customers a business loses over a given period of time due either to canceling or failing to renew their subscriptions or contracts. While customer attrition is also known as churn, customer turnover, or defection, it’s primarily also referred to as “logo churn” in the SaaS industry.

Categories

Table of Contents

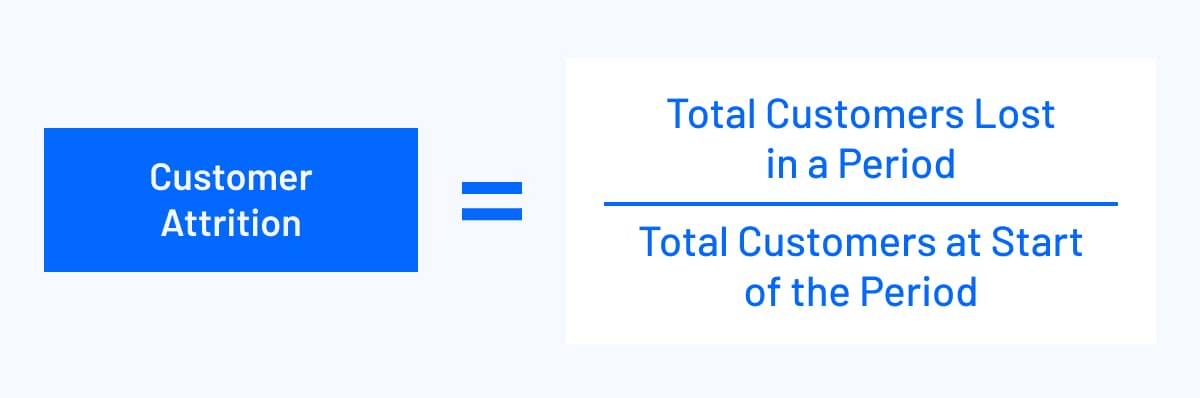

Customer Attrition Rate Formula

Customer attrition rate measures customer loss as a percentage of the total customer base. It’s calculated by taking the number of lost customers in a specific time period and dividing it by the total number of customers at the beginning of the period.

Say you want to calculate your customer attrition rate for a month. If you started the month with a total of 35,000 customers and lost 1,500 customers, your customer attrition rate would be:

Customer Attrition Rate = 1,500 / 35,000 = .043 or 4.3%

Active vs. Passive Churn

There are several reasons a customer may fail to renew their contract or subscription. But each reason falls into two categories: active and passive.

Active churn happens when subscribers cancel their plan. Passive churn refers to a failure to renew a subscription without a customer action, like when there’s a payment processing error. Both types are included in the customer attrition rate formula.

While tracking churn, you can use closed lost analysis to figure out the root causes of customer loss and whether they’re more active or passive. Maybe you need to evaluate how your SaaS pricing strategy impacts annual contract value. Or, maybe you need to come up with new levers to increase net revenue retention with price jumps at renewal instead of having static pricing.

The Importance of Customer Attrition in SaaS

Customer attrition is the quiet killer of any SaaS company, which is why keeping a close eye on the metric is so important. But it’s also important to remember that churn is a lagging indicator in your business. Simply reacting to backward-looking reports on customer attrition isn’t enough to make strategic changes in your business.

Companies that are proactive with their attrition tracking and are able to put the metric in the right context can unlock strategic insights that improve renewal rates, drive greater and more efficient growth, and achieve negative churn. A few areas where this metric is particularly important include:

- Revenue forecasting. Attrition is a crucial financial assumption for revenue forecasting. Even small tweaks can have a major impact on your ability to hit growth targets. You can’t realistically expect 100% logo retention, so you need a strong understanding of historical churn rates to effectively set your assumption.

- Pricing strategy review. Monitoring attrition rates can help you understand how well your pricing matches the value you provide to existing customers. Splitting attrition into segments of customer sizes can show you where to adjust pricing or increase acquisition efforts.

- Customer success collaboration. You want your CS team to own customer retention metrics. But that doesn’t mean you can’t add another perspective on attrition. Your ability to drill down into the numbers and add context about performance using other SaaS metrics can help improve strategic decision-making in customer success. Together, you can identify issues with poor onboarding experiences, low customer satisfaction, lack of customer loyalty, product/market fit, and more.

Like any other SaaS metric, customer attrition rate is only as valuable as the context you have around it. It’s a critical metric for your business, but you unlock its true value by analyzing it alongside revenue growth, net revenue retention, and broader operational efficiency metrics.

What Is a Good Customer Attrition Rate?

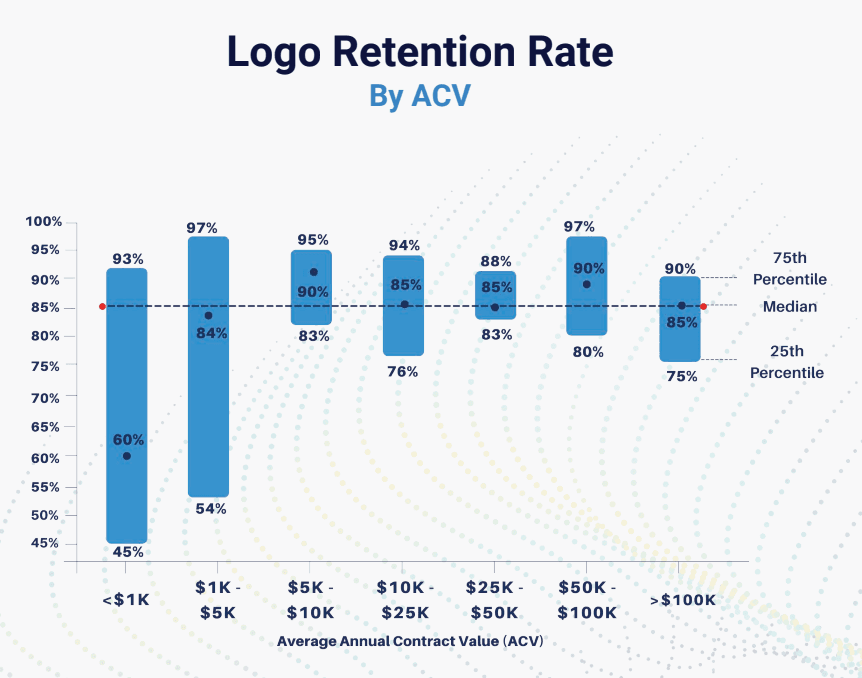

The bottom line is, for SaaS companies, about a 5-7% annual churn rate (not monthly) is a good benchmark. But if you want a more specific benchmark for logo retention/attrition, you should look at companies with similar ACVs as your business. The 2022 B2B SaaS Benchmarks report from RevOps Squared highlights ACV as the biggest factor in attrition rates, coming up with the following breakdown.

While these SaaS benchmarks are a good frame of reference, it’s better to plan around your own historical data for customer retention rates. Ultimately, “good” customer attrition rate is relative to your business model and strategies.

How to Reduce Your Customer Attrition Rate

Every business loses customers — it’s inevitable. However, here are a few best practices to keep in mind while you support your CS team and other partners in minimizing customer attrition.

1. Optimize Customer Onboarding

Many customers churn because they don’t get value out of the platform fast enough. But where exactly are they falling out of the onboarding process and starting to churn?

Your understanding of the company’s historical data gives you the necessary perspective to spot trends in attrition rates. If you have a two-month onboarding period, is there a particular week in the process where you see more churn than others?

These are the kinds of insights you can bring to the customer success and sales teams to help shore up any issues in the onboarding process. You won’t necessarily have insight into how the onboarding program should evolve, but your strategic partnership in analyzing the data can make churn prevention a more proactive effort.

2. Make Customer Communications More Proactive

Proactive and frequent customer communications is crucial to retention. And while you can lean on your CS team to manage that process, there are opportunities for finance to partner with them to empower proactive communications that strengthen customer relationships.

Take the situation of the 2022 market downturn as an example. Companies of all sizes and segments have had to rethink their budgets — and your software could be on their list of things to cut. This has put pressure on CS teams to step up retention efforts, but they don’t have to do it alone. You can work with CS to implement new flexible pricing, billing, and collections policies to put active customers at ease. And you can help CS get out ahead of those conversations instead of reacting to them as customers come to the table.

This is just one example of a finance/CS partnership that improves customer communications. But broadly speaking, the more proactive you are about collaborating with customer success, the more proactive they can be about communicating with current customers.

3. Monitor and Analyze Customer Attrition Continuously

If you want to change any metric, you have to track it. The same is true for attrition. Tracking it lets you understand your baseline and monitor your progress toward goals.

Churn and customer retention analysis data can help product, marketing, and customer success teams identify gaps and opportunities to improve throughout the customer experience and lifecycle. You can make informed decisions to improve the product, tighten up messaging, and reduce customer loss.

Get Deeper Insight into Retention & Attrition Metrics

Track Your Customer Attrition Rate with Mosaic

Customer churn is far from the only retention metric that matters in your business. You also need a handle on several other KPIs, including net revenue retention, gross dollar retention, lifetime value, and more.

Mosaic makes it easy to keep track of these essential metrics in real time. As a Strategic Finance Platform, Mosaic provides valuable insight into customer growth, including comparisons between customer acquisition, churn, and customer retention metrics all in one platform.

Mosaic comes prebuilt with dashboards, templates, and 125+ out-of-the-box metrics that you can use immediately or refine to create your own custom dashboard. Mosaic includes customer attrition metrics alongside customer retention metrics in the retention dashboard so you can easily see this data in one place and move faster toward the strategic insights that will improve attrition and retention.

To learn more about effortless customer data tracking and analysis, request a personalized demo today.

Customer Attrition FAQs

What is customer attrition vs. churn?

Customer attrition and churn are synonymous as they both account for lost accounts (either through active or passive attrition).

What causes customer attrition?

What is active vs. passive customer attrition?

Explore Related Metrics

Own the of your business.