Tracking key revenue metrics helps finance teams and company leadership make well informed business decisions. From choosing the best strategies for pricing, product development, and sales processes, to creating headcount plans or managing marketing efforts, revenue metrics can help you determine when and where to allocate funds and resources.

But with dozens of revenue metrics to choose from, determining which ones are the most important to monitor can be tricky. In this article, we provide a list of the 6 essential revenue metrics SaaS startups should be tracking closely in order to understand their company’s financial health.

Table of Contents

The Role of Revenue Metrics in Strategic Planning

In SaaS and other industries, revenue metrics are critical indicators that inform strategic decisions and long-term planning. They help you know when to push forward, when to be cautious, and where the best growth opportunities are.

For example, suppose you notice a consistent increase in your monthly and annual recurring revenue, i.e., revenue growth. In that case, it signals a strong and growing customer base, encouraging you to invest in product development or market expansion. Conversely, high customer attrition or rising customer acquisition costs might prompt you to reevaluate your marketing strategies or invest in customer success to improve the customer experience.

Collectively, these metrics empower you to assess your performance, identify trends and areas for improvement, and make informed decisions on resource allocation, pricing strategies, and market positioning.

That said, to effectively understand the data and make thoughtful, timely business decisions, you will need a powerful strategic finance platform like Mosaic on your side — we’ll share more on that later.

The Link Between Revenue Metrics and Business Health

Revenue metrics are deeply connected to the overall health of your SaaS business, as they serve as crucial indicators of your company’s financial and operational health. As stated above, these metrics give you a detailed view of your ability to generate revenue, how efficiently you’re acquiring and keeping customers, and the sustainability of your business model.

For instance, a healthy SaaS business would display positive trends in revenue metrics, which typically shows a strong and expanding customer base and an efficient use of resources to grow and solidify your market position. On the flip side, negative trends in revenue metrics can pinpoint areas that urgently need your attention to avert long-term repercussions.

Simply put, the direct link between revenue metrics and the health of your SaaS business stems from their power to offer actionable insights — and these insights are instrumental in guiding your strategic decisions, ensuring business growth and sustainability in a fiercely competitive market.

The 6 Key Revenue Metrics SaaS Businesses Should Track

The array of revenue metrics out there can understandably be a lot to dig through. While every metric is significant, we’ve rounded up the top six revenue metrics for SaaS businesses below to help you get started.

For a complete list of essential SaaS revenue metrics, head to our Metrics Catalog.

1. Annual Recurring Revenue (ARR) / Monthly Recurring Revenue (MRR)

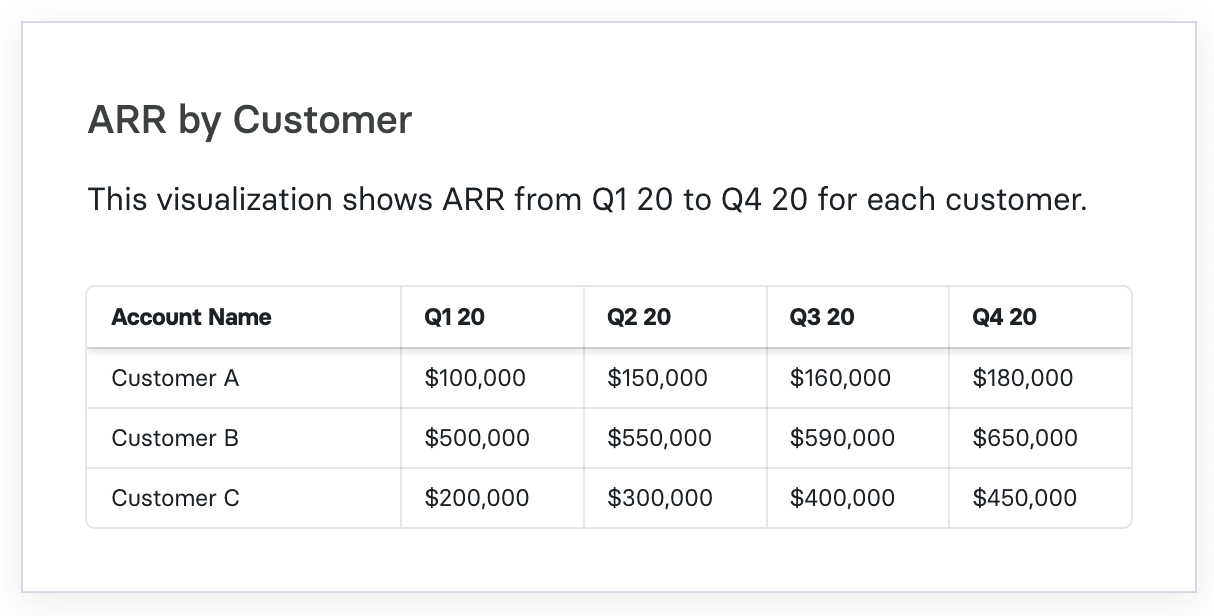

Annual recurring revenue, or ARR, represents the total revenue you can expect from customer contracts in the next 12 months. This includes revenue from year-long (or longer) contracts and the annualized value of shorter ones, like monthly, quarterly, or semi-annual.

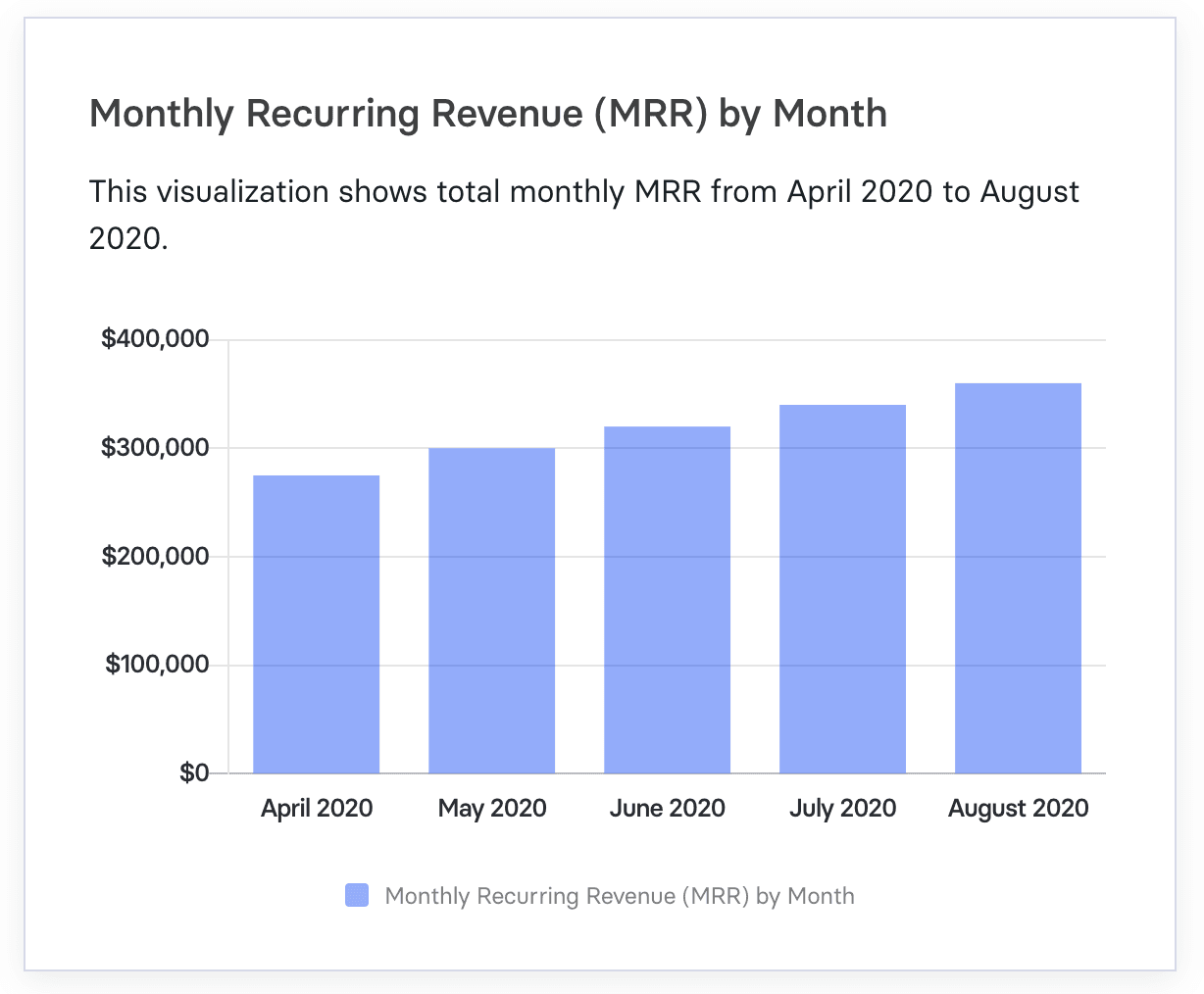

Similarly, monthly recurring revenue, or MRR, is the total amount of revenue your company brings each month from your customers, no matter how long they’ve signed up for. Notably, MRR gives you a view of your earnings in the short term, breaking down the granular details of your monthly and quarterly revenue. This insight is highly valuable for your marketing and sales teams, as it helps them tweak strategies based on immediate impacts, like adjusting campaigns, speeding up the average sales cycle, or making the onboarding smoother — all to positively affect your MRR.

For SaaS companies, it’s essential to consider ARR and MRR when measuring growth, as these are key revenue metrics that can help you determine return on investment (ROI), decide when to reinvest in your business, and track product-market fit.

Investors, too, use these metrics as benchmarks before betting on a company’s future, as it gives them a clear picture of the organization’s revenue predictability moving forward.

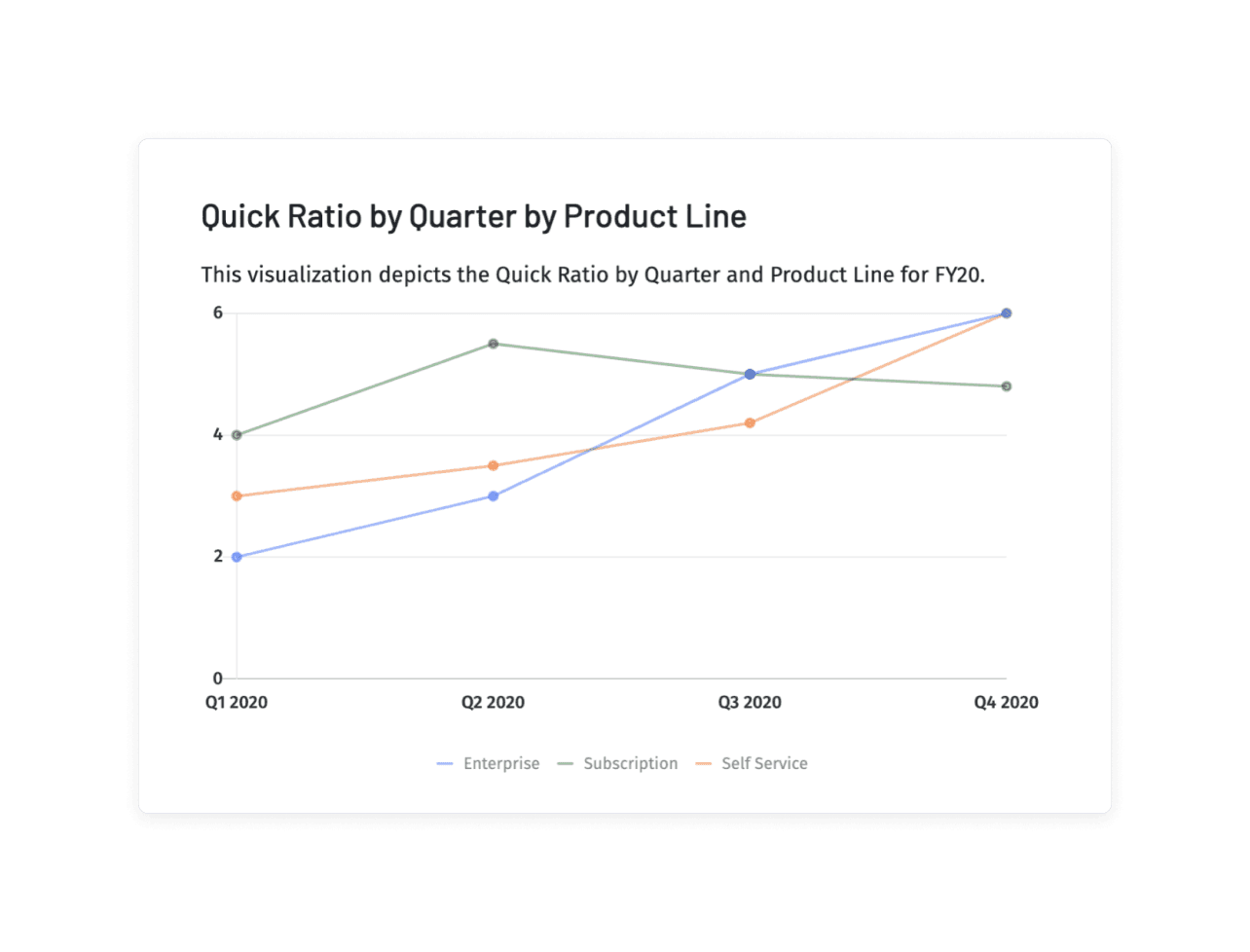

2. SaaS Quick Ratio

The SaaS quick ratio measures how well a company can grow its recurring income, even when losing some customers. This business metric works by weighing the revenue coming in from new and upgraded subscriptions against the losses from cancellations or downsized subscriptions.

Essentially, the SaaS quick ratio is a simple financial efficiency metric because it zeroes in on how effectively a company can grow its monthly recurring revenue despite any customer churn. Think of it as a litmus test for a company’s growth, sustainability, and resilience in the competitive SaaS landscape.

That said, this metric is more directional than crucial, as noted by Ben Murray, The SaaS CFO. Your SaaS quick ratio gives you quick, surface-level insights by showing whether your recurring revenue or bookings are increasing or decreasing over a timeframe — it helps compare your company’s growth and stability at a glance.

But having a strong, quick ratio isn’t the whole story of your growth’s efficiency. It’s important to remember that this metric is just one part of a larger picture when evaluating the health of your business.

3. SaaS Magic Number

The SaaS magic number tells you how efficient a software subscription business is at making sales in a given period. It looks at how much revenue the company earns for every dollar it spends on sales and marketing to attract new customers.

Typically, a SaaS magic number around 0.75 suggests you’re on the right track with sales efficiency. In contrast, a high number means you can likely build out your sales and marketing functions, as you’ve proven there’s a solid product-market fit. However, a magic number less than 0.5 typically indicates a flawed business model, as your cost-to-serve might be too high.

Ultimately, for any SaaS business, keeping this number in check means ensuring your growth efforts are both sustainable and profitable.

4. Pipeline Coverage Ratio

The pipeline coverage ratio measures how your current sales pipeline stacks up against your sales targets for a specific period of time. This financial metric is basically a health check that hints at your company’s future success potential.

The pipeline coverage ratio is a key revenue metric for SaaS businesses because it clearly shows whether there’s enough potential sales activity to meet or exceed sales targets. So, think of it as an early warning system indicating if you’re on track for growth or need to ramp up your sales efforts. Simply put, it helps ensure your sales strategy is aligned with your revenue goals, keeping your business on the path to success.

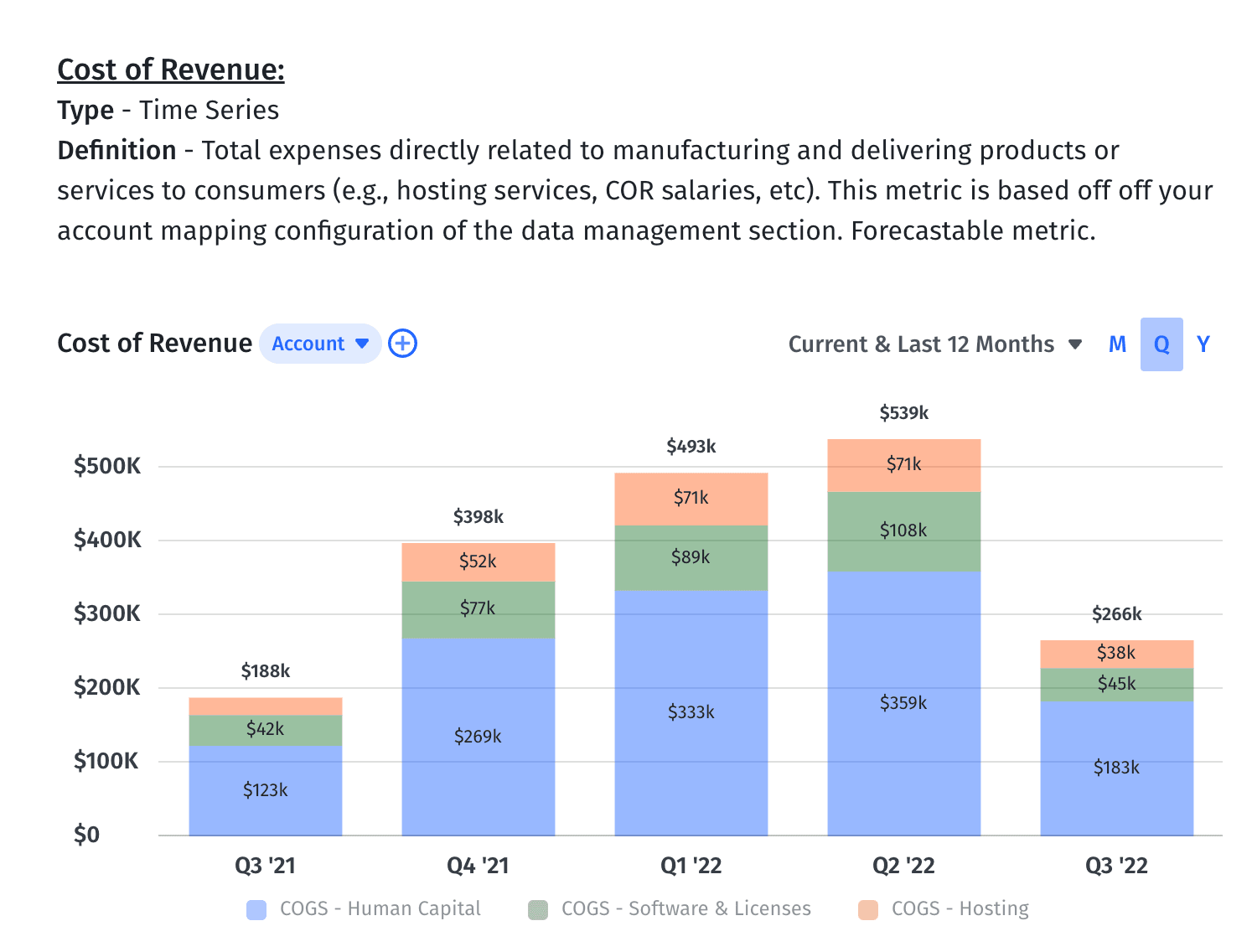

5. Cost of Revenue

The cost of revenue covers what it takes to get your product or service into the hands of your customers or subscribers. For SaaS companies, this includes everything from hosting fees, the space you need on servers or the cloud, keeping your website running smoothly, and software licenses to what you pay your customer support team.

Understanding the cost of revenue is crucial because it lets you figure out a SaaS company’s profit margin. This insight helps evaluate your company’s overall profitability, especially when applying the rule of 40. Plus, the costs that fall under “cost of revenue” for SaaS companies are pretty varied compared to other sectors, and these costs can really impact your bottom line, either narrowing or widening your gross margins.

6. Customer Acquisition Cost (CAC)

SaaS businesses are often built on efficiency, and knowing how much it costs to acquire a customer is the first step to having a strategic insight into your company’s growth and capital efficiency.

Customer acquisition cost, or CAC, is what it costs on average to acquire a new customer. Although it’s not a typical revenue metric, this efficiency metric helps you figure out your business’s financial health and shows how well your sales and marketing teams are pulling in new customers. In the right context, CAC can give investors a look into the durability of your business model and play a significant role in how they value your company when it’s time to raise money.

Beyond the Numbers: Interpreting Revenue Metrics for Growth

Any financial metric in isolation tells you only part of the picture, and decisions made based on just one or a few of them won’t be very reliable. To draw deep, actionable insights from your revenue metrics and turn them into informed business decisions, take a step back and understand the story behind these numbers — this is where Mosaic can help.

As a strategic finance platform, Mosaic integrates with your CRM, ERP, HR systems, billing platforms, and data warehouse and calculates your essential metrics in real time. It also tracks how these metrics evolve, offering you a clear picture of their growth or decline.

Essentially, Mosaic acts as your one-stop financial data hub, simplifying and automating the calculation of critical metrics. You can gain insights into important figures like the SaaS rule of 40, CAC, lifetime value (LTV), cost of revenue, and so many other important metrics, including such revenue metrics.

With Mosaic, you have access to over 150 ready-to-use metrics designed for SaaS businesses and the option to create custom metrics that better suit your specific needs.

Turning Data Into Strategy: Mosaic’s Analytical Tools

What really sets Mosaic apart isn’t just its ability to calculate metrics — it truly shines in financial analysis.

Finance teams excel when they have clear and accurate insights into their business’s financial performance. Mosaic provides real-time, in-depth analysis of critical business questions, helping you make informed financial decisions when it matters most.

Mosaic allows you to adjust and experiment with different variables, tailor your calculations to align with your key performance indicators (KPIs), and share your findings in a clear, easy-to-digest way. So, no more manual data gathering, error-prone calculations, or confusing financial dashboards — Mosaic offers you a holistic overview of your financial efficiency and future potential.For instance, look at an example of Mosaic’s ARR SaaS dashboard below:

Mosaic’s dynamic approach to reporting enhances your understanding of your revenue’s past and sharpens your forecasts and strategic investment decisions. The possibilities of what you can do with these insights to propel your company’s growth are truly endless.

Take it from our customers — they’ve all saved significant time, money, and resources since using Mosaic.

If you want to learn how Mosaic can work its magic to elevate your company’s financial narrative, request a personalized demo.

Revenue Metrics FAQs

What are revenue metrics?

Revenue metrics are essential indicators of a company’s financial performance. They tell you how effectively a company earns revenue, retains customers, and acquires new ones. For finance teams at SaaS companies, these key metrics hold particular importance as they offer insights into the company’s growth patterns, profit potential, and operational efficiency.

How does Mosaic simplify the tracking of revenue metrics?

What are the most crucial revenue metrics for businesses?

Is there a difference between a revenue metric and a profitability metric?

Own the of your business.