Startups live and die by their ability to turn their financial projections into reality. That might sound a little dramatic, but new companies, by definition, have less historical financial data that can be used to value the company or forecast its future results.

If Bank of America or Apple provide a forecast for the coming year, there’s a much narrower range of outcomes for them to work with. Even without a detailed forecast, an established business like that is going to have a relatively stable set of results year to year.

Not so much with startups. Financial projections are more difficult to get right, and at the same time, they’re also much more important to the longevity of the business. It’s those forecasts and the progress towards making them a reality that attract potential investors.

If you’re a SaaS startup, it’s vital to ensure your financial projections are realistic, achievable, and based on accurate data. In this article, we run through a comprehensive guide on how to build financial projections and why they’re so important to a startup.

Table of Contents

What Is a Financial Projection?

A financial projection is an estimate of a company’s future financials based on assumptions of performance, such as total revenue, expenses, and cash flows.

Most commonly, financial projections are created for the coming year. But they can also be projected quarterly for businesses that are scaling rapidly (like SaaS startups) or with a longer-term view of 3, 5, or even 10-year time scales. Obviously, the further out financial projections are made, the less accurate they’re likely to be.

Why Startups Need Financial Projections

There’s uncertainty in the startup world. When a company is new, there are a lot of unknowns, from the actual product roadmap itself, to the most effective marketing strategies, or the success of expanding to new geographic regions.

The more accurate these financial projections are, the more useful they can be in driving growth of the company (see our guide on planning vs forecasting for more insight on how to accomplish this). These financial projections provide much needed context for decision makers when setting corporate objectives and budgets, as well as expectations for investors, lenders, and other stakeholders.

Additionally, scenario planning, or creating multiple projections with different assumptions, can be hugely beneficial in this planning process. Scenario planning allows you to see various potential outcomes, giving you an expected range of results or an idea of how different strategies might impact the business. The more of these scenarios you model, the better your understanding will be of the best case and worst case scenarios for the company.

If you’re a SaaS startup and you don’t have a solid set of financial projections, you probably won’t have a business for long. It’s a necessary part of running a startup, and if done correctly, it can help you scale the business faster and more efficiently.

What Is Included in a Startup’s Financial Projections

Financial projections for a SaaS startup begin with people, which is the largest of a SaaS company’s expenses by far. Before we can start projecting the financials, we need to gain an understanding of the headcount roster.

Finance executives need to have a clear understanding of the headcount plan from every department leader to ensure they’re accurately projecting these costs and the expected revenue each employee will contribute.

In short, start with headcount planning.

From there, the focus can shift to the financial performance that is expected to flow from the team. The typical place to start is with the three financial statements from the prior period — the balance sheet, the income statement (or profit and loss statement), and the cash flow statement.

From here, you can pull together your current figures and start considering how to forecast them into the future. Here are some of the fundamental numbers that should be included in your startup’s financial projections:

Sales & Revenue

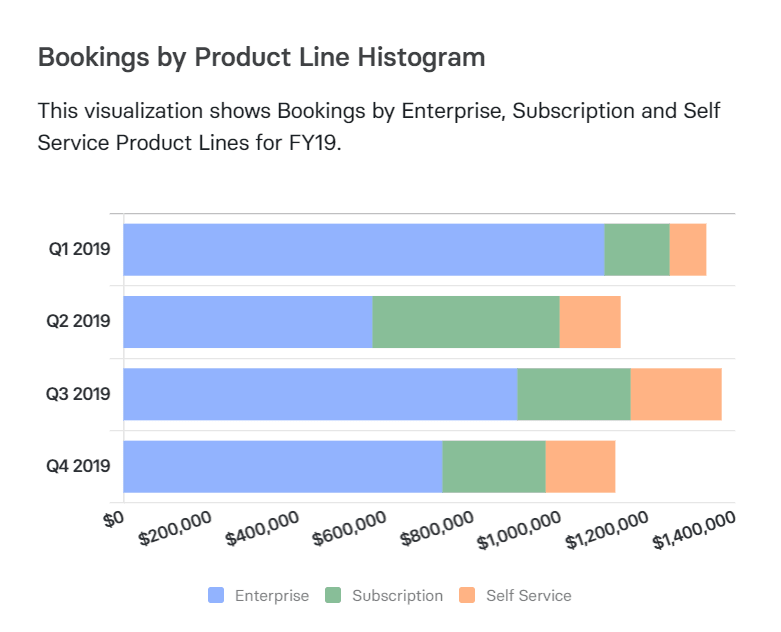

Of all the aspects of a company that needs to be projected, sales, or bookings, is probably the most obvious. Simply put, this will allow you to calculate the amount of revenue that you think the company is going to be able to generate over the coming period.

For a sales-led company, a sales capacity model can help plan your top-line by using sales rep performance to forecast future bookings. If a top-down approach is better suited to your company, the ARR snowball model uses historical trend data to project future growth.

Costs of Goods Sold (COGS)

While sales are important, you also need to ensure that the sales you’re making are profitable. The first component of that is forecasting your COGS, or for SaaS business, cost of revenue, which are the costs incurred directly in bringing your product to market.

For SaaS companies, this generally includes things like hosting costs, payment processing fees, and some engineering expenses related to keeping your product running for customers. Essentially, anything that is required to keep the service live and operational.

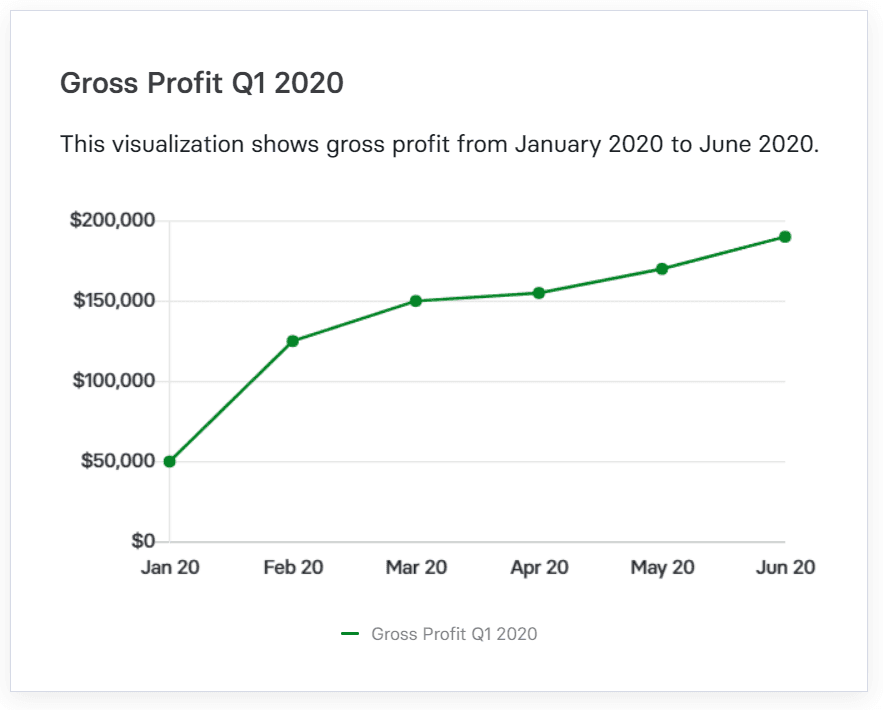

Gross Profit

You can subtract COGS from your sales figures to calculate a gross profit estimate. When creating financial forecasts, it’s useful to include the gross profit figure as a separate line item, as it makes it easy to compare the forecast financial performance to the current and historical data. Generally speaking for SaaS businesses a gross margin of 70% is where you should aim to be.

Operating Expenses

COGS aren’t the only costs incurred by a business, and we need to project other expenses to get an accurate forecast of the overall profitability of a company. Operating expenses are costs like marketing campaigns, HR or management spend, travel expenses, professional memberships, rent, utilities, and employee benefits such as health insurance. If you nailed your headcount forecast earlier, salaries for employees should flow into your payroll, benefits and payroll tax line items.

Another great tip is to carve out the top 10 vendors and forecast this spend with a fine tooth comb. The video below shows how Mosaic helps with vendor level forecasting.

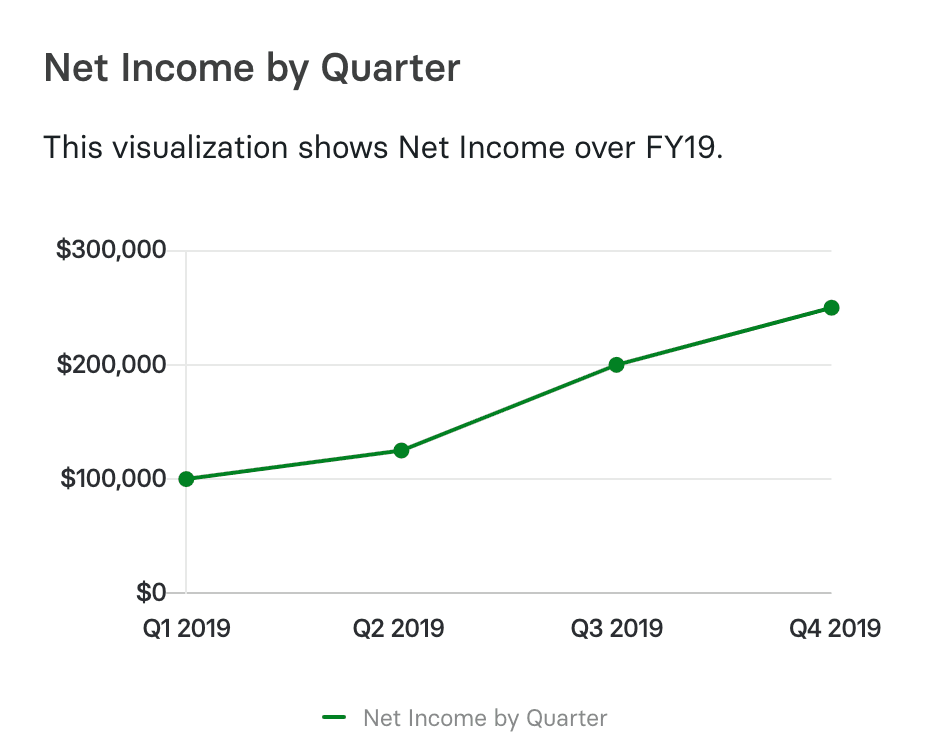

Net Income (Loss)

Now, you can subtract the operating expenses figure from the gross profit to get to your net profit forecast. This is the bottom line profitability of a company. While the overall goal of most companies is to maximize net profit, a SaaS startup may have that as a long-term objective only. In the short term, net profit might actually be a negative, as it could be a sign that not enough reinvestment of earnings is taking place.

Every business will create their financial projections slightly differently. Certain executives place more emphasis on specific areas that they want to watch closely, and some financials are more important in different sectors or for certain business models.

That’s where there is huge value in using the right cash flow forecasting software tools. Platforms like Mosaic allow you to access detailed forecasts of just about any financial metric you can imagine, without the need to build a specific model for each one.

How To Create a Financial Projection For a Startup

Now let’s take a look at the step-by-step process of creating a financial projection for a startup. Firstly, you can take what’s known as a top-down or a bottom-up approach to projections.

For most companies, bottom-up makes the most sense. In a bottoms-up approach to budgeting, you build your forecasts from ‘the bottom up’ using your own financial data. But that doesn’t mean ignoring the macroeconomic environment or market segment trends.

Headcount Planning

Regardless of which approach you take, headcount planning has to be the starting point. Salaries, benefits, payroll taxes and other forms of compensation can all add up to a significant amount of money, often 75-80% of a SaaS business’ total costs.

Before you start to forecast your financials, you need to create a robust headcount plan. It’s only once you have a clear outline of how your team is going to grow, that you’ll be able to accurately forecast all of the costs and revenue associated with them.

A bottom-up headcount forecast at a departmental level will provide a solid starting point for the rest of your financial projections.

Forecast Expenses

It makes sense to start with expenses when creating a financial projection, once you have a clear view on headcount. You generally have more control over them and because of that, they’re easier to project accurately.

Expense forecasting can be done at a high level using some of your operational metrics (which can also be built and viewed in minutes using Mosaic), or you can project out individual line items, or break down expenses by departments or by vendor. You want to leverage your internal departments here to gain as much insight as possible for more accurate figures.

As with all of the components of your projections, the more granular you get, the more accurate the results are likely to be. It’s best to use software with real-time data because the process can become too unwieldy or time-consuming to be practical if you’re working off manual spreadsheets.

Historical costs can be the best place to start if you have them, but these should be adjusted based on the strategic plan and objectives for the coming year. Engineering costs may have averaged $500,000 over the past three years, but what does the coming year hold? Has the team grown?

A key point to consider in your spend forecasting is which of your expenses are fixed operating expenses and are unlikely to change based on sales (like office rent or employee healthcare) and which expenses are variable costs and could change substantially (like sales team commissions).

Quick tip: figure out a per head cost for things like software spend, travel, and equipment such as laptops and monitors to nail these line items and have them grow proportionally as more people join the business.

Build a Sales Forecast

The next step in building a financial projection is to forecast your sales or bookings. Accurate revenue forecasting requires a clear understanding of how a company will generate sales. Will it be sales-led? A sales capacity model (in conjunction with the headcount plan) will help you to estimate the performance of your sales team and the revenue they expect to generate.

A sales forecast is not just about the headline figure. You also need to understand the typical length of the sales cycle, the expected win rate of your sales team, and the average annual contract value.

For a company that is more product-led, you’ll need to understand the expected amount of traffic that your marketing team can generate to your website and what conversion rates will be reasonable.

This process becomes easier with more historical data, but even new companies can rely on the expertise of their sales and marketing teams to help provide context on what is achievable.

To help you with building this as accurately as possible, you’ll want to get together your SaaS metrics, such as:

- Sales team performance

- Average revenue per user (ARPU)

- Sales rep ramp

- Quota attainment

- Closing rates

As mentioned in the previous section, don’t forget to consider how the macroeconomic environment might impact those numbers.

When doing this manually, there is a significant amount of work and time that goes into building a forecast that is realistic. FP&A modeling using a tool like Mosaic makes this process substantially faster and more accurate and allows for multiple scenarios to be built and reviewed.

Forecast Cash Flow Statement, Income Statement, and Balance Sheet

With your sales and expenses forecasts completed, you can use these figures to generate projected cash flow statements, income statements, and balance sheets. These simply require taking actual figures from the last financial period and forecasting them forward based on the numbers in your projections.

Here, it’s important to ensure that you include financial details not directly related to your product, such as debt expenses, depreciation, or income from bank account interest.

This type of financial reporting can be a complex area, but we have a range of different resources to help you with cash flow projections and balance sheet forecasting.

What Most Startup Founders Get Wrong About Financial Projections

Creating a financial projection isn’t a hard science. There are many different ways to look at the numbers, which can lead to common mistakes. Here are a few of the key things startup founders often get wrong when it comes to their financial projections:

Overly Optimistic

At a startup, it pays to be an eternal optimist. Sure, there are a lot of things that can go wrong, but you believe in your company, and you want to focus on best case scenarios. That’s great, but with financial projections you also need to keep things grounded in reality.

Projections can, and should be, ambitious. But it’s important to make sure they’re also realistic.

Rely on Past Performance

Financial projections will obviously take into account the historical performance of the company, the market, and the economy as a whole. But a common mistake is to focus only on these past numbers without looking carefully at how these might change in the coming period and properly accounting for new business strategy and bets the company is making.

Accurate financial projections shouldn’t just ask ‘How can we maximize our performance in the current market?’ but also ‘How might the market change and how will that impact our performance?’

The best way to avoid this pitfall is to have conversations with your department heads to ensure their plans for the year are accurately captured in your financial forecasts.

Underestimate Costs

The flip side of overestimating sales is underestimating expenses. This is particularly true with engineering when developing a new product, as the timeline and work involved can often be unclear at the outset.

This is why, when creating financial projections, there should be ample allowance for unexpected delays, costs, or product fixes.

Automate Financial Projections And Gain More Insight Than Ever With Mosaic

All of this is great, but as you’ve probably realized, it’s a huge amount of work. Sure, anyone can slap a 5% growth percentage on every line item and be done with it, but that’s not going to lead to accurate forecasts that help inform business strategy and keep stakeholders happy.

To do forecasts right, you need access to detailed financial data, and the best way to do that is through the use of financial data analytics software. Mosaic brings all of your financial data together in one place, allowing you to access any metric imaginable at the click of a button.

Not only can you access that real-time data instantly, but you can also use it to create forecasts and projections for multiple scenarios without any need to create manual financial models. Mosaic gives everyone in your finance and FP&A team the capabilities of a highly experienced financial analyst and allows you to scale the finance team efficiently as the company grows.

When you use software like Mosaic in your forecasting process, the numbers can easily be changed as needed. Realized after Q1 that your sales funnel conversion rate is much higher than you expected? A couple of clicks, and your forecasts are updated.

Mosaic allows your finance and FP&A team to spend less time on the ‘what’ of your company financials, and more time on the ‘why,’ adding strategic value and becoming a more integral part of the direction of the company.

See Mosaic in action. Request a demo today.

Own the of your business.