Fully Burdened Labor Rate

What is Fully Burdened Labor Rate?

The fully burdened labor rate refers to the company’s total cost of paying a worker beyond the base salary or wages. Typically, this includes overheads like benefits, taxes, paid time off, training, travel, and equipment, among other expenses. These additional costs contribute to the “burdened” labor rate.

Categories

Table of Contents

How to Calculate Your Fully Burdened Labor Rate

The fully burdened labor rate is an essential metric for businesses, and even more so for professional service companies that charge clients an hourly or blended hourly rate. Here’s why: When you base your service prices on the true cost rate of hiring or employing workers, including overheads — the fully burdened labor costs — you’re setting yourself up to keep your profit margins healthy.

This metric gives you a better picture of what you’re actually spending on your team. It also makes budgeting and financial planning and analysis (FP&A) easier by guiding your investment decisions to reduce the total labor costs associated with your total headcount.

Here’s a simple formula to calculate the fully burdened labor rate:

For example, let’s say you employ a website developer with an annual base salary of $80,000, and they are not eligible for a bonus. As a full-time employee, the developer also receives health and dental benefits totaling $20,000, plus a training allowance of $2,500 per year.

Additionally, your share of employer payroll taxes adds up to $4,500. The cost of a laptop and software licensing totals $3,000 per year. In that case, your total fully burdened labor rate for this employee is as follows:

Fully Burdened Labor Rate for Consultant = $80,000 (base salary) + 20,000 (benefits) + $2,500 (training) + $4,500 (employer taxes) + $3,000 (laptop and software) = $110,000

Now, assuming a standard work year of 2,080 hours (40 hours/week x 52 weeks), we can calculate the fully burdened labor rate per hour:

Fully Burdened Labor Rate Per Hour = $110,000 (Total Annual Cost) / 2,080 (Total Annual Work Hours) = $52.88 hourly cost

If you’re charging clients for the developer’s time, you’d want to ensure the hourly rate you charge is much higher than the cost of employing them to ensure a good profit margin.

If you need help setting the rate and maintaining a profit margin, you can use the calculator below to determine your company’s fully burdened labor rate per worker:

Fully Burdened Labor Rate Calculator

Your Fully Burdened Labor Rate

$0

Note: Employer payroll taxes for full-time employees typically include Medicare, social security, workers’ compensation insurance, and federal unemployment insurance, among others.

Benchmark Across Industries

The generally accepted rule is that the fully burdened cost of an employee will be between 25 – 40% higher than that employee’s salary. And the US Bureau of Labor Statistics reported that benefits for private industry employees increased the fully burdened cost by 42% over their salary and wages.

In professional service companies, such as consulting firms, marketing agencies, and other service-oriented businesses, the fully burdened labor rate can vary significantly — it depends on the sector you’re in, where you’re located, and how experienced your team is. Executives, for example, who often receive a significant portion of compensation in the form of bonuses and benefits, may cost a company more than 3X their base salary.

Impact of Remote Work on Fully Burdened Labor Rates

The shift towards remote work has significantly reshaped how companies look at the fully burdened labor rate, especially regarding overhead costs and benefits.

Traditionally, overhead expenses included those related to physical office spaces, such as rent, utilities, and office supplies. However, companies that offer remote work typically see a drop in these traditional overhead costs since rent for office space, utilities, and travel expenses are excluded.

Remote work has also pushed companies to rethink their benefits packages. For instance, there’s an increasing emphasis on asynchronous or flexible working hours, mental health support, and home office stipends over more traditional fringe benefits like travel allowances.

That being said, remote work adds other expenses, such as home office setups, cybersecurity costs depending on the nature of work, and technology or software that facilitates online collaboration. So, you’d still have to account for these expenses and keep them in check.

Tips to Optimize Your Fully Burdened Labor Rate

Optimizing your fully burdened labor rate can boost your company’s financial performance and give you a competitive advantage. Below, we’ve shared some tips to help you get there:

- Compare your labor rates with industry standards or competitors to determine if there are opportunities to adjust your rates without compromising on quality or productivity.

- Invest in employee training and development, which can lead to higher productivity, effectively lowering the fully burdened labor rate by spreading fixed costs over a larger output.

- Similarly, streamline operations and work processes to reduce the time and resources needed to complete tasks, eventually lowering the cost of labor.

- Leverage technology and automation to reduce the reliance on manual labor for repetitive tasks.

- Consider offering a flexible work environment, such as hybrid or remote work, as it can reduce overhead costs associated with an office space.

- Improve your hiring and retention strategy, specifically ensuring that you hire the right talent and can keep them, to reduce turnover-related costs, such as recruitment, onboarding, and training new employees.

- Regularly review your company’s benefits to ensure they are competitive and cost-effective. For instance, tailoring benefits to what employees value most can be more cost-efficient than offering a wide range of less-valued benefits.

While all these tips can help you lower your fully burdened labor rate, remember there’s no one-size-fits-all solution. Focus on what aligns most with your company’s needs and your industry.

The Role of Mosaic in Managing Labor Costs

With workforce planning software like Mosaic, you can transform how you manage your labor costs and, in turn, your bottom line.

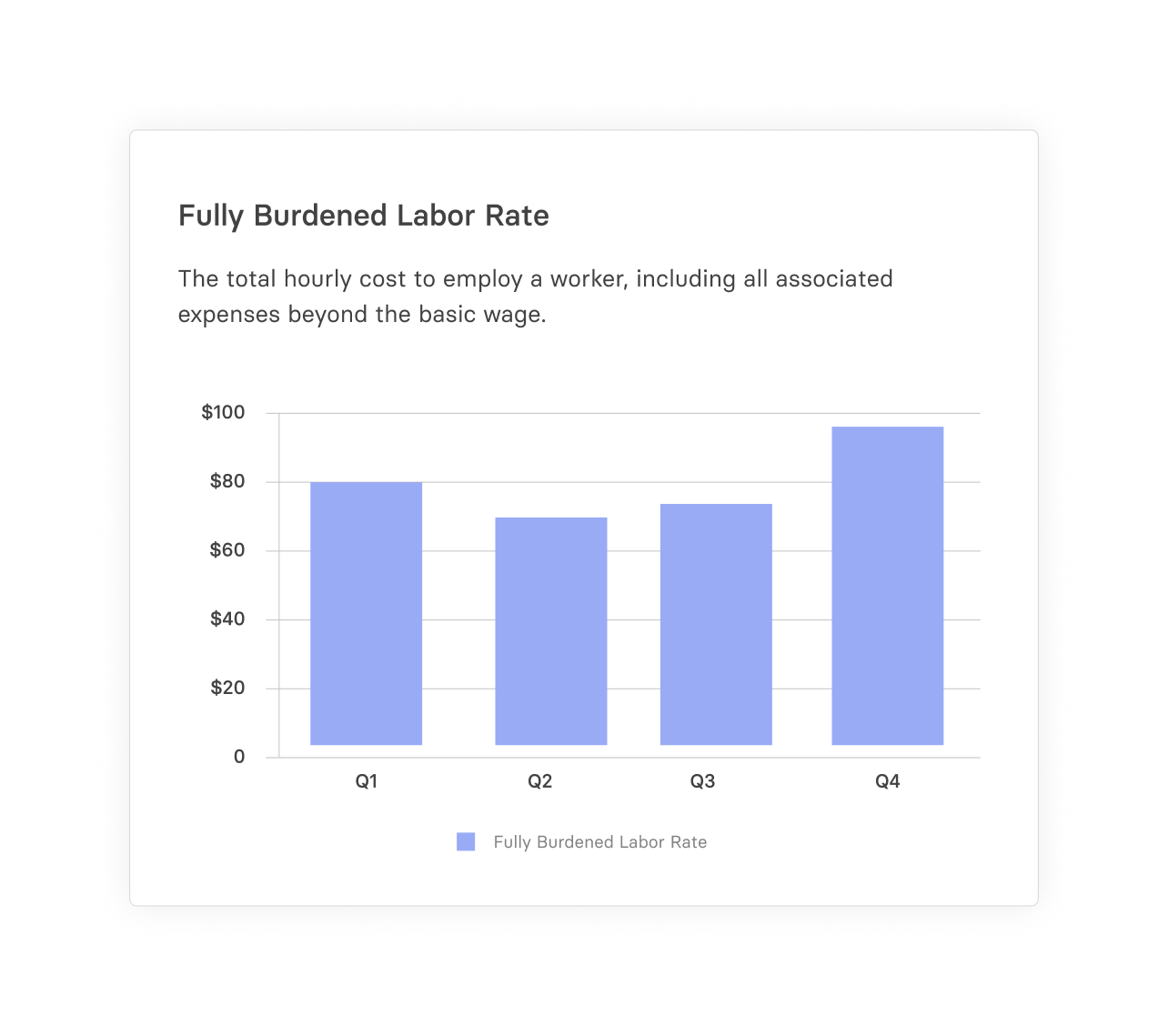

For instance, the Mosaic Metric Builder automates the calculation of your fully burdened rate, along with other crucial financial metrics. And it takes things a step further with a dashboard that gives you deep insights into other key headcount metrics and workforce planning metrics. Mosaic integrates with your source HRIS and other systems and pulls that data in real time — ensuring you always have accurate numbers in hand, exactly when you need them.

With these insights, you have better visibility into your direct labor costs and indirect labor costs and are set up to tackle any workforce planning challenges that may come your way. Ultimately, you can rest easy knowing your business decisions are made based on reliable data.

Want to see how Mosaic can help you stay on top of your financial metrics and make strategic decisions? Request a personalized demo today.

Get the Professional Services P&L Model Template

Fully Burdened Labor Rate FAQs

How often should companies review and update their fully burdened labor rate calculations?

Companies should review and update their fully burdened labor rate calculations at least annually and more frequently during periods of significant change (e.g., retirement benefit adjustments and employees’ wage increases).

Are there any industry-specific considerations when calculating the fully burdened labor rate?

What are the common pitfalls in calculating the fully burdened labor rate?

Explore Related Metrics

Own the of your business.