Accounts Receivable (AR) Turnover Ratio Guide + Formula

What is Accounts Receivable Turnover?

Accounts receivable turnover is a financial ratio that helps companies assess the efficiency of their credit and collections processes, specifically how well the business collects outstanding (unpaid) customer invoices.

A higher or good accounts receivable turnover ratio indicates that the company collects its credit sales efficiently. In contrast, a low ratio may highlight a need to re-think the company’s credit policies or collections processes.

Categories

For any business, having a steady stream of cash coming in is key to keeping operations running smoothly. This is where AR turnover comes into play, as the metric sheds light on a company’s credit and collections processes. By understanding efficiency ratios like AR turnover, companies can quickly spot operational inefficiencies, cash flow shortages, and customer payment behavior.

For example, suppose customers don’t settle their bills on time. In that case, a significant delay in payments can leave the company in a cash crunch, unable to allocate resources toward planned projects, and uncertain about its future.

In these scenarios, AR turnover can help SaaS finance teams understand the effectiveness of the company’s ability to collect timely payments and its credit policies. By indicating whether the credit terms are too lenient or strict, AR turnover allows the management to make informed decisions to optimize credit policies.

Finance and accounting teams that align on the insights behind a metric like AR turnover are able to optimize the financial health of their businesses and make strategic recommendations for operational improvements.

Table of Contents

Accounts Receivable Turnover Ratio Formula + Example

AR turnover ratio gives insight into how often you collect your average accounts receivable balance over a year. You can find this out by dividing your net credit sales by your average accounts receivable, as seen below:

Net credit sales refers to the revenue generated from sales on credit, which means the customer has committed to make the payment, but the money has not yet been received. In SaaS, this could mean the subscription has been signed for a given period, but the payment is still pending.

A high AR turnover ratio means your cash flow is steady and reliable. On the flip side, a lower ratio might be a cue to ramp up your collections process or tune your credit policy so customers make payments on time.

Example

Let’s say a company had net credit sales of $600,000 in 2022. The average accounts receivable for the same accounting period was $50,000. So, here’s how you’d calculate the AR turnover:

AR Turnover in 2022 = $600,000 (net credit sales) / $50,000 (average accounts receivable) = 12 number of times

The AR turnover for the company is 12, meaning on average, the company collected outstanding debts 12 times by the end of the year. In this case, a higher ratio could indicate that the company efficiently collects payments from customers.

Having said that, it’s also essential to consider other factors and metrics to understand the company’s credit and collections performance comprehensively.

How to Interpret AR Turnover

Generally, the type of business and industry determine what qualifies as a “good” AR turnover ratio, so there’s no one-size-fits-all number you should aim for. To gauge the performance of your company’s credit and collection processes, compare your AR turnover ratio to industry averages or similar companies.

For instance, an AR turnover ratio of 10 might fall above average in an industry where the norm is 6, so you could already be doing most things right.

In any case, know that several factors can influence your company’s AR turnover ratio:

- Credit Terms: For example, if your company has more lenient credit terms, you might see lower AR turnover ratios, so a conservative credit policy might help improve the ratio.

- Collections Process: The efficiency of the collections process also affects this metric, so a more efficient process with well-defined protocols to guide your teams’ actions can lead to a higher AR turnover ratio.

- Customer Base: The type of customers can impact the speed at which your company can collect receivables. For instance, small businesses might have less established credit histories or face cash flow challenges, potentially leading to delays in payments. In contrast, large, established businesses generally have better cash flow and can be high-quality customers.

Typically, people see a higher AR turnover ratio as a positive sign, as it shows the company can promptly collect payments from customers, which implies a healthy cash flow forecast. Conversely, a low AR turnover ratio might surface ineffective collections processes or poor credit policies.

As a best practice, try to align the AR turnover ratio goals with the broader company objectives and continually assess and tweak credit and collections processes as needed. For example, ensuring accurate and regular invoicing can enhance the AR turnover ratio by making it easier for customers to understand their bills and pay on time.

What AR Turnover Doesn’t Tell You (Limitations)

While AR turnover can give finance teams valuable insights, it isn’t a catch-all metric. For instance, the ratio doesn’t consider seasonal fluctuations, economic or market variabilities, or customer size. So, relying solely on AR turnover can result in overgeneralization, not reflective of the actual state of business.

Plus, a positive AR turnover ratio may not necessarily be good for the business. For example, a high accounts receivable turnover can hint at overly stringent credit policies that might deter your customers, giving competitors an edge. So, it’s important to remember that the AR turnover ratio often provides a short-term picture of credit management and may not reflect long-term trends or issues.

Other Key AR Metrics to Track

To get a truly comprehensive idea of your AR turnover performance, measuring the metric with other accounts receivable KPIs in tandem is important.

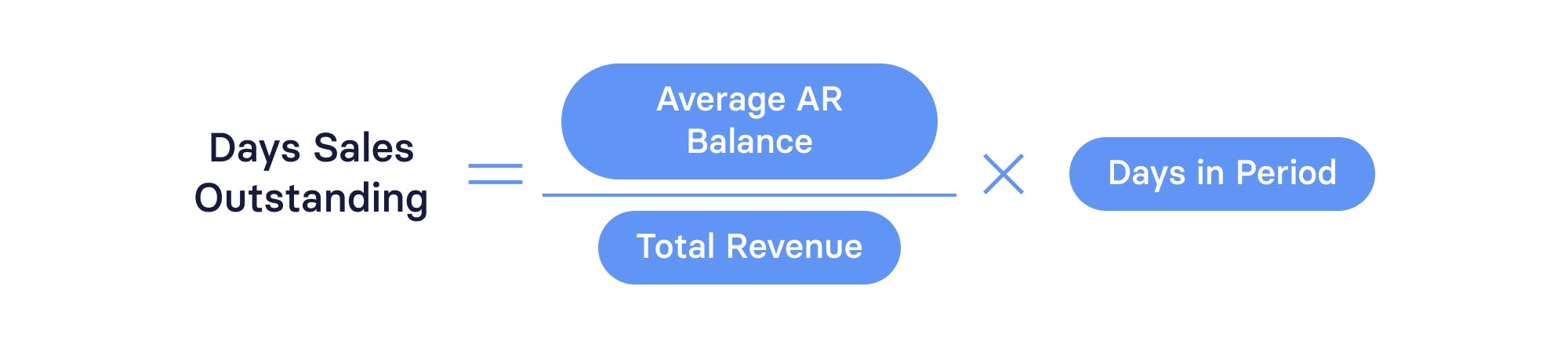

Days Sales Outstanding

Days sales outstanding (DSO) refers to the average days customers take to settle their bills, or the average collection period. A low DSO indicates a quicker cash inflow, smoothing the financial operations. Conversely, a high DSO signifies a substantial portion of your funds is tied up in accounts receivable, so your invoices are outstanding for an extended period of time.

Typically, DSO and AR turnover share an inverse relationship. A higher DSO implies that it takes longer for the company to collect payment from customers, leading to a lower AR turnover ratio. On the other hand, a lower DSO, signaling faster collections, results in a higher AR Turnover ratio.

AR Aging

AR aging gives you a peek into your company’s accounts receivable and collections performance by listing unpaid customer invoices and unused credit memos according to date ranges. This information is all laid out in an AR aging report or the aging schedule, highlighting how swiftly your company gathers cash sales and can hint at potential financial hiccups with customers.

An AR aging report sorts customer invoices based on your aging schedule, usually incremental 30-day date “buckets” from the invoice’s due date. These buckets help you foresee the cash coming in from customers and spot the ones with late payments, who might just become credit concerns over time.

Average Days Delinquent

Average days delinquent (ADD) is a valuable accounts receivable metric that provides insight into the average number of days your receivables are overdue.

Calculating ADD is straightforward with the following formula:

This metric will give you a clearer understanding of the average delinquency of your receivables, aiding in better management of your collections process. Ideally, the goal is to have zero ADD, indicating no overdue accounts. However, that’s a rare scenario. In reality, there are usually some delinquent accounts, which will be reflected in your ADD.

5 Ways to Improve AR Turnover

Understanding the significance of AR turnover on your profitability is just the first step. More importantly, what you do with this information matters. Below are five ways you can improve your AR turnover:

1. Proactively Communicate with Customers

Every SaaS product’s interface differs, and a customer may be subscribed to multiple software simultaneously. Rather than assuming these payable invoices are top-of-mind to your customer, a little proactivity can go a long way in helping them remember.

During onboarding, consider using a drip email campaign to educate customers on navigating the billing system and whom to contact for billing inquiries — encouraging timely payments and fostering a smoother payment process.

That’s not all. Research shows that companies could boost the likelihood of receiving payment within a week of the invoice due date by 56% through a mix of SMS and email reminders. Create a structured follow-up process for overdue accounts, including reminder emails, texts, and calls. Don’t be closed to escalating non-payments to collections agencies when necessary.

2. Invoice at the Same Time Every Pay Period

Consistent invoicing schedules can make it easier for customers to remember when an invoice will be coming in. Put simply, it makes the billing process predictable and structured for the company and its customers.

If a customer has multiple subscriptions with your company, consider consolidating your invoices to send them at the same time every period — be it monthly, quarterly, or annually.

As for the ideal day to send invoices, there’s no hard and fast rule. Your decision will likely depend on your type of product, industry norms, and customer expectations. Your customer might have a unique billing cycle, typically paying invoices on a particular day of the week. If you aim for those days when sending your invoices, you will likely see payments coming in quicker.

Or, you might invoice customers based on the subscription start date to keep things simple. Either way, the goal is to create a consistent, reliable schedule.

3. Use Automated Billing or Accounting Software

SaaS businesses are ideally positioned for automation of the billing process, thanks to recurring invoices.

SaaS billing software saves time and energy, improves cash flow, and enhances customer relationships. An ideal solution can handle the entire billing process — from issuing invoices and sending reminders to offering multiple payment options and tracking payments.

Relying on good billing software can make the process more efficient and less prone to errors, positively impacting your AR turnover ratio. Giving customers the benefit of doubt, expect most customers to likely settle their bills when they receive a reminder, rarely needing manual escalation.

4. Adapt Your Credit Policies

You can optimize your company’s AR turnover ratio, improve cash flow, and enhance its financial health by continually reviewing and adjusting credit policies to align with customer payment behaviors and broader financial trends.

For example, you might revise credit policies to include incentives for early payments, motivating customers to pay on time. Alternatively, during volatile market conditions, you might want to introduce penalties for late payments to safeguard your cash flow and motivate customers to pay promptly.

5. Offer Multiple Payment Methods

Every customer’s internal accounting systems are likely to be different. So, the best way to cater to the convenience of a broad range of customers is to offer a variety of payment methods.

Depending on your business, this could range from credit cards, debit cards, ACH direct debit, bank-to-bank transfer, or through digital wallets like Paypal, Apple Pay, Google Wallet, and Venmo.

Whichever payment options you offer, remember that a seamless payment experience is critical to ensuring your business gets timely payments and customers are satisfied with their interaction with your product.

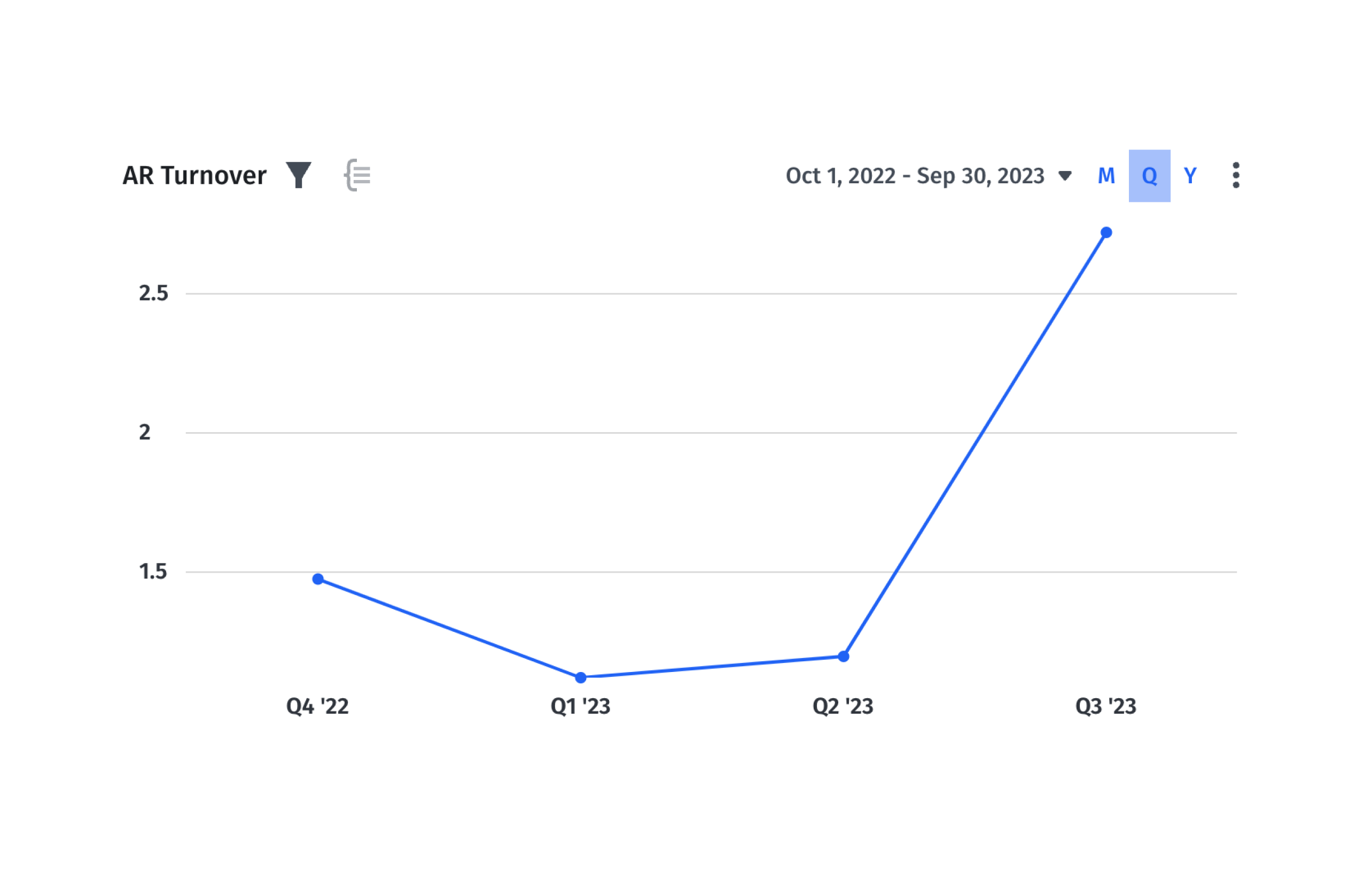

Using Mosaic to Track and Analyze AR Turnover

Mosaic is a Strategic Finance Platform built with SaaS businesses in mind — offering real-time analytics that swiftly bridge the gap between data and decision-making.

Mosaic’s Metric Builder empowers SaaS finance teams to build and customize metrics aligned with their distinct business requirements. Besides the ready-to-use metrics bundled with the software, it allows you to create custom metrics harnessing the familiarity of Google Sheets and Excel-like formulas — all without a single line of code.

Metric Builder can pull data from any system in various formats, such as ERP, CRM, HRIS, billing, data warehouse, or flat file upload.

Metric Builder unveils deep insights into your accounts receivable metrics, such as AR turnover, AR aging, DSO, bad debt to sales, and beyond. The best part? Incorporate these metrics into tailored SaaS dashboards to secure a comprehensive view of your company’s financial and operational landscape — spanning historical, present, and future scenarios.

Mosaic streamlines accounts receivable KPI tracking with its pre-designed dashboard templates and offers in-depth analysis and financial modeling, enabling finance and accounting teams to adopt a more strategic approach.

If the ready-made billings and collections template doesn’t quite fit your accounts receivable dashboard requirements, that’s all right. You have the flexibility to craft your own Analysis Canvas — which allows you to customize key metrics, goal variances, and reporting views in minutes to tell your story your way — focusing on the AR KPIs that resonate most with your business needs.

AR Turnover’s Role in SaaS Success

As illustrated, AR turnover is crucial in managing your company’s financial health and preventing cash flow hiccups. The best way to manage AR turnover and other key metrics is to stay ahead of it, proactively measuring and analyzing progress to spot inefficiencies before they become problems.

Request a demo of Mosaic to empower your finance teams with better financial insights.

AR Turnover FAQs

How does Mosaic help in tracking and improving AR turnover?

Mosaic’s Metric Builder empowers SaaS companies to measure, track, and enhance AR turnover alongside other pivotal AR metrics by providing in-depth, real-time financial insights.

How often should I review my AR turnover metrics?

What are the benefits of tracking AR turnover?

Explore Related Metrics

Own the of your business.