Net Burn

What Is Burn Rate?

Your cash burn rate is the rate at which your company, especially a startup, uses up money. It’s most commonly measured as a monthly rate, and there are two types of burn rates: gross burn, which is your total monthly cash outflow, and net burn, which is your total monthly cash loss.

Categories

For venture capital-backed companies, cash runway is the lifeblood of the business as you push for hypergrowth. Tracking operational financial metrics and cash inflows and outflows on a month-to-month basis is the only way to understand the health of your business.

Gross burn and net burn are at the heart of your runway calculations and are essential concepts for startups to fund their strategies and push for stronger SaaS valuation in later funding rounds.

Knowing your burn rate helps you understand your business’s cost drivers and decide where to spend your money and which revenue streams to prioritize.

Table of Contents

Gross Burn vs. Net Burn

Gross burn rate measures your total monthly cash outflow, whereas net burn rate measures your total monthly cash loss. In other words, gross burn only includes expenses, but net burn also considers your income.

Tracking your company’s gross burn gives you insight into your cost drivers and the total amount of money you need to keep your business running without considering your revenue streams.

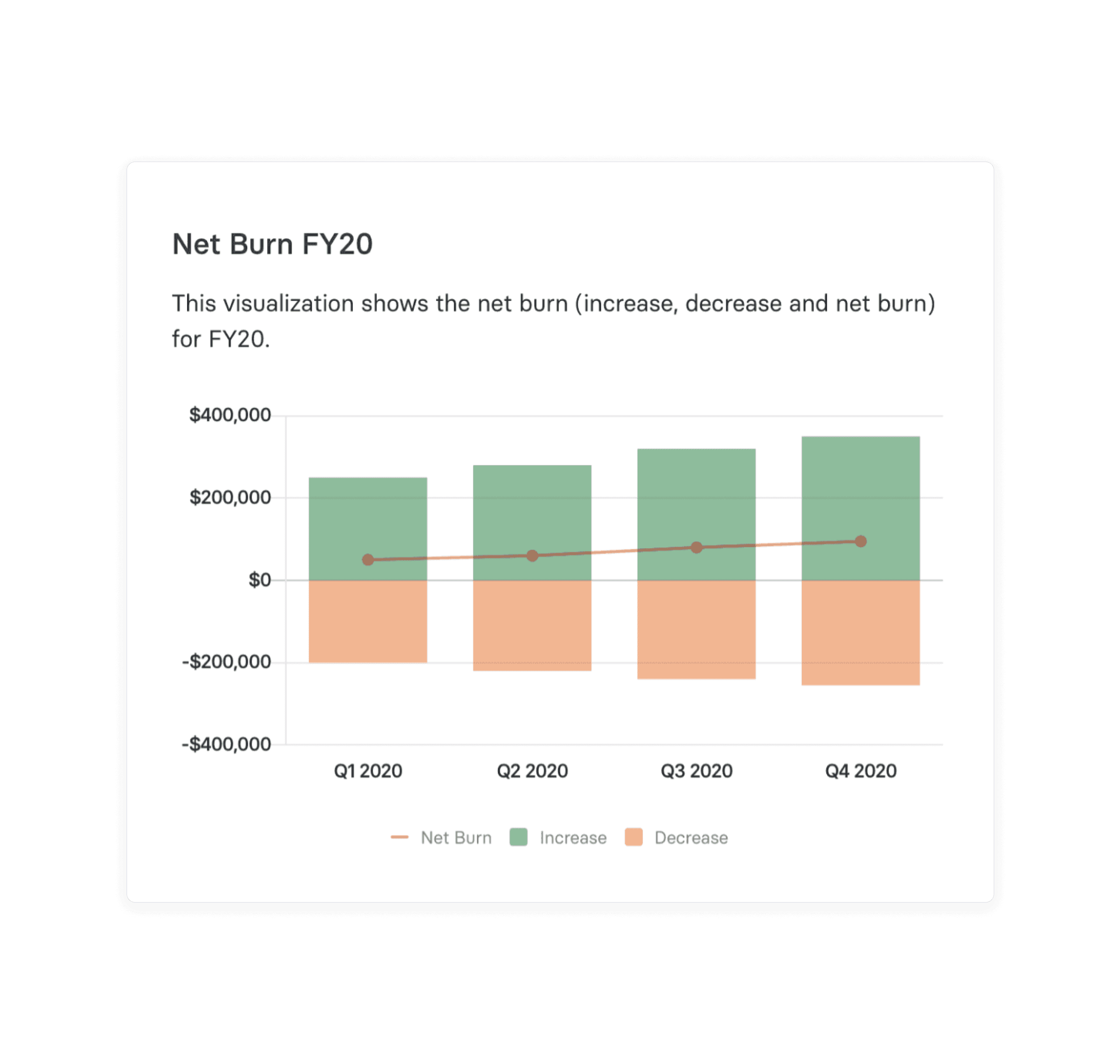

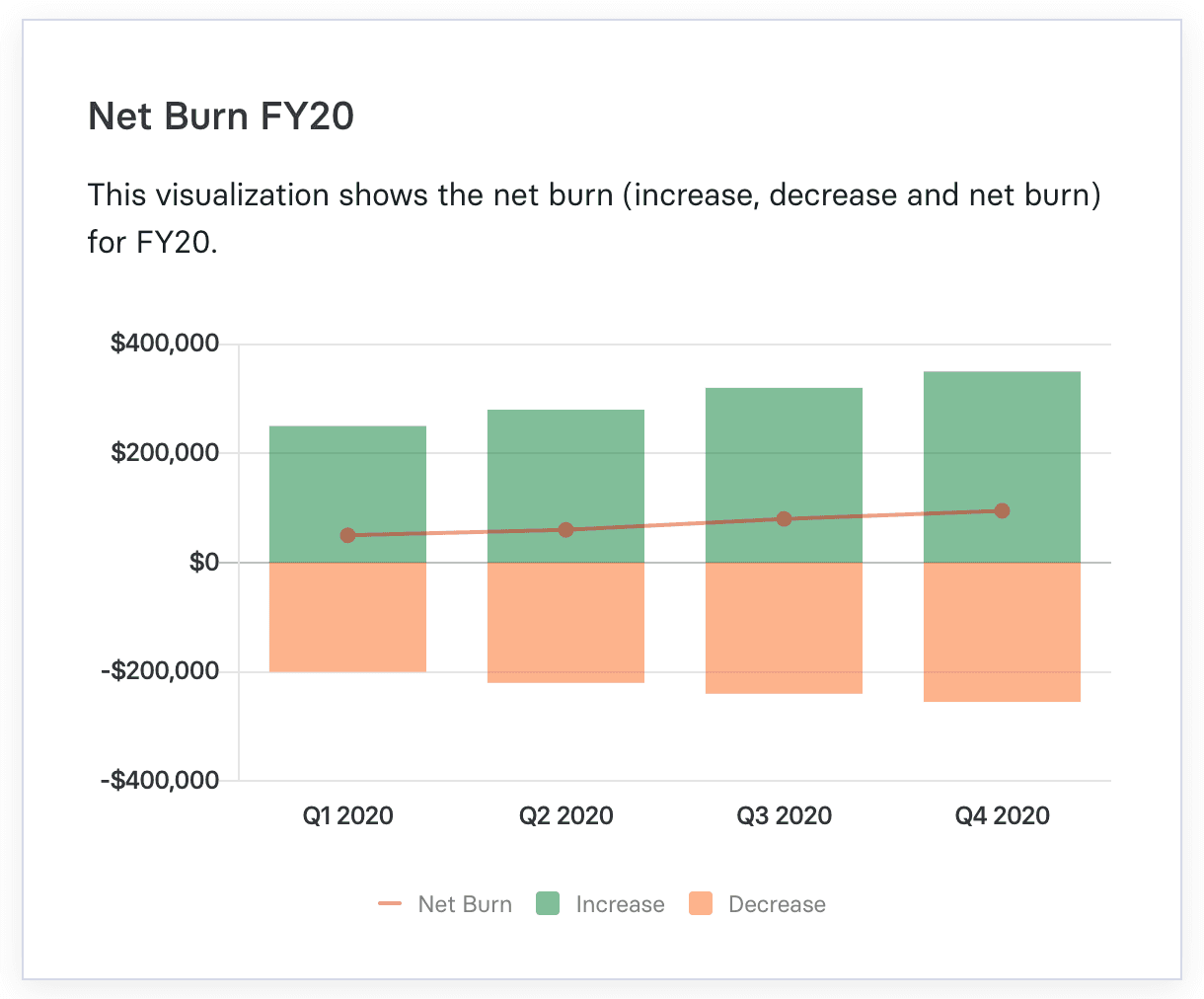

Net burn, on the other hand, measures your monthly net spend or negative cash flow. Since it takes income into account, it tends to vary more than gross burn.

Below we dive into each of these in more detail.

What is Gross Burn?

Gross burn is a financial metric commonly used by startups and venture-backed companies that represents the total operating expenses a company incurs each month. This can include all expenses such as salaries, rent, utilities, software subscriptions, marketing costs, and any other costs necessary to keep the business running. It’s a crucial indicator of a company’s spending habits and financial health, often used to understand the sustainability of current operations and guide strategic decision-making.

How to Calculate Gross Burn

Calculating gross burn involves a straightforward process. It simply includes tallying up all the operating costs incurred in a month. Let’s look at the formula:

Gross Burn Rate = Total Monthly Operating Costs

The result is the gross burn rate, representing the total capital outflow of a company, excluding any revenue it might generate.

What is Net Burn?

While gross burn provides an understanding of a company’s monthly expenditures, net burn offers a more comprehensive view of a company’s financial health by considering its revenue. Net burn is the total amount of money lost each month after accounting for its revenue. This metric helps entrepreneurs, founders, and investors gauge the speed at which a company is spending its capital reserves and the sustainability of its business model.

How to Calculate Net Burn

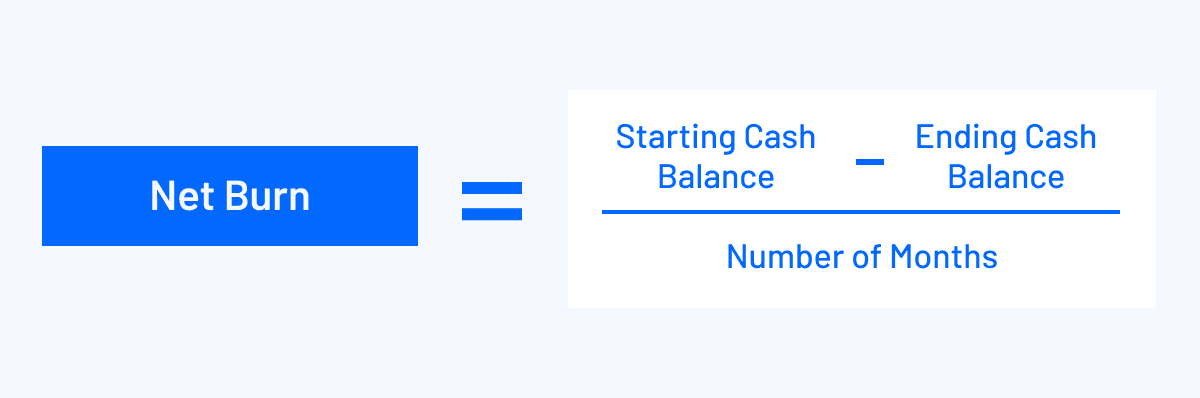

You can calculate net burn by looking at financial statements that indicate your cash flow from operations (cash in less cash out) over a given amount of time, excluding bank transfers and financing transactions. You can calculate it with monthly revenue using the following formula.

For example, if you’ve $10,000 in monthly expenses and bring in $4,000 of monthly revenue, your net burn amount is $6,000. Burn is a measurement of loss, so a net burn of $6,000 means you lose that much each month. That $6,000 would come out of your cash runway, giving you an idea of how much longer you can operate without another round of funding.

You can also use your starting and ending cash balances for a burn rate calculation instead of total expenses and revenue:

Cash Burn Rate Calculator

Your Burn Rate

$0 burned per month

How Startups Use Net Burn

Understanding and effectively managing net burn rate is a critical skill for any startup. This key financial metric is used in various ways, from planning to communicating with potential investors. In this section, we’ll delve into how startups can leverage their net burn rate to maximize their financial efficiency and plan for future growth.

Analyzing Operational Efficiency

Finance leaders and founders use net burn to understand their operational efficiency.

In the early days of a startup, you might be in “growth at all costs” mode, pushing to capture as much market share as possible while maneuvering from one funding round to the next for infusions of cash.

But the venture funding market isn’t always on fire. When there’s a market downturn, the focus tends to shift from growth at all costs to growth with operational efficiency. And this is when net burn takes on even more importance than normal.

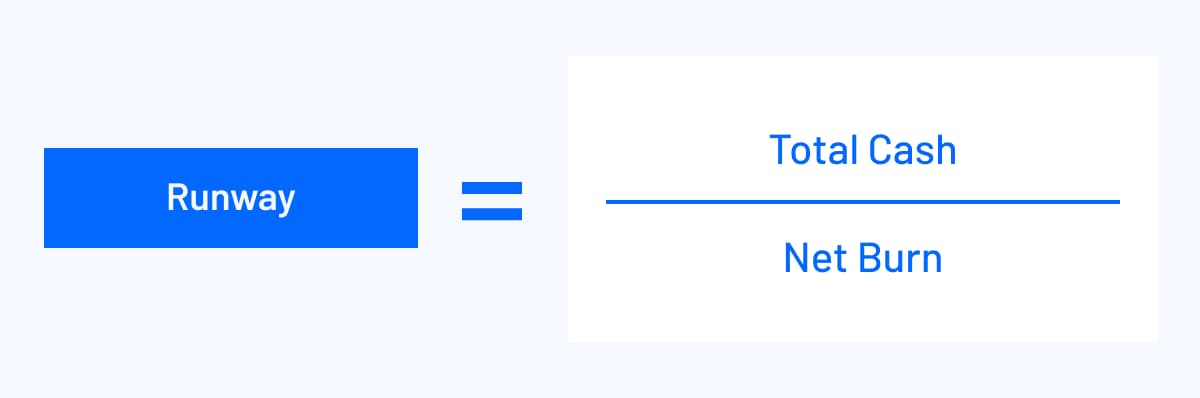

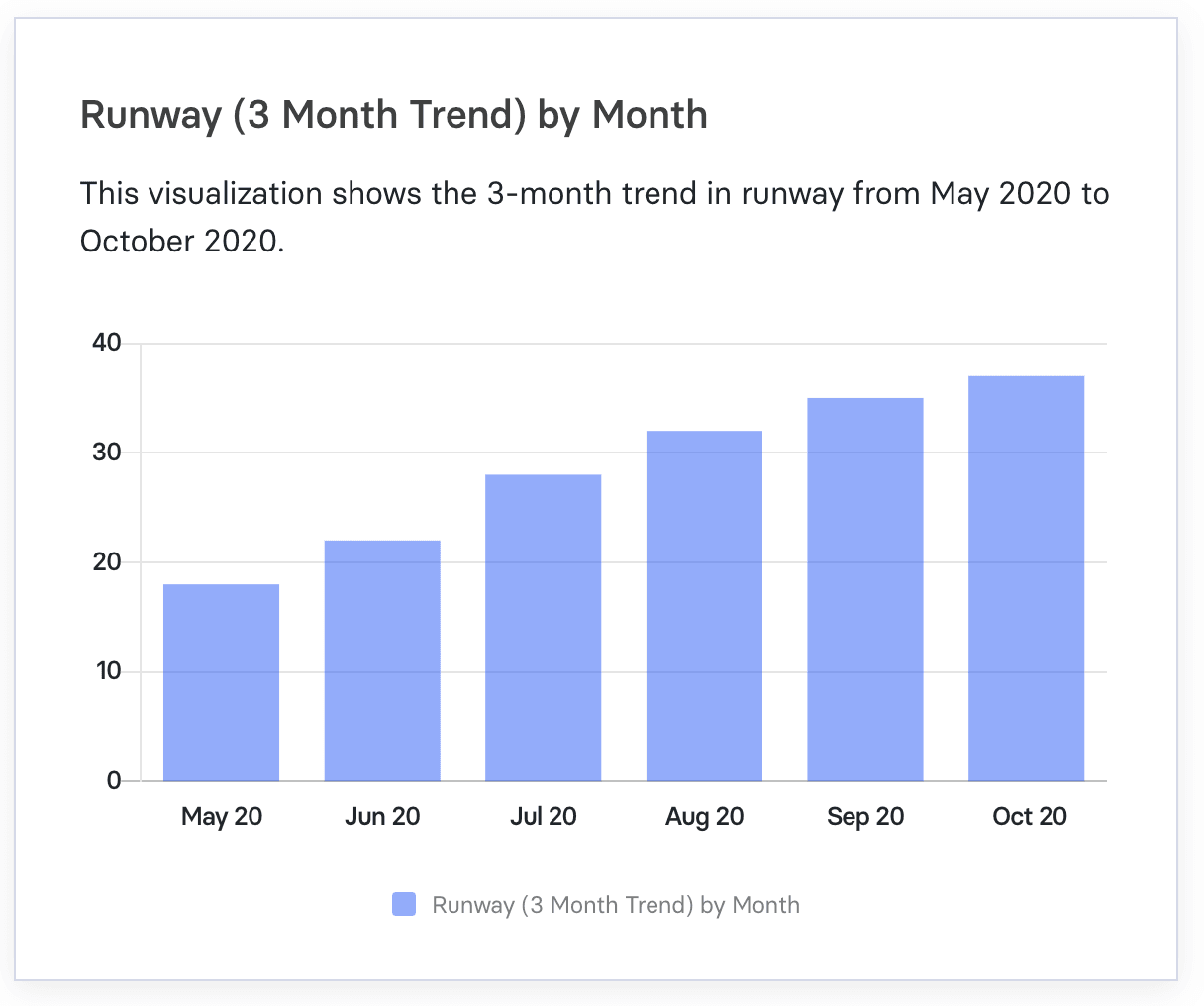

Calculating Runway

One of the most common ways startups use net burn is to calculate their cash runway. The term runway refers to the number of months you can keep your business going before running out of cash reserves.

Runway is calculated using the following formula:

Suppose you have a total amount of cash of $1,000,000 on hand with a net burn amount of $60,000 per month. Your runway would be $1,000,000/$60,000 or 16.7 months.

Runway helps founders and finance leaders decide when to start a new fundraising round or set goals for when the business needs to begin turning a profit.

Benchmarking Efficiency

Experts recommended most early-stage startups have a 12-18 month runway to achieve set goals and secure new funding.

But a study by Florida International University found that the average time between funding rounds fell between 18 and 22 months. So, to be on the safe side, you may want to set your runway goals at 18 months or higher.

Once you know how long you want your runway to be, you can calculate your net burn benchmark. If you want 18 months of runway, your net burn should be equal to 1/18th of your total cash available.

Advantages and Disadvantages of Net Burn

Net burn is an important metric among startup founders and investors because it’s a simple calculation that provides valuable information about how long a company can keep operating without new investments.

You can include net burn in your board deck or other investor communications to demonstrate your progress toward profitability. As a metric, it also tells you how much additional monthly revenue you need to break even.

While net burn is an essential metric to track, it does have limitations. For instance, it doesn’t provide a comprehensive look at your cash flows. To make strategic decisions, you need more information, such as your cost and revenue drivers.

As with any metric, net burn is only as strong as your ability to explain the “why” behind it and identify strategic ways to improve it as needed.

4 Ways Startups Can Manage Net Burn Rate

Most startups take at least 3-4 years to become profitable, so having a negative cash flow in the beginning is expected. But that doesn’t mean you can maintain a high burn rate and blindly spend your investment capital.

Here are five actionable steps you can take to stay on top of your monthly burn rate and keep it under control to make it to that next round of funding.

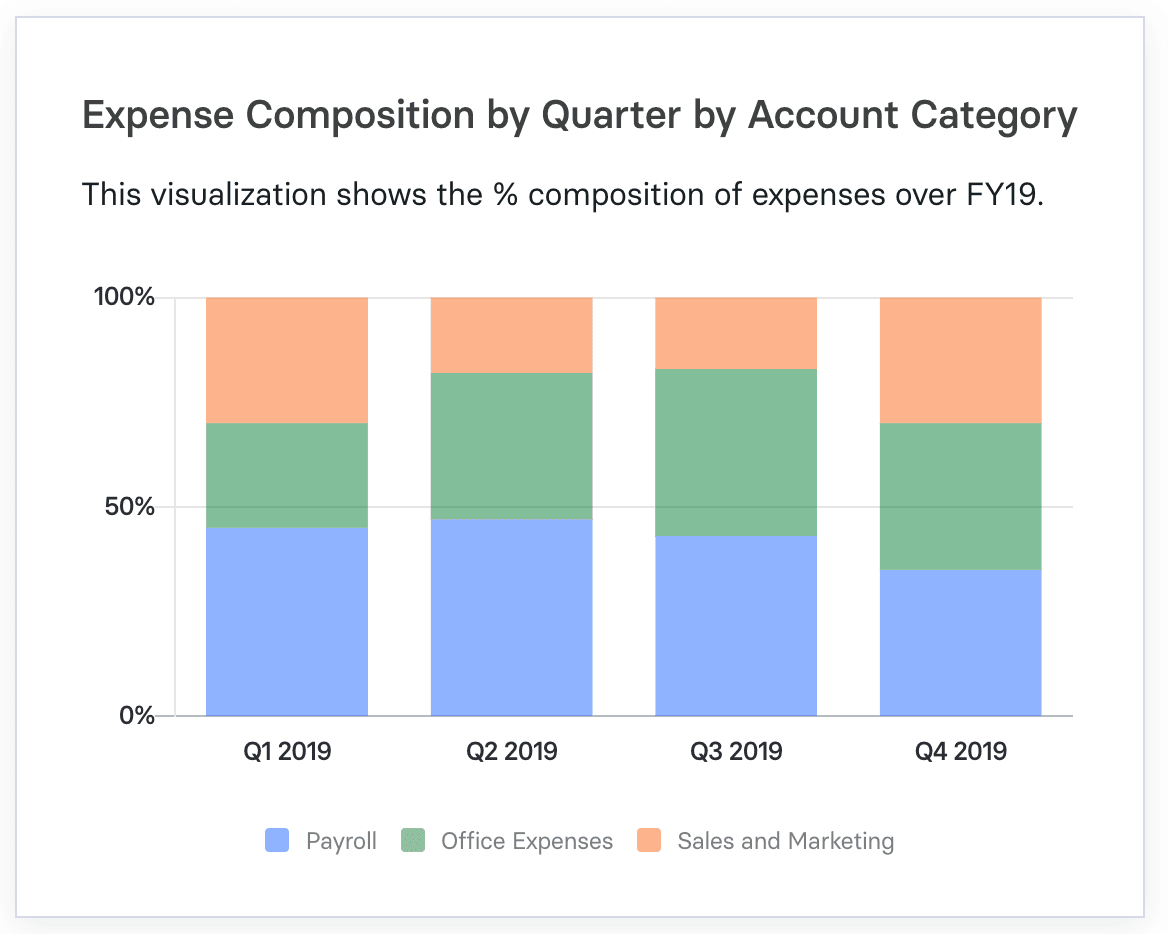

1. Track Costs by Category

Measuring the amount of money leaving your business each month is a good start, but you should also dive deeper and look at the sources of your expenses.

Break down your costs into categories to know which areas drive the most costs each month. Knowing where your money goes can help you look for opportunities to operate more efficiently and reduce costs.

2. Prioritize Your Growth Objectives

Success in startups often requires ruthless prioritization. When you have limited capital, you can’t do everything all at once. Instead, you must learn to focus your resources and figure out which milestones matter the most to your customers and potential investors.

By prioritizing your goals, you can stay lean and limit your expenses to those expenses that are absolutely necessary to get to the next round of funding.

3. Lower Your Fixed Expenses

You don’t want to get bogged down by too many fixed expenses before your business is profitable. Keep most of your costs variable by renting office space instead of buying commercial property and hiring independent contractors instead of full-time employees for certain roles.

Doing so gives you more control over your net burn and cash flow.

4. Don’t Neglect Existing Customers

Bringing on new customer segments is important for future growth, but your existing customers keep you afloat in the meantime. Not to mention, it’s more cost-effective to sell to an existing customer than to bring on a new one.

Track metrics such as retention rate, churn rate, and monthly recurring revenue to ensure you keep your monthly revenue stable or growing.

Track Your Net Burn Rate in Real-Time With Mosaic

Staying on top of your financial metrics can mean the difference between closing that next funding round and shutting down your operations.

Explore Mosaic by requesting a demo today and discover the all-in-one finance platform that will keep you on top of your company’s performance and make it easy to draft financial plans for your investors.

Net Burn FAQs

How can a startup effectively manage its Net Burn rate?

Startups can manage their Net Burn rate by tracking costs by category, prioritizing growth objectives, lowering fixed expenses, and focusing on customer retention to maintain or increase monthly revenue.

Does a high Net Burn rate always indicate a problem?

Is there a "good" or "bad" Net Burn rate?

Explore Related Metrics

Own the of your business.