Categories

For most companies, the cost of labor (also called cost rate) is typically your largest expense, sometimes accounting for as much as 70% of spend. Understanding your fully loaded cost of labor helps you grasp the true ROI of each hire, build tighter budgets and create more effective plans for growth.

Table of Contents

Direct vs. Indirect Labor Costs: What’s the Difference?

Cost of labor can be broken down into two types: direct costs and indirect costs.

Direct labor costs include all employee costs tied directly to your product. In traditional companies, direct costs include roles like assembly line workers or machine operators. In SaaS companies, direct costs include engineering teams as well as sales reps, who directly drive product revenue.

Direct labor costs for professional service companies would include salaries and benefits for employees who deliver your service, for example, technicians, consultants, or content creators.

Indirect labor costs are payments made to employees not directly involved in product design or driving revenue, but who are still necessary for the functioning of the company — think HR, customer success, and marketing teams. Indirect labor costs are also known as overhead costs.

Understanding the difference between your company’s direct and indirect labor costs is crucial for pricing, as you get a fuller picture of profit margin per product.

4 Key Factors Influencing Employee Costs

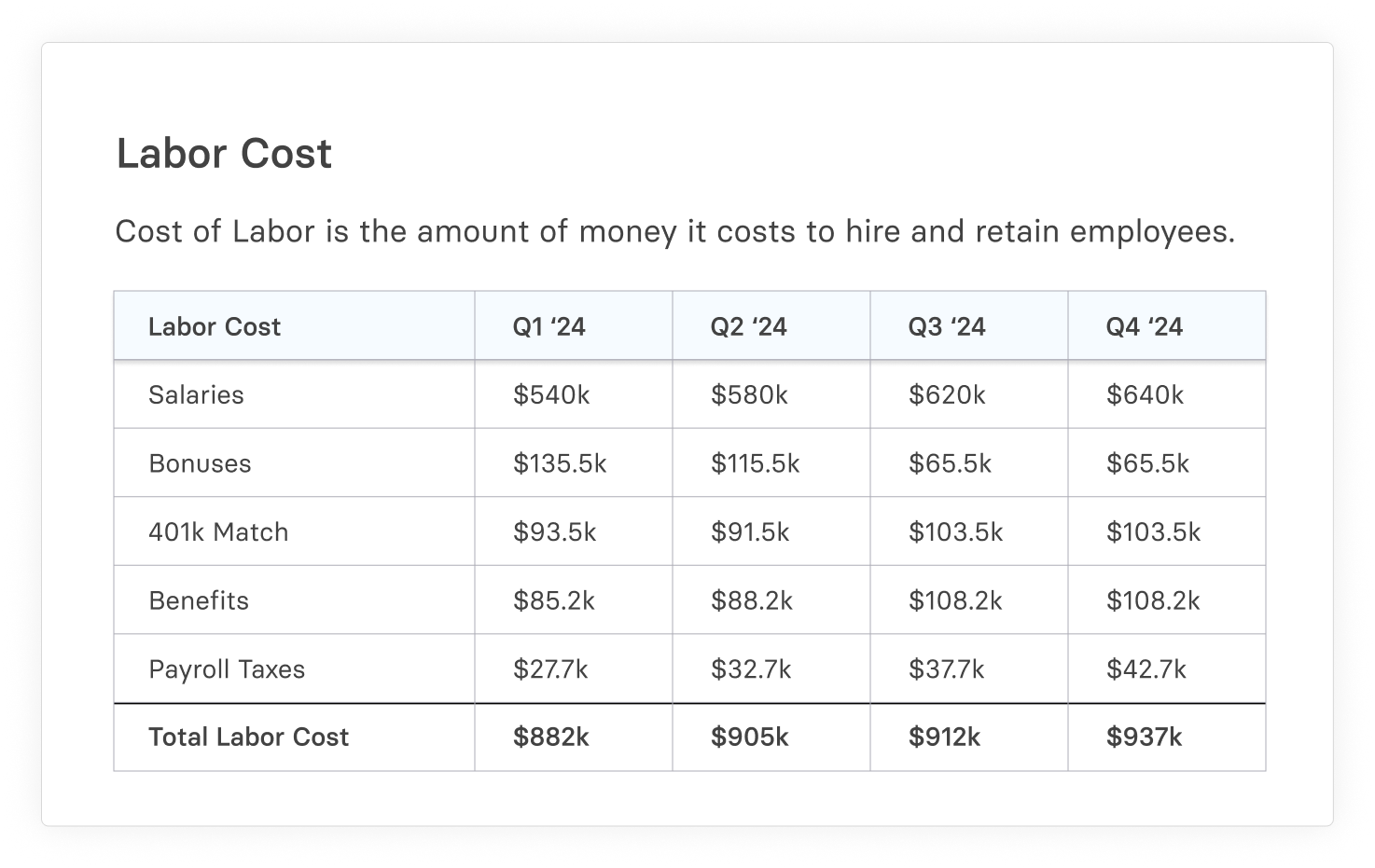

Individual employee costs are much more than just a salary. You need to consider benefits, the costs of onboarding, payroll taxes, and more. This ensures you understand your fully burdened labor rate.

1. Hiring Costs

How much does it cost your company to get new employees up to speed? Do you offer training materials or programs?

What about the associated G&A costs like legal fees and audit expenses? Equipment costs come next — new employees may need a laptop, for example. What about software licenses?

One aspect of employee onboarding costs that’s often overlooked is differing costs across different departments. For instance, all employees get laptops, but engineering hires need more powerful laptops than sales hires due to their hardware-intensive programming work. On the other hand, sales hires need travel allowances whereas engineering hires most likely don’t.

And, obviously, your software licenses are going to vary across departments (maybe Salesforce for sales and JIRA for engineering). Distinguishing labor costs per head, per department is crucial for building an accurate picture of the true cost of hiring to build into your forecast.

Lastly, if you have a physical location, space will be another consideration. Say you’re hiring 10 or 20 employees at a time — how much space do you need? What effect will this have on rent costs?

2. Salary and Wages

Salary and employee wages are the most obvious and largest components of labor costs. They’re also your starting point when calculating related expenses like payroll taxes, which we’ve broken down in more detail below.

To begin your labor cost assessment, clearly segment employees based on role and salary. This will make the rest of the process a lot easier.

3. Benefits and Perks

After salaries, benefits and perks are usually your second largest employee expense. These include things like health insurance premiums, retirement, and paid time off.

To get your fully loaded benefit costs, you’ll have to answer some questions.

- First, what’s the scale of the benefits you provide? What percentage of healthcare premiums do you cover? Do you offer benefits per dependent?

- If the person’s working from home, do you provide a work-at-home stipend? What about wellness stipends?

- Do you offer variable comp? How often do employees hit these targets?

- Does your company match 401(k), or do you have a contribution cap?

- What travel costs need to be budgeted for?

- How many paid sick days and vacation days do you offer per year?

4. Taxes

After salaries and benefits, the final component of labor costs is taxes.

While no one likes taxes, the good news is that federal, state, and local income taxes are withheld — they come out of your employee’s hourly wages or salary, not company revenue.

You’ll only have to calculate and remit them.

Calculating payroll tax

There are two methods of calculating income tax: the wage bracket method and the percentage method. Whichever you use, you’ll need your employee’s W-4 and gross salary.

The wage bracket method is used for salaries less than $100,000. This method looks at marital status and payroll period. Simply refer to IRS Publication 15-T to find your employee’s wage bracket and get the tentative withholding amount. You then apply any tax credits and look at elections on the employee’s W-4 form to get the final amount.

The percentage method is similar in that you first identify a wage bracket. This is your tentative withholding amount. You then add a percentage based on the amount over $100,000, based on IRS guidelines.

FICA

FICA taxes cover Social Security and Medicare. This is partially withheld, but you will have to match the amount that comes out of your employee’s salary — 7.65% of their income.

FUTA

FUTA is federal unemployment tax. The FUTA tax comes in at 6% of your employee’s salary, up to $7,000. Fortunately, most states cover up to 5.4% of this amount.

Calculating Labor Costs: A Step-by-Step Guide

To calculate your total labor costs, you first need to work out the all-in cost for each type of employee before applying those figures to your total headcount. Let’s walk through the process.

Labor Cost Calculation Example

Say you hire someone to fill an IT consulting role. The starting salary for consultants at your company is $90,000 — easy enough.

You provide them with a $1,500 laptop, and routine G&A costs run you $400.

Next come benefits. Say you cover 75% of healthcare premiums and extend this coverage to dependents. You pay about $520 per month for the employee and an additional $520 a month for their spouse and two children, for a total of $2,080.

Your company matches 401(k). Since employees contribute 7.4%, you’re on the hook for $6,600 (7.4 % of $90,000 is $6,660.)

You also offer a travel allowance of $3,500 per year.

Finally, we have taxes. Because they’re earning less than $100,000 per year, you use the wage bracket method to determine federal income tax. This amount is withheld — you’re not actually responsible for it other than remitting. Remember to include state and possibly local income taxes, too.

FICA taxes include 6.2% for Social Security and 1.45% for Medicare — a total of 7.65% that you are responsible for.

So, in this example, you’d have to pay $6,885 (7.65% of $90,000 is $6,885).

For the FUTA tax, you pay only $540, thanks to state tax credits.

Now, the moment of truth. Add it all together to get your fully-loaded labor cost:

- $90,000 base salary

- $1,900 for onboarding costs

- $2,080 for health insurance premiums

- $6,660 for matching 401(k)

- $3,500 travel allowance

- $6,885 for FICA taxes

- $540 for FUTA tax

It turns out your actual annual labor cost for that employee is $111,565 — significantly more than just the $90,000 salary.

Once again, keep in mind that cost could look different for a different type of employee — if you’re a SaaS company hiring a software engineer, for example, they may need a more expensive laptop and, unlike the traveling IT consultant, could have a work-from-home stipend.

Labor Cost Formula

To get a full picture of your true labor cost, complete the above process for every employee group (e.g., entry-level sales, senior engineers, marketing team leaders).

Multiply the result by the number of employees you have in each band, and this is your total labor cost for the year.

Labor Cost Percentage

Labor cost percentage shows your total labor costs as a percentage of total revenue. The formula for calculating labor cost percentage is:

Aim for a result between 20% and 30%. Anything higher than 30% shows labor costs are having too great of an effect on your bottom line.

Labor Cost Calculator

Your Labor Cost Percentage

0%

Strategic Implications of Labor Cost Analysis

A granular understanding of your fully-loaded labor costs informs company strategy, showing how fast you can grow, which targets are realistic, and how much they’ll cost.

Making Informed Budgeting Decisions

Understanding labor costs is critical for understanding employee ROI. This makes it an ideal guide to resource allocation and budgeting. For instance, when you know the true cost of each employee involved, you get a much better view of the profitability of a specific initiative.

You can then prioritize accordingly.

Since headcount is such a large expense, you need to maintain a delicate balance between hiring and revenue growth. When you can forecast your true cost of labor, you see how revenue needs to grow to keep up with headcount costs while leaving enough room for gross profit.

This helps you understand how much money you actually have to pursue goals like developing new products or launching new marketing initiatives, without jeopardizing your runway. Conversely, if you have specific revenue targets, understanding employee ROI lets you know what hires to make and when to make them.

Overall, you get a clearer picture of the true effect of each hire on your cash runway, as well as how much you need to allocate to headcount costs. For instance, if a salary is $125k, you might say, “Alright, I can make 30 hires for $3.75m — no problem.” But the fully-burdened cost will probably be closer to $5 or $6m.

Aligning HR Strategies With Financial Goals

HR is the operations center for your employee strategy. Once they understand the true cost of labor, they can build out headcount models that fit to company goals.

Understanding the fully-loaded costs of your largest expense helps you quickly prioritize which positions are necessary based on which objectives are most important. Building models should be a collaborative process between finance and HR.

It also provides a firm foundation for workforce planning, a process that keeps roles filled and employees happy.

But there’s more to the picture than just a high revenue per employee. To maximize labor cost ROI, HR needs to track employee turnover metrics like overall retention rate and turnover cost. If these metrics aren’t in line with targets, HR can launch investigations into why that’s the case and begin making necessary adjustments.

Some additional ways to lower labor costs include good HR policies and optimizing benefits.

Maintain clear HR policies

One example is to limit travel expenses by providing a fixed per diem and an approved list of hotel chains, so employees aren’t staying at expensive hotels or ordering expensive meals.

Limit the type of equipment you provide. For example, only offer costlier laptops to engineers who need them to code. Collect equipment when employees leave so you can reuse it and reduce onboarding costs.

It’s also best practice to require any expense reimbursement claims to be lodged within 30 days. This way, you won’t get hit with large expenses at the end of the year.

Optimize benefits

Business owners not only need to think about how benefit costs can grow, but also how they might scale. An option like Gusto might be great for a small business but, once you hit 50 employees, it can become disproportionately expensive per head. You’d be better served moving to a different platform, or working directly with healthcare providers.

Another strategy is to outsource jobs to different states or countries that are more cost effective. For example, the Canadian government pays for employee benefits. But keep that approach balanced — don’t forgo an excellent hire just because they require a higher state unemployment tax contribution, for example.

Leveraging Mosaic for Efficient Labor Cost Management

Your fully-loaded labor cost has many components. While keeping track of all of these can be difficult, a granular understanding of your largest expense is crucial for the success of your company.

By integrating with your source systems, Mosaic makes it easy to break labor costs down by indirect and direct costs, as well as per head and per department.

You can then visualize this information in collaborative dashboards and dig deep — see exactly where that 70% of spend is going and what the associated ROI is. From there, Mosaic builds this information into financial models that help you better allocate resources and target realistic objectives. See Mosaic in action — request a demo today.

Labor Cost FAQs

How does Mosaic simplify labor cost tracking?

By integrating with your HRIS, Mosaic allows you to track employee headcount in real time. You can break it down by type of role, as well as direct and indirect costs, to get a full, detailed picture of your labor costs represented in collaborative dashboards and financial models.

What are common mistakes in calculating labor costs?

Explore Related Metrics

Own the of your business.