Your budgeting process requires strong collaboration from department heads and executive leadership. Yet if you’re only going to each department once, asking them what they need, and simply saying, “Here you go” once you get executive approval, then you haven’t done enough testing around your top-line goal metrics.

If you want to pave a path toward sustainable growth, you need to embrace agility and proactivity — and one way to do that is through budget allocation. Running a budget variance analysis and rolling forecast helps you set baselines and growth goals, but these processes can still take weeks to gather and manipulate data from multiple departments and source systems.

Here, we explore how quarterly budget allocation creates a path for more agile, strategic planning and spend.

Table of Contents

What Are Budget Allocations?

Budget allocations refer to the amount of money each department receives from the general fund to execute their strategic plans. Budget allocation breaks department spend down into an approved maximum amount each department can spend per resource, whether it’s on software, contractor or freelance assistance, or ad spend for a marketing campaign.

The Importance of Allocating Budgets

You need to optimize operational efficiency metrics yet understand your constraints to ensure ample runway and team support as you track the company’s growth trajectory.

You dictate the company roadmap based on expected return on investment (ROI), which has to tie out at the department level. The R&D department is integral for Seed and Series A companies, yet once the product is ready to launch, you want to allocate budget to your sales and marketing teams. Once the budget goes toward sales and marketing, and you begin acquiring customers, you now have new constraints that impact your budget: your customer acquisition cost (CAC), CAC payback period, and your annual recurring revenue (ARR).

Budget allocation fuels overall efficiency, in that department leaders don’t need to ask for approval to expense individual tools, assign projects to freelancers, or add seats for software. By allocating budget to general categories, each department can cherry-pick when and how to apply the budget. Of course, departments need to ensure they use their budget. While saving money is generally seen as positive, departments may not receive the same budget allotment in the next cycle — which may be detrimental to department-level goals and planning.

If departments experience strain, such as requiring more seats on a specific tool or running into production issues, you run into employee retention issues that stem from operational efficiency and satisfaction. To hire more employees costs more, which digs into your runway. By keeping an eye on your goals and constraints, you can then proactively figure out where you’ll get the highest ROI.

How to Optimize Budget Allocations in 6 Steps

Knowing your startup costs (for each employee and desk space), fixed costs, and variable costs and how they impact your total budget is one thing — but to optimize budget management and allocation requires ample cross-collaboration to keep goals top of mind and realistic.

Your budget allocation strategy will depend on your industry, your growth stage, and overall macroeconomic environment. But here’s how you can optimize your budget allocation with more strategic and agile decision-making from everyone involved regardless of stage.

1. Set Company Goals and Priorities

While knowing your total budget is technically the first step, the real strategic insights begin with a simple question: What are your North Star metrics?

Naming your company goals and priorities is the key to driving how you think about and create departmental budgets across the company.

In ideal market conditions, many executive leaders say that their top priority is to grow at all costs. Yet during a market downturn, priorities shift toward keeping a closer eye on burn and preserving runway. Depending on how those priorities shake out, there’s two ways to approach budgeting:

- Growth goals: A focus on growth goals requires high confidence in achieving them. Your growth goal is the starting point, then you work backwards to allocate your budget to achieve that goal. A focus on top-line revenue growth leads to creating a sales and marketing budget around cost per lead and win rates/conversions. The question becomes “How much do I have to spend in order to get this growth goal?” which then spits out your sales and marketing budget.

- Capital efficiency: A more conservative approach begins by asking, “How much can I spend in order to only burn X number of dollars a month, or to make sure I have runway for 24 months into the future?” You can also focus on a certain set of unit economics, meaning you’d build your budget to hit a particular CAC number or set a payback period within a particular period of time.

Regardless of your approach, tying your budget back to goals (i.e. strategic budgeting) and target metrics is critical. If you believe growth goals are most important, for example, then your ROI on spending additional sales and marketing dollars could be higher than hiring a different engineer where you may have a longer-term payoff.

2. Set Your Constraints

Your goals establish whether you’re approaching budget allocations from a bottom-line or top-line growth perspective. Utilizing both allows you to gain a sense of customer retention (with your top line) alongside expenses (bottom line), which helps you strike the right balance or priorities. Applying constraints to your goals allows you to set realistic expectations.

Company-wide, you want to keep an eye on runway and burn multiple. Yet when diving deeper into department budgets, you’ll need to focus on different metrics. For example, CAC payback period impacts your sales and marketing budget.

Your CAC payback period sets a precedent for how long potential customers stay in the sales funnel. Incorporating sales funnel metrics into this equation provides invaluable insights — and setting constraints around your payback period requires sales and marketing to scrutinize and optimize these metrics within the funnel.

3. Check Your Goals Around Budget Allocation Benchmarks

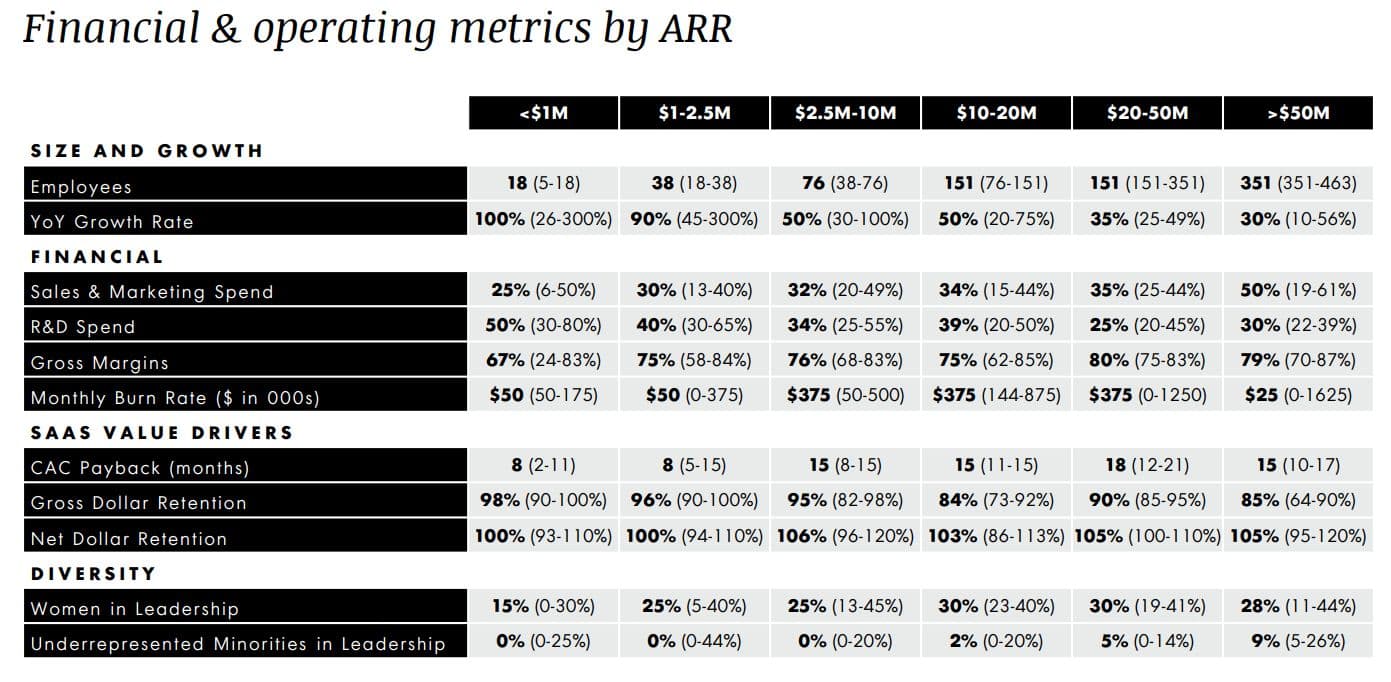

Your company’s growth stage impacts where your goals and constraints stay relevant and applicable to ensure strategic growth. OpenView runs a SaaS Benchmarks Survey that explores budgetary benchmarks in correlation with your growth stage. Here’s their chart from 2021:

OpenView SaaS Benchmarks Survey 2021 Results, courtesy of Curtis Townshend, Senior Director of Growth at OpenView.

The top row indicates the stage of the business per million dollar revenue. The numbers in bold represent a median, with percentages assigned for how much each company would allocate per category. For example, a company with $1-2.5 million in revenue would allocate 30% of their budget to sales and marketing and 40% in R&D, while aiming for 75% in gross margins.

While the above table does not mention a ratio for general and administrative costs, the standard spend for SaaS companies is about 10-12% of your total budget.

After you establish your goals and constraints to ensure financial efficiency, you can approach your budget and measure against these benchmarks.

4. Establish Your Headcount Plans

Headcount accounts for 70% of overall company spend in SaaS, and each department has different ROI.

Sales and marketing headcount should directly produce returns — but to drive the sales and marketing machine, you need to continuously spend. You need to ensure you have a strong control and understanding of your product-market fit to keep the engine running. If the company is not at the point of understanding the output of each dollar spent across the sales funnel, the budget should focus on product or internal system process data.

Work closely with human resources partners to decide how much to set aside for workforce growth in every department. Decide how many full-time hires you’ll need in the next budget year, where it might be appropriate to hire out to contractors, and where your stakeholders need the most help.

5. Conduct Scenario Planning with Mosaic

Optimizing budget allocation helps you optimize ROI of operational initiatives by forcing you to constantly check where you think you’ll get the most out of your dollars and how that spend relates to company-level goals.

Mosaic’s financial modeling and scenario planning tool integrates with your source systems to offer scenario analysis that elevates the strategy behind your budget allocation. Scenario analysis examples include looking at how cutting a fixed cost (like office space) impacts your runway, or how your product release plan may hinge on engineer headcount or come down to asking, “How much should you spend on ads to promote the product — and when?”

Being able to quickly see how adjustments to specific budgets affects your downstream metrics is extremely helpful. Mosaic syncs in real time so you can easily integrate your historical and actual data into your scenarios. If you want to see how increasing spend by $500,000 impacts your sales and marketing budget, you can simply apply the change in one model to see how it affects your CAC, CAC payback, burn multiple, and other key metrics.

You don’t need to build entirely new models or scenarios — instead, you can tweak your budget assumptions in different scenarios and see the immediate downstream effects on the metrics that you want to employ as your constraints.

Keep in mind that your strongest models align on two or three metrics: Too many inputs leads to an overlap in ideology, which causes clutter and slows you down.

6. Make Cross-Department Collaboration a One-Stop Shop

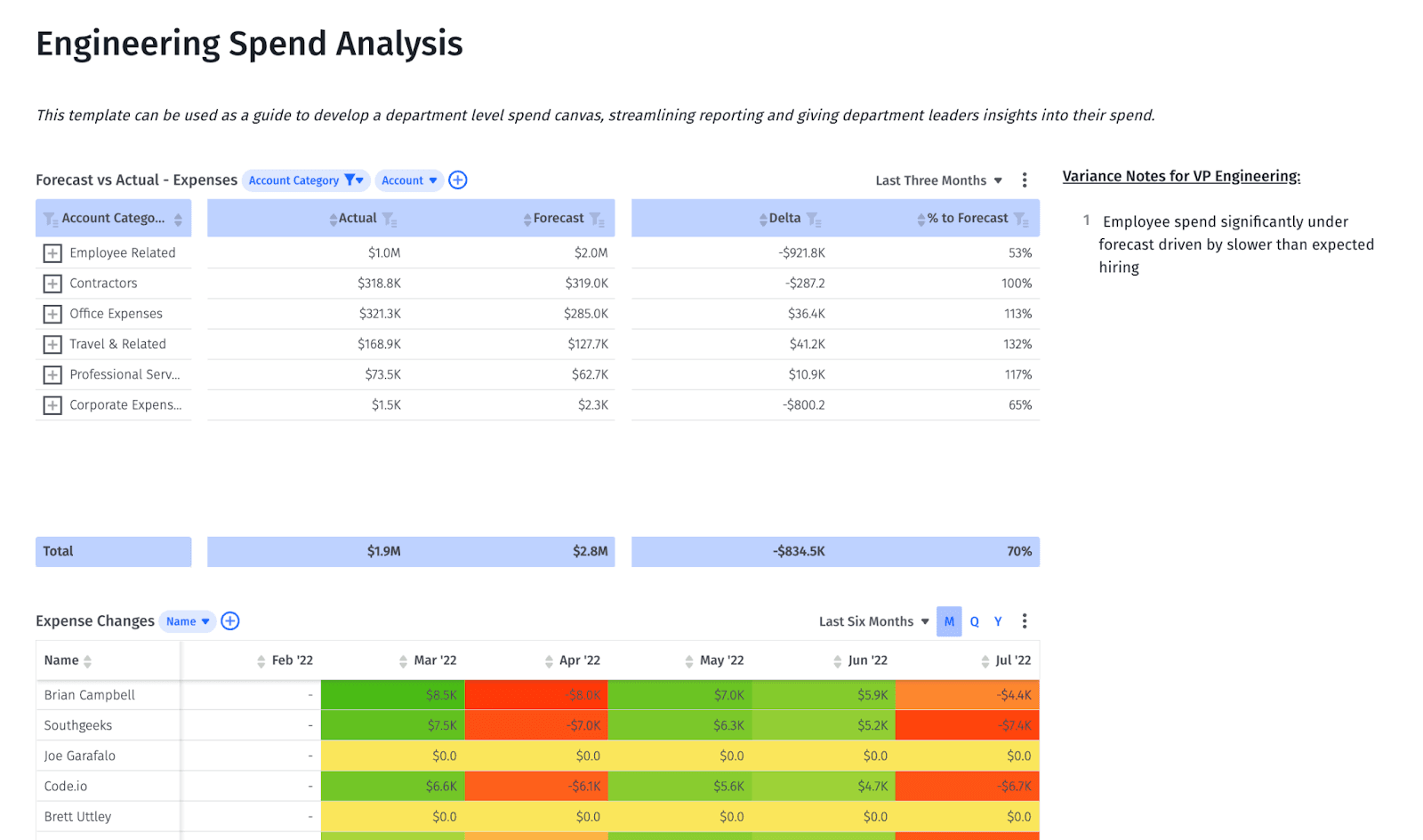

The budgeting process is notorious for multiple Excel sheets and communication across multiple emails or Zoom meetings. Mosaic allows you to create department-level dashboards that align leaders and give them one place to stay updated on budget allocation and spend.

Department leaders can look at a graph or table in Mosaic’s variance analysis software to see where their budget currently is and where it was spent. Mosaic can immediately generate a budget analysis that allows them to make strategic decisions on what they want to do with their remaining budget or where they need to cut back to hit their budget for the month or quarter.

Mosaic also allows reports to be easily accessible for department leaders. Since Mosaic offers real-time updates, finance teams can help establish one report that automatically updates so department leaders can make plans with actual numbers. This leads to not just saving time between going back and forth to establish numbers, but more proactive decision-making that keeps leader engagement high into understanding the “why” behind their budgeting line items.

When to Review Budget Allocations — And Why You’re Not Doing It Enough

A “one and done” annual budget process doesn’t work for high-growth companies. A more adaptable or flexible budget approach is essential, especially for those experiencing rapid changes. Keeping it to even twice a year causes everyone to miss out on key drivers for overall success. Proactive budget development should happen at least on a quarterly schedule, where you can change resource allocation based on historical data from the previous year to last quarter.

While establishing a quarterly financial plan review is good in practice, you also need to allow for some flexibility. Here are some other reasons to perform financial audits on budget allocation:

- Macroeconomic events. Anything from a market downturn or industry collapse signals immediate action. Budget allocation should transition into a monthly schedule to stay as ahead as possible.

- Not hitting topline goals. You may need to redistribute your budget to ensure you get as high of an ROI as possible. You may need to allocate more budget toward supporting sales and marketing than hiring another engineer, for example.

- Runway cost. If you predict that you’ll burn $5 million, but realize that headcount needs to increase in the second half of the year, you need to factor that cost in. You also need to keep track of your burn and when it occurs: If it increases from $2 to $3 million in one month due to headcount, you carry this cost throughout the rest of the year. You can then take budget away to make up the costs — it’s much harder to try and get the budget back once people start spending it.

- Capital efficiency metrics are off. Analyzing capital efficiency metrics like burn multiple on a regular basis can help you proactively address inefficiencies in the business. Drill down into your expenses and see how you can reevaluate spend.

Embrace a Smarter Way to Allocate Budgets with Mosaic

Mosaic offers preloaded, out-of-the-box metrics, templates, and dashboards that allow you to cut the budget allocation and planning process from two weeks to two days. Mosaic offers a SaaS acquisition metrics dashboard that considers CAC and CAC payback alongside other important metrics, like your SaaS magic number, to gain granular insights that craft your company’s growth narrative. You can also customize financial reports to include other key metrics, such as your burn multiple and runway, to help establish and keep your benchmarks in mind.

With Mosaic, budget planning can be a quicker, more collaborative, strategic process that keeps your company moving along toward its goals. Request a personalized demo today.

Give Department Leaders Deep Financial Insights for Better Budgeting

Budget allocation FAQs

Why is budget allocation important?

Understanding your budget allocations and appropriations can help your company maximize ROI. Knowing where your money goes ahead of time reduces discretionary spending and leaves a strategic roadmap for spending and expenditures. And, since this is done ahead of time, departments can run more efficiently on their allocated budget.

What is an example of a budget allocation?

What is the best way to allocate your budget?

Own the of your business.