Billable Utilization Rate

What is Billable Utilization Rate?

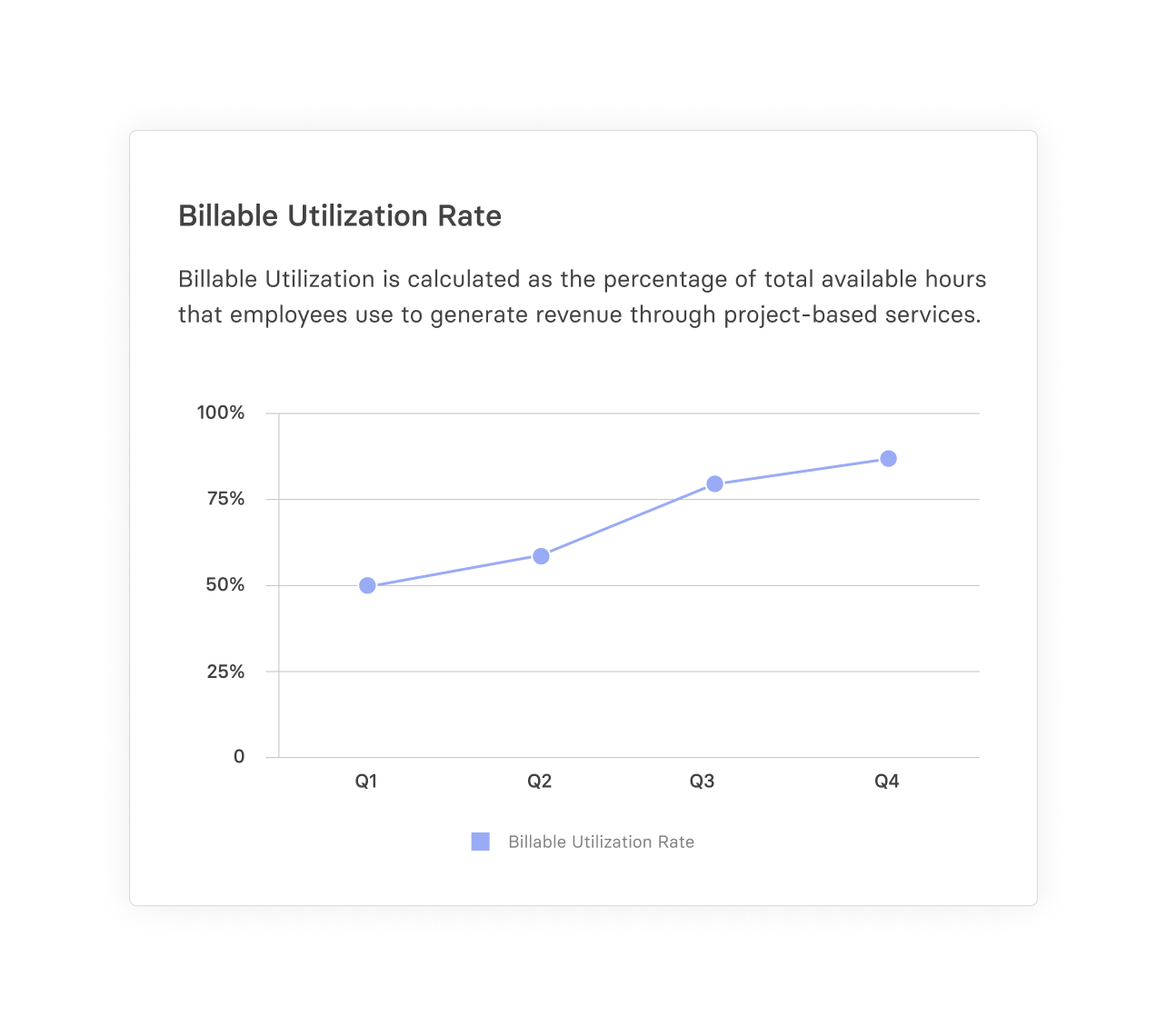

Billable utilization rate measures employees’ time spent on billable client work against their total time at work. As you can imagine, this metric directly impacts revenue, particularly for professional service firms, because when more hours are charged to the client, more money comes into the company.

Categories

Table of Contents

How To Calculate Billable Utilization Rate + Calculator

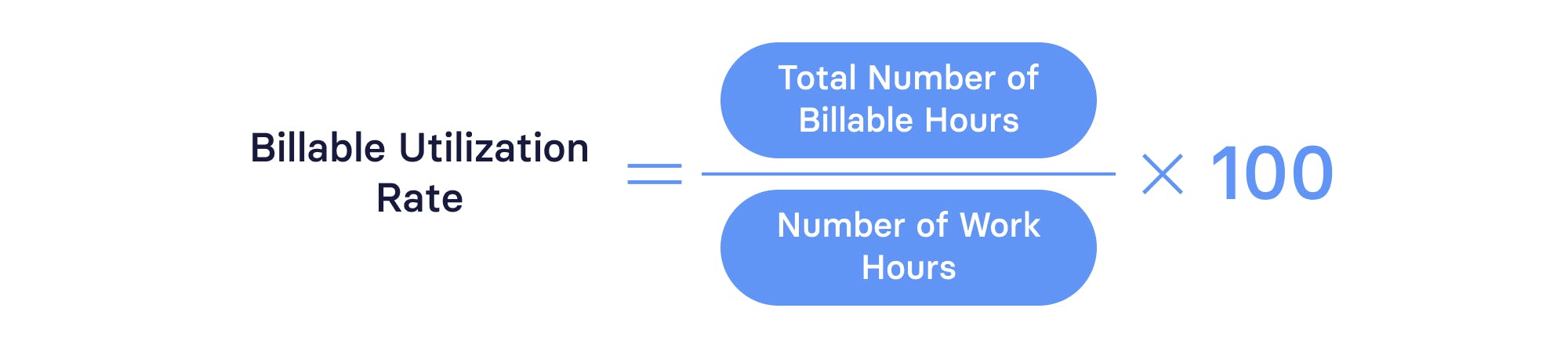

Calculating your billable utilization rate is pretty straightforward. Divide the number of billable hours of an employee by their total number of working hours for a given period, be it a week, month, quarter, or year. Then, multiply that number by 100 to get the percentage. Here’s a simplified billable utilization rate formula:

A high percentage indicates that most of the employee’s time was spent on work that can be charged to the client, which in turn translates to income for the company — that’s the ideal scenario. Conversely, a low percentage can indicate that most of the employee’s time is not spent on billable work, which could be due to a variety of reasons:

- The employee might not be in a client-focused role.

- The employee’s workload may not be balanced appropriately.

- The employee isn’t managing their time efficiently.

For instance, let’s say you have an employee in a law firm who works 40 hours a week but spends only 30 hours on client-related tasks. In that case, their billable utilization rate would be as follows:

Billable Utilization Rate = (30 Billable Hours / 40 Total Hours) x 100 = 75% Per Week

Depending on the specific role, the workload assigned, and the performance benchmarks you’ve established for employees — for client work and internal projects — this percentage may either meet your expectations or need to be improved to achieve the desired profit margins.

Billable Utilization Rate Calculator

Your Billable Utilization Rate

0%

Why Billable Utilization Rate Matters

From a financial perspective, professional service companies absolutely need to track employees’ billable utilization rate. This metric offers insights into revenue generation and operational efficiency. It can also guide your decisions around resource allocation, sales capacity planning, and bill rate, among others.

Think about it this way: In a company where people’s skills or labor are the main product — such as consulting, legal, or marketing services — billable utilization is fundamentally linked to revenue generation, particularly when the revenue model relies on hourly rates. In that scenario, a higher utilization rate means a large number of employee hours can be charged to clients, translating directly into more money for the business.

Get the Professional Services P&L Model Template

Additionally, by efficiently managing employees’ work hours and maximizing the time they spend on billable tasks, your company can more effectively cover its costs and boost profit margins without necessarily increasing rates, workload, or headcount.

That said, overutilization, i.e., a too-high percentage, could indicate that employees are overworking, resulting in burnout or subpar performance. In the long run, overutilization can also cause employee turnover and hinder business growth. That’s why it’s important to aim for the sweet spot where billable utilization is neither too high nor too low and balances profitability, employee needs, and work quality equally.

For most companies, an ideal utilization rate would be between 70% and 80%. However, individuals in leadership positions typically spend less time on billable client work (between 30% and 70%) as they are focused on high-impact strategic work that grows the business. Depending on your industry and the employees’ positions and responsibilities, your benchmark for the billable utilization rate may look different.

3 Ways to Optimize Billable Utilization Rate

Clearly, billable utilization rate is an essential financial metric for professional service companies. But how can you ensure your company achieves a healthy percentage? Below, we suggest three ways to get started on the right foot.

1. Set Realistic Utilization Targets

Of course, before you begin calculating or tracking billable utilization rate, you need to know your north star. What does a healthy utilization rate look like for your company? Consider the industry benchmarks, the nature of work, the number of clients you have, and the team members assigned to the job. What does high productivity look like? How can you adjust existing project management processes or workflows to get there?

With that in mind, set an ambitious yet achievable utilization target that will push your company forward in terms of profitability and scalability, but that doesn’t ask too much of your employees. This way, you’ll set your company up for success.

2. Track Hours Diligently in Real-Time

Your employees’ billable utilization is only as good as the time tracked — it needs to be accurate and consistent. In professional services, the hours spent on client work determine the company’s ability to stay afloat financially and, eventually, thrive.

So, invest in reliable time-tracking software that streamlines time entry and makes it easy for employees to log their hours, even when context-switching between numerous tasks. Also, check timesheets to see if employees have logged their billable hours before the end of the week, month, or quarter. This way, you can catch any issues before or as they happen. Ultimately, when your company has a good time tracking hygiene, you can focus on other strategies to boost your employees’ billable utilization rate.

3. Allocate Resources Smartly

Make sure your company has sufficient resources to take on new client work to avoid overusing existing employees. Also, plan for busy periods ahead of time so there’s no gap between billable projects. This way, you’ll make the most of your employees’ time at work and space out client projects rather than seeing a sudden rise in billable utilization rate or a steep drop when there’s not as much work.

Additionally, it will help if you assign low-impact administrative tasks to employees whose hourly rate isn’t expensive. This frees up skilled employees (with high hourly rates) to tackle strategic client work. This approach will also help ensure high quality of work while clients get charged appropriately based on the nature of the task. It also distributes client work more evenly across your employees, reducing idle time, giving you a realistic sense of employees’ available time for project or resource planning.

If your company doesn’t have employees with a diverse range of skills, it’s important to upskill them. Although this might lead to them spending more time on non-billable work, you’ll see the benefits in the long term, as employees will be able to work more efficiently as they build new skills.

Integrating Billable Utilization with FP&A Tools

From a financial perspective, it’s essential to review billable utilization rate frequently. By closely monitoring this metric, you can identify trends, patterns, and areas for improvement. Ultimately, these insights help you make informed decisions — about processes, training needs, or strategic changes — to boost the bottom line.

A strategic finance platform like Mosaic makes this easier. Mosaic integrates with your ERP, CRM, HRIS, billing systems, data warehouses, and flat file upload to pull key data and consolidate it in a single source of truth. This way, you have the crucial financial insights you need to make financial decisions — exactly when you need them.

For instance, you can upload your employees’ time logs and leverage automation to calculate billable utilization rates, getting continuous, real-time insights to support forecasting. Moreover, you can weigh billable utilization rate against other critical financial metrics and create custom metrics in Mosaic’s Metric Builder to dig into what’s working within the company, what’s not, and why to make necessary changes to optimize the amount of time spent on client work versus non-billable tasks.

Customizable Dashboards and Reporting with Mosaic

Mosaic’s financial dashboards can be tailored to your company’s specific needs, making it easier to see billable utilization rate and other key metrics that impact your business. Mosaic presents these metrics in easy-to-understand, attractive visual charts so you can view and share what matters most to your stakeholders — easily and quickly.

Take the CFO dashboard, for example. It gives you an overview of efficiency metrics and financial information, opening up a higher-level view of the company’s growth trajectory.

And that just scratches the surface of what you can do with Mosaic. Simply put, Mosaic makes FP&A easier for finance folks and CEOs and propels your company forward.

If you’d like to see Mosaic in action, request a demo.

Billable Utilization Rate FAQs

What should I do if my team's billable utilization rate is consistently low?

If your team’s billable utilization rate keeps falling short, it’s time to investigate why. Identify and rectify the root causes, such as a lack of client work or inefficiencies, by acquiring more clients, reallocating resources, or enhancing operational efficiency. Additionally, invest in training and tools to increase your employees’ billable activities.

How often should I review billable utilization rate?

Can Mosaic's reporting features be tailored to track individual and team billable utilization rates?

Explore Related Metrics

Own the of your business.