Companies can build something important when employees have the opportunity to apply their unique strengths to the mission. The more product teams can stay laser-focused on building great products and customer success on making customers more successful, the better off your company will be.

An extension of that philosophy is that people outside of the finance team shouldn’t have to focus on finance.

At least that’s what former Palantir CFO Colin Anderson believes. It’s a mindset that Anderson’s team embraced as the software company scaled from less than $10 million in revenue in 2009 when he joined to $20 billion in valuation in 2017 when he left to a $40 billion valuation today in the public markets.

Anderson will be the first to tell you that Palantir’s success came down to having world-class talent across the entire organization united behind an important mission and that he was fortunate to play a part in it.

One key thing he did to help support Palantir’s rapid growth? He and his finance team modeled themselves as a customer service organization for the business.

Embrace a Customer Service Mindset in Finance

According to Anderson, finance’s “customer is everyone in the company, from business development and engineering to PeopleOps and the executive team. You need to provide relevant value to the customer, or your work may be meaningless. Learn to speak their language and translate the numbers into something that has meaning for them. That is what can earn finance a seat at the table as a true partner.”

From this perspective, a customer service mindset in finance means operating based on a shared language with the business. A unique strength of your team is speaking the language of finance—apply this strength by embracing your customers’ terms and finding ways to support their needs, all while keeping the overall company on a path to its broader financial goals.

Creating a shared language with the business requires a granular understanding of each department’s data—their “atomic units,” as Anderson calls them. Finance’s atomic units include credit card swipes, invoices, payroll expenses, debits, and credits. But people in your organization think in different terms.

For example, your instinct may be to ask the Head of Engineering whether her team’s payroll expense will increase from $4 million last year to either $5 million or $6 million this year. You may get a number, but the framing of that question fails to give you a granular understanding of the engineering team’s needs. And it doesn’t lay the groundwork for a true partnership between your team and theirs.

Instead, consider asking questions about the department’s current resources and specific goals.

“It’s more useful to see they currently have twenty engineers on their team and ask how many more they need to hire to meet their goals,” said Anderson. “Will the new hires be entry-level or more senior? What month might they start?”

Turn these answers into structured data (projected salaries, start dates, expected headcount) that fuels your SaaS financial models. When you have that kind of granular data powering your financial models, it will be easier to translate numbers into insights your business partners may value the next time you connect.

The customer service mindset helps you operate in a way that builds trust and partnerships across the business. But you’ll need an intentional plan to run your team like a customer service org. Approaching finance as a customer service team at scale requires the right framework.

Follow a Simple 5-Part Framework for Finance as a Service Function

Colin Anderson came up with a simple model for scaling finance to support Palantir’s hypergrowth. The goal of this framework is for the finance team to build itself and its operations to deliver value as a trusted partner across the business.

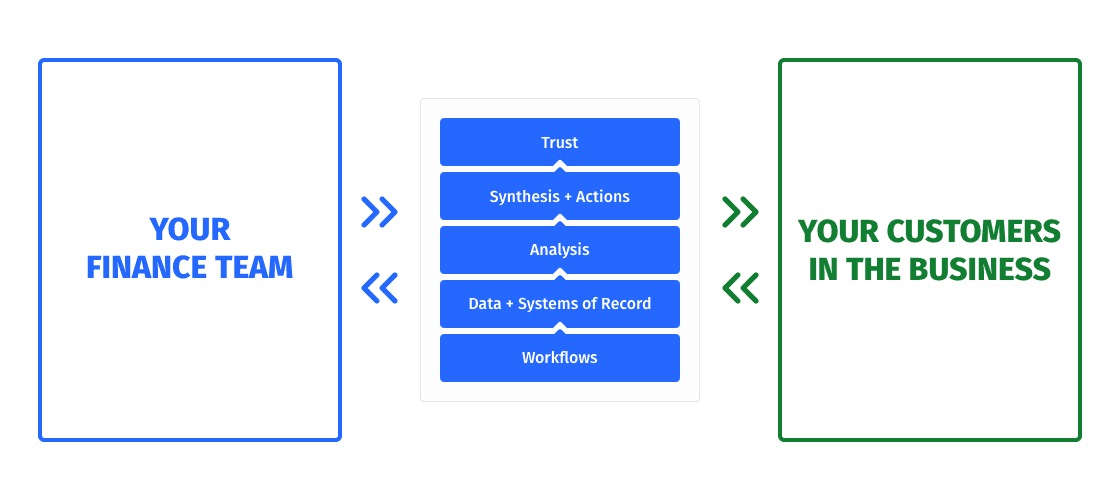

At the most fundamental level, finance’s service role begins and ends with people. Your “atomic units” are the finance team on the one hand and your customers (everyone across the business) on the other. And in the middle, you have everything needed to systematize and scale a shared language between finance and the rest of the org.

The middle piece is where Anderson’s five-part framework comes into play. It’s where you build processes and a tech stack to bridge the gap between finance and the business by translating numbers into the atomic units that the business cares about most.

The five main components of Anderson’s framework for finance as a customer service org are:

- Finance Workflows: Design your operations to enable your team to reach its goals and deliver high levels of service. Make sure your processes are as repeatable and scalable as possible while remaining adaptable to meet the ever-changing needs of a rapidly growing company.

- Data as Digital Exhaust: Capture raw data as digital exhaust in your systems of record whenever possible. This data is your foundation for asking (and answering) interesting questions with your business partners. Implement systems and workflows to automatically capture this digital exhaust so that no one has to do work twice. Start building the most important datasets first, and remember to translate finance frameworks into meaningful business frameworks.

- Analysis: Analyze your digital exhaust at a granular level to understand what the data is telling you about the business. Do this alongside your business partners through their lens first so that you can communicate clearly around shared goals.

- Synthesis and Actions: Determine key takeaways and actionable insights from the analysis together with your customer, through their lens, using your numbers. Work with your business partners to enable course corrections (on your side and theirs) as you build upon your common operating picture over time.

- Trust Through Repetition: Create a foundation of trust with your business partners through repeat interaction and shared decision-making. You can earn your customers’ trust if you consistently come to the table with clean data, key takeaways, and actionable insights with why they agree. And that trust becomes the basis for a partnership.

This framework facilitates finance’s role as a forward-looking, strategic finance function. Anderson likened this to operating a train:

While people in the business focus on keeping the train moving, finance’s job is to help see the tracks ahead. How far ahead can we see? How soon will we be able to see that a bridge is out? Does our five-part framework have the right levers in place to take action when we see trouble ahead? Sometimes, that might mean switching tracks, hitting the brakes, or accelerating straight through the problem.

Because it uses real-time digital exhaust from your business, this framework ensures you have near real-time visibility of the past and present while also helping you support people in strategic decision-making. To power this framework, Anderson emphasizes that you’ll need the right technology in place to support your business at scale.

Take Advantage of Tech to Centralize Financial Data

For finance to work as a service organization, you need tech that enables rapid data collection and analysis from multiple sources. According to Anderson, finance works best as a service organization “when it’s connected through tech and processes that are legible and adaptable enough to scale alongside the business.”

But implementing the right tech posed a real challenge for Anderson and his team when they were scaling finance at Palantir 10+ years ago.

“The available technology for finance was just so bad in those early days,” said Anderson. “We had to constantly push the boundaries of what technology could do for finance so we could properly support our business partners.”

Ten years later, an explosion of finance technology means you can now avoid some of these challenges.

Today, you don’t need to build a custom workflow to rip data out of your payroll system every time you update a headcount plan. You can implement Gusto from the start and integrate it with your other systems of record for real-time insights. And you don’t need to worry about errors in subscription management because you’re working out of paper folders. You can implement a solution like SaaSOptics to translate bookings to cash automatically.

But it takes more than an ecosystem of point solutions to build strength at scale. You also need to centralize your financial data into a common operating picture if you want to be a strategic partner in the business. The problem is the complexity and effort required to bring financial data together from your ERP, CRM, HR systems, billing systems, and every other SaaS tool that generates digital exhaust. Overcoming that challenge to create a shared view of your business is crucial to building finance as a customer service org.

Anderson and his team were “lucky because we had free access to Palantir’s own product, a world-class software platform” to handle that data integration and analysis challenge. But today, “you can use a tool like Mosaic that’s tailored specifically for finance teams, automatically centralizing data and translating it into the atomic units that matter to the business at a fraction of the cost,” according to Anderson.

The right infusion of technology into Anderson’s framework unlocks real value for the finance team and its business partners. These partnerships enable members of the finance team to apply their unique strengths to impact the company’s products, customers, and mission directly—and that’s the absolute core of finance’s customer service role.

Build Trust with People to Earn a Seat at the Table

The customer service mindset gives you a path to earn finance’s seat at the strategic table.

“People would only take the time to sit down with us, let alone ask us what we thought, once they trusted us, trusted our data, and had seen us in repeat interactions,” said Anderson.

When you combine great finance talent with the right data and technology, you can execute the framework for supporting the business at scale, just like Palantir did.

“Being able to answer sophisticated questions quickly was crucial,” according to Anderson. “At the time, we had to do it based on the tech stack we built from the ground up. Mosaic does it out of the box. I wish we had that on our journey.”

Finance sits in a unique seat at the table with both a qualitative and quantitative view of the business. If you use this seat wisely, you’ll be able to add value to impact your company’s mission and unlock growth for both the organization and the people in it.

Own the of your business.