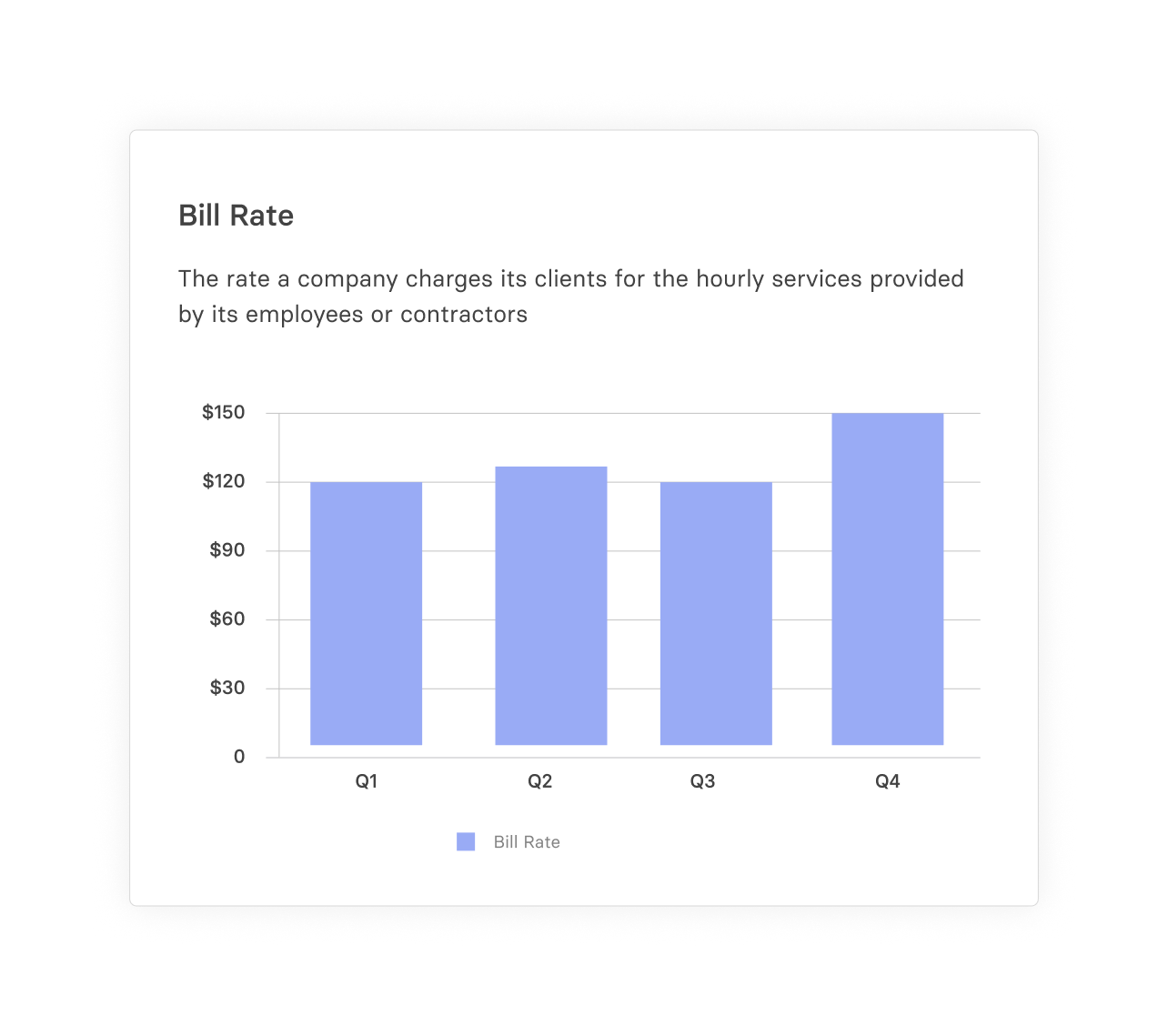

Bill Rate

What is Bill Rate?

Bill rate is the hourly rate your company charges clients for services. For professional service companies, in particular, the bill rate ensures your services are priced competitively and sets the foundation for how much money your company generates, thereby directly influencing profitability.

Categories

Table of Contents

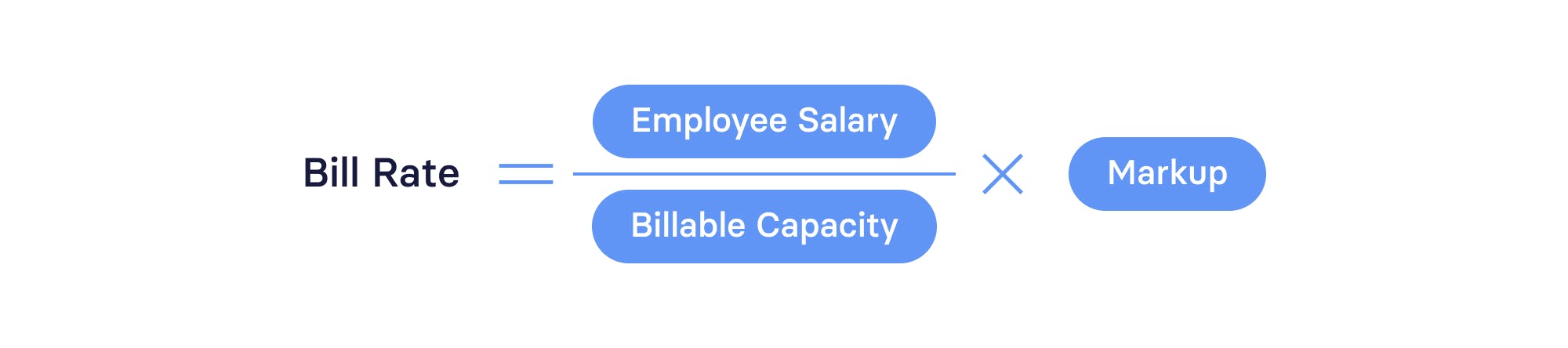

How to Calculate Bill Rate

Your bill rate helps ensure your services are priced correctly. To secure a healthy profit margin for the work you do, you must set your bill rate above the actual cost of delivering those services. Let’s break down the formula:

Let’s say you have an employee earning an annual salary of $90,000, and they’re working 40 billable hours a week, which adds up to 2080 hours over the year. In this case, their hourly salary works out to $43.2. Now, if you want to figure out what to charge your clients (your bill rate), you’ll need to cover all the employment costs for this person and hit your targeted profit margin. So, assuming you’re aiming for a 60% margin on the employee’s hourly rate, you’d use a multiplier (markup) of 1.6.

Here’s how you’d go about calculating that bill rate:

Bill Rate = ($90,000 / 2080) * 1.6 = $69.12 per hour

To achieve your profit margins, you’d need to charge clients an hourly bill rate of $69.12 for the employee’s time spent on the project.

That said, although there isn’t a universal profit margin that fits every situation, various factors such as location, industry, project duration, and employee experience all play a role in determining the appropriate multiplier and, by extension, bill rate for your company. For professional service companies, markups can vary greatly from 1.5 to 4X and employees hourly salary.

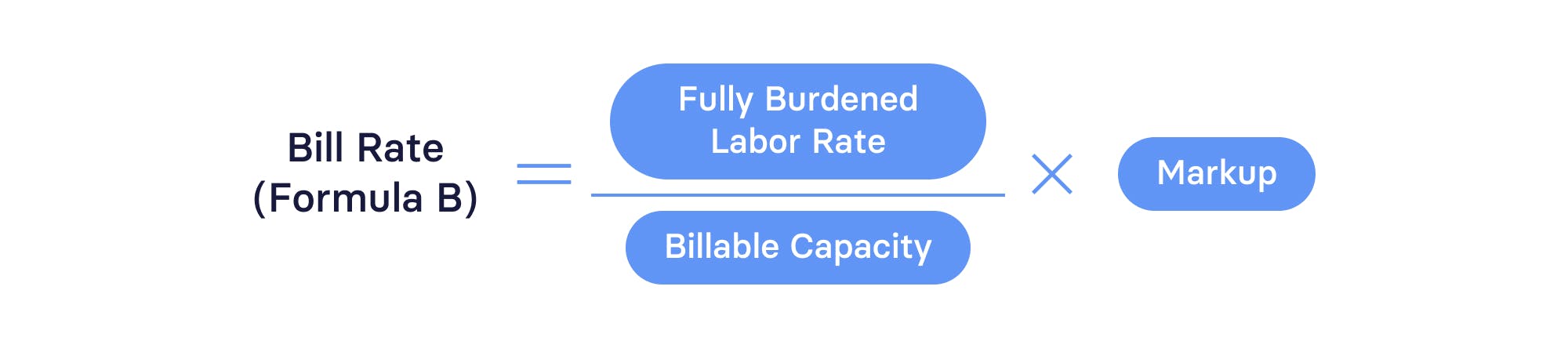

It’s also important to consider an employee’s cost rate when setting your bill rates. Employees’ fully burdened labor rate or labor cost can be significantly higher than their base salary, so some companies use the following formula to determine their bill rate and ensure they’re making enough profit margin to sustain a healthy business.

So, if the employee from our previous example has a base salary of $90,000 but a fully burdened cost of $126,000 with benefits, bonuses, etc., and they work 40 billable hours per week (or 2080 hours per year), their hourly cost comes out to $60.57. So, if you wanted to maintain a 60% margin, you’d calculate your bill rate as follows:

Bill Rate = ($126,000 / 2080) * 1.6 = $96.92 per hour

The final piece of the bill rate puzzle is figuring out how much of different employees’ time will be required for different projects. A senior consultant is going to have a higher cost rate than a junior contributor at the same agency or firm. So, you’ll likely need to calculate bill rates for multiple employees and then figure out how much time each level of employee will contribute to a project before setting a bill rate for a client, especially if you charge on a per project basis.

Impact of Remote Work on Bill Rate

The shift towards remote work in recent years has significantly impacted bill rates across many industries, mostly due to changes in overhead costs and the diversity of talent.

For instance, with employees working remotely, you can reduce or eliminate costs associated with maintaining physical office spaces, such as rent, utilities, and office supplies. This reduction allows you to pass on the cost savings to your clients and set a more competitive bill rate — without compromising the profit margin.

Remote work can also open the talent pool to more diverse candidates without geographical restrictions. As you hire more highly skilled workers, your company gains a competitive edge, allowing you to adjust the bill rate accordingly, i.e., set a higher bill rate for better quality work.

In the end, from a financial perspective, remote work can boost your bottom line by reducing overhead.

Navigating Challenges in Bill Rate Management

When managing bill rates, you’re usually juggling two priorities: staying competitive and ensuring profitability — and there can be a few curveballs along the way.

One of the trickiest aspects of managing your bill rate is navigating client negotiations. Clients typically look for the best value, which often means the lowest price. Naturally, this puts pressure on you to justify your company’s rates or concede to lower ones. In an ideal scenario, you wouldn’t have to undercut your own margins to win clients over, but that’s not always the reality.

Moreover, market fluctuations add another layer of complexity. If demand for your company’s services changes or new competitors enter the market, you might have to adjust the bill rate or offer discounts to stay relevant. At the same time, you should avoid alienating existing clients or diminishing the perceived value of your services. Also, when you actually decide to change the bill rate, you have to get your team on board to support the new pricing strategy.

As you can see, navigating bill rates is a delicate, challenging balancing act.

7 Tips to Optimize Your Bill Rate

Getting your bill rates right is critical to boosting your company’s profits and standing out in a crowded market. Below, we’ve shared a few tips to help you optimize your bill rate:

- Start by comparing your rates with what’s out there, whether it’s industry benchmarks or what your competitors are charging. Research the going market rates for similar roles, skills, and experience levels in your industry and geographic location. This way, you have a competitive baseline to set your bill rate against. Once you have that benchmark, you can ensure you’re offering value to your clients without shortchanging your services.

- To increase your profit margin, embrace dynamic pricing, i.e., adjust your bill rate to suit each unique situation. Before deciding the bill rate, account for market demand, competition, project duration, required skill set, and urgency of the project. Being agile can help you stay competitive during changing market conditions without reducing profits.

- Also, consider differential pricing based on client segments or project types. For instance, more flexible pricing could be applied to new clients or less critical services, while premium rates could be reserved for high-demand services or established clients.

- Find the right balance when it comes to the seniority and expertise of employees involved with the account or project. Be realistic about how much of the work will be done by a senior employee, especially if you’re billing upfront or on a per-project basis. You don’t want to charge the junior employee’s bill rate for the senior employee’s time. You also want to include enough senior employee time and attention to ensure high-quality work.

- Lean into value-based pricing by setting your bill rate based on the perceived value of your services rather than just the delivery or project costs. When clients see the unique benefits you bring to the table, they’re generally willing to pay a premium. So, understand and articulate what makes your service valuable to clients. Is it saving them time? Improving their revenue? The clearer this is, the easier it is to justify higher rates.

- Consider transitioning to a remote or hybrid work setup, as it can significantly reduce your overhead costs — making it easier to adjust your bill rate while keeping overheads low.

- Revisit your pricing strategy regularly. Continuously monitor your costs, market rates, and operational efficiency. Based on your findings, be prepared to renegotiate vendor contracts or adjust your multipliers to maintain competitive and profitable bill rates over time.

Ultimately, there’s no catch-all strategy to optimize your bill rate. It’s about finding what works best for your company and your clients. So, keep tweaking and testing your pricing strategy until you find your perfect rate.

Role of Technology in Streamlining Bill Rate Management

You already know that in professional services, keeping an accurate track of time is vital to ensuring your company is compensated fairly. However, logging every billable minute spent on client projects is easier said than done, with some tasks inevitably slipping through the cracks.

This is where the right tools can really make a difference. For instance, software like ClickUp and Monday go beyond project management — they bring time tracking, project oversight, and resource management together under one roof. With this setup, your team can keep a close eye on their time, and you get a clearer view of their capacity, efficiency, and billable utilization rate. With these insights, you can adjust your bill rates to strike the right balance.

Integrating Bill Rate with Financial Planning and Analysis (FP&A)

Managing bill rates goes beyond putting a price on the time spent. Simply put, bill rate is at the heart of financial planning and analysis (FP&A) — it directly impacts budgeting, forecasting, and profitability, particularly for professional service companies. By getting your bill rate right, you can predict the amount of money that you expect to see in the future more accurately and gauge if your pricing strategy hits the mark or needs more work.

Get the Professional Services P&L Model Template

Tracking Bill Rates with Mosaic

Mosaic is a strategic finance platform, and integrates with your key systems and pulls in data from various sources in a central place — such as sales from your CRM, payroll details from HRIs. You can use Mosaic to track customer profitability and forecast and track margins by uploading bill rates and forecasting trends in business. With Mosaic, you’ll have better visibility into your company’s overall financial health and can make better business decisions that boost your bottom line.

In other words, Mosaic gives you real-time, reliable insights into your company’s financial performance, allowing you to remain agile and make decisions quickly.

Additionally, Mosaic makes it super easy to dive deeper into the data. You can tailor the financial dashboards to zoom in on the metrics that really matter to your company. Mosaic also turns those metrics into clear, attractive charts, making it super easy to share important information with your stakeholders. Armed with this knowledge, adjusting your pricing strategy — and by extension, your bill rate — becomes a whole lot easier.

In short, while Mosaic might not get into the weeds of bill rate, it gives you everything else you need to make sure you’re making smart decisions that facilitate healthy budgets, accurate forecasts, and, ultimately, higher profitability. In other words, Mosaic lets you see the whole picture and make informed, strategic calls that propel your company forward.

Request a personalized demo to find out how Mosaic can make your business better.

Bill Rate FAQs

How can finance teams effectively communicate changes in bill rates to clients?

Finance teams can effectively communicate changes in bill rates to clients by being transparent about the reasons behind the adjustments and surfacing the added value clients will receive. Also, notify your clients well ahead of the change and keep an open line of communication for questions.

Can Mosaic facilitate the tracking and analysis of bill rates?

What factors should influence bill rates for different consultants or contractors?

Explore Related Metrics

Own the of your business.