The Peloton Dilemma and the Future of Stay-at-Home Stocks

Joe Michalowski

Director of Content

Stay-at-home stocks are gradually heading for a moment of truth. The companies that saw massive spikes in financial performance because of stay-at-home orders could go down one of two paths—keep growing when life goes back to normal or see their financial performance decline when demand tails off.

A company like Zoom seems well situated to sustain its growth. Remote work seems to be here to stay, and the SaaS business model allows the videoconferencing giant to scale as needed to meet demand.

By comparison, Peloton faces a dilemma. Its business model depends on selling hardware products (fitness equipment) and driving customer lifetime value through its $39/month workout subscription program. Because hardware plays such a fundamental role in Peloton’s business model, the company faces unique challenges in sustaining pandemic-level success.

Despite recent news of treadmill recalls, security issues, and other hardware-related challenges, Peloton’s history of fundamentally sound financial decision-making and strategic finance give the company a path to continued success.

What Kind of Company Is Peloton, Really?

When Peloton went public in September 2019, CEO John Foley told investors and analysts that he felt the company was actually several different types of companies. He said, “I feel like we’re six or seven different companies in one. It is a unique modern company that’s singularly focused on one experience of better fitness in the home.”

Peloton’s many identities are why investors and analysts see (and value) the company more like a tech company. It isn’t just trying to scale a hardware business with an Apple-style approach to regular product refreshes. Beyond the hardware business and the manufacturing/logistics that come with it, Peloton:

- Operates like a retail business with nearly 100 showrooms for consumers to test its products.

- Plays the role of a software company with its subscription service for on-demand workouts.

- Is building an apparel business to strengthen its brand and community.

- Acts like a media company, investing heavily in content to build something “like a Netflix library, but for fitness classes.”

These identities have all contributed to Peloton’s success. And the pandemic only accelerated it.

The company’s sales grew 172% in 2020, thanks to a widespread shift toward home fitness during the pandemic. As a result, Peloton posted its first profitable quarters ever and reached the 1 million subscriber mark for its Connected Fitness platform. All of that is why investors and analysts are optimistic that Peloton will be able to outlast the phenomenon of stay-at-home stocks.

“I feel like we’re six or seven different companies in one. It is a unique modern company that’s singularly focused on one experience of better fitness in the home.”

The company may aspire to be all kinds of things beyond a hardware business. But at the end of the day, 80% of Peloton’s revenue in 2020 came from equipment sales. And a recall of over 125,000 treadmills due to safety concerns dealt a serious blow to its stock price.

Maintaining brand trust and growing beyond the pandemic depends on Peloton’s ability to continue scaling its hardware business—and that comes with challenges that will make it difficult to sustain stay-at-home stock levels of success.

Hardware Is at the Core of Peloton’s Growth Challenges

The explosion of demand for Peloton equipment in 2020 further strengthened the company’s first-mover advantage in the at-home fitness space. The benefit (beyond more sales and profits) is that the hardware business acts as a moat for customer retention. But overcoming hardware challenges to maintain that moat has proven difficult, to say the least.

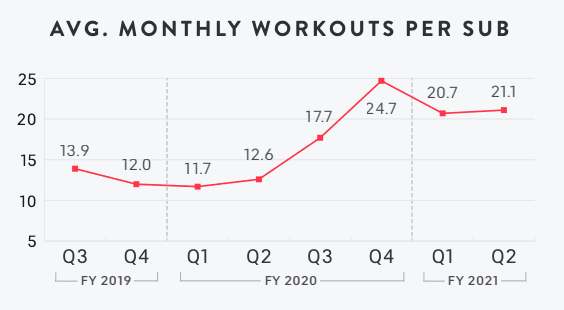

As Fool.com contributor Matt Frankel says, people who have spent thousands of dollars on a piece of Peloton equipment are going to use the service. You can see that play out in the company’s 92% retention rate for its Connected Fitness service and, as shown in the graph below, high engagement for monthly workouts.

But Peloton has long struggled to maintain consistent, short order-to-delivery times. And the pandemic revealed cracks in its supply chain that CFO Jill Woodworth and others must fill.

Peloton Prioritized Customer Experience with Supply Chain Investments

Peloton has invested heavily in its supply chain between late 2020 and early 2021 after its product lines were plagued with delivery delays. COVID-related shipping issues led to some customers waiting upwards of 10 weeks to receive their equipment orders, causing widespread frustration that hurt the company’s financial performance.

In a December 2020 discussion with Barclays, Woodworth explained that Peloton’s growth from $112 million in Q1 2019 revenue to $758 million in revenue 24 months later put significant pressure on the supply chain. And she also explained that eCommerce, in general, experienced six to seven years’ worth of growth in just nine months, “creating a lot of our ocean freight delays.”

Woodworth, Foley, and the rest of Peloton’s leadership took two main steps to start addressing supply chain issues.

- They Acquired Precor to Scale Manufacturing: In December 2020, Peloton closed a $420 million acquisition of Precor, a massive commercial fitness manufacturer. This is a medium- to long-term supply chain improvement, giving Peloton a large footprint for manufacturing in the U.S. instead of overseas.

- They Invested $100 Million in Short-Term Shipping Fixes: In February 2021, Peloton announced it would invest “more than $100 million in air freight and expedited ocean freight” to resolve short-term delivery delays. According to Foley, they’re spending 10x the usual cost per item to fix shipping delays, prioritizing customer experience over short-term profits.

These hardware-related stories have dominated headlines about Peloton over the last few months—and understandably so. But the secret to Peloton’s success isn’t an ability to fight through the challenges of scaling a hardware business. Rather, it’s a continued focus on being more than an at-home fitness equipment manufacturer.

Financial Storytelling Positions Peloton as a Tech Company

Woodworth’s ability to turn financial data into a narrative that supports the company’s overarching vision helps position Peloton as a scalable tech company—not just a consumer fitness product manufacturer. Since joining Peloton as CFO in 2018, she has adopted consistent subscriber-first messaging that aligns with Peloton’s mission to use “technology and design to connect the world through fitness.”

When Woodworth discusses Peloton’s performance in interviews and earnings calls, subscribers always come first. Where other finance teams might prioritize their basic financial reports and GAAP performance metrics, Woodworth ensures her team is always focused on Peloton customers.

The relentless focus on long-term customer experience—rooted in strong financial management—will help the company sustain success even as the world goes back to normal.

For example, when asked if Peloton might use its leverage as a market leader to raise the price of its subscription service, Woodworth explained that the $39 price point is “sacred” to the company. She told Barclays that Peloton “would rather continue to pile more and more value and more content and more software features and more fitness verticals into that subscription than think about raising the price over time.” That statement, rather than a rundown of financial numbers, highlights Peloton’s Netflix-esque commitment to content and customer experience—two things that elevate it above traditional hardware companies.

But subscriber-first doesn’t mean that Woodworth’s messaging isn’t rooted in sound finance fundamentals.

Woodworth says that their decision-making is based on a projection that Peloton will reach a subscription contribution margin range of 70%+ in a few years. But simply reporting that number might fall flat for investors and analysts. Her ability to build a subscriber-first narrative around the numbers helps position Peloton as a tech company rather than a hardware company.

From the outside looking in, it might seem like the hardware business complicates Peloton’s ability to sustain its stay-at-home stock success. But, in reality, the hardware business is an entry point that helps Peloton pursue its real focuses—building community, driving long-term engagement with high-quality content, and growing its fitness lifestyle/apparel brand.

The relentless focus on long-term customer experience—rooted in strong financial management—will help the company sustain success even as the world goes back to normal.

Peloton Is a Model for the Future of Stay-at-Home Stocks

Peloton’s success is about much more than an unexpected spike in demand during the pandemic. The Connected Fitness company was growing efficiently well before 2020—the pandemic just poured fuel on the fire. And that’s why it could be a model for the future of stay-at-home stocks even as it’s dealing with significant hardware-related challenges.

Stay-at-home stocks like Zoom, DoorDash, and now Peloton are positioned for long-term success because they figured out their financial fundamentals and North Star metrics well before COVID hit. Having that strategic foundation in place enabled the companies to adapt and address the challenges of an unpredictable demand curve.

Companies in the stay-at-home stock category face a number of post-pandemic challenges. Something as simple as a cash flow forecast becomes complicated when the revenue spikes during the pandemic make a mess of historical trends. Implementing a dedicated cash flow forecasting software can aid these companies in navigating these complexities, helping to adjust for anomalies and maintain accurate predictions.

Not every company in the stay-at-home stock category will be able to carry its success beyond the pandemic. But the CEO-CFO relationship between Woodworth and Foley, combined with a deep focus on customer/subscriber experience, puts Peloton in a good position to continue its upward trajectory.

Own the of your business.