Three Financial Factors that Sank Quibi in Six Months Flat

Joe Michalowski

Director of Content

NYU Stern School of Business professor Scott Galloway predicted Quibi would fall apart eight months before it did. Unsurprisingly, that rubbed some Quibi leaders the wrong way. On Vox’s Pivot podcast, Galloway said he “got a call from the CFO of Quibi before it even launched and [she] said, ‘You have to stop dancing on our grave before we’ve even been birthed.’”

Well, six months after launch, Quibi officially died, so Scott Galloway can happily dance on the grave.

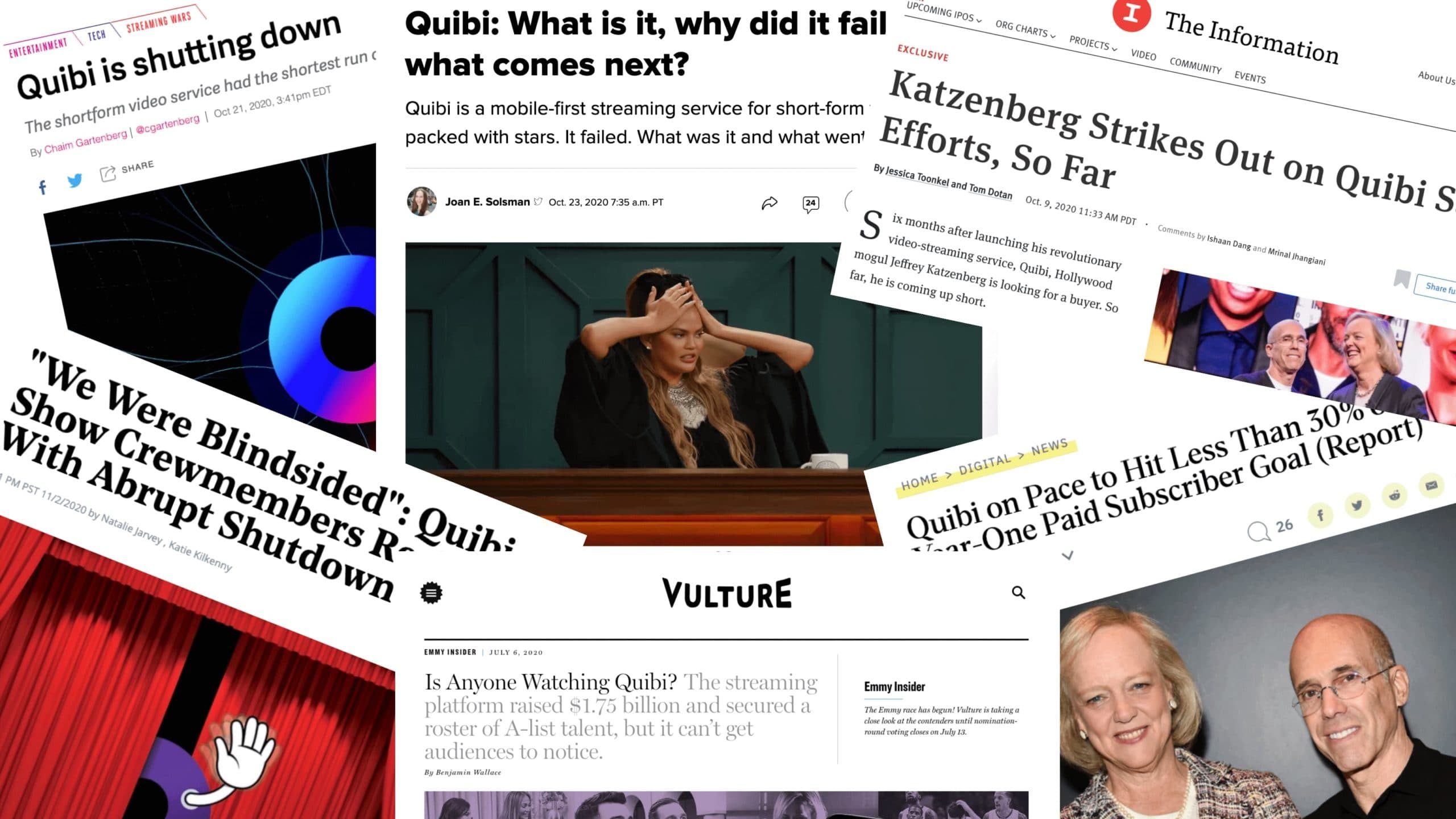

If you’ve (somehow) missed the barrage of Quibi news and commentary, here’s what you need to know. Quibi, named for the “quick bites” of short-form video content it would offer users, was founded by Jeffrey Katzenberg (founder of DreamWorks) in August 2018 and quickly closed a $1 billion round of funding. With grand aspirations to compete in the streaming wars, Quibi raised another $750 million in March 2020 before launching its platform in April 2020.

And it did not go well.

Ahead of the platform’s launch, Quibi CFO Ambereen Toubassy told Variety: “We concluded a very successful second raise which will provide Quibi with a strong cash runway. This round of $750 million gives us tremendous flexibility and the financial wherewithal to build content and technology that consumers embrace.”

Launching at the scale necessary to meet Quibi’s lofty goals was always going to take a heroic feat of financial planning. As CFO, Toubassy had to shoulder all of the challenges that come with forecasting and tracking financials at that scale. However, the execution of strategic finance just wasn’t there.

Executives have been quick to blame the COVID-19 pandemic for the platform’s problems. But if there’s one thing you take away from Quibi’s story, remember that it wasn’t a freak health crisis that sank the company—it was a lack of financial fundamentals that resulted in the Quibi failure.

Trying to Outrun the Burn Rate

Even after raising a total of $1.75 billion in funding, Quibi managed to spend money at an unsustainable rate. As Quibi’s CFO noted, the two rounds of funding should have set the company up with a strong cash runway—the kind that could support the platform’s aggressive entry to the streaming wars. But a closer look at the company’s spending shows that an unmanageable burn rate almost completely wiped that runway out over the platform’s six-month life span.

Reports show that after paying outstanding bills, Quibi will be returning $350 million to its shareholders. Without more insight into Quibi’s revenue, it’s tough to estimate a net burn rate. But, at the very least, the company spent $1.4 billion over the course of about 26 months, putting its monthly gross burn rate somewhere between $40 million and $50 million.

That figure obviously proved unsustainable, but where was all the money going? There were two standout costs eating into Quibi’s runway:

- The $100k-per-minute production problem: At one point, Katzenberg said Quibi’s first-year content budget was $1.1 billion, and that higher-profile, scripted shows would have production budgets of $100,000 per minute. According to TechCrunch, CEO Meg Whitman “proudly contrasted the jaw-dropping sum to the estimated $500 to $5,000 an hour spent by YouTube creators.” The result? A product in limbo between two different target markets. They committed to the “Hollywood-quality content” of a Netflix or an HBO to compete against free-to-watch powerhouses like TikTok and YouTube. The cost of content proved too high.

- A prelaunch “hiring rampage”: Just a year after starting the company, and before ever bringing a product to market, Quibi’s head count was already at a costly 160. Then, in August 2019, people close to Quibi told Business Insider the company was about to go on a hiring rampage. The company hired expensive talent, like Netflix’s director of acquisition marketing, DC’s entertainment president, Netflix’s head of product creative, and at least 17 Snapchat engineers. Another year later, Quibi’s head count reached at least 260, and the company had to ask senior executives to take a 10% pay cut to avoid layoffs, according to the Wall Street Journal.

Other factors impacting Quibi’s burn rate included a 10-year lease on a 49,000-square-foot office in the heart of Hollywood, fees from a legal battle over its app features, and (maybe most importantly) an astronomical marketing budget for a new startup—but that deserves its own section.

Creating a CAC Nightmare

Right as the platform was about to launch, reports said Quibi was planning to spend between $400 million and $500 million on marketing in 2020, with a target of 7.4 million paid subscribers for the first year. In the best-case scenario, that would put customer acquisition costs (CAC) at $55-$65, which doesn’t sound too bad compared with Stratechery’s 2018 estimate that put Netflix’s CAC at $45-$60. Like the CFO’s plans to use the recent $750 million in funding to stabilize runway, these projections seem acceptable in theory.

However, postlaunch disappointments complicated Quibi’s CAC. External factors like the pandemic and lukewarm reception for the platform led to a much tighter marketing budget and (at best) 500,000 paying customers by October 2020.

One study found that from launch through the company’s shutdown, Quibi ended up spending only $63 million on ads after launch. Even if you use that figure as Quibi’s entire marketing budget, the most conservative estimate would put its CAC about 2x higher than expected. That’s a problem, but it’s not exactly a nightmare.

The real CAC nightmare becomes apparent when you factor in the content costs. If you were running strategic finance for Quibi, you couldn’t have a CAC conversation without considering the money spent on the content library. This is a streaming business, which means content isn’t just a product development concern—it’s a tool for customer acquisition. Quibi invested heavily in big-name creators, hoping that it would translate to more paying customers while massively skewing CAC.

Assume that a conservative 20% of the $1.4 billion Quibi spent in 26 months went to production costs for its initial slate of shows. That’s $280 million to add to the $63 million in ad spend. Calculated against the base of 500,000 paid subscribers, CAC jumps all the way up to a crushing $686.

When reports came out saying Quibi was only able to convert 8% of its free trial users to paid subscribers, it was clear that customer lifetime value (LTV) was also going to be an issue. And, ultimately, the LTV to CAC ratio was just impossible to fix—especially at Quibi’s scale.

Committing to Overcapitalization

Raising $1 billion to open the company may have doomed Quibi from the start. It positioned Katzenberg and Co. to fall victim to overcapitalization. Because the company had so much cash on hand, product-oriented leaders like Katzenberg and other executives felt they could bypass financial fundamentals and spend hundreds of millions of dollars before ever generating revenue or even bringing an MVP to market. This path left the company with massive expectations that were almost impossible to meet.

This was especially problematic as Quibi tried to prove its model. Here’s how Katzenberg would explain the strategy early on:

I’m going to continue to believe, and argue, and preach that Quibi is not a substitute or a competitor for television. Our [service] is exclusively about what you do from 7 a.m. to 7 p.m. on your phone. And what you’re doing today, if you’re in our core demographic of 25- to 35-year-olds, is you’re actually watching 60-70 min of YouTube, Facebook, Instagram, and Snapchat. That growth is now a well-established consumer habit that Quibi is sailing into.

One of the biggest consequences of Quibi’s overcapitalization and commitment to blitz the market was that it was almost impossible to act like a true startup when consumers didn’t respond well to the platform, ultimately resulting in Quibi shutting down. Startups pivot all the time when their initial ideas aren’t working. Quibi couldn’t. As Scott Galloway said on the Pivot podcast, “Great companies start small, validate a concept, almost always pivot to something that’s working. This was, let’s start with $1.5 billion.”

Raising a massive amount of money (like Quibi did) isn’t inherently a problem. You only start to see the consequences of overcapitalization when all that money leads to poor financial hygiene. And this can happen at any scale. Whether you’ve raised $1 million or $100 million, your financial forecasts have to remain realistic to maintain stability as the business evolves rapidly.

It didn’t take long for Quibi’s financial forecasts to prove unrealistic. But by spending so much money so quickly, they backed themselves into a corner that limited their options as the platform missed subscriber projections by a wide margin.

Good Financial Hygiene Prevents Quibi-Sized Disasters

Raising more than $1 billion in funding isn’t exactly common, so we probably won’t see startups labeled “the next Quibi” anytime soon. But that doesn’t mean you’re immune to the same kinds of problems that sank the streaming platform so quickly.

Maybe Katzenberg is right, and the pandemic really did limit Quibi’s potential. Maybe everyone on the outside is right, and the product-market fit just wasn’t there. People will argue those points endlessly as Quibi goes down in history as one of the fastest startup failures ever.

What can’t be argued is the fact that poor financial hygiene was at the very core of Quibi’s problems. By prioritizing a “revolutionary” product vision over strategic financial decision-making, Quibi dug a hole so deep that it had no choice but to shut down. Don’t fall into the same trap.

Whether you’re well on your way to becoming the next unicorn, or you’ve just raised your seed round, make sure you can run financial forecasts continuously and that you have real-time insight into your key go-to-market metrics. When you can answer key financial questions at the pace of your business, you’re able to collaborate with stakeholders more effectively and put yourself in the driver’s seat for strategic planning. And that’s how you avoid a Quibi-sized disaster.

Own the of your business.