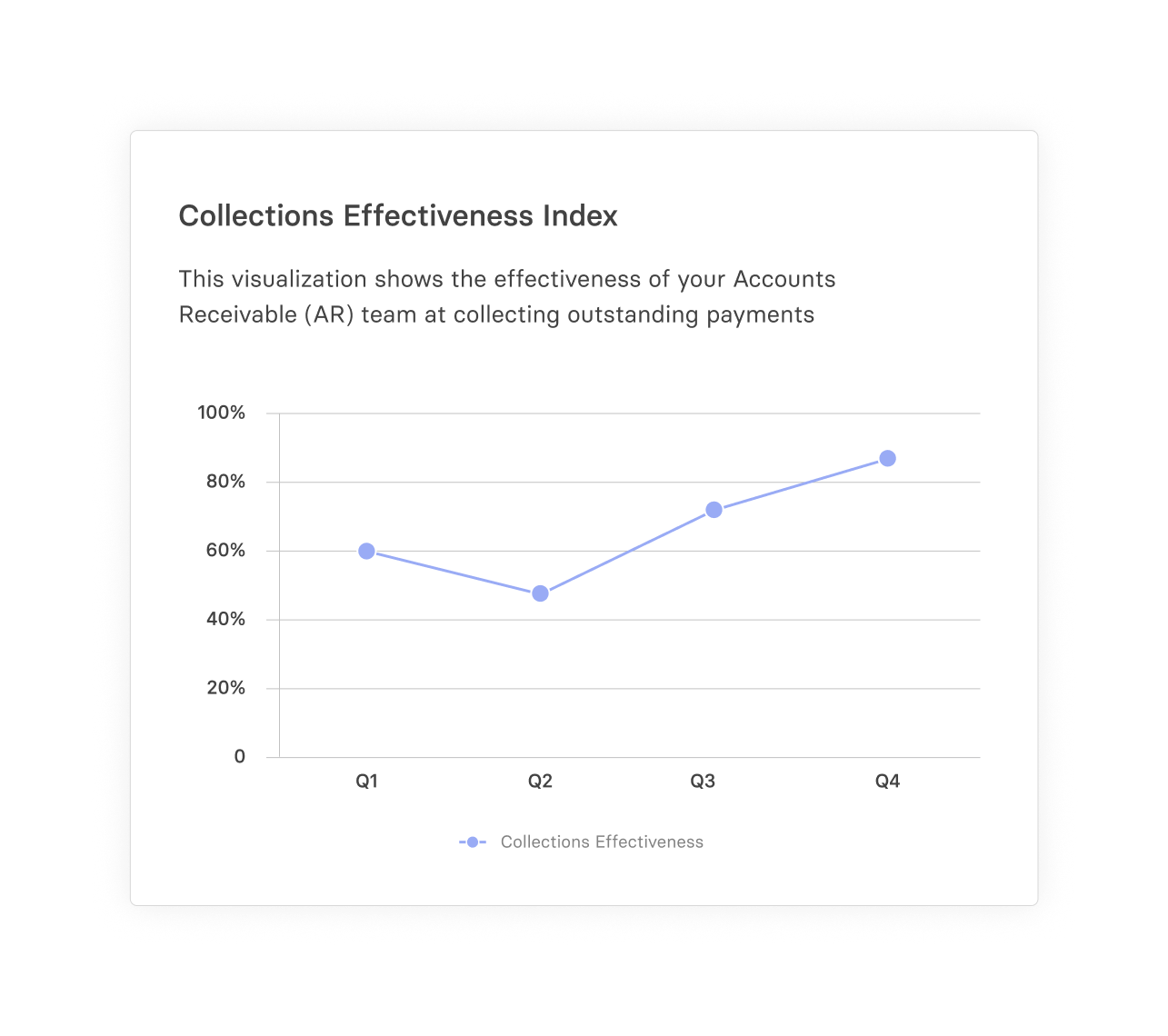

Collections Effectiveness Index

What is the Collections Effectiveness Index?

Collections Effectiveness Index (CEI) evaluates the effectiveness of your Accounts Receivable (AR) team at collecting outstanding payments.

A greater CEI indicates better performance by your collections team. So, maximizing the CEI is in your company’s best interests. Some strategies to achieve that include accurate invoicing, clear communication with debtors, and persistent follow-ups.

Categories

As SaaS companies typically rely on a subscription-based revenue model, the efficiency of collections is absolutely crucial. Here’s why: In most cases, the CEI indicates the company’s ability to stay financially afloat, so a higher CEI is a positive sign.

The stakes are especially higher for fast-growth SaaS companies with aggressive expansion plans, as it makes them particularly sensitive to the fluidity of cash flow. Any interruptions in converting sales into cash can derail these growth efforts.

There’s also more to CEI than meets the eye. When you zoom out, CEI reflects the overall health of your SaaS billing operations — the metric tracks the progress in every journey step, from when an invoice is generated to when payment is finally confirmed.

When leveraged correctly, CEI can spotlight the company’s strengths and pinpoint the areas where the billing process may need to be refined. In other words, a strong CEI ensures that subscription revenues — the foundation of the SaaS business model — are not at risk.

Table of Contents

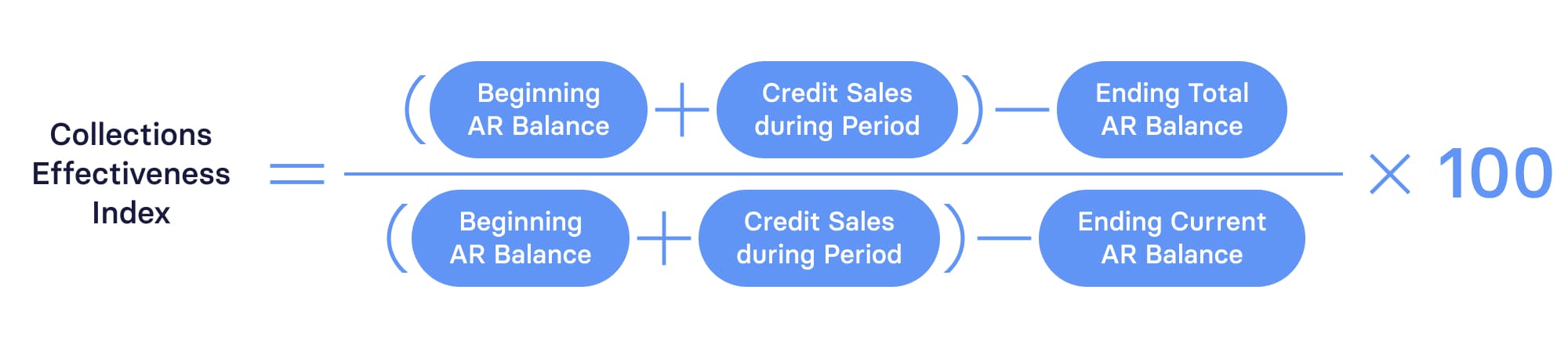

How To Calculate Collection Effectiveness Index

To calculate your collections effectiveness index, first you’d need to choose the period you want to evaluate, such as a month or a quarter.

Once you know the period you’re looking at, begin with the amount your customers owe at the start of the period — these are your beginning receivables. To this, add your credit sales, which are the value of subscriptions billed during the period. From this combined total amount, subtract the total outstanding receivables at the end of the period to learn the amount successfully collected.

Next, divide the number you just calculated by the total of beginning receivables plus credit sales, then subtract the ending current receivables. To find your CEI percentage, multiply the result by 100, which indicates the receivables collections efficiency.

Here’s how that looks as a formula:

Collections Effectiveness Index Formula

Collection Effectiveness Index (CEI)

0%

What’s a “Good” CEI?

Generally, the closer your CEI percentage is to 100%, the better the company is at collecting overdue payments. Often, a CEI lower than 80% can signal that you need to dig into your collections and billing processes.

Get the B2B SaaS Benchmarks Report

However, what’s considered as a good collection effectiveness index depends on several factors, such as the specific industry, the company’s billing practices, the payment terms, and the economic context. For instance, when the economy’s in flux, it’s common for customers to take longer to pay their invoices, which could impact the CEI. So, to accurately assess and interpret your collections process performance, consider the nuances influencing CEI in tandem.

Why CEI Is a Critical SaaS Metric

In SaaS, CEI directly measures the company’s ability to collect its earned revenues. As the industry is driven by subscription-based revenue models, consistent cash flow is everything to the business — it sustains operations and fuels growth.

CEI offers insight into how effectively a SaaS company converts its sales into actual cash, highlighting the efficiency of its billing and collections processes. When CEI is above 85%, it indicates a healthy cash flow, so the business has the funds to invest in other areas such as customer acquisition, product development, or market expansion.

On the flip side, a lower CEI may signal issues in billing or collections that need immediate attention to prevent cash flow disruptions. That’s why investors often glance at the CEI to gauge a company’s performance and determine if it’s worth investment, among other metrics.

4 Ways to Improve CEI

A healthy CEI means the company maintains a steady cash flow critical for operational stability and growth. It indicates efficient receivables collection, safeguarding against cash shortfalls that can stall expansion or other strategic initiatives.

Here are four ways you could improve your company’s CEI:

1. Tailor Your Credit Policy to Your Customer Base

Tailoring the company’s credit policy to fit the customer base significantly improves CEI — it aligns credit terms with customers’ payment abilities and habits. So, customizing credit policies encourages timely payments. For example, offer flexible payment terms to reliable customers or enforce stricter terms for those with late payment histories.

Through a targeted strategy, you can reduce the number of delinquent accounts, resulting in a better collections process and directly raising the CEI.

2. Use Invoice Management Software

Invoice management or SaaS billing software enhances a company’s CEI through invoice automation, ensuring accuracy and speeding up the billing cycle.

Reliable software tracks unpaid invoices right away, follows up as needed, sends timely payment reminders to customers, and simplifies the payment process — all contributing to more efficient collections and improved cash flow. The result? A higher CEI indicates a more successful receivables collection process.

3. Accept Payments in Multiple Mediums

Accepting payments through multiple mediums can improve CEI by making it easier and more convenient for customers to settle their invoices. Offering various payment options—such as credit cards, bank transfers, online payment platforms, or mobile payments—accommodates different customer preferences and reduces payment friction.

Depending on your industry, there are other benefits, too, from better conversions, lower abandoned carts, and broader demographic appeal to improved brand perception among customers.

Alternatively, syncing your invoices with customer’s payment cycles can be another way to encourage timely payments. In all cases, the increased convenience usually leads to faster payments and reduces the likelihood of overdue accounts, effectively boosting CEI.

4. Proactively Communicate Payment Policies With Your Customers

Proactively communicating payment policies with customers can improve CEI as you’ll set clear expectations regarding the timing and method of payments. When customers are well-informed about their payment obligations, due dates, and any penalties for late payments, they are more likely to pay on time.

Essentially, the clarity in communication helps minimize misunderstandings and disputes, leading to a more streamlined collections process and, ultimately, a higher CEI.

Comparing CEI with Day Sales Outstanding (DSO)

Day Sales Outstanding (DSO) is a metric similar to CEI — it calculates the average time it takes for a company to collect payment following a sale, giving insight into the collections process.

DSO and CEI are valuable metrics in analyzing a company’s accounts receivable performance, but they serve different purposes. DSO gives you a quick read on how fast a company turns credit sales into cash. But, the metric can be skewed by sales cycles and doesn’t focus specifically on the collection process.

Conversely, CEI gives you clear insight into the collection team’s success in securing revenue owed, with adjustments based on the sales volume. It’s a more complex metric and less commonly used than DSO, potentially making comparisons and broader financial assessments more challenging.

When to Use CEI Versus DSO

While both CEI and DSO evaluate a company’s receivables collections process, there is a subtle difference. A company’s CEI percentage indicates how much receivables have been collected. In contrast, DSO shows how many days, on average, those collections take. Put simply, CEI measures effectiveness, whereas DSO evaluates efficiency and speed.

A good rule of thumb is to use CEI when you’re focused on improving the internal collections process and want to track progress over time. On the other hand, track DSO when you want a high-level view of cash flow trends, you’re looking to compare against industry benchmarks or to analyze the impact of credit policies on company finances.

How to Use Both Effectively

DSO and CEI have their uses, so leverage them in tandem for a comprehensive understanding of your accounts receivable performance. By analyzing both metrics together, you can spot whether cash flow issues are due to credit policies or specific collection practices. This way, your financial strategy can be more nuanced, either through broad credit policy adjustments or targeted process improvements.

Emerge Saves $1.2M With Financial Insights From Mosaic

While visibility into metrics like CEI and DSO is great, ultimately, the real value surfaces when you dig deep into the numbers and gain complete visibility into your spending to quickly spot opportunities to improve operational efficiency.

Take it from Emerge, a company at the forefront of reinventing freight procurement within the $800 billion trucking industry. In 2022, Emerge, like other global companies, sensed an economic slowdown and recognized the need to pivot from a hyper-growth strategy to one of smart growth. But to do that, the company’s finance team needed better visibility into its data in NetSuite, specifically a way to easily visualize business and financial performance without spending long hours buried in Excel spreadsheets.

That’s where Mosaic stepped in. As a strategic finance platform, Mosaic granted Emerge instant, detailed insight into its financial health, all without the finance team having to dedicate hours to manually collecting or cleaning data or navigating complex spreadsheets. Additionally, Mosaic offered immediate, clear data visualizations, making it easy to analyze and interpret the gathered data — supporting better forecasting.

“It was a pain before Mosaic,” said Christopher Decker, senior finance manager at Emerge. “It used to be a very manual process. Now, we just show Mosaic and it’s all right there. And the expectation is that department heads will start using Mosaic to see budget overages, see where they can save, and get those insights on their own rather than coming to finance.”

Through Mosaic, Emerge began to analyze spending by vendor and collaborated with the business to pinpoint possible cost reductions. Thanks to the level of transparency offered by our platform, the company audited its tech expenses and identified $100,000 in savings per month or $1.2M annually.

Discover how Mosaic can transform your financial visibility and drive substantial savings for your business— request a demo today.

Collections Effectiveness Index FAQs

Why is CEI important for SaaS companies specifically?

CEI is crucial for SaaS companies as it measures their effectiveness in turning billed subscriptions into cash, directly influencing cash flow and enabling sustainable growth.

What is a collections effectiveness rate?

What if my CEI is significantly lower than industry standards?

Explore Related Metrics

Own the of your business.