Secure sharing platform DocSend updates its Pitch Deck Interest Metrics page weekly, noting investor and founder activity and pitch deck engagement through its platform. Through their research, DocSend discovered that VCs and investors’ average time reviewing pitch decks is two minutes, 28 seconds.

That’s a small amount of time to make a big impression.

On an episode of The Role Forward about funding rounds and pitch decks, John Luttig, Principal of Founders Fund, noted that SaaS pitch decks “shouldn’t just be a backward-looking report on the business.”

Your VC pitch deck needs to expand into the future — because, as Luttig’s colleague says, in venture investing, “your price is a discount on the future, not a multiple on the present.” Here’s how to build a SaaS pitch deck that grabs investors’ attention.

Table of Contents

What to Include in Your SaaS Pitch Deck

Successful pitch decks define the company’s business plan in terms of where it is now and how the team plans to grow it in the future. Potential investors want to gain a sense of, if things go right, what a company looks like five to 10 years from now.

While pitch decks have a basic structure and items to cover, they will look slightly different depending on the funding round. A seed round pitch deck won’t be able to cover the same information as a Series B deck. These necessary slides in your deck focus on the two primary concepts for any pitch deck: painting a clear story of the company’s growth narrative and what goals will be accomplished with the capital raised from the funding round.

Executive Summary (Problem/Solution Descriptions)

Pitch decks need to answer “why” a business exists, which you can craft through honing your company narrative within the first few slides of your presentation. Begin with the problem, the specific pain point(s) your company wants to address. Then, explain the solution for these pain points and how your product or service benefits customers.

In later stages of maturity, this can become a snapshot of business performance.

Market Insights

Including market insights, such as market size, market growth, and total addressable market (TAM), shows an awareness of where the company sees itself among its customer base. Your TAM will evolve as your product develops, so it’s important to continue updating this section as needed.

Competitive Insights

These insights answer two important questions: Who are the company’s direct or indirect competitors? And where do you place yourself within the competitive landscape? This is your chance to define your place among your competitors (and reiterate it within the market) based on pricing strategy, global or local presence, and other factors (like whether your solution is only available via desktop or has mobile app functionality).

Product Roadmap

The product roadmap describes short- and long-term goals and outlines milestones for optimal growth. In early-stage companies, it presents the timeline to hire engineers to develop the product and its eventual implementation. For mature companies, the roadmap looks at developments and launch dates for new products.

Financial and Operational Metrics

Financial and operational metrics indicate the overall health and efficiency of an organization.

At a high-level, financial metrics include go-to-market metrics, expense composition, customer retention metrics, sales performance metrics, and more to provide a clear view of your company’s health. Operational metrics measure the efficiency of the company’s workflows, such as headcount, employee ramp to productivity, and system efficiency, to ensure company growth remains viable alongside revenue growth.

Revenue Model

The revenue model represents your company’s SaaS pricing strategy. For seed and Series A rounds, the model signifies a sense of value proposition in terms of understanding what customers are willing to pay to implement the software.

For later rounds, historical data provides insight into how the business model has performed. Use that historical data to explain the impact of product upgrades and expanded features to justify any price increases and forecasts.

Forecast Summary and Fundraising Goals

All the data has been presented. Now, it’s time to remind your potential investors how much you’d like to raise and what goals you’ll accomplish with the raised capital. This is where you describe your runway in further detail, such as any headcount planning, department or product development, and marketing efforts. Ensure that your forecast and numbers line up before the meeting: You don’t want to ask for too little or not supply enough information that doesn’t peek investors’ interests.

Founder and Team Information

This slide is very important for seed and Series A fundraising rounds, as venture capitalists will only be getting glimpses at the prototype or plan pre- and post-product launch. Success, then, depends on the quality of the team. Focus on answering what Luttig refers to as “founder market fit”: why this founder or team is uniquely well-suited to solve this problem.

Create Best-In-Class Reporting Packages for Investors

Essential Pitch Deck Metrics

Due diligence requests during funding rounds cost finance teams an incredible amount of time. It’s not an exaggeration: It would take a full week, working around the clock, to try and pull this data together and clean up any historical data.

Having the infrastructure in place as early as possible to start tracking the pitch deck metrics that you know you’re going to need when it comes time to fundraise is a huge advantage. Here are the metrics you need to include.

Go-to-Market Efficiency Metrics

Go-to-market metrics scale with company growth. These metrics display sales and marketing efficiency over time. This category includes the following metrics:

- Customer Acquisition Cost (CAC). This metric determines what it costs to gain a customer. CAC plays a role in calculating other metrics to determine when to invest more into marketing and sales.

- Customer Lifetime Value (LTV). Startups need to be excited about this crucial metric, as it helps estimate how much customers will pay for services over their relationship.

- CAC Payback. Luttig considers CAC payback periods as huge value drivers. Luttig noted that “It’s a key driver of your return on invested capital and how quickly you can deploy incremental dollars.” This CAC-driven metric shows your company can recover acquisition costs (as long as it’s shorter than LTV).

- Sales Rep Ramp. Sales representatives bring in deals — but they need to ramp up first. This metric determines when new sales reps reach full productivity, which gives a peek toward internal workflow efficiency as well.

- Total Addressable Market (TAM). Based on your forecast, what’s your maximum revenue share? Your TAM speaks to your market share and further defines your place within the industry. How much of the market will your product or service win over?

- Magic Number. Calculating your company’s magic number gives a quick indication of how sales and marketing are functioning in a specific time period. Ideally, your number will be over 0.75, meaning you need to invest more into these engines to continue performing well.

- Sales Win Rates. Calculate the number of deals sales closed. For pitch decks, keep it at the high-level overall percentage within a given time. You can also calculate potential leads who received a demo or pitch but decided to go with a competitor, which provides a sense of how you’re doing within your market and against competitors.

Land and Expand Metrics

Once you acquire (land) a customer, it’s all about expanding with them. These metrics emphasize company-level efficiency matters, like ongoing costs to retain customers and how much net new ARR you’re adding per dollar burn. These insights may even lead to structurally different turns in your margin profile.

Land and expand metrics answer questions like, “How much do marketing and sales contribute to new growth?” and “What is the impact of general and administrative operations on overall profits and losses?” These are crucial insights, especially for companies funding for Series B and C. You want to show a sense of control over the levers that indicate “dollars in, dollars out.”

- Annual Recurring Revenue (ARR) Growth. This metric is especially important for SaaS startups, as it shows generated interest in your product and sustainable growth.

- Monthly Recurring Revenue (MRR). For SaaS companies using freemium models, it makes sense to focus on MRR as the revenue growth indicator.

- Free Cash Flow. Strong cash flow forecasts capture investors’ attention and bolster their confidence. This projection shows how much money the business has after reconciling income and expenses over a specific time period.

- Gross Margin. Your gross margin indicates that you can invest more into your departments, whether that’s marketing, product, or sales. It also shows the company’s profitability.

- Net Revenue Retention (NRR). As soon as a company can calculate NRR, they need to include it in their SaaS pitch deck to go deeper into churn and customer retention analysis. The ideal NRR is 120%, but anything over 100% shows that you’re not just retaining customers — you’re turning them into revenue drivers. Luttig suggests going even deeper into this metric by performing a cohort analysis or segmenting by market.

- Runway. Runway matters, especially for seed and Series A companies that need at least 12-month runways to reach their next milestone. Past Series A, maintain a 24-month runway.

- SaaS Rule of 40. This efficiency metric may not be perfect, but it sets a solid benchmark to quickly determine your company’s health. It’s best to use for later funding rounds (like B, C, and D).

Examples of SaaS Pitch Decks

A quick search for pitch deck examples will surface all kinds of inspiration. You can find VC pitch decks from companies like Mixpanel, Facebook, Mattermark, Dropbox, Foursquare, Buffer, Airbnb, Uber, Moz/SEOMoz, LinkedIn, and hundreds more. And there’s one thing you’ll learn for certain along the way — there’s no one-size-fits-all pitch deck.

Instead of looking for the perfect SaaS pitch deck template, search for inspiration that can help you tell your story well. Of all the potential examples, John from Founders Fund said there are two that stand out from recent memory: Figma and Rippling.

Figma Series C

Figma successfully raised $40 million in a Series C, which included firms such as Sequoia Capital and Founders Fund. Luttig remembered Figma’s Series C pitch deck and presentation for “disproving what investors were skeptical of.”

After Sequoia passed on its Series B, Figma changed its approach to its Series C. Figma crafted its deck around specific concerns, such as the size of the design market and how horizontal its product was. And as Sequoia partner Andrew Reed pointed out, Figma was able to change people’s minds with their prevalence in the market in the 12 months between their Series B and C rounds.

Rippling Series B

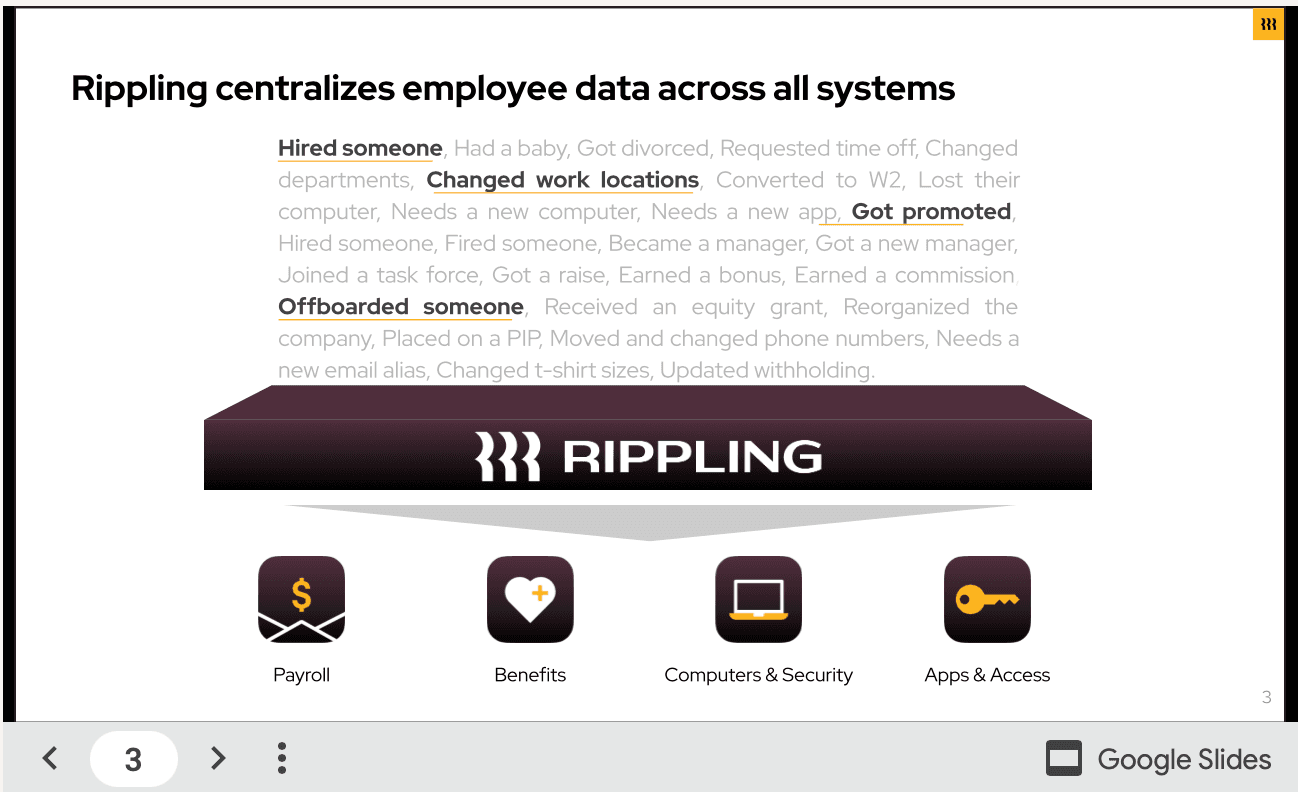

HRIS company Rippling shared its process for putting together its Series B investor pitch deck. Rippling pulled together a deck that combined an investor memo (which they used during their Series A funding round) and layered in SaaS metrics to continue building their narrative.

Founders Fund was part of the Series B. Luttig commented that “Rippling laid out a really strong thesis around the accumulative advantages they were building,” which led to a $145 million round.

Tips for Pitching VCs

Building a great pitch deck is one thing — now it’s time to make the pitch. If the pitch deck had to speak for itself, what would it say? Here are a few ways to ensure your story is clear from deck to presentation.

Frame Your Pitch Around Investors’ Biggest Concerns

Investors can change their minds or invest at a later stage (as seen with Sequoia and Figma). You can find your framework by asking:

- What are the riskiest pieces of my business?

- What is the quantitative case for why those risks are so overblown?

- How will those concerns be de-risked over the next few quarters?

Luttig noted a few specific concerns and solutions. “If the investors are concerned about margin structure, then you should have some sort of chart around gross margin over time. Or if you’re a heavily sales or marketing-oriented company, you’ll want to show the trajectory of your sales team and how efficiency has trended over time.”

Avoid Common Mistakes with SaaS Metrics

The only thing worse than not knowing a number that an investor wants is showing the wrong numbers. Many SaaS metric calculations may seem simple on the surface but can be difficult to get right.

For example, Luttig notes that CAC impacts many important SaaS metrics, so it has to be right — and that means making sure you’re calculating fully-burdened CAC. “It’s not just including full sales and marketing team headcount. And it’s not just ad spend,” said Luttig. “If the CEO is doing sales, they should be included in CAC.”

For CAC payback, you need to adjust for gross margins. Customer success costs impact the payback periods over time, so ensure that the gross margin structure accommodates the CEO’s time.

And don’t forget to break out by other segments, such as company or industry size, to understand how quickly you can go after other segments. Your market expands and changes as your product and business grow — you don’t want to ever settle and miss out on new customers.

Focus on the Narrative

As a founder, you need to think of the narrative within every slide. What is the story you’re telling potential venture capitalists and investors? Don’t just present the metrics — tell the “why” behind them.

Your present actions enrich your story for success. Explain what you can do this quarter (and between rounds) to ensure that you accomplish what you set out to do with any raised capital within your proposed time frame.

Think Outside the Deck

Rippling secured their Series A with their investor memo, which focused on prose. Mosaic did a quasi-demo, where our founders pulled up company metrics within our Strategic Finance Platform to show how quickly users could create data visualizations.

When you shake up the typical pitch deck — as long as it relates to your company’s goals and narrative — you set yourself up to capture investors’ attention as a transformative solution in the industry.

Make SaaS Pitch Deck Prep Easier with Mosaic

Finance doesn’t have to spend hours pulling spreadsheets together to figure out SaaS metrics. Instead, they can gain those hours back and actively affect change within the company with a self-serve platform that gets them the information they need within minutes.

Mosaic integrates with your core systems of record to help you easily track the most important financial ratios and metrics you need to tell your story to investors. The value of saving time from reconciling data and crafting your company narrative with the numbers goes beyond the pitch deck. Finance can improve collaboration across the company as they pose questions about improving margins or pointing out duplicate spend.

Setting your SaaS business up for success starts by having a clear real-time view of the numbers and the ability to dig deep into the “why” behind them. Request a personalized demo to discover how Mosaic helps your finance team drive strategic conversations and collaboration.

SaaS Pitch Deck FAQs

How long should a SaaS pitch deck be?

John Luttig, Principal at Founders Fund, recommends keeping your pitch deck to 10-15 slides, similar to what Rippling did when raising its Series B. Pitch decks can be in PowerPoint or Google Slides format and often last about 10-20 minutes when presented, leaving ample time for Q&A and discussion. There is a lot of information to go through but it should be succinct, concise, and easily digestible for venture capital investors.

What should you avoid in a pitch deck?

Own the of your business.