Finance teams have an incredible vantage point within the business. They analyze historical data to provide insight that impacts decisions regarding the business’ future. But the processes to retrieve the data remain stuck in a rut.

It’s easy for finance to get caught up in doing “the same as last year” and reporting requirements put teams in vicious, backward-looking cycle. But if a process works, why fix it?

Because executive leaders strive not just to make decisions, but better decisions that optimize growth potential.

And the way to get there is for finance to have more time for strategic tasks, versus digging through Excel sheets and financial files to ensure relevant, dependable data is ready for real-time decisions.

You need finance automation to gain more time and take your business from simply making financial decisions to embracing strategic finance.

Table of Contents

What Is Finance Automation?

Finance automation is the process of implementing different types of technology to get repetitive tasks done without the need for manual work from your team. In many cases, automating finance workflows means implementing software driven by artificial intelligence (AI), robotic process automation (RPA), intelligent automation, machine learning, and any number of integrations with your systems of record.

This doesn’t mean that humans are out of any system or process, of course. As Gem Controller Temi Vasco noted in an episode of The Role Forward podcast, “The bots can do the grunt work, but you’re still going to need someone that’s going to look at all those exception items and make decisions.”

Why Finance Automation Is Important for CFOs

While part of finance’s job is to get a handle on the historical data, the role continues to shift from backward-looking scorekeeper to forward-looking strategic partner.

The fastest route to the future of finance lies in finance automation—which relies on ensuring finance leaders are equipped with the right tools and data to make the best decisions possible.

Improves the Trust in Numbers

Reporting needs to be timely. When a process like the month-end close takes two to three weeks to complete (according to 50% of companies), the business is stuck waiting for insights to come through. And even when you do finish manual reporting, the outputs can be fallible to human error, which means it might take weeks to course-correct.

Automating data collection means that your team doesn’t have to manually input anything, which reduces human error and eliminates the potential for miscalculations.

Makes Finance a More Collaborative Partner

When finance reports on and forecasts departmental spend and needs, they need to translate the spreadsheet into a language each department lead understands.

Automation gives time back to finance to get out of their spreadsheets and visualize data for non-finance stakeholders. That might mean something as simple as creating a timeline for updates. Or, it might mean delivering your own feedback items in prose rather than in charts and tables.

Giving department leads easier access to the numbers improves engagement and facilitates a more collaborative relationship between you and your partners.

Makes the Finance Function More Scalable

In the past, the only way to scale finance’s output was to add headcount. Automated tools make it easier for startups, smaller companies, and high-growth organizations to achieve the finance capabilities of much larger organizations without needing a massive team of finance professionals.

You never want to reactively hire because you’ll never actually get ahead of your challenges. As your business grows, the issues can compound. But they don’t have to if you hire proactively or embrace automation.

Automation technologies empower the finance organization to save time with manual tasks while also forecasting growth opportunities. And through your team’s findings, they can create models for more accurate financial planning by crafting multiple scenario analysis examples.

Reduces Finance’s Need for a Technical Skill Set

The evolution of the finance department has trended toward an increasingly technical position. There’s a need for code to connect disparate data sets to embrace the strategy part of reporting: crafting a narrative from the numbers.

Automation takes care of the technical work, which frees finance up to focus on storytelling in a powerful way. Automation isn’t just a smart strategy, either. It’s an approach to finance function transformation that fosters a growth mindset, where finance proactively engages with the data and empowers department and executive leadership to do the same.

What Finance Processes Can Be Automated?

Finance has rhythms of operation, where particular tasks must be completed within strict timeframes. When executive leaders need urgent information, they can’t wait for finance to go through long reporting cycles to get answers.

Automation is the only way to get to the point where data is available in real time. But which processes should you automate? The three points to consider for automating a process are:

- Is it repetitive? Do you do the same steps over and over? And if not for the entire process, what about part of it?

- Does it require structure? Every change finance makes has to be somewhat auditable: You need to follow the breadcrumbs back to the beginning, which leads to a defined path of how we got from one point to another.

- Is it everybody’s problem? Finance is the foundation of a business’ growth and stability, so finance needs to be able to share information, whether it’s for individual department headcount planning or board members curious about overall cash flow analysis for the quarter.

A process that satisfies all of these criteria is good to automate. There will always be bespoke business processes in an organization that you can’t automate. But if you follow these three criteria, you’ll be able to streamline tasks that typically require manual human intervention and free up a significant amount of working hours for your team every month.

6 Examples of Financial Processes to Automate

While you may not be able to automate every process, there’s plenty of low-hanging fruit for finance teams to get out of manual workflows. While you may not be able to automate an entire process, you can most likely find one or more steps that would benefit from automation.

1. Expense Reports

Individual purchases happen across the company every day. Instead of relying on finance to log every expense, employees can log their expenses through an app or system that aggregates the data into the expense report. While there will still be human oversight with approvals, you can require expenses (like travel) to be logged by a certain date for reimbursement.

2. Spend Management

Knowing how your business spends its money provides deeper insight into what tools, systems, and processes are in place to complete day-to-day tasks. With automation, you can filter spend into categories and notice any discrepancies (like paying for a tool that barely gets used). You can also automate invoice processing and payments, which eliminates the manual labor and frees up time for oversight.

3. Data Collection and Aggregation

Because businesses now run on dozens of different SaaS tools, financial data is scattered across your organization. The sheer amount of time and effort necessary to aggregate it, clean it, and organize it all for reporting can set your team back days or even weeks.

Automating data collection and organization through integrations with critical systems of record reduces the potential for human error, keeps your team from having to hard code everything in spreadsheets, and helps you report on the numbers faster.

4. Data Visualization

Finance teams should be focused on telling the story behind their numbers—not tinkering with charts and graphs in slide decks trying to design executive presentations. Moving away from basic Excel-generated graphs to automated platforms that deliver powerful, flexible charts is crucial.

With the right financial business intelligence tool, you can build financial dashboards and quickly format them for both high-level visibility for board members and executive leadership and granular visibility necessary for accurate department planning and financial reporting.

5. Month-End Close

The month-end close process is repetitive and structured: It occurs 12 times throughout the year and your finance team knows what to look for. Automating steps of the bookkeeping process, such as emailing invoice reminders to vendors or aggregating accruals and account payables, allows finance to enhance transparency and get to follow-up conversations faster, which speeds up the overall process.

6. Board Reporting

Board reports are check-in points for your business’ narrative of where it stood, where it currently stands, and whether it’s on track toward its goals. It’s a valuable time to get strategic input from investors about growing your business. But it’s also stressful, forcing finance teams to spend weeks preparing materials to create a perfect board deck.

Automate board reporting by maintaining real-time visibility into the numbers and streamlining data visualization. With the information already set, board reporting software can help finance determine the narrative behind the numbers and work with executives to nail it down faster.

Finance Automation Software for Your Core Tasks

The road to finance automation is paved by software. Any automation solutions your team engages with shouldn’t present a large learning curve—rather, the ease of implementation, ramp, and use needs to empower finance with more time to embrace their position as strategic contributors at the business decision-making table.

The list below highlights software that can be used for core finance tasks.

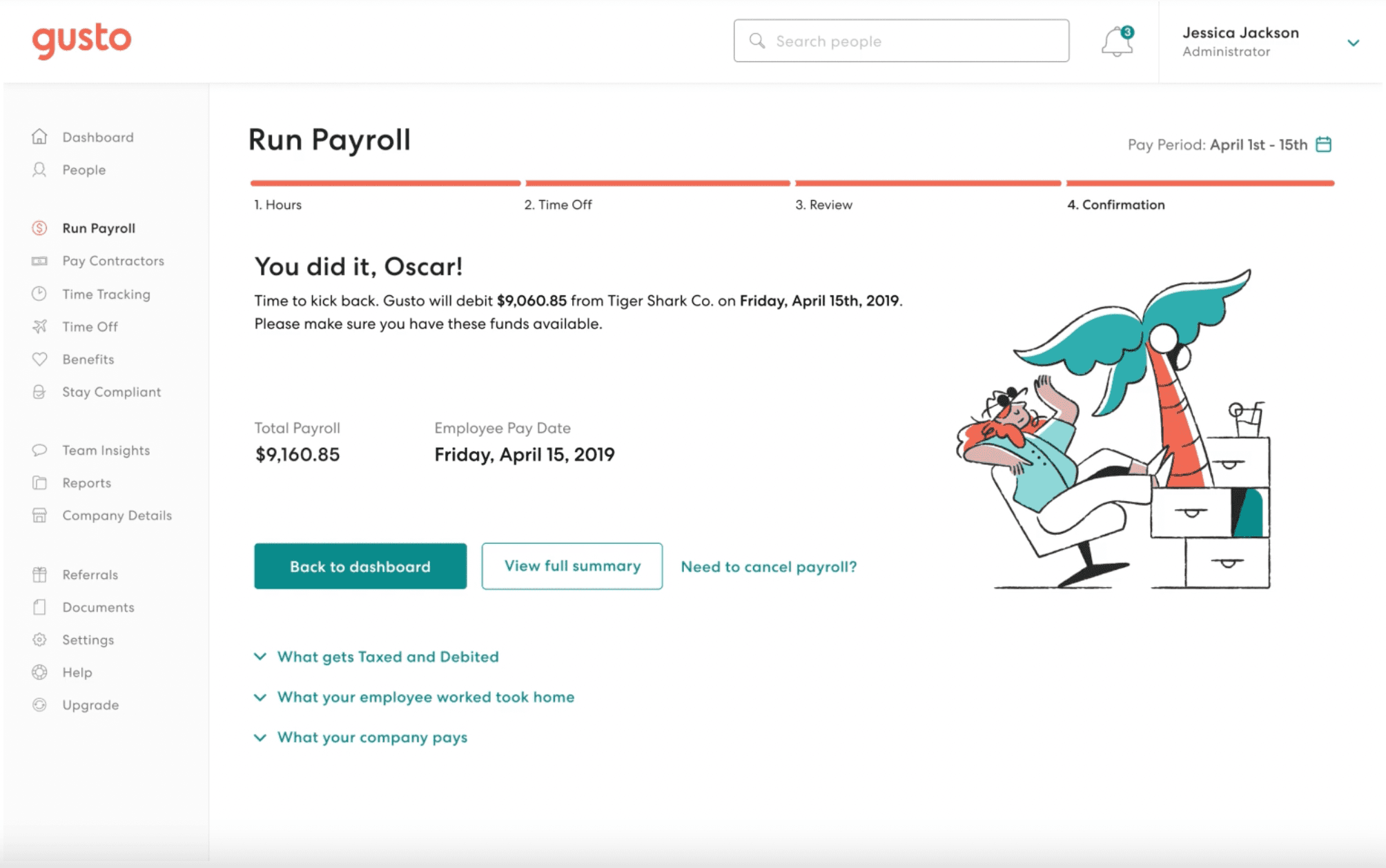

Gusto: Payroll Automation

Gusto customers report that using the company’s full-service payroll offering has made running payroll a 13-minute process. Gusto automatically updates for any state tax changes and aggregates payroll data (such as hours worked, salary, lunch breaks, etc.) so finance can easily review, correct, add in commissions or overtime, and approve it for payday.

Chargebee: Billing

Billing can happen every day, depending on your client contracts. Whether you charge clients on specific dates, annually, monthly, or even need to fluctuate costs based on usage, Chargebee automates billing to ensure minimal error and full transparency for your business and your clients.

SaaSOptics: Revenue Recognition

Managing revenue in spreadsheets might work well when you have a handful of clients. But as you scale, those spreadsheets start to break and manual data entry becomes a bottleneck that is unmanageable.

Revenue recognition tools like SaaSOptics connect to your CRM setup and ERP to sync contract data and automatically generate revenue schedules so you don’t have to waste time in spreadsheets.

Spreadsheets work well when there are a handful of clients—but scaling will happen, and that’s when spreadsheets are susceptible to errors, which cascades the inaccuracy of your data and can harm the business’ valuation. Automation plays a significant role in SaaSOptics’ revenue recognition capabilities, where data collection and aggregation enable high-level and granular reporting for whoever needs to see where it’s coming from.

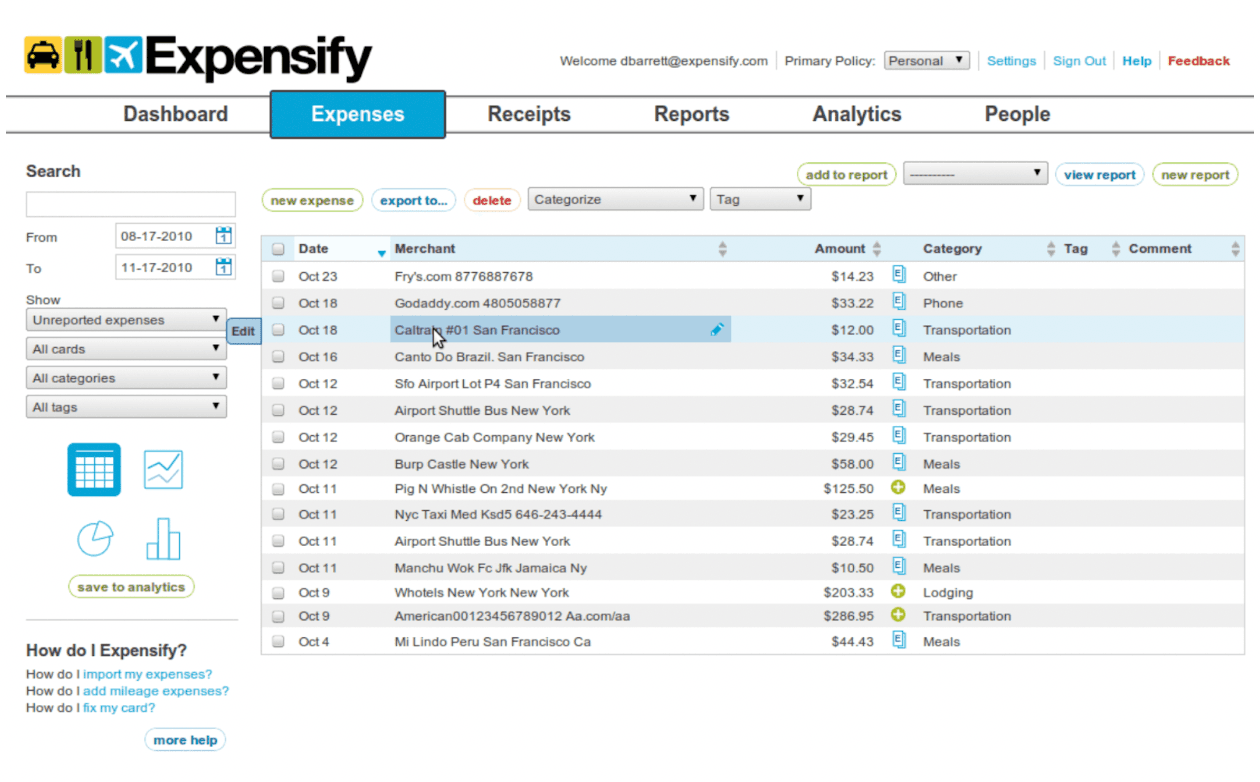

Expensify: Expense Reports

Expensify provides an easy-to-use interface that makes expense tracking and reporting a breeze, whether it’s a receipt that needs scanning or aggregating reimbursement requests.

Ramp and Airbase: Spend Management

Spend management requires multiple eyes and ears, which makes it ripe for collaboration between finance and department leaders. Automating spend management reduces overspending, from software to travel, while also easing up manual processes, such as setting up payment and processing invoices.

Spend management review is engrained with multiple processes. Depending on the size of your business and your software needs, there are three leading tools you could choose from:

- Ramp offers virtual or physical credit cards, where you can set spending limits. Ramp automates receipt delivery and categorization for any purchase when you import your chart of accounts structure.

- Airbase automates workflows for all spend and reimbursement requests, alongside creating bills and other documentation for any reporting or auditing needs.

FloQast: Month-End Close Workflow

The month-end close is another modern finance function that comprises multiple steps and processes. Its repetitive steps and structure make it prime for automation.

FloQast is one automation platform that covers a wide range of accounting processes, including workflows for accounts receivable, accounts payable, and general ledger account reconciliation, limiting the manual data entry needed to create journal entries during the financial close process.

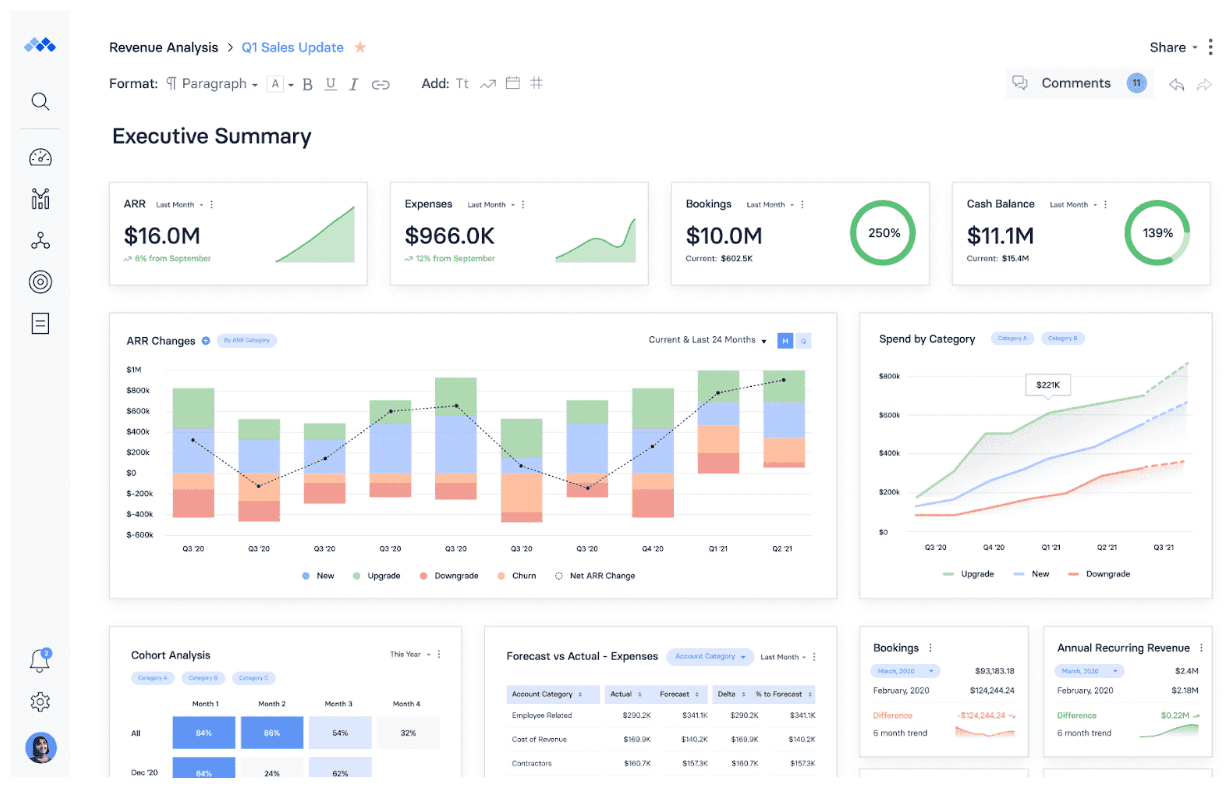

Mosaic: Data Collection and Analysis

Mosaic is the connective tissue for financial data in an organization. We built our platform around the idea of the golden framework, or an FP&A framework which integrates data from your enterprise resource planning (ERP) system, CRM, HRIS, and billing systems to provide a holistic view of the customer journey in regards to finance, from first interaction to conversion. It’s this framework that enables finance to answer any question about the business in real time.

Mosaic automatically consolidates financials across multiple subsidiaries. Alongside automating manual tagging and allocations, you can then generate mapping and visualizations with our templated dashboard capabilities. With those numbers and visuals, collaboration and analyzing the data become even easier across departments, which pushes toward more time for strategic insight.

Mosaic Paves the Way to the Future of Finance

Finance automation requires intentionality. Making a process easier and less time-consuming is great, but, as Vasco said above, you’ll still need humans to take the next step toward intentionally embracing digital transformation. When finance transformation enables your team to proactively provide deeper insight in real-time and with accuracy, business leaders can make better-informed decisions that amplify your business’ forecasts for success.

Ready to see how Mosaic’s ability to automate financial data integration boosts your finance team’s abilities as strategic partners? Reach out for a personalized demo and discover how real-time insight into financial performance sets your business apart.

Finance Automation FAQs

What can you automate in finance?

With financial automation software, you can automate time-intensive tasks such as

- Payroll administration

- Billing

- Month-end close

- Expense reporting

- Data collection

- Strategic financial analysis

- Financial planning

- Financial statement production

Why is automation important in finance?

Will finance jobs be replaced by automation?

Own the of your business.