Too many businesses take a set-it-and-forget-it approach to budgeting. But the sooner you prioritize ongoing budget analysis, the sooner you’ll move beyond simply tracking numbers in a spreadsheet to provide forward-looking, strategic insights that drive business growth.

These exercises give you a detailed look at every department’s budget allocation and variances in spending cadences to determine opportunities to optimize the budget and the process around cash flow from operating activities.

As your business moves faster and continues to grow, your planning and analysis cycles have to be agile enough to keep up. Start transforming your budget analysis processes now so you can understand not only what you’re spending on a monthly/quarterly basis — but how that spend is impacting growth and what you can do to make improvements.

Table of Contents

What Is Budget Analysis?

Budget analysis is a way to assess all the cash flowing in and out of your business. to see whether you’ve gone over, under, or stayed within your spending limits. The more information you collect from a budget analysis, the easier it is to avoid overspending and underspending.

Conducting regular budget analysis is a great way to improve a company’s financial health. While too many SaaS startups go out of business because they don’t realize they’re running out of money (until it’s too late), budget analysis helps you stay on track with your revenue and expenditure targets. By routinely analyzing your cash flow, you’ll always know where your budget stands and whether your finances are headed in the right direction.

3 Examples of Budget Analysis Use Cases

The hallmark of any budget analysis process is the ability to clearly understand plan versus actuals — also known as a budget variance analysis. But these reports aren’t a one-size-fits-all tool.

You can apply budget analysis to a number of use cases in your SaaS business, including the department-level allocation process, ongoing spend management, and long-term strategic planning.

Some of the most common applications of budget analysis for SaaS businesses include budget allocation, budgetary control, and budgetary planning.

Budget Allocation

Budget allocation is the amount of money each department receives from the general fund to execute its strategic plans. In essence, budget allocation breaks down department budgets into an approved maximum per team (and per resource).

Regardless of whether the company takes a top-down vs. bottom-up budgeting approach, each department ultimately decides how they want to allocate their budgets, whether it’s on software (like business budgeting software), contractor or freelance assistance, or ad spend for a marketing campaign.

Budget allocations are generally thought of as an annual practice. More agile companies take at least a quarterly approach depending on cash runway, any changes in revenue targets, or market conditions. Cross-collaboration becomes especially top of mind between finance and department leaders to ensure everyone keeps the company’s financial goals in mind and can optimize their budgets for operational efficiency.

Ongoing Spend Management

Budgetary control is the process of comparing actual income or expenses to planned income or expenses as a way to identify if corrective action is required.

Most people think of budgetary control as a yardstick against which actual performance of your operating budget is measured and assessed. Not only does this process promote accountability, but it helps businesses create more accurate budgets so they can maximize profits and stop wasting financial resources. That said, budgetary control needs visibility to be successful — which is where budget analysis comes into play.

Budget analysis is a precursor to budget control, as it provides a clear picture of the company’s financial health at any point in time and tells you whether actual performance matches up to your original plan (or initial forecast). From there, you can share observations with department and executive leaders and other stakeholders to reign in the budget as needed and ensure the company continues to operate effectively.

Long-Term Planning

While budget allocation deals with the bottom-up, department-level side of your plans, long-term strategic planning is the top-down side of the budgeting process. These plans involve executive-level discussions about where the business is going next year and beyond.

You can use budget analysis in these situations to inform decision-making and get a better understanding of how historical plans impacted business results. For example, was your marketing team on budget throughout the entire year but missing its numbers? Maybe there’s evidence to support an increase in paid ad budget moving forward. Or, maybe you can dial down certain initiatives that weren’t effective and double down on what worked to improve efficiency.

This kind of big-picture thinking sets the stage for annual planning processes and creates a foundation for more agile budgeting conversations at the department level. And the clearer insight you have into historical performance, the easier it will be to set a strategic path forward.

Why Budget Analysis Is Crucial for SaaS

Budget analysis is crucial for startups and SaaS businesses because it helps you manage SaaS-related costs, make precise budget plans, and keep the business on track for longevity versus suddenly running out of money at a critical moment.

Manage SaaS-Related Costs

One thing that makes budget analysis so important is that it helps you manage a variety of SaaS-related costs — especially when the company is in an early growth stage. While in the R&D phase, many SaaS companies operate at a loss, so leadership must be cognizant of how they build their marketing and sales departments before they fully hit the ground running and begin to build awareness and, eventually, sales. Without proper budget analysis to guide decisions on hiring and how much to spend on ads, overhead costs like salary and advertisements can get out of hand in a hurry.

Continuous budget analysis is a proactive approach to cost management that prevents SaaS spending from becoming too complicated or overblown. When department leaders dive into the budget on a monthly basis (especially in times of a down market), they’re able to have more proactive, strategic conversations with executive leadership and the finance team around what’s truly mission-critical to keep and where adjustments can be made and the potential impact on team efficiency and productivity.

Make Precise Budget Plans

As mentioned above, budget analysis and budgetary planning are inherently linked. Careful, consistent budget analysis positions your company to make precise and reliable future budget plans — which are foundational to the company’s financial success, security, and longevity.

Budget analysis takes your financial planning that next level deeper due to the granular insights you uncover around cash flow. These insights gauge and inform any scenario planning around spending and focus any budget initiatives to ensure they align with the company’s larger goals. Budget analysis is a catalyst for smarter budget planning, which will pay off in both the short- and long-term with gains like financial stability and improved allocation.

Avoid Running Out of Money

Not only does budget analysis help you plan and forecast for the future, but it also keeps you from running out of money in the present. Without a firm grasp of how much cash is coming in (and out) of your business, your company is vulnerable to spending more money than is actually available.

Instead of simply tracking your spending, budget analysis does a full inspection of all your expenses and revenue. This in-depth look is a key player in monitoring and maintaining a healthy budget throughout the entire fiscal year and helps safeguard your budget, so you don’t overspend and wind up working with negative numbers.

Analyze, Adjust & Improve Budgets in Real-Time with Business Budgeting Software

4 Steps of the Budget Analysis Process

There’s no reason for budget analysis to be a burden. If you keep the process simple, you can execute budget analysis with a lot less headache and hassle.

1. Decide on a Budget Time Frame

First things first, you’ll need to choose a time frame for how often you’d like to analyze your budget. Can the business sustain an annual budget conversation? Probably not. The pace of the business likely requires a quarterly or monthly cadence.

While you have all these options available to you, it’s recommended that early-stage startups and high-growth businesses stick to a monthly or quarterly schedule. This cadence allows teams to stay on top of their budgets, which allows you to make adjustments or address concerns at critical moments.

Early-stage companies are likely testing out different marketing and sales strategies to see what sticks. When that’s the case, revenue and expenses aren’t quite as predictable compared to a more established enterprise. For that reason, your budget will need to be analyzed and adjusted more frequently as your company finds its footing in the marketplace.

2. Make Note of Budget Variances

Once your time frame is established, you can start analyzing the numbers by comparing your planned budget to actual performance. During this analysis, make note of any budget variances — that is, your budget vs. actuals.

Say your business budgeted $20,000 for Google Ads in Q1, but you only spent $12,000 by the end of that quarter. In this case, you have a budget variance of $8,000. The next level of that conversation then becomes whether marketing needs the full $20,000 per quarter or where they can pivot their attention to another marketing tactic that will utilize the full $20,000.

As you go through your budget analysis, be sure to look for variances in both expenses and revenue. If you generate more (or less) revenue than anticipated, it’ll directly impact your company’s spending and growth initiatives moving forward. Headcount planning, for example, may need to slow if revenue is not high enough to justify another sales rep or critical hire that would propel the product to the next level.

3. Compare Your Budget to the Forecast

The next step of your budget analysis process requires you to compare your budget against the forecast. This step is especially important if your company uses dynamic budgeting models — like rolling or flexible budgets – rather than static budgets. Whereas static budgeting models remain consistent throughout the entire budgeting cycle, dynamic budgets allow you to make adjustments from time to time.

To perform this kind of comparison, check your actuals in relation to your forecast. If you notice that your actuals are often over or under budget, you can assume that your forecast is inaccurate.

Try to compare your actual revenue over the last 3-6 months against the forecasted revenue for that same time period. This way, you can get a good idea of whether your growth trajectory is realistic or not. You’ll also want to pay attention to whether your expenses are steady or if they experience a lot of variance. You want your expenses to be trending flat — so if there’s significant ebb and flow, you’ll need to dig deeper to figure out why this is happening. This is particularly important for any expenses that are tied to your revenue, like the cost of revenue.

4. Prepare for Your Next Budget Cycle

A budget analysis without any follow-up action doesn’t really do you any good. That’s why the final step in this process is to make necessary adjustments based on what you learned — and then start preparing for your next budget using data collected from the previous cycle.

More specifically, your end total from the selected month or quarter becomes the beginning dollar amount for the next budget cycle. This gives you a good template, so you’re not starting a budget from scratch — and it ensures your next cycle is more accurate than the last.

Budget Analysis with Mosaic

While the above steps are accurate, there’s a precursor step all finance teams need to consider: Where will they conduct their budget analyses?

Many finance teams rely on spreadsheets to help them reconcile data. But with so many department leaders also working in those spreadsheets, issues like version control and human error in punching in numbers may lead to hours more work to get clarity around the numbers.

Third-gen FP&A tools are helping finance teams catch up to more accurate, automatic financial planning that helps to eliminate some of the roadblocks that occur with budget analysis. But to truly get to actionable insights that optimize critical cash flow and budgetary decisions, you need a Strategic Finance Platform like Mosaic.

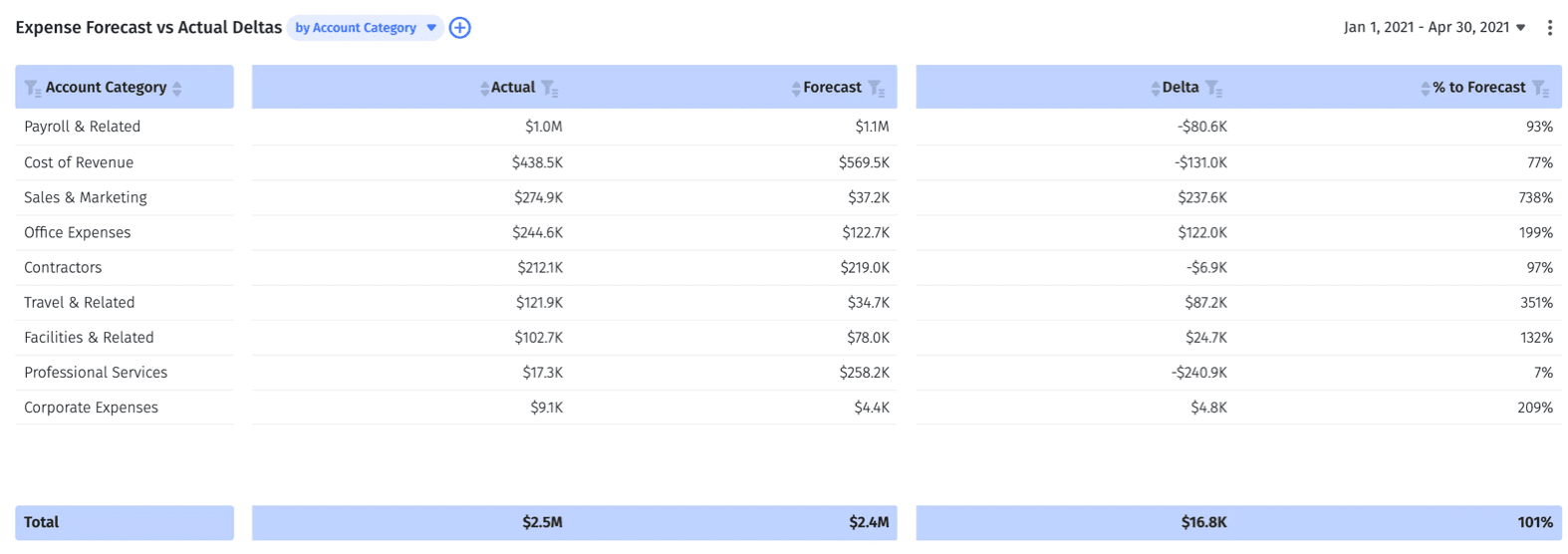

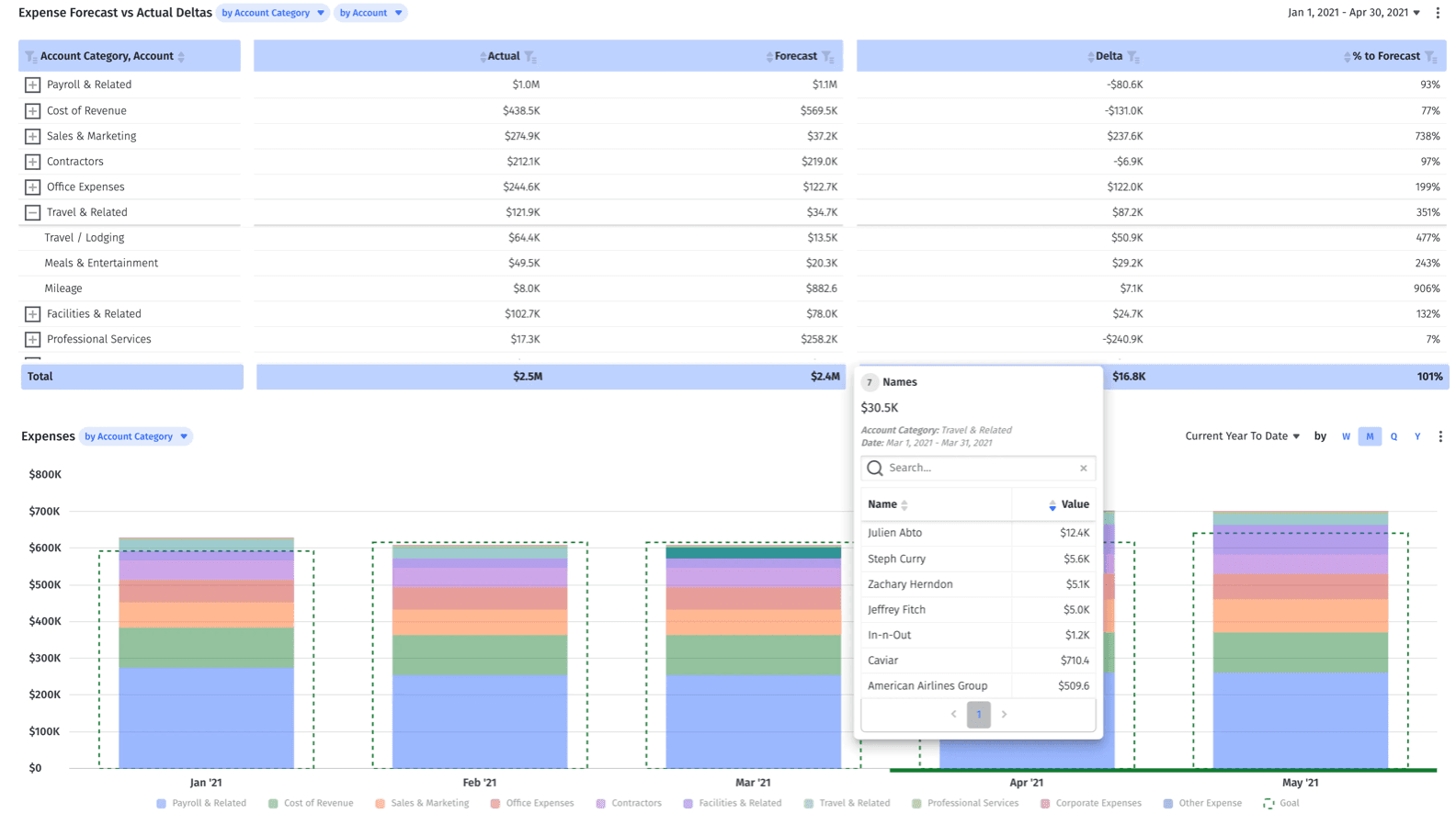

Mosaic syncs with your ERP, CRM, HRIS, and billing systems to centralize critical data across the company to ensure you have access to assessing the company’s financial health in one holistic view. Mosaic pulls the data together into prebuilt templates and dashboards, including a budget vs. actuals dashboard that you can further view by account level or category.

These views offer more flexibility and opportunities for deeper collaboration as you dive into individual department needs with department and executive leadership. However the company approaches budgeting, Mosaic provides the tools to uncover variances and opportunities to optimize budget quickly to help make your budgeting process, allocation, and analysis as effective as possible.

Want help spotting budget variances, so your budget analysis is smooth sailing? Request a personalized demo from Mosaic today.

Budget Analysis FAQs

What are the different types of budgets?

The four most common types of budgets are:

- incremental budgeting

- activity-based budgeting

- value proposition budgeting

- zero-based budgeting

Depending on your business’s size and specific financial goals, one budgeting method may be better suited to your needs than the others.

What should a budget analysis include?

What does a budget analyst do?

Own the of your business.