Traditional budgeting doesn’t fit these criteria. That’s why more and more SaaS startups are switching to alternative, strategic budgeting methods like zero-based budgeting, activity-based budgeting, or value-proposition budgeting.

Thanks to its dual focus on driving value for stakeholders and objective-based resource allocation, value-proposition budgeting (VPB) is especially well suited to SaaS companies.

Table of Contents

What Is Value-Proposition Budgeting?

Value-proposition budgeting (VPB) is a strategic budgeting approach that prioritizes line items based on the value provided to stakeholders, from customers to investors. It’s also sometimes referred to as value-based budgeting.

But how you define value depends on your org’s objectives. It could be qualitative (higher MRR), quantitative (raised customer satisfaction), or some combination of the two.

VPB asks questions like:

- What are our strategic goals?

- Based on our goals, where should we prioritize allocation?

- What is the ROI of this line item?

- How can we measure the alignment of this line item with our strategic goals?

Get the 2024 Financial Planning Blueprint

Value-Proposition Budgeting vs. Zero-Based Budgeting

Value-proposition budgeting (VPB) and zero-based budgeting (ZBB) are similar — both seek to cut unnecessary spending and bring budgets in line with a company’s strategic goals.

The main difference between value-based and zero-based budgeting is one of complexity. Zero-based budgeting is much more resource intensive and time-consuming than VPB. In zero-based budgeting, you start every line item from zero, completely ignoring prior allocations.

Unlike zero-based budgeting, value-based budgeting does not create a budget from scratch. You simply analyze your existing budget’s line items in terms of value provided, reallocating resources in line with your objectives. You’re restructuring according to importance — that’s why VPB is also called priority-based budgeting.

Top-down vs. bottom-up budgeting is relevant to the difference between VPB and ZBB — VPB is more top-down, since the goals and values come from the top. ZBB is more bottom-up, since goals begin as initiatives from individual departments and are consolidated into one, overarching budget.

How To Implement Value-Proposition Budgeting in SaaS Businesses

To implement a value-proposition budget for your SaaS business, you’ll first need to identify your objective. Next, you’ll identify which expenses are tied to that objective by examining their ROI. Finally, you’ll build your budget accordingly.

Identify Your Objective

First, what’s your org’s current priority? Is it acquiring new customers? Retaining existing ones? Maybe it’s to hit a specific MRR target, or flesh out a specific feature users have raved about. Whatever the case, these goals should fit into your annual operating plan.

Identify High-Value Expenditures

VPB involves diving into expenses to determine their ROI. For SaaS companies, some major expense groupings include:

- Marketing costs

- Vendor spend

- Headcount

- G&A Costs

But how do you know which expenses provide the highest value?

Marketing costs

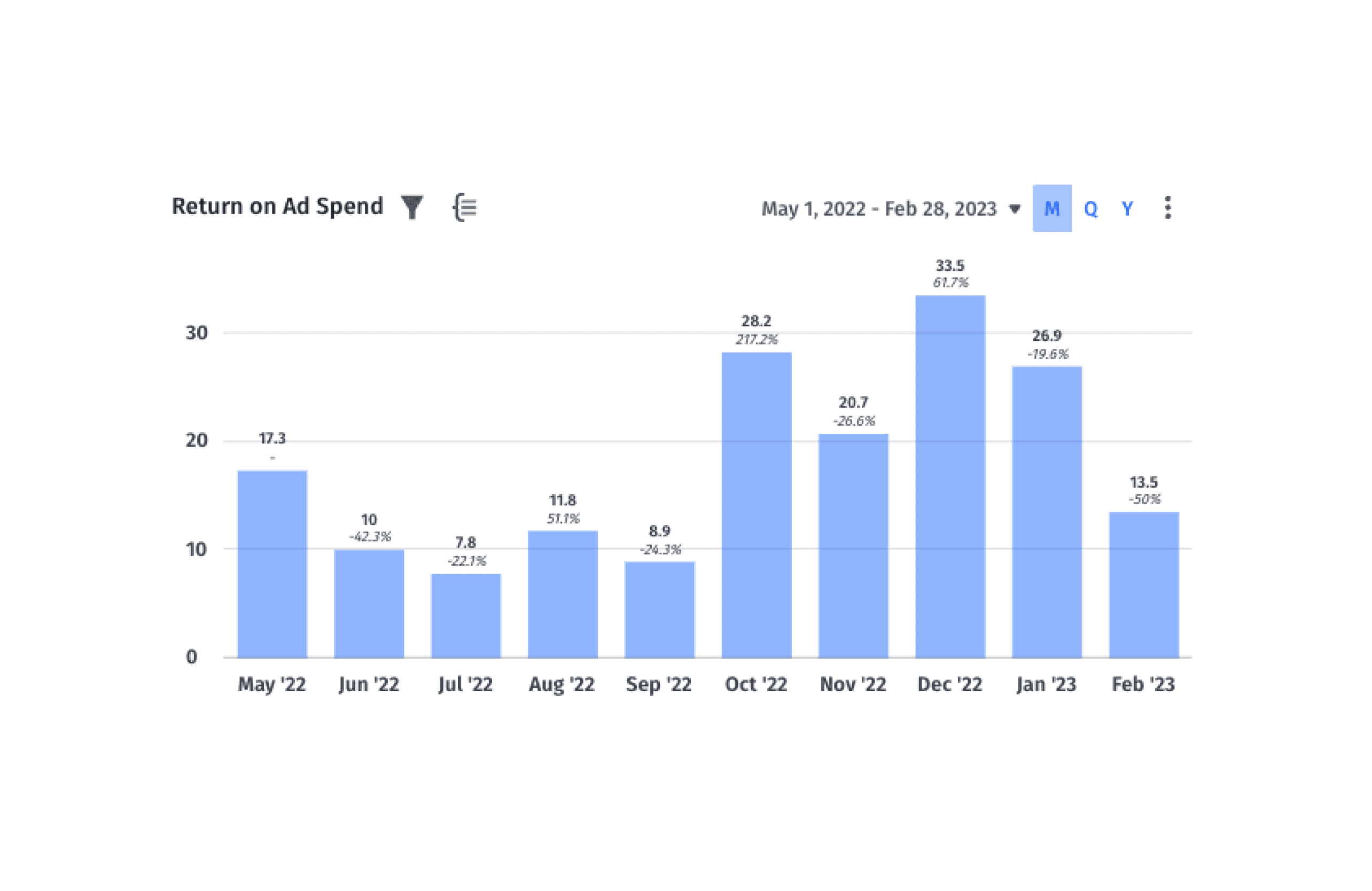

For SaaS, digital marketing costs are your primary means of acquiring new customers. But in order to see which channels and campaigns are most effective, you need to calculate return on ad spend (ROAS).

Through integration with your CRM and ERP, Mosaic ensures attribution is correct and provides a clear view of spend per channel and sales pipeline. When ROAS is simplified, you can spend less time on calculations and more on prioritizing channels that drive the most value.

Vendor spend

With “tool overload” running rampant, vendor spend is often an excellent place for SaaS companies to reduce wasteful spending.

Aligning vendors with your value proposition takes two steps:

1) Having all your vendors in view

2) Talking with department heads to determine how they fit with your goals

As to the first point, Mosaic works to automatically tag vendor expenses in your ERP. From there, you can get a clear view of how much you’re spending per department, per month on vendors. This helps facilitate conversation on ROI and use cases with department heads.

Headcount

Headcount is usually a SaaS company’s largest expense, accounting for around 70% of spend.

That’s why making this cost as efficient as possible is crucial. For that, you need an accurate understanding of headcount ROI.

For customer success, that means drawing the connection between number of reps and specific retention metrics like NRR or MRR churn.

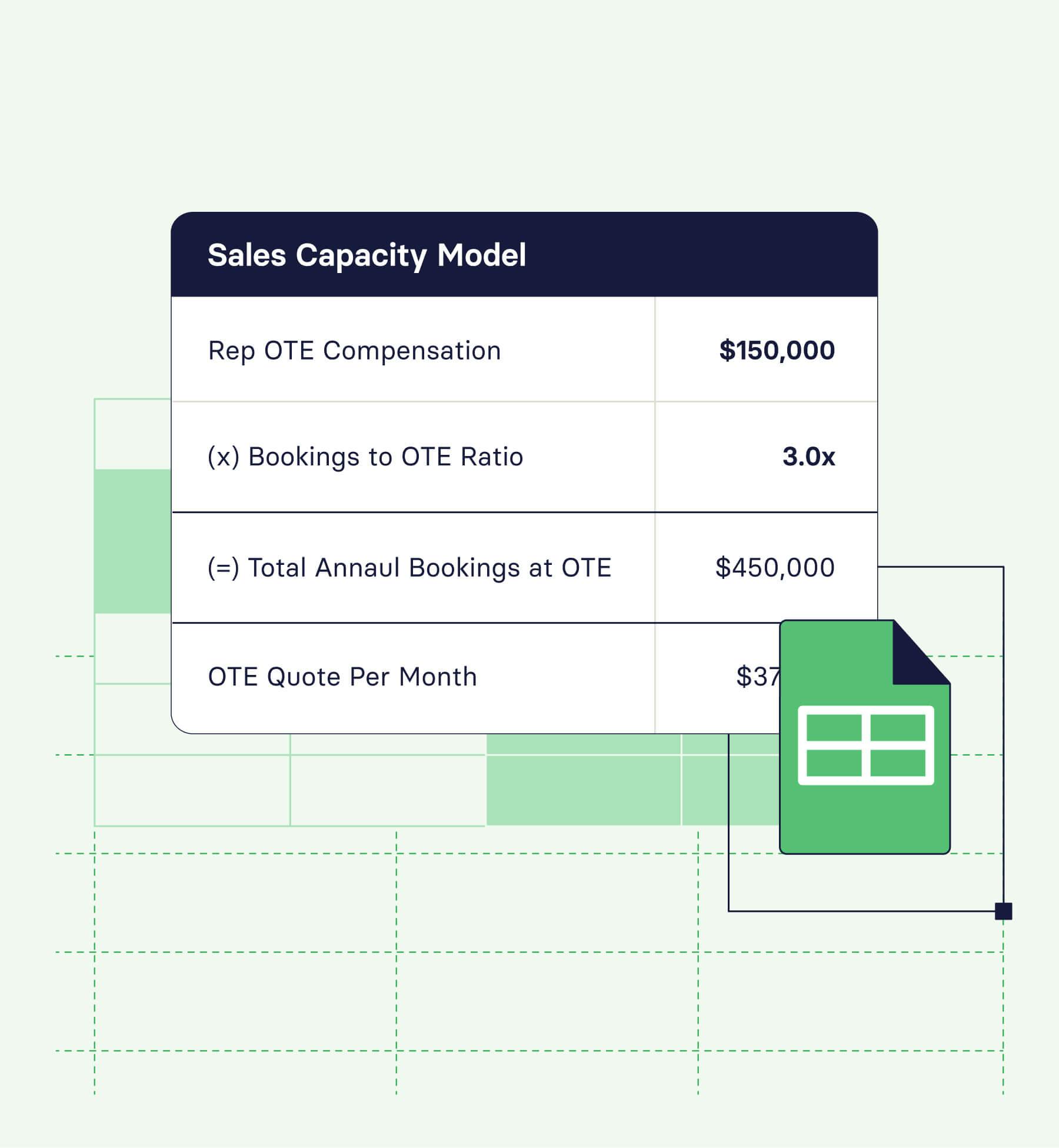

For sales, it means accurately accounting for factors like sales rep ramp rate and quota attainment. By understanding headcount as a value driver you can assess with metrics, your org can save money and build more accurate forecasts.

G&A Costs

G&A costs can eat up a sizable portion of spend, especially as you scale.

The problem is G&A costs can be difficult to track. Leverage budgeting software that categorizes them correctly so you can quickly get a handle on fixed and semi-variable costs.

While you can’t do much about fixed costs, you can target those semi-variable costs to match more closely with current goals. Track G&A expenses in real-time with Mosaic to get a sense of how they’re affecting your bottom line.

Aligning Your Budget With Business Goals

Value-proposition budgeting is all about bringing your budget in step with your strategic goals.

Say your goal is to increase MRR. You’d tackle customer churn by boosting funds to customer success programs, and (with the help of a sales capacity model) set aside the necessary amount for sales headcount.

Whichever goal you choose, the best way to keep tabs on how your budget is tracking against goals in real-time is with rolling forecasts. An alternative to traditional budgeting, rolling forecasts allow you to adjust line items month to month.

Using a rolling forecast, you’d keep an eye on the key performance indicators connected to the drivers behind your goals. If your goal is to increase MRR, for example, you’d watch revenue growth percentage (the KPI), directly connected to sales headcount (the driver).

If MRR growth over one month didn’t go as expected, you’d know to rethink your assumptions on factors like quota per sales rep and readjust the budget to reflect this. Leverage budget variance analysis in conjunction with your rolling forecasts to keep resource allocation as closely aligned to values as possible.

Advantages of Value-Proposition Budgeting for SaaS Businesses

With its focus on customer value, efficient resource allocation, and strategic growth, value-proposition budgeting is an excellent budgeting process for SaaS businesses, especially at the early and medium stages.

Cost Efficiency and Resource Optimization

The value-proposition budgeting process requires you to go through each line item of your existing budget and prioritize expenses based on how they provide value to your company and customers. This makes value-proposition budgeting excellent for restructuring — you can more easily cut costs and allocate resources where they’ll drive the most revenue in the short- and long-term.

Strategic Decision-Making and Growth

SaaS companies often operate with limited resources — it’s impossible to allocate uniformly throughout the business. By scrutinizing expenses, value-based budgeting helps your org identify priorities and invest accordingly.

Vendor spend is a great example because these costs can easily get lost in the shuffle and quickly grow out of control.

Mosaic can help you get a solid view of expenses and forecast how they’ll grow as you scale. Seeing the associated costs makes it easier to decide which are necessary and which can be cut.

Overcoming Challenges in Value-Proposition Budgeting

Like all budgeting methods, value-proposition budgeting comes with its own set of challenges. For one, it can be tough to find the balance between short- and long-term objectives. Next, it requires a complete view of your financial picture, which can be difficult to attain.

Balancing Short-Term Needs With Long-term Goals

Value-based budgeting is focused on short- and long-term goals, whether that’s building out a new feature or reducing customer churn. But you can’t allocate every resource to these goals — short-term needs should be prioritized to keep the company operating. Use financial models to project cash flow needs at each stage of growth.

You’ll also want to contextualize these models with scenario analysis, which provides extra wiggle room in case assumptions miss the mark.

Build Financial Forecasts & Models with Real-Time Data

Integrating With Existing Systems

Value-proposition budgeting leverages rolling forecasts, meaning it must be aligned with your org’s real-time data.

The best way to do this is by consolidating your existing systems — CRM, ERP, HRIS, billing, etc. — in a centralized platform.

Mosaic does just that, granting you a real-time view of business-critical details like sales pipeline, headcount, and vendor expenses by department.

Armed with this complete view, you can model out value-driven plans and adjust them as needed.

Mosaic’s Role in Streamlining Value-Based Budgeting

By helping you analyze historical data and understand value drivers in your complete business context, Mosaic simplifies value-based budgeting. By helping you construct forecasts and scenario plans, Mosaic allows you to build those plans with tight resource allocation while also leaving your budget room to adjust to changing circumstances.

Leveraging Historical Data

One of the best ways to understand today’s budget is by looking to yesterday’s actuals.

What’s been the average return on investment for specific line items? Is that ROI — whether quantitative or qualitative — relevant to your current goals?

You can also dig into trends to show why expenses increased over time.

Mosaic leverages historical data with predictive analytics in order to help you more carefully allocate resources by showing how your future expenses will change as you scale — another guide to strategic decision making.

Forecasting and Scenario Analysis

You can’t only work off of historical data — forecasting is crucial for value-proposition budgeting. Why? Well, by prioritizing specific line items and forecasting that budget allocation, you see if your resource allocation matches where you want to be months down the line.

In other words, you see if you’ve identified the correct value drivers.

At the same time, the SaaS environment is often unpredictable — it’s important to build flexibility into your plans. For instance, you’re probably assuming a certain rate of revenue growth, or a similar level of competition as time goes on. But what if your assumptions turn out to be false? How large of an effect would that have on your budget?

While forecasting helps you build your budget, scenario analysis helps you weigh its risks. By integrating with your financial systems and automatically generating a baseline, Mosaic simplifies both.

Conclusion: The Future of Budgeting for SaaS Businesses

At the end of the day, your goal is to create a product that provides value to stakeholders. As more and more business leaders recognize the potential of leveraging real-time data, budgeting stands to become less focused on incremental increases and more focused on value and agility.

See for yourself how you can transform your data into a flexible value-based budget. Request a demo today.

Value-Proposition Budgeting FAQs

What is value-proposition budgeting and how does it differ from traditional budgeting methods?

Value-proposition budgeting asks how each line item is contributing value to the company and to customers. Where traditional budgeting methods are incremental, usually expanding on budget allocation from the previous year, VPB continuously reassesses and reallocates resources based on alignment with strategic goals.

How can value-proposition budgeting benefit a SaaS company specifically?

How is value determined in value-based budgeting?

Own the of your business.