Categories

Table of Contents

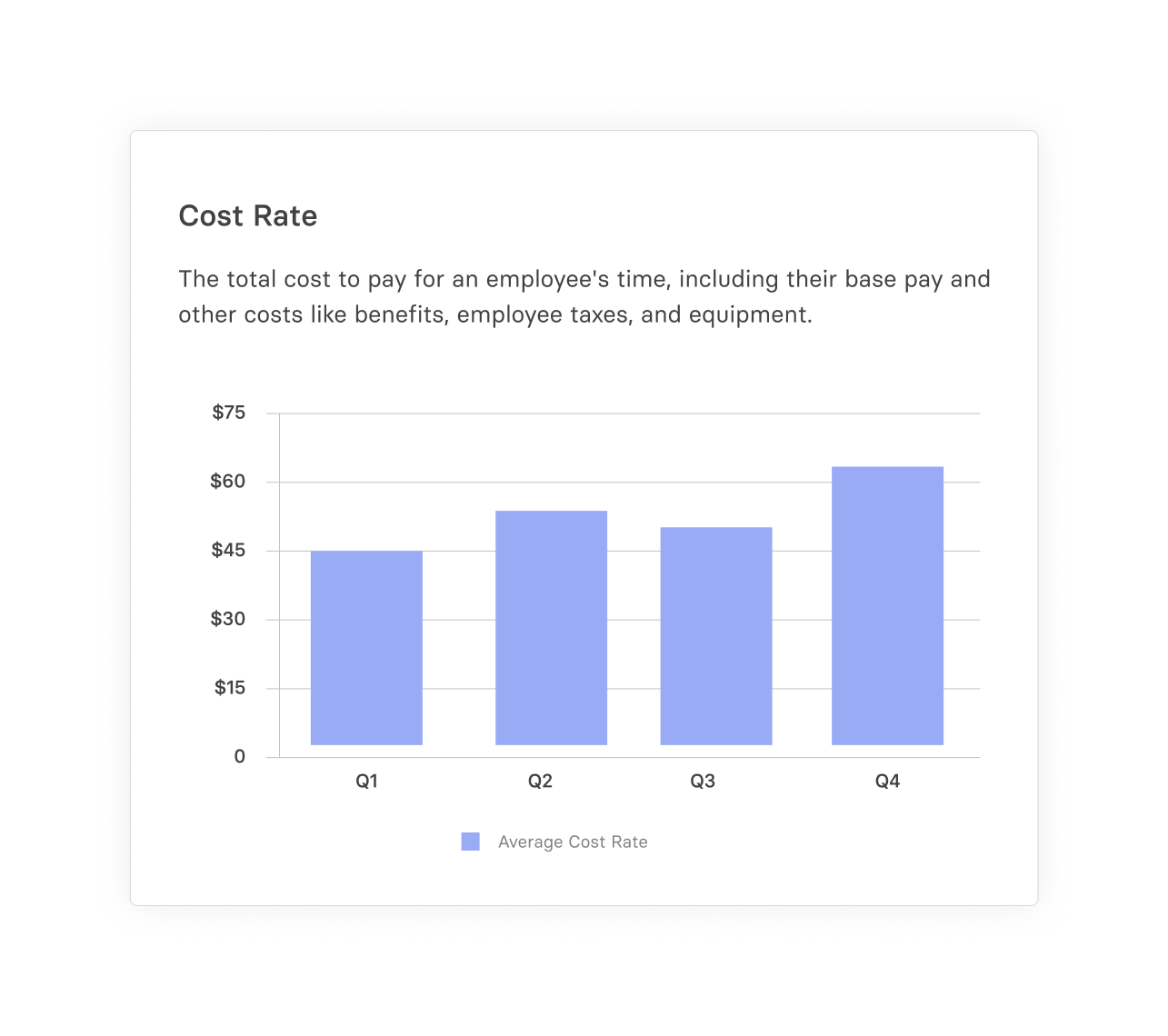

The Significance of Cost Rates

Understanding your employee’s cost rate is important because it can be far higher than their annual salary. From a top-down perspective, understanding the cost rate for different roles can ensure that finance sets budgets accurately and creates forecasts that reflect the reality of additional hires in your headcount plan.

Cost rates should also be a significant factor in project pricing for professional services businesses. Knowing the fully burdened cost of delivering a project means that you can bill and allocate resources in a way that improves the bottom line.

While the difference may seem insignificant on smaller projects or clients, the margins can add up to a serious gap in profitability when compounded over the long term and many clients.

Understand the Difference: Pay Rates, Cost Rates, Billable Rates, and Non-Billable Rates Explained

Cost rates in isolation don’t tell you a lot about your business. You also need to consider other metrics like pay rates and billable rates for context.

Pay Rates

A pay rate is the amount of money an employee receives. If they’re hourly workers, this will be their hourly wage. For full-time workers, it’s generally the annual salary that we look at.

For example, a full-time accountant’s salary of $75,000 (or $36.06 per hour) is their pay rate.

Keeping your company pay rates in line with market benchmarks will give you access to the talent you need to grow the business.

Cost Rates

As outlined above, labor cost rates are the total costs to the company for each employee. They include costs for maintaining your workforce in addition to their monetary compensation are sometimes referred to as the fully burdened labor rate.

The same accountant whose salary is $75,000 might have a cost rate of $97,500 (or $46.88 per hour).

Billable Rates

On the other end are the bill rates you charge to clients. The difference between the cost rate and the billable rate represents potential profit. Not everything in that margin will be profit, as the cost rate doesn’t include all of a company’s operating expenses.

However, understanding this gross margin between costs and income is vital for project pricing and building robust financial forecasts.

The billable rate for the accountant might be $200 per hour.

Non-Billable Rates

You can’t bill all employee time to your clients. Training, general research, and administrative work all need to be done but aren’t directly billable. You need to consider your non-billable rates when calculating a profitable billable rate and overall revenue per employee.

While there is likely a large margin between an accountant’s cost rate and their billable rate, the cost rate applies for the 40-hour week, while they will only be doing billable work for a portion of that time. Understanding the ratio between billable and non-billable times is vital to determining an employee’s impact on the bottom line.

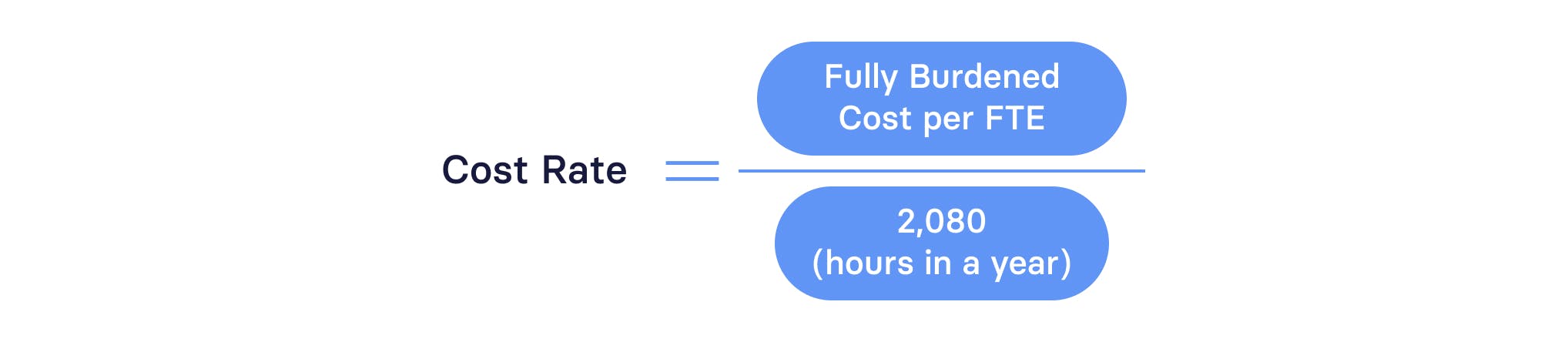

How To Calculate Cost Rate: A Step-by-Step Guide

The formula for calculating cost rate is straightforward.

Additional steps are needed to make the cost rate as valuable as possible and allow for accurate project pricing and financial forecasts.

Step 1: Identify employee categories

Before calculating cost rate, you need to create a range of categories or bands to which it can be applied. This will make it easier to assess the costs for each employee based on the benchmark pay rate for their role and the expected overhead costs.

A paralegal, for example, would be in a different band or category than a senior associate at a law firm due to their lower pay rate. At an IT services company, an engineer and a salesperson may have the same pay rate, but their overheads will differ. The engineer will likely need a higher-spec computer than a salesperson, but sales will generally have additional costs like travel.

Step 2: Assess the fully burdened cost for each category

With these categories identified, you can now put together a list of all the overhead expenses associated with each. As mentioned above, this can include things like laptops and travel expenses, which may be category-specific, and costs that apply to every employee, like benefits and payroll tax.

Step 3: Calculate the cost rate for each category

Once you’ve identified your employee categories, pay scales, and the additional overhead for each type of employee, you can now calculate their cost rate.

Simply add all of these ancillary costs for a year to their annual salary, and then divide the sum by the amount of working hours at your company.

Get the Professional Services P&L Model Template

Best Practices for Keeping Your Cost Rate in Check

The guiding principle of cost rate is that it needs to be lower than your billable rate. This differential is the fundamental lever that professional services companies have to maximize profitability and grow the company.

Not only does your billable rate need to be higher than your cost rate, but there needs to be sufficient margin to account for the fact that not all of your employees’ hours are billable.

There are several ways to optimize this margin.

Regular Financial Reviews

It’s easy for professional services firms to get too focused on their day-to-day work, losing sight of the company’s overall aims. Leaders and finance teams should regularly assess existing business and new pipeline for profitability. Considering both the cost rate and billable rate, finance can ensure the client is providing positive net value to the business over the total length of the contract.

Efficient Resource Allocation

Part of that review process should include finding ways to meet the client’s needs while minimizing costs. For example, could a junior employee with a lower cost rate complete the first 30% of a project before handing the remaining 70% off to a senior employee with a higher cost rate?

This could provide the client with the same result while lowering the company’s total cost rate for the project, maximizing the total contract value.

Use Modern Technology

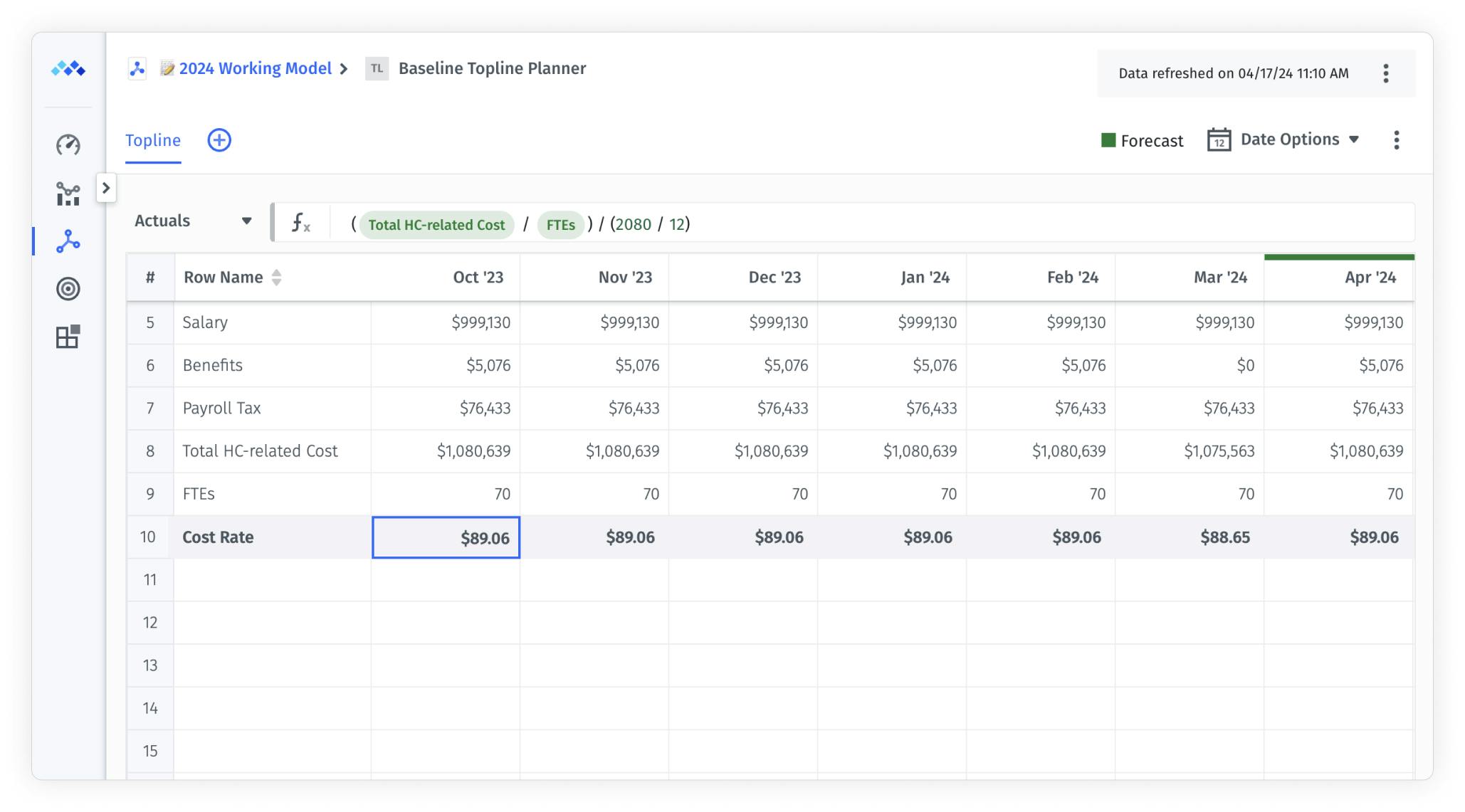

Finance teams can manually calculate and analyze cost rates, but that can be incredibly time-consuming. The right technology can calculate cost rates automatically, providing profitability snapshots while also combining with headcount planning software to forecast total future labor costs.

Managing Cost Rate with Mosaic

When it comes to tracking and managing cost rates, Mosaic is the perfect tool. The all-in-one strategic finance platform can automate calculating and monitoring cost rates, providing valuable insights for decision-making.

This is done through direct integration with your existing sales, marketing, HR, and accounting software, giving finance teams complete oversight of your company’s data. Mosaic provides detailed metrics and dashboards that show how things stand now, feeding directly into your company’s financial forecasts.

Book a demo today to see how Mosaic can help your business optimize cost rates and improve profitability.

Cost Rate FAQs

Is it possible to have a negative cost rate?

No, it’s not possible to have a negative cost rate when hiring employees. As the cost rate is the total cost to hire someone, including their pay, benefits, and tax, a negative cost rate would mean the employee was paying the employer.

Can cost rate affect employee salaries?

How often should I calculate the cost rate?

Explore Related Metrics

Own the of your business.