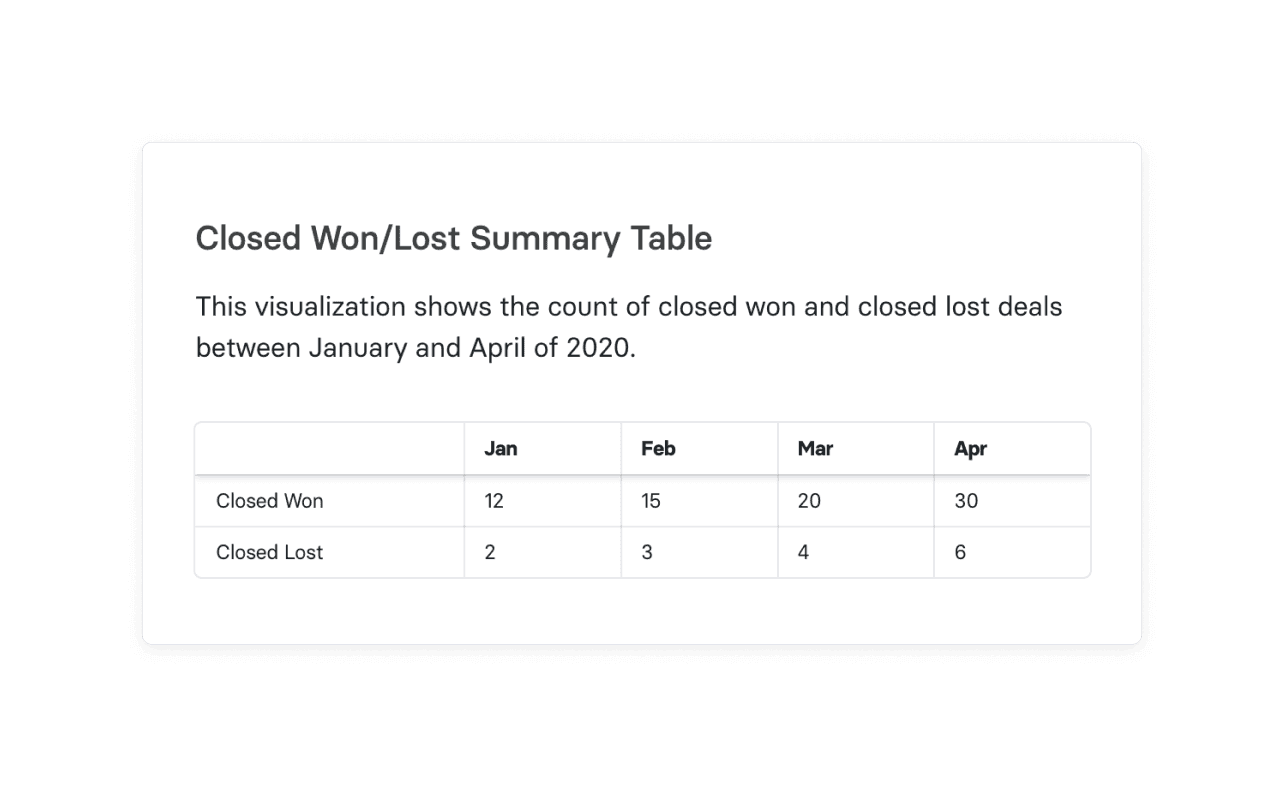

Closed Won/Lost Summary

What Is a Closed Won/Lost Summary?

The closed won/lost summary shows the total count of closed-won deals and closed-lost deals within a given period. It’s a useful SaaS metric for assessing the overall effectiveness of the sales cycle. It can also be helpful in understanding whether you have a good product-market fit.

Categories

Your closed won/lost summary is a high-level, basic breakdown of the total count of closed-won deals and closed-lost deals within a given period.

While the summary can give you an idea of trends in sales cycle effectiveness, the real value comes when you dig deeper into your closed-won and closed-lost analysis. That’s what will help you collaborate with your sales reps and marketing team to push toward more powerful, strategic decision-making that continues to fuel the pipeline and solidify product/market fit.

What Is Closed-Won in Sales?

“Closed won” is a sales term used when a prospect has signed a contract or made a purchase and officially becomes a customer. Closed won is the final deal stage in the sales cycle.

Your CRM may include a list of “closed-won opportunities,” which indicates a closed sale for new customers alongside upgrades and renewals for existing customers.

What Does Closed-Lost Mean in Sales?

“Closed lost” is a term used in sales when the sales cycle officially ends without closing a deal: in short, when a prospect gives you a final “no.” A “closed lost” marker can occur at any time in the sales process, meaning that regardless of where the prospect is in the sales cycle, once they decide to disengage, the account is closed, and the sale opportunity is lost.

It’s important for your CRM setup to facilitate clean records of closed-lost opportunities because there may be an opportunity down the line to re-engage with the prospect. Closed-lost reasons range from pricing to product functionality, timing to lost momentum, and ultimately fall on decision-maker authority or signing with a competitor.

Depending on the strength of the potential customer relationship, you can continue to nurture old prospects. Prospects who say “no” may still engage with your content, and as your product develops more features or your company grows, the timing may work out for prospects to fold back into the pipeline. Keeping customer relationships open also benefits you if the contact decides to go to another company that potentially needs your services.

Other Important Metrics to Track to Improve Sales Performance

CRMs like Salesforce organize deals via sales stages, which offers your sales team full transparency of where prospects are within your sales pipeline. When you close a deal, Salesforce includes the value of the sale and the length of time for the sales engagement.

Sales and marketing teams can use this point-in-time data to understand the overall effectiveness of the sales cycle and how to perceive product/market fit with other prospects. But to truly leverage your closed-won and lost Salesforce reports, you must track concurrent sales performance metrics that enhance the “why” behind the numbers and surface trends in the data.

Here are the metrics to bring in to optimize sales performance:

Deal Conversion Rates

Your deal conversion rate compares closed-won and closed-lost deals to open opportunities. Digging deeper into the “why” behind the rates helps to measure sales efficiency and the overall perception of your product from customers and prospects alike.

Average Sales Cycle

Trending your average sales cycle leads to optimizing revenue generation efforts. Sales managers can identify major pain points and make improvements to optimize faster sales conversion while also helping marketing to qualify leads or improve marketing campaigns.

Quota Attainment

Many companies use quota attainment as a metric to measure a salesperson’s efficiency. Typically the sales team sets a benchmark around sales goals and each team member’s experience, which you then compare to the salesperson’s total sales within a given timeframe.

Sales Rep Ramp

Your sales rep ramp not only identifies how long sales reps take to ramp to productivity; it also improves the accuracy of top-line plans. The sales rep ramp bridges sales hiring plans and revenue goals to ensure optimal growth for the business and pipeline.

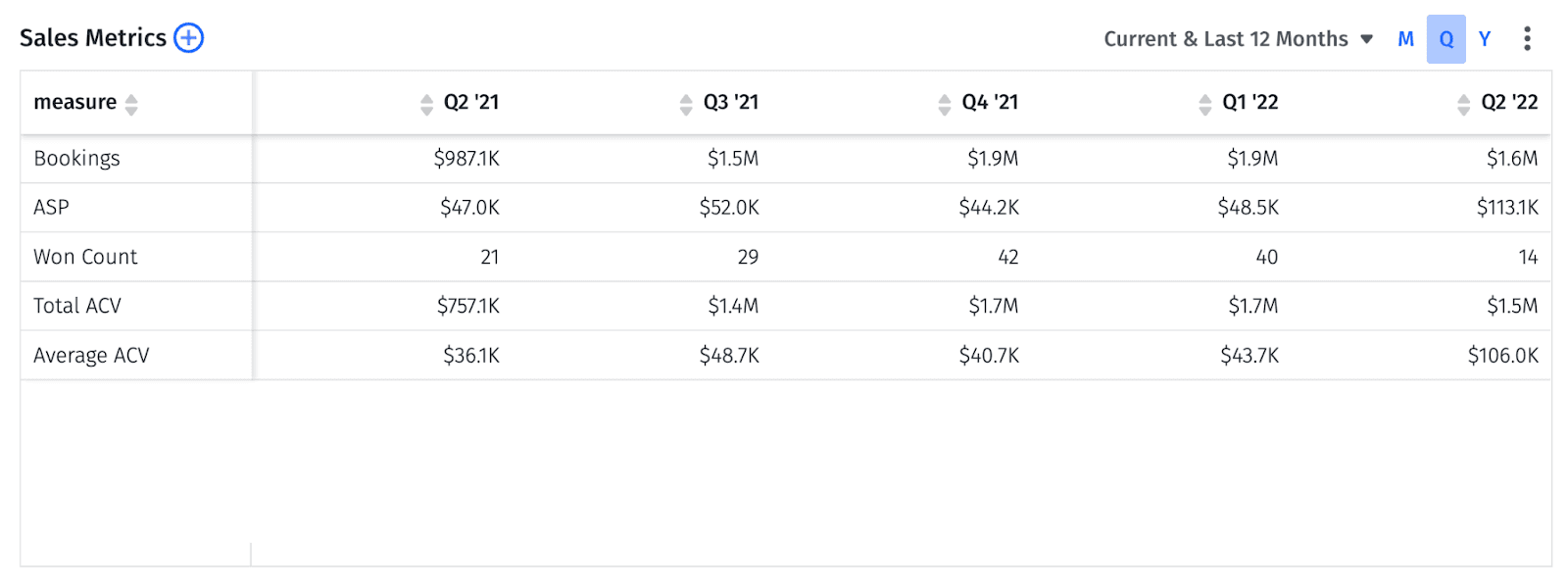

Average Sale Price (ASP)

Average sale price takes the total of closed-won deals for new customers and divides it by the number of customers signed. Segmenting the data through a customer cohort analysis allows you to trend particular industry interest in the product or company sizes that match the product and help increase ASP.

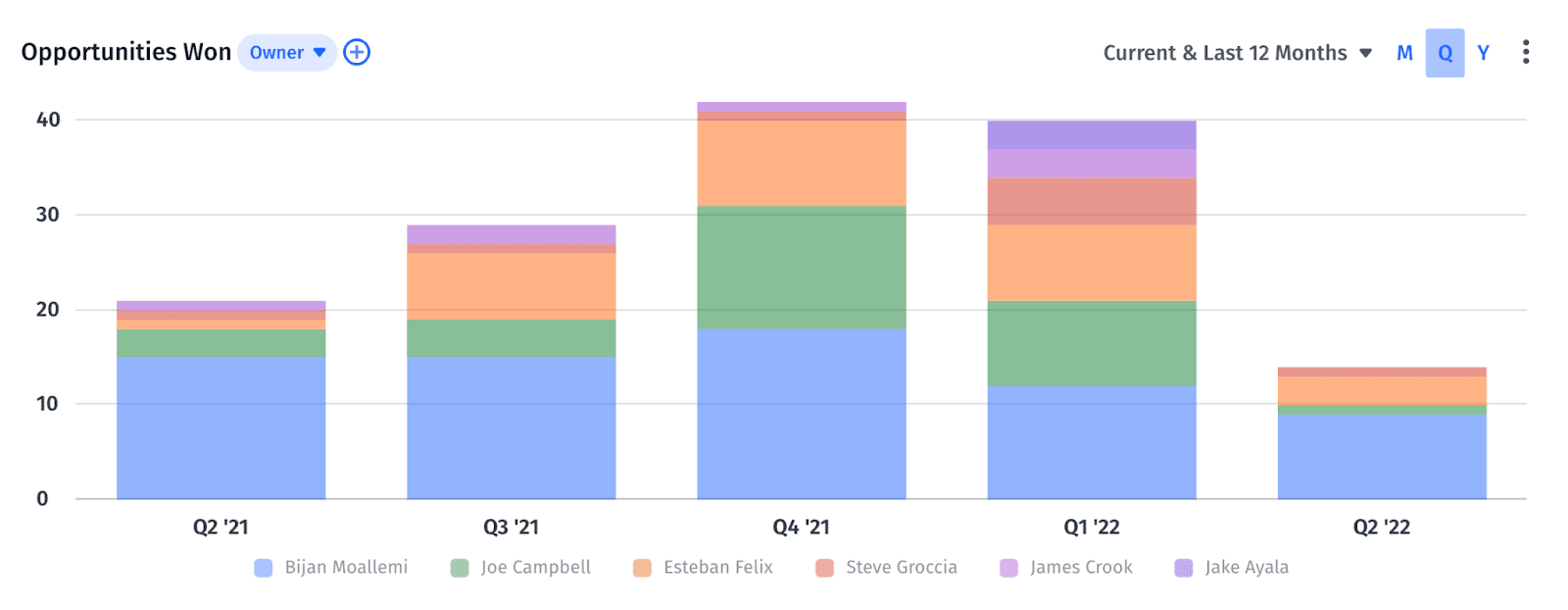

Level of Total Sales by Person/Team

Identifying the level of total sales by person allows the sales team to see who are top performers and who may need additional assistance to drive prospects through the sales cycle.

Closed-Won by Campaign

The marketing team tracks the customer journey through systems like HubSpot, which can identify points of conversions (like signing up for the company newsletter after being led to a blog article from a social media post on LinkedIn). Finance can segment win rates by campaign to help identify campaigns that have been successful, which prompts the marketing team to dive further into exploring how to replicate that success.

Opportunity Age and Stage Duration

When a prospect begins to engage with the sales team, Salesforce assigns an “age” to the opportunity to provide an open/close date. Prospects can spend a particular amount of days at each stage, whether it’s between opening conversation and demo or demo follow-up. Knowing these sales funnel metrics prompts sales to look at where they can move prospects through the funnel faster to optimize opportunities and increase sales funnel conversion rates.

Track Sales Metrics & Rep Performance in Granual Detail

What Is Closed-Lost Analysis and How to Perform It

A closed lost analysis unpacks the sales team’s experiences with prospects within a given timeframe. As there are various reasons for accounts to fizzle to closed lost, it’s important that the sales team discusses why particular deals fail and where they can improve their sales strategy.

For finance, a closed-lost analysis is a two-fold process that relies on not just knowing the numbers but sharing the data with the sales and marketing teams to prompt their conversations into actionable outcomes.

To get deeper into your closed-lost numbers, segment your closed-lost list by customer cohort. Trend any patterns, which can range from total number of days a prospect engages with the sales team to what stage prospects tend to fall out of the sales cycle. Highlight large brands and contract values to see where they decided to disengage with the sale.

Once you have your findings, ensure that you deliver your findings through a shared language, whether it’s a graph that points out trends to a written paragraph highlighting the data for the sales team to dive deeper into. If you notice a high number of lost deals, for example, it may indicate the product isn’t solving the right need, or marketing and sales need to realign on targeting the right customer base.

Why Closed-Won Analysis Can Tell You More Than Closed-Lost Analysis

You want to conduct a closed-won analysis in a similar fashion, except you need to pay attention to a particular metric: the level of total sales by salesperson. While you want to ensure that other metrics like customer acquisition cost (CAC) and CAC payback period are fully burdened to accurately forecast revenue, you also want to help find patterns to repeat successful closes again and again.

Finance can break closed-won deals and opportunities out by cohort and track a timeline for where these customers engaged and moved through the sales funnel. If a customer has high engagement with marketing materials and works quickly through the sales pipeline, the customer is a great candidate for potential case studies and testimonials, which will help marketing continue to attract prospects.

A solid, established sales team knows what their processes are and what’s been successful for them — and they want to achieve more. Some customers may move at a slower pace than others, but still become a successful sale and engagement once they sign.

The closed-won data finance provides allows sales reps to highlight success stories and where to continue improving the sales cycle to create better-qualified leads and quicken the sales cycle. Sales can then work with marketing on improving sales enablement material that answers prospects’ concerns and bring them over the finish line.

Get More from Your Salesforce Closed Won/Lost Metrics with Mosaic

Salesforce is a powerful, customizable CRM platform that enables your sales team to do their best work. Typically, finance teams tend to aggregate the data and normalize it in other tools, like Excel or Google Sheets. This process can lead to manual errors and inaccuracies, which limits the power of any insight behind the numbers.

Startups need clean, robust data to ensure the type of financial accuracy that spurs proactive decisions that keep the sales pipeline and top-line growing. Mosaic is a Strategic Finance Platform that integrates with Salesforce and other source systems to provide finance teams with real-time updates regarding the sales pipeline to build accurate financial planning & analysis models.

Mosaic offers a preloaded sales pipeline template, which breaks your closed won/lost summary into opportunities won and lost lists alongside other sales pipeline metrics. Mosaic implements finance automation to immediately calculate these important metrics for you, which saves you time from the busy work of calculating metrics to focusing on deeper insights.

Ready to close the deal and win back valuable time while providing valuable insights into your company’s sales processes? Request a personalized demo of Mosaic today.

Closed Won/Closed Lost FAQs

What should you do after losing a sale?

You should use lost sales opportunities to identify weak points in your sales process. Closed lost analysis, in particular, allows for a conversation with your team to discuss potential improvements. Segmenting your customers into cohorts can also help spot potential patterns in lost opportunities.

What are Closed Lost Reasons?

What is a Closed Won opportunity in Salesforce?

What is the Closed Won amount?

Explore Related Metrics

Own the of your business.