Average Deal Size

What Is Average Deal Size?

The average deal size shows, on average, the amount of money a business receives per deal they close. Average deal size is normally calculated monthly or quarterly and can help businesses understand their sales pipeline metrics and revenue forecast.

For example, you can use ADS insights to improve your sales practices and the performance of sales reps or identify the price points at which leads are most likely to convert. ADS insights can also be compared against industry benchmarks to measure a business’s performance.

Categories

Table of Contents

Businesses grow by improving the size and number of deals they close. The deal sizes may vary based on the product, the customer’s buying power, and the salesperson’s skill.

For that reason, looking at individual deals might not give you an overall idea of how your business is doing.

The average deal size (ADS) can give you a better insight into your business growth. Besides revenue growth, ADS can uncover valuable insights about your:

- Sales process

- Sales pipeline

- Sales executive’s performance

Let’s look at how to calculate ADS and make better business decisions with it.

Average Deal Size Formula + How to Calculate

Your average deal size can be calculated by taking the sum of each closed-won opportunity within a given period and dividing it by the total number of deals made in that same period.

Here’s the average deal size formula:

Suppose you’ve made five deals last month, each valued at $5,000, $5,500, $6,500, $4,700, and $5,200, respectively. In that case, your average deal size is:

ADS = ($5,000 + $5,500 + $6,500 + $4,700 + $5,200) / 5 = $5,380

Average Deal Size Calculator

Average Deal Size Calculator

$0

How To Leverage Average Deal Size Insights To Make Better Business Decisions

Your ability to calculate average deal size is only as valuable as the insights you get from it.

Here are a few ways you can use average deal size as a sales performance metric to make better business decisions.

Sales Forecasting and Determining Sales Quota

You can use ADS along with the opportunity win rate to estimate the number of opportunities you need to pursue to hit a revenue target.

For example, if your target is $1 million and your ADS is $50,000, you’ll need to close 20 deals to hit the revenue target. Now assume that your sales representatives successfully close a deal 40% of the time. That means your opportunity win rate is 40%. So, you at least need to pursue 50 opportunities to hit your revenue goal.

You can use this information for sales capacity planning or assigning quotas to your reps.

When the sales professionals work with a precise number in their mind, they can qualify leads better and prioritize their efforts.

Better Targeting

The average deal size helps you recognize the opportunities with a high chance of converting. Let’s say your ADS is $50,000, and you are pursuing two opportunities, one worth $100,000 and another worth $45,000.

The average deal size indicates that the $45,000 deal has a better chance of converting.

This insight helps you prioritize the right opportunity. It also enables you to take calculated risks while pursuing an opportunity bigger than your average deal size.

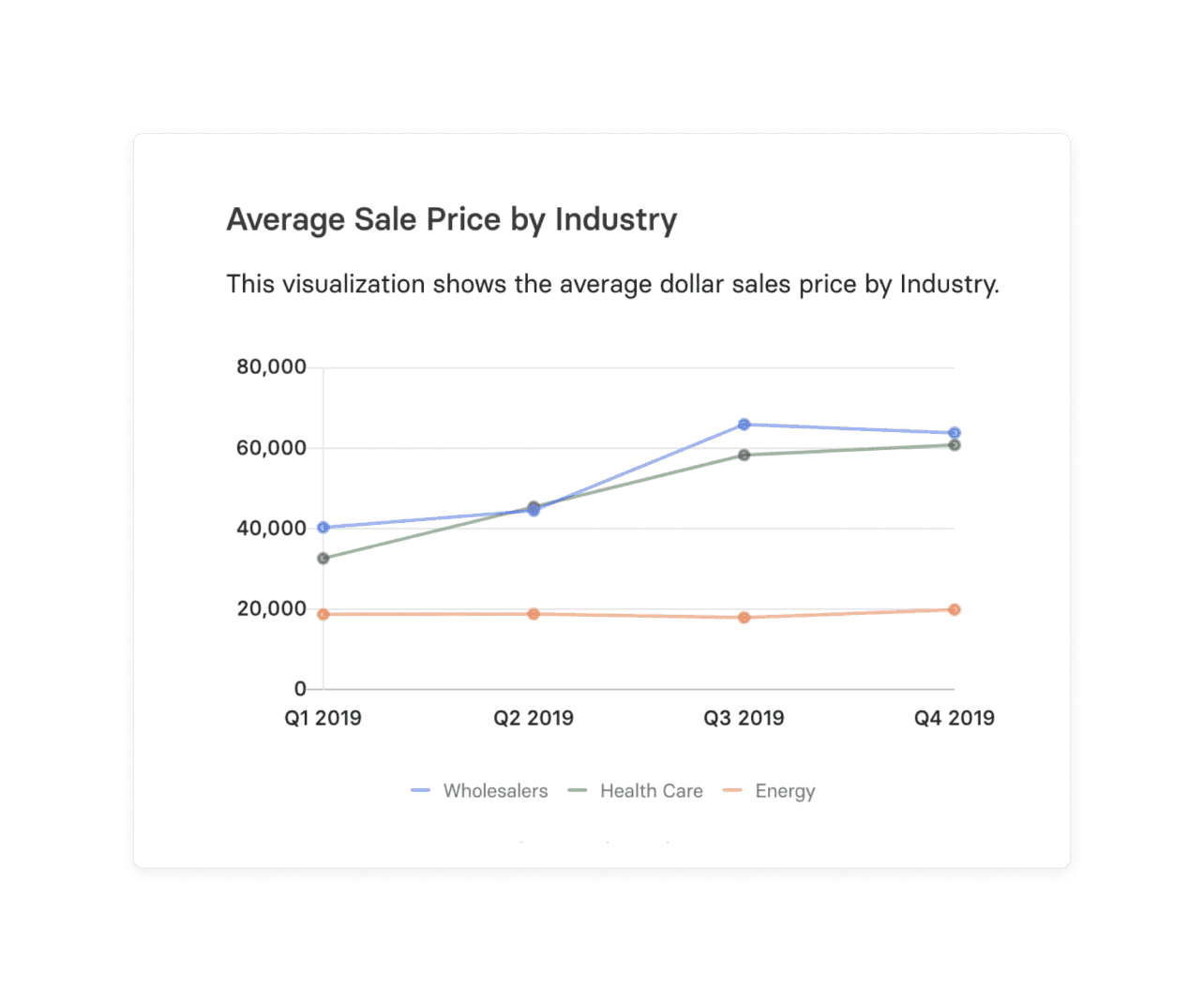

Identify Trends in Your Sales Pipeline

The average deal size bolsters sales management by helping you identify the trends in your sales process. For instance, let’s say your ADS has decreased, but your monthly recurring revenue (MRR) hasn’t changed. It could mean that your sales reps are pursuing smaller opportunities.

If there’s an increase in the number of closed-won opportunities but a decrease in ADS and MMR, it may indicate you’re giving too many discounts.

If you see a sudden rise in ADS compared to your historical data, it may mean your sales pipeline is changing. Your products might be attracting a set audience different from your original target audience. You may want to dig deeper and pursue this new opportunity to get a greater number of larger deals.

Other Useful Financial Metrics To Consider

Your average deal size alone can’t determine how your business is doing. Here are a few metrics you may want to consider along with your ADS:

- Monthly recurring revenue: It indicates how much revenue you made from your products or services for a particular month.

- Sales Velocity: Understanding and improving your sales velocity is crucial for accelerating revenue growth. This metric measures the speed at which opportunities move through your sales pipeline and convert into revenue.

- Revenue churn: It shows how much revenue was lost in a specific period.

- Customer lifetime value: It tells you the average amount you can expect from a certain customer over the life of their relationship with your brand.

- Opportunity win rate: It’s the percentage of closed-won opportunities out of the number of opportunities pursued in a specific period.

- Days sales outstanding (DSO): This metric shows the average number of days it takes for a company to collect payment after a sale has been made, which is crucial for understanding cash flow and managing accounts receivable effectively.

4 Ways To Increase Your Average Deal Size

Improving your average deal size is a way to increase revenue. A price increase might seem to be a sure-shot way of increasing ADS. However, higher pricing could create a bottleneck in your sales.

The price increase could also lead to customer churn in subscription-based businesses. Here are some ways to increase average deal size without increasing your pricing:

1. Pursue Upsell and Cross-Sell Opportunities

During a sales negotiation, you have two ways to improve your average deal size:

- Upselling: Which means selling an advanced version of your product or service.

- Cross-selling: Which means selling products related to the products the customer has already bought.

If you have a deep understanding of your customer’s pain points, you can find the touchpoints where you can leverage the upsell and cross-sell opportunities.

2. Implement Approval Process for Discounts

Discounts are great for closing deals, but you need to plan them strategically. According to Price Intelligently, discounts can reduce the customer lifetime value of SaaS companies by 30%.

Ensure your discount plans are more structured and sales reps follow an approval process to offer discounts.

3. Qualify Your Leads Early On

Focusing your energy on prospects who are most likely to sign a deal is an excellent way to improve your ADS. In that sense, you need to have well-defined qualification criteria for your prospects.

You also need to know how to detect the red flags and when to disqualify leads. That helps you focus resources on better opportunities and improve the ADS.

4. Increase Deal Duration

The duration of the deal or subscription length is a key determinant of your ADS. As such, increasing the deal duration is a good idea. For example, if you get an annual contract instead of a monthly contract, the deal will contribute to your ADS for 12 months instead of one.

Design your SaaS pricing strategy to encourage longer subscription periods, even if it means you need to give a discount.

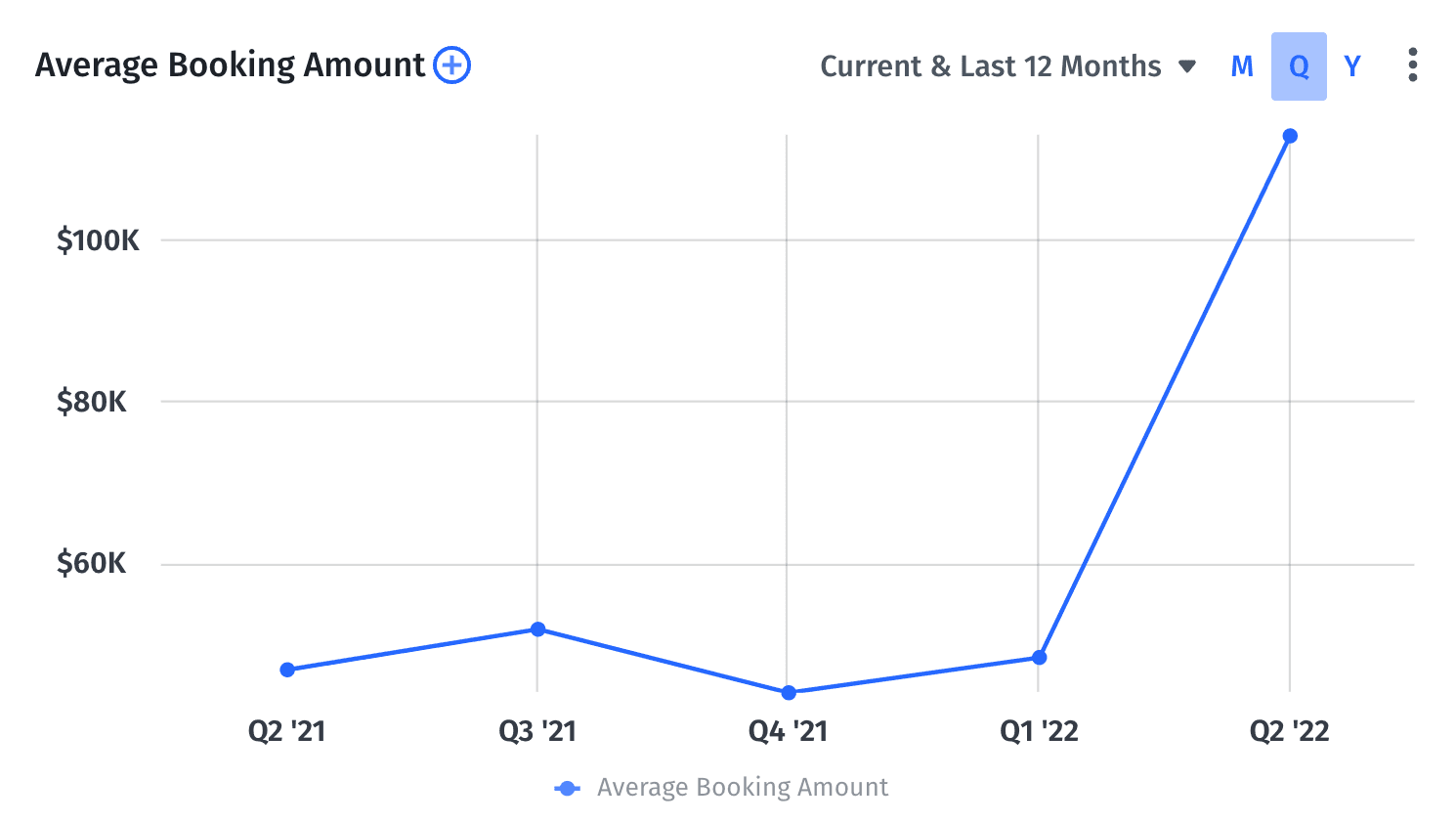

View Your Average Deal Size in Real Time With Mosaic

Companies need to track multiple performance metrics to monitor the health of their business.

Monitoring your average deal size in real-time can help you track your business growth, identify better opportunities, and forecast your sales. It also helps sales executives stay better informed about their goals.

Although keeping track of various metrics may be challenging for sales leaders, Mosaic helps you capture real-time business data and analyze it to derive valuable insights.

With Mosaic, you can capture real-time ADS data and use it to adjust your revenue goals and sales quota. You can create in-depth sales dashboards, breaking down the ADS data by product segments, business locations, or sales reps.

Would you like to see how Mosaic can help you monitor the average deal size in real-time?

Track Every Performance Metric Automatically

Average Deal Size FAQs

How can businesses differentiate between seasonal fluctuations and genuine changes in ADS?

Businesses can compare the current ADS with the same period in previous years to differentiate between seasonal changes and genuine shifts in ADS. If the ADS consistently differs during a specific season or month, it might be a seasonal variation. However, if the change persists over multiple cycles or doesn’t align with past seasonal patterns, it might indicate a genuine shift in the business model or market behavior.

How can ADS influence a company's marketing and product development strategies?

How does the Average Deal Size impact sales team training and development?

How often should businesses re-evaluate their ADS, and what external factors can affect it?

Explore Related Metrics

Own the of your business.