Financial Modeling Software: A Buyer’s Guide to the Best Solutions

Carly Miller

Content Marketing Writer

Businesses need more from finance than ever before. They demand faster analysis, more real-time planning, and continuous visibility into the numbers.

Finance teams that meet these demands become growth catalysts for their organizations, spreading out and providing strategic value to each department. But, even with the rise in SaaS tools and platforms, manual processes hold most teams back.

An explosion of point solutions and SaaS tools across the business has resulted in financial data being stored in multiple spreadsheets and platforms, then siloed within those systems.

Instead of spending valuable time building financial models that forecast the future of the business, finance gets stuck in a vicious cycle of financial consolidation, manual reconciliation, and backward-looking reporting. These processes are rife for human error — and take hours away from providing important insights that push your business forward.

Finance deserves new technology to drive continuous planning, which means leaning on financial modeling software instead of complex spreadsheets. Here’s everything you need to know to choose the right financial modeling software for your business.

Table of Contents

What Is Financial Modeling Software?

Financial modeling software is a tool that helps aggregate financial data from source systems of record like your ERP, CRM, HRIS, and billing systems and enables finance leaders to create a vision for the company’s future with their numbers.

It’s the operating system that brings revenue, expense, and payroll data together from your many business systems so you can build financial assumptions, create driver-based forecasts, and weave together a story for how your business will grow in the coming months, quarters, and years.

The right financial modeling software enables your team to create financial models and scenario analysis examples that display the company’s current financial standing and forecasts future growth scenarios.

While the world’s most popular financial modeling tools are Excel and Google Sheets, there’s a rising tide of software-based solutions. As expectations for finance teams continue to rise, spreadsheets won’t be able to keep up — no matter how good your Excel skills are.

How Does Financial Modeling Software Work?

Finance modeling software streamlines the model-building process with pre-configured components, flexible drivers, and automated metric calculations to enable more agile planning — both at the company level and on a more granular department level.

Instead of the tedious work of downloading, cleaning, and consolidating data, your finance team starts with trustworthy, accurate, real-time data so they can spend more time helping executive leaders make better-informed decisions.

Some financial model software focuses on specific workflows and some focus on serving specific company sizes. Regardless, the software or tool should be customizable to your business’ needs.

Financial models, in and of themselves, are a tool: They’re built through the software in order to lead toward the financial analysis and decision-making critical to the future of a business. Finance modeling software is able to:

- Model multiple scenarios and outcomes. These models can fall under headcount planning, cash flow forecasting, discounted cash flow analysis (DCF), SaaS valuation, mergers and acquisitions, balance sheet planning, and many other scenarios that impact the company financially.

- Build flexible forecasts. Finance teams should be able to forecast overall or specific department spend by vendor, as well as forecast timelines for various goals, such as overall revenue, monthly or annual recurring revenue (MRR and ARR, respectively) or headcount goals. And they should be able to update those forecasts easily as business needs change.

- Identify revenue drivers. Any cash flow modeling should be able to break out into particular drivers, such as by customer, their customer journey, conversion point, and sales representative.

The best financial modeling tools streamline data mapping from systems of record like billing, CRM, HRIS, and ERP , taking complex management and manipulation out of the equation. They come with pre-loaded financial metrics, which helps your finance team track key performance indicators (KPIs) like ARR, sales pipeline, runway, and more without having to perform manual calculations.

Not all financial modeling software is created equal, though. As you evaluate potential solutions, consider everything from data visibility to custom metric building to the integrations the software supports to find the best solution for your business.

Excel vs. Financial Modeling Software

Even as new CFO tools emerge, one thing remains — spreadsheets continue to be the dominant tool for finance teams. In our 2022 SaaS performance reporting research, we found that 75% of companies use Excel for their metric calculations. And that reliance on the flexibility of spreadsheets extends to financial modeling.

But the flexibility of spreadsheets comes at a price. Manual data management, complex formulas, and interwoven financial assumptions force finance to spend too much time looking backward, rather than focusing on pulling growth levers to effectively forecast the future.

Excel and Google Sheets templates offer a good starting point. But they don’t eliminate the downsides of relying on spreadsheets to model your business. Why (and how) is software better? It facilitates collaboration, reduces human error, and provides real-time accuracy in the numbers.

- Easier to manage continuous planning. Create rolling forecasts that automatically update with actuals so finance doesn’t have to constantly rebuild models. Collaboration becomes easier, too: Instead of building out a model that only finance actually looks at, key business stakeholders can be pulled into the conversation at the right time with relevant context at the ready.

- Plan multiple scenarios with ease. Financial modeling software can save models and overlay goals dynamically. That way, finance teams can easily manage base, low, and high-case scenarios to thoroughly answer “What if?” for all kinds of plans.

- Manage driver-based models instead of weaving webs of assumptions. Historical data is great: It sets a baseline. But historical assumptions along can’t drive a model. Scale driver-based planning with flexible scenarios to really dive into your actuals and forecast based on real-time influences.

- Skip data collection and automate instead. Direct integrations with key source systems and point solutions help automate data aggregation. Automating that data collection keeps real-time actuals flowing through the system so teams don’t have to manually update the numbers.

- More accurate modeling and spend forecasting. As you integrate platforms and systems, you gain real-time access to real-time actuals and historical data. With all of this data flowing in real time, you can cut data at a more granular level. Look at your spend on a department level or run cohort analysis on retention metrics with a few clicks instead of building out new spreadsheet-based models or running into the pitfalls of cohort analysis in Excel.

With financial modeling tools at your finance team’s disposal, you gain more agile and thorough forecasts with actionable insights thanks to better-rounded visibility from your business’ finance functions.

Top Financial Modeling Software Compared

The best financial modeling software will check all of the boxes on features and benefits listed above. And while spreadsheets continue to dominate the space, financial planning software has evolved significantly over the past decade or two.

If you’ve been in the industry long enough, you may know the traditional players in the financial modeling software space. Enterprise-level platforms like Anaplan and Adaptive have promised a newfound level of agility and flexibility that spreadsheets can’t deliver. But they’re massively complex themselves and aren’t well-suited for the needs of lean finance teams at high-growth companies.

Instead of forcing those complex, highly-technical, and high-touch enterprise-level platforms to meet the needs of your business, consider some of the emerging financial modeling software options that exist in the strategic finance space.

Cube

Cube improves forecasting workflows by combining an integrated spreadsheet interface with limited cloud data management. While Cube requires extensive manual setup to get toward customization, it helps automate calculations for models and forecasts.

Cube is a good option for companies that want to continue working with standard ERP and spreadsheet integrations, like Excel and Google Sheets. But everything requires manual setup: Cube doesn’t provide driver-based financial models and doesn’t offer integrated headcount and sales planning. Finance teams would need to spend time identifying drivers, which can take weeks to establish and implement into future forecasts. Your team also loses time with data set cleaning, consolidation, and reconciliation, which keeps forecasts assumption-based and backward-looking instead of ramping your business forward with stronger insights for decision-making across the company.

Jirav

Jirav focuses on continuous planning and reporting for teams that rely heavily on Excel as its data set tool versus integrations. Jirav is great for small businesses that may not need SaaS metrics and focus on short-term workflows.

As your company scales, the finance team may need access to more metrics or and platform integrations than Jirav currently offers. The platform doesn’t connect to CRM or billing systems, and finance teams will spend much of their time manually consolidating Excel templates and spreadsheet information, to then have to calculate and reconcile that data between workflows. Jirav also doesn’t provide unlimited reports, forecasts, or scenarios — instead, access is tiered, so some planning features are only accessible to particular user-tiers.

Mosaic

Mosaic is the first Strategic Finance Platform, blending the flexibility and customization of enterprise-grade financial modeling software with the agility and automation that small and mid-sized companies need.

The Mosaic platform integrates with over 25 systems across ERPs, CRMs, HRISs, and billing systems. These include some of the biggest tools in those key categories, including Salesforce, NetSuite, QuickBooks, Gusto, and Stripe. Mosaic automatically centralizes data from all your core systems of record to power financial modeling with real-time actuals.

The platform also offers a suite of pre-configured components and flexible drivers that allow finance teams to truly explore their models and create the base, low, and high-case scenarios and reports that will allow executive leadership to make the most informed decisions with confidence.

Financial Modeling Software Drives Your Finance Team Toward the Future — By How Much Is Up to You.

Financial modeling software and tools set your team up for success: The software can bear a lot of the brunt of work. But finance modeling software’s impact on your business depends on how quickly it drives forward-looking, strategic insights that pioneer companies for success years down the line.

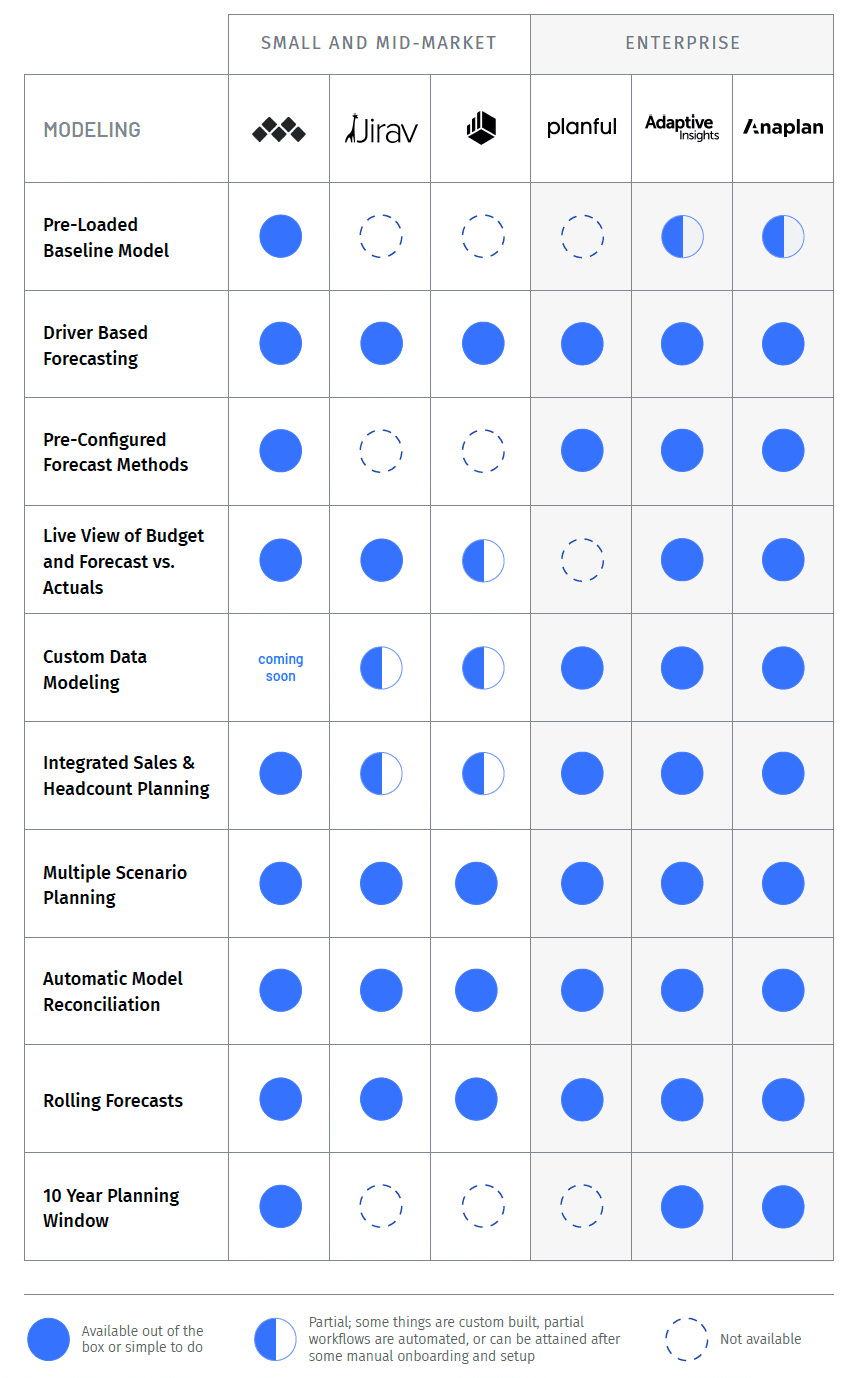

The Modern Buyer’s Guide to Strategic Finance Software is a resource that expedites the journey toward discovering the right finance modeling tools and software for your business. In it, we compare six of the top financial software companies that serve your needs now and into the future.

At the end of the day, the adoption of any financial forecasting tool needs to lead toward collaboration. Finance needs to dive into the “why” behind the numbers and craft the narrative for department leads and key stakeholders alike. That’s when everyone gains real visibility into a company’s current well-being and can have a seat at the ever-expanding table of successful growth initiatives — all thanks to the models that are forecasted today.

Own the of your business.