There comes a time for every scaling finance function when Excel’s row limit becomes a very real problem. And when you see that problem on the horizon, you start to think about bringing business intelligence (BI) into your tech stack.

Too bad implementing (and using) powerful BI tools like Looker and Tableau comes with crushing complexity and costs.

Business intelligence has become a necessity for finance at scale. But financial business intelligence, specifically, has to be a purpose-built solution that delivers the power of BI without the technical complexity.

Table of Contents

What Is Business Intelligence (BI)?

Business intelligence is a combination of software, process automation, and potentially machine learning and artificial intelligence that helps companies turn massive amounts of data into actionable insights about the organization.

Business intelligence software is meant to be a self-service option for data analysis. These tools can ingest information from any and all data sources across your business, breaking down silos in your business and providing insight into KPIs that draw from cross-functional operational data.

In theory, business intelligence solutions should be the future of finance. Big-data analytics platforms that can process endless amounts of information and visualize it in a way the business can understand? Sounds exactly like what the modern CFO and finance team need.

The right BI solutions give finance the ability to:

- Build financial dashboards with centralized data

- Create a single source of truth for planning and budgeting processes

- Automate and optimize data collection and analysis workflows

- Uncover competitive advantages by drilling deeper into data

The only problem is that no matter which of the many business intelligence providers you work with, the tools aren’t built specifically for finance. You should be focusing more on plotting a path to profitability — not building ETL pipelines and writing code.

Finance Can’t Keep Up With Big Data Without Business Intelligence

All the SaaS tools that keep your business up and running create so much financial data that, eventually, you can’t manage it all in spreadsheets. That’s when business intelligence becomes a necessity. You need BI’s processing power to maintain control of the numbers after your spreadsheets reach a tipping point with big data.

Financial data tipping points aren’t sudden, though. You slowly start to realize that the dataset you used to download in 20 seconds now takes a few minutes. Before long, it starts to take 20 minutes just to download that same dataset you need to get your job done.

When you see those simple warning signs, you’re approaching at least one of three key data management tipping points with your spreadsheets:

- Employee Count: When I worked at Palantir, headcount data started to break our spreadsheets around the 1000-employee mark, especially when employee mobility became fluid.

- Customer Count: At 100 or 150 customers in the pipeline, all the data that comes with new opportunities, customers moving through the funnel, prospects dropping out, churn of existing customers, and renewals/upsells will quickly overwhelm your spreadsheets.

- Transaction Count: It’s harder to nail down a specific tipping point for transaction count because it depends on the complexity of your business. But at a certain point, payment data from hundreds of software vendors around the world will make financial reporting in spreadsheets nearly impossible.

If you don’t want to invest in a BI tool when you hit one of these tipping points, you’re essentially left with two workaround options.

First, you can start breaking down your business into subsections, so the data is manageable in spreadsheets. Then, you start to scale your finance team around these niche business specialties. But without a way to connect the dots between those subsections, you lose sight of the bigger picture, and you struggle to play the role of a strategic business partner.

Your other option is to rely on the data-visualization capabilities of individual business systems. You might get some actionable insights from a reporting layer that sits on top of QuickBooks, Salesforce, or your ERP. But without a way to connect all that data, you’ll never get a cohesive financial story.

Business intelligence gives finance a way to connect, visualize, and analyze data from all business systems at any scale. The only problem is that it’s far from a plug-and-play standard like Excel spreadsheets.

Go Beyond BI with Strategic Finance Software

But Implementing BI Is a Steep Uphill Battle

The truth is that implementing and maintaining business intelligence is unnecessarily difficult for finance teams.

Even if you invest the six to nine months and hundreds of thousands of dollars that it takes to get business intelligence off the ground, you’ll still have to deal with significant technical challenges to actually use and maintain it.

Challenge #1: Piping Financial Data to a Database

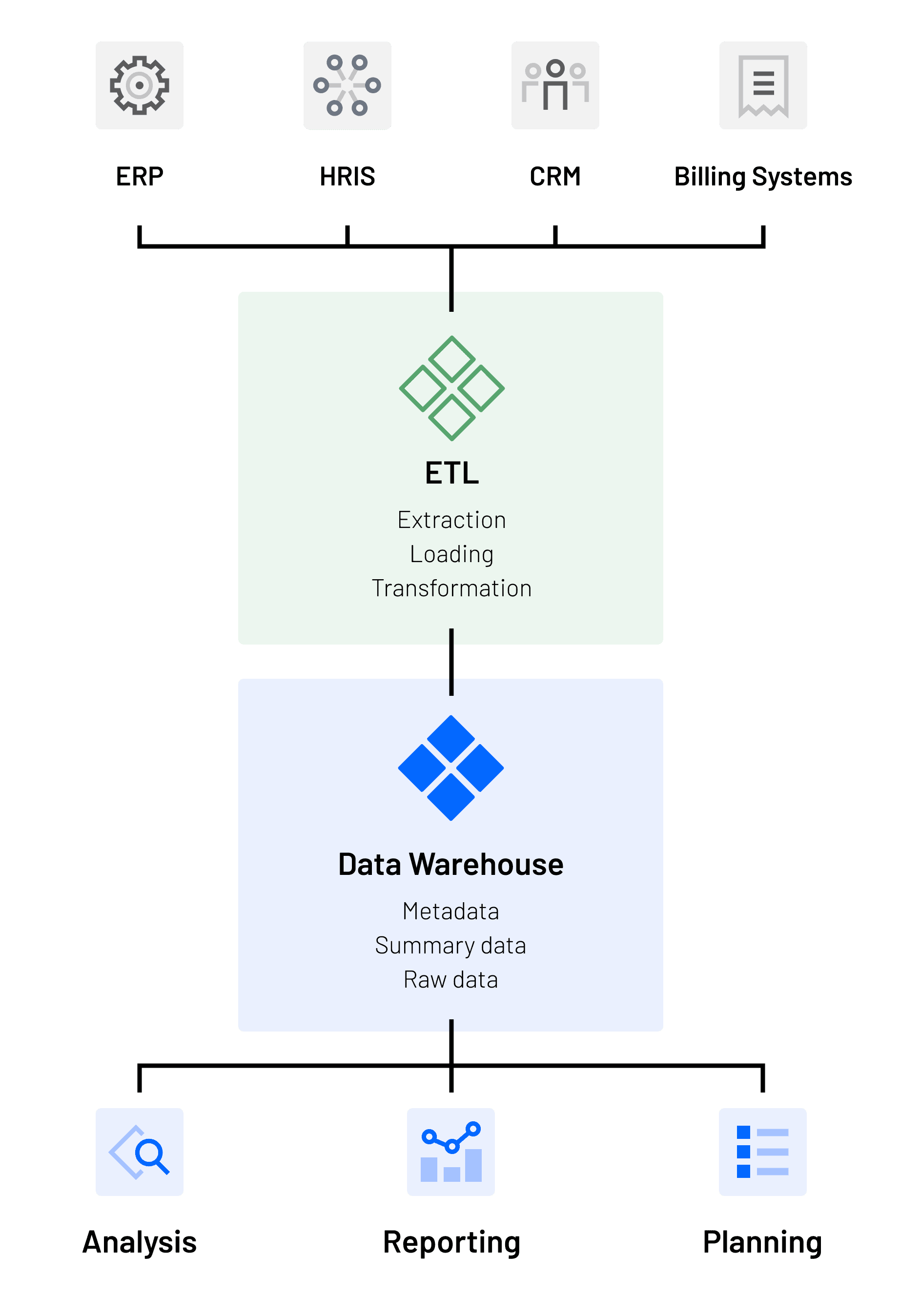

The average finance team doesn’t have the kind of technical skill necessary to set up the database and ETL pipeline that power business intelligence solutions. Without that technical skill set, you won’t be able to fuel BI tools by connecting them to financial data from the entire ecosystem of point solutions that run your business—NetSuite, Quickbooks, Xero, Salesforce, ADP, Gusto, all your payment systems, and more.

Configuring the BI tech stack requires a database admin who can set up permissions and build the ETL pipeline that aggregates the full scope of financial data. But most teams can’t make this internal hire for the finance function, and pulling data engineers away from mission-critical projects to set up financial business intelligence is probably out of the question.

Challenge #2: Maintaining Your “Trust and Verify” Responsibility

One of finance’s fundamental responsibilities is to “trust and verify” the company’s numbers on a regular basis. But when financial data collection requires so much code that your team doesn’t understand, it’s nearly impossible to verify that the numbers are accurate.

You can overcome the challenges of initial implementation by hiring a consultant. Then what? Unless you have a working knowledge of SQL, Python, or LookML, you’ll never have a true, granular understanding of your numbers. And when you don’t understand the numbers at a granular level, problems start to fall through the cracks and create massive strategic issues, making it hard to prepare for a financial audit.

Challenge #3: Scaling Data Analytics Capabilities

Your data analytics capabilities need to scale alongside your modern finance function, evolving to meet the ever-changing needs of your business. But because of the technical complexity of business intelligence, scaling data analytics capabilities after implementation is easier said than done.

Implementing business intelligence isn’t a set-it-and-forget-it project. A consultant might be able to get you up and running. But what happens when a board-meeting update pushes you to change one of your calculations? You can’t just keep sinking money into consultants or using engineering resources every time the initial configuration gets stale.

Traditionally, you’d need to hire full-time staff just to manage the BI stack or turn your finance pros into data engineering experts. And neither option is a good one.

The Solution: Purpose-Built Financial Intelligence with Mosaic

Mosaic is a purpose-built financial intelligence solution that gives you the advanced business analytics you need from BI without any of the technical complexity.

Our goal is to empower CFOs with the resources they need to advance their positions as strategic partners in the business. And for scaling finance functions, that starts with making business intelligence far more accessible.

Mosaic Eliminates Complex Database and ETL Pipeline Configuration

We simplify the BI tech stack by integrating directly with all of the point solutions that run your business. Everything from your ERP to your CRM, payroll, billing, and payment systems funnels financial exhaust directly through Mosaic, consolidating your data, so you get a cohesive view of the business.

You shouldn’t need to spend months and millions of dollars setting up an ETL pipeline and database to streamline planning, analysis, financial consolidation, and the other critical functions of your role. And with Mosaic’s simple integrations, you don’t have to.

Mosaic Makes It Easy to Scale Strategic Finance

Cutting out the database and ETL pipeline means that all the numbers you see in Mosaic are actuals pulled directly from your point solutions. Real-time visibility into your financial data satisfies your “trust and verify” responsibility. And when you don’t have to worry about so many technical challenges, you can focus far more effort on strategic finance.

Purpose-built financial intelligence empowers your strategic finance function with:

- Granular Operational Insight: Understand your numbers at the most granular level to drive operational efficiency. Maintain your “trust, but verify” responsibility, and dig deep into your financial metrics to make more informed business decisions.

- Simplified Financial Planning and Forecasting: Get an automated, predictive forecast for each account and easily understand all of your company’s most fundamental financial assumptions. Plan multiple scenarios and compare SaaS financial models without any technical configuration.

- Easy Collaboration Across the Entire Business: Present financial data in a way that anyone in your business can understand. Enable strategic decision-making for business leaders by providing digestible views of financial insights relevant to their departments.

The responsibilities of CFOs and finance departments at large have increased exponentially in recent years. Implementing general-purpose business intelligence only exaggerates the problem by forcing you to become part data engineer. A purpose-built financial intelligence solution like Mosaic lets you focus on what you do best.

Business Intelligence Is Necessary for Finance—It Just Shouldn’t Be So Complicated

There’s no denying the raw power of Tableau and Looker. But is that power really worth it if you have to retrain your team to be data engineers while still paying for all those point solutions, ongoing maintenance for an ETL pipeline and database, and a financial planning tool like Anaplan or Adaptive Planning on top of it all?

Pricing for the entire BI tech stack quickly gets out of control. But for scaling finance functions that haven’t had an alternative? It’s been worth every penny.

But you don’t really need business intelligence tools that can do anything and everything. You need one that’s built specifically for finance. And that’s what you get with Mosaic.

Want to learn how you can move beyond BI? Get real-time Financial Business Intelligence without the lift. To see Mosaic in action, reach out for a personalized demo.

Financial Business Intelligence FAQs

What is the role of business intelligence in finance?

Business intelligence provides your finance team with easily accessible real-time data to gain insights into operational plans, financial performance, and predictive analytics. BI allows decision-makers to put data-driven initiatives into place and drive bottom-line growth.

Why is financial business intelligence important?

Own the of your business.