Your cash flow is like the sand in an hourglass — once it runs out, your business is done. That’s why cash flow analysis and budget analysis have to be more than just tedious, backward-looking processes..

The best finance teams can make cash flow analyses strategic assets to the business. And the sooner you implement the tools and processes to help you proactively improve cash flow management, the longer you’ll be able to make the sand in that hourglass last.

Cash flow metrics need to be readily available at a moment’s notice, with an automated view and real-time updates. Here’s how you can get there with Mosaic.

Table of Contents

What Is Cash Flow Analysis?

Cash flow analysis is the evaluation of financial statements, focusing on cash inflows and outflows within a given period of time to determine a company’s financial health. Your cash flow analysis shows how the company generates cash, repays debts, and funds operating expenses.

The 3 Parts of the Cash Flow Statement

The process begins with finance creating the cash flow statement, which organizes cash expenses and inflows into three categories:

- Cash flow from financing activities: This category focuses on cash movement that supports the company. Line items for these financing activities include issuance and amortization of debt and equity, payment of dividends, and any raised capital from funding rounds or lease payments.

- Cash flow from investing activities: This category focuses on investing activities, such as capital expenditures (for SaaS companies, this could be computers and office upgrades), corporate investments in stocks, bonds, etc., and research and development.

- Cash flow from operating activities: This category breaks net income down into operating activities. Line items would be changes in any net cash flow from operations, including liabilities and operating assets (like accounts payable and accounts receivable), depreciation of property and equipment, and any income taxes or tax provisions.

Technically speaking, there are two ways you could analyze your cash flow after categorizing your activities. But the direct method is mainly for less mature small businesses that use simpler cash-basis accounting.

You’ll more than likely use what’s called the indirect method, where you start with net income and add/subtract period-over-period changes in your assets and liabilities. This income statement-based approach is especially important for SaaS companies because accrual accounting allows you to record revenue before collecting it, giving you more flexibility in the key performance indicators you use for cash flow analysis.

Why Is Cash Flow Analysis Important?

A strong cash flow analysis helps you frame the narrative of your company’s short-term and long-term cash position while also uncovering opportunities to increase financial efficiency.

Cash flow analysis pinpoints how a company currently gains and burns cash. By bringing in key metrics and the power of financial business intelligence, the finance team continues to pave the company’s foundational narrative through the numbers. The analysis focuses as closely on current numbers as possible. Then you can use that analysis as the basis for your cash flow forecast as you project your runway for different growth scenarios.

At the highest level, you want to see if you have a positive cash flow or a negative cash flow. But analysis isn’t that simple. A VC-backed startup will inevitably have negative cash flow as it takes a growth-at-all-costs approach to capture market opportunity. You aren’t expecting to see free cash flow until at least the later stages of venture funding or you’ve gone public.

Instead, you want your cash flow analysis to go a layer deeper, emphasizing the most accurate company-wide view of the cash impact of your growth strategies.

Done well, cash flow analysis helps you discover any issues with incoming or outgoing cash, which adds more security around your company’s runway. And with more accuracy and proactive analysis (through saving and cutting spending) comes stronger sources of information that lead the company to make better-informed decisions in regard to growth and operational efficiency.

Run Your Cash Flow Analysis in Minutes with Mosaic

The traditional cash flow analysis process takes hours and relies on data manipulation to get a view that clearly communicates where cash currently stands.

You’d normally download multiple datasets from your ERP and spend hours manipulating that data in spreadsheets to finally drill into expenses and functional P&Ls. That labor-intensive process means deep cash flow analysis can only occur on a monthly basis, making it a backward-looking process that fails to deliver much strategic value.

With a Strategic Finance Platform like Mosaic alongside your financial close software, the time-consuming tasks are significantly streamlined, providing quicker insights into your financial health and facilitating decisions that can meaningfully influence your business’s trajectory.

Mosaic allows finance teams to conduct cash flow analysis in minutes, with real-time updates that allow for immediate, real-time decision-making. You can build a Canvas that pulls together the real-time data that your executives care about most.

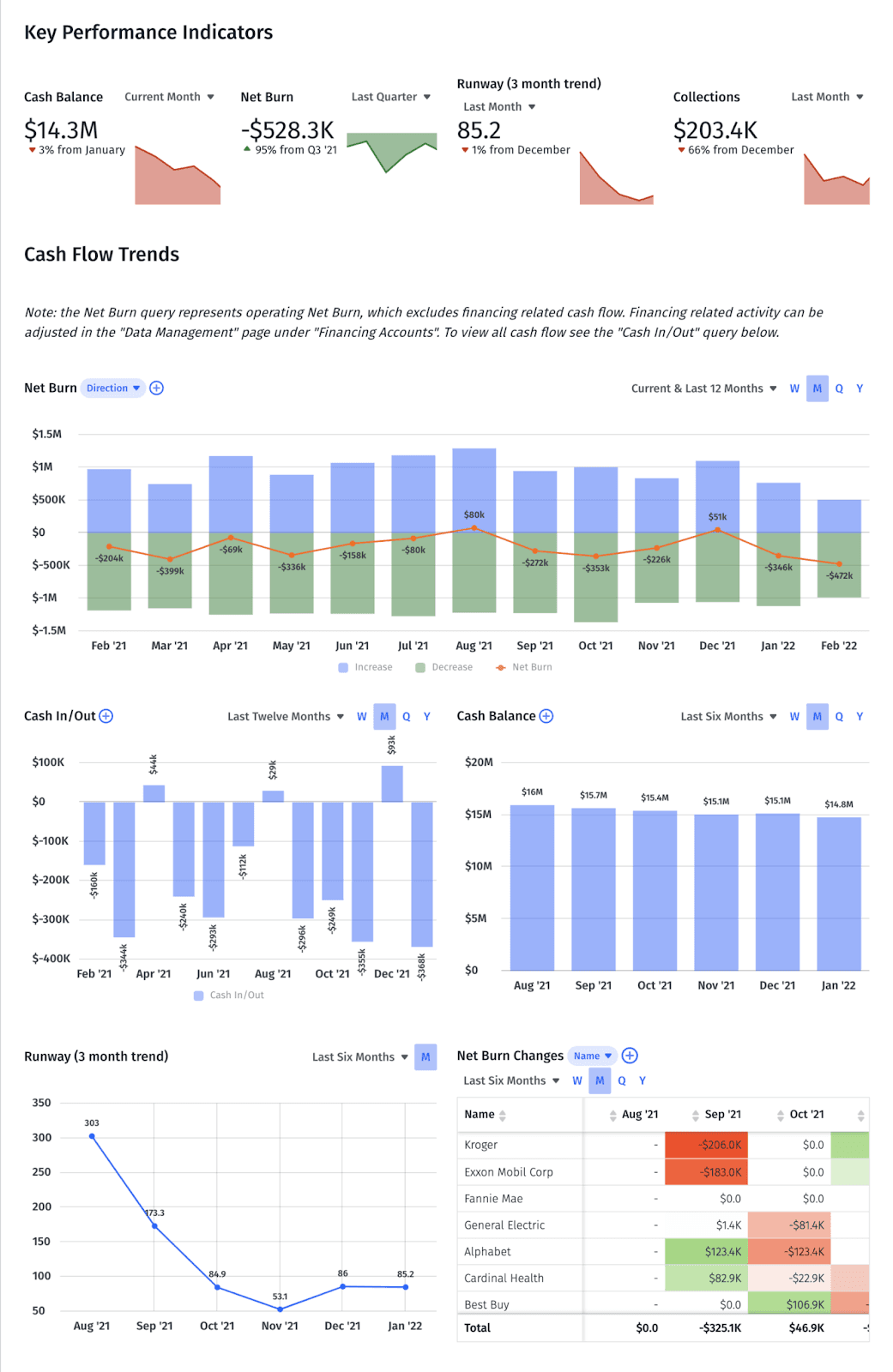

Or, you can use our pre-built financial dashboard template for cash flow analysis. The template updates in real-time with the latest actuals from your ERP integration and includes out-of-the-box metrics like:

- Operating cash flow. Consider this a view of your working capital and net burn, where you can observe how the business runs day to day. It doesn’t include any funding from lenders or long-term debt. You can drill deeper into who (customer-wise) is paying you, what the company is spending money on, and the timing of bills.

- Cash in and cash out. This view reflects an all-inclusive picture of the company. It extends and digs deeper into what the monthly-end close process tells you in terms of cash in and out.

- Runway. The runway metric serves as a gut-check. To calculate this metric, you need to take last month’s cash and divide it by the last three months of burn. The metric allows you to consider larger questions around growth opportunities, like how hiring adds to your cash outflow, which impacts your burn rate and runway.

CFOs need to know every dollar in and dollar out — and Mosaic helps them save time toward discovering that information and sharing it with other company leaders.

This template in Mosaic lets you, your executives, and your other stakeholders check on cash flow whenever they need to.

Instead of reviewing a somewhat stale cash flow report 12 times out of the year, Mosaic allows them to check in more frequently with real-time, updated information — meaning there are ample opportunities to optimize cash flow from the spending or savings side. And when the company extends its runway, it promotes a higher valuation and brand image due to continuing to build traction and efficiency.

How Sourcegraph Uses Mosaic for Cash Flow Analysis

Cash flow analysis examples are abundant. But what about examples where real-time updates provide faster results and truly walk the walk when it comes to operational efficiency? Code intelligence platform Sourcegraph serves as a shining example.

Sourcegraph came to Mosaic with a specific challenge: After raising a $50 million Series C, they wanted a faster way to analyze cash flow to ensure better cash management for their long-term growth plans. Their finance team only looked at cash flow on a quarterly basis, but new investors and board members wanted real-time visibility. And with a remote team and data spread across different systems, it would be a difficult task to align cash flow with the most up-to-date view for everyone.

Once Sourcegraph integrated Mosaic with their systems, the finance team discovered that instead of waiting three days, they were able to pull ERP and CRM data within minutes.

“Mosaic is now my go-to tool to understand what's happening across our entire business. It allows me to confidently tell the story of our financial investments and cost from the P&L perspective by looking directly at real-time interactive dashboards and reports.”

Mosaic’s cash flow analysis template and Analysis Canvas continue to serve Sourcegraph’s goals, as they can drill deeper into transactions and automatically calculate SaaS metrics like net burn in pre-populated reports. Sourcegraph saves hundreds of hours of manual labor while diving deeper into successful headcount planning and investment strategies.

Get Deeper Insight Into Cash Flow & Other Metrics

Five Ways to Improve Your Cash Flow Management

Frequent cash flow analysis leads to better cash flow management. If you’re digging into the numbers and spotting some issues with cash flow management, here are five ways to improve by thinking beyond your financial and cash flow statements.

1. Maintain Close Communication with Department Heads

As a SaaS business owner, one way you can end up with cash flow issues is if you’re constantly surprised by one-off occurrences of major spend from individual departments. The easiest example is marketing: Maybe marketing is planning a conference sponsorship one month, and you aren’t aware of it. Suddenly you have a $50,000 invoice on the balance sheet that you weren’t prepared for. Even if you have a large amount of cash in the bank, that lack of visibility will become a problem.

Stay in close communication with your department heads, so you know when those cash impact events are coming up down the line. It’ll help you proactively manage cash flow instead of just reactively reporting on the events.

2. Create a Roadmap of Tech Implementations

As a company scales, it inevitably needs to implement new systems and/or upgrade old ones. Whether you’re a company that’s always scrambling to do so, reacting to business needs as they come up, or proactively planning, tech implementation projects will impact cash flow.

Finance should be collaborating with business partners to plan out technological needs as early as possible. Is marketing trying to implement new intelligence tools that will significantly increase spend? Are you seeing a spike in the sales headcount plan coming down the road, which would mean you need to add new seats in Salesforce? Is engineering planning to implement a data warehouse tool like Snowflake to fuel new business intelligence efforts?

Through asking these questions, finance can then build scenario analysis examples with these questions in mind to flesh out the roadmap toward optimizing cash flow.

3. Close the Books Faster

Cash flow analysis needs to be as close to real-time as possible — and you won’t get there if it takes three weeks to close the books. If it takes that long, you’re getting the complete picture with just a week to analyze and implement changes, which won’t go into effect until after next month’s close (or even later).

If there are issues with cash flow, you’re a month behind in fixing them. The faster you close the books, the more value accounting can bring in to identify patterns in spending and potential cash flow optimization opportunities.

4. Implement Real-Time Visibility to Improve Key Cash Flow Metrics

It cannot be overstated how important real-time visibility impacts cash flow analysis and management. Real-time metrics mean that you can do up-to-date financial modeling and immediately see the impact on your net burn and runway. It leads to more accurate analysis, which pushes toward better insights and decisions.

Cash flow analysis serves as your foundation for any forecasting. When you apply real-time visibility to your cash flow metrics, you make cash flow easier to predict through certain business plans. What if you were to run with your aggressive headcount plan instead of the conservative scale — how would that impact your runway? Does that mean you need to raise a new round sooner than expected? By tuning in deeper to the present, the future feels more immediate and possible to scale successfully toward.

5. Become More Efficient at Collections

There’s a big difference between bookings and sales revenue/collections. Bookings may be on an annual basis, as the customer commits to buying the service or product through a contract. Revenue and collections, however, are what accounting considers the money on the books. For example, if a client signs on for a $45,000 contract, the company recognizes $3,750 in monthly revenue.

Any delays in your collections process will inevitably hurt cash flow. So how can you get better at cash collection? Start with visibility. Create an effective AR aging report, so you know when invoices went to customers and how long they’ve been outstanding, and track other accounts receivable KPIs like Days Sales Outstanding or average collection period. This visibility will help the accounting and accounts receivable (AR) team get more proactive about hunting customers down for payment, which improves cash flow in the process.

Strengthen Your Cash Balance with More Strategic Insights

Cash flow projections should never be tied to your pie-in-the-sky sales targets. Instead, you want to grow your cash flow like it’s a rainy day fund, where if you didn’t make that dollar, what’s your runway toward preserving your company’s well-being?

Extending your runway allows you to gain insight and cash back. Knowing your cash’s movements in and out allows you to catch spending errors early and boost the company’s bottom line sooner.

Your actuals hold powerful information — and with Mosaic, you can unleash their power in real-time, with updates that come straight from your source system integrations. Request a personalized demo today to see our cash flow analysis template in action and how it allows you to build your strategy to new heights.

Cash Flow Analysis FAQs

What is an example of cash flow analysis?

An example of cash flow analysis would be a business looking at the company’s cash flow in a given time period to evaluate its financial health. After categorizing their business activities, they can add/subtract changes in current assets and current liabilities to/from their net income to gain a better understanding of their statement of cash flows. One example of a cash flow analysis is to use information from the statement of cash flows to get insight into net burn, runway, and cash in/cash out.

How do you run a cash flow analysis?

What is cash flow forecasting software?

Own the of your business.