Continuous planning shouldn’t feel like a revolutionary idea. Where traditional financial planning centers around a fixed annual budget, continuous financial planning considers the financial management and objectives of a company to be a constantly moving set of parameters, recalibrating as the business landscape changes — which it does. A lot.

The only certainty with traditional budgeting is that the figures laid out at the start of the year will not be 100% accurate by the end of it. So if traditional budgeting is so obviously flawed, and continuous budgeting offers an apparent solution, then why has it not become the standard for finance teams everywhere?

It comes down to complexity and the challenges of accessing the right data. While continuous budget planning can offer a far more accurate and dynamic way to manage a company’s finances, the need for constant updates requires accurate, timely data, and the time and resources to collate, organize, and analyze it.

That’s tough if you’re building everything manually in Excel or Google Sheets. In this article, we get into the details of continuous budgeting, break down exactly how it works, and show you how you can implement it without complexity or placing a huge resource burden on your finance team.

Table of Contents

What is Continuous Planning?

Continuous planning is a business planning and budgeting technique where you conduct strategic reviews whenever circumstances change.

Moving to continuous planning allows a company to be far more agile and dynamic in their strategy, revenue forecasting, and resource allocation than they would be if they relied solely on traditional planning processes and annual budgets. Continuous planning gives you the ability to alter plans in response to changes in demand, product delays, economic conditions, delays in hiring plans and more.

The continuous planning process makes financial decision-making a key component of the strategic direction of the company rather than a static, potentially detached process that happens once a year. Continuous planning enables companies to make far better use of their resources and quickly take advantage of changes in market conditions.

The Benefits of Continuous Planning

Businesses of all sizes should consider continuous planning because it boasts an array of benefits that traditional planning does not, such as increased agility and better cross-team collaboration.

Agility

The core benefit of continuous planning is agility. Traditional financial planning and budgeting doesn’t align with the way businesses operate. The market doesn’t stay static for a year or a quarter and let companies calmly roll out their strategy. New products can perform better or worse than you expected, economic crashes can happen without notice, and government regulations can change.

With an agile financial planning process built into your business, all of these things can be adjusted for, allowing the company to better mitigate risks and take advantage of new opportunities as they arise.

Collaborative Decision-making and Empowerment of Teams

Gaining oversight of quantitative data for reassessment is central to continuous planning, but so, too, is the qualitative information that adds context to the raw numbers. In simple terms, that means the leadership team, department heads, and team members can discuss what’s working and what’s not.

This not only helps keep plans effective, but fosters a positive working relationship within the team and a feeling of mutually working towards company strategic goals, rather than simply following directives handed down from above.

Finance leaders should make it clear that insights from all levels of the business are vital in making continuous planning a success.

Transparency

A strong focus on data and a collaborative approach to decision-making means a high level of transparency in companies that operate on a continuous planning model. This helps build trust within the company and gives everyone the opportunity to spot problems and opportunities.

Get the Startup’s Guide to Finance Fundamentals

While continuous planning offers some serious benefits, there’s a risk if it’s not executed well. Because continuous planning is designed to facilitate constant change, it can be easy to fall into the trap of pivoting too frequently and losing track of the long-term strategy. That’s why it’s important to understand that while tactics might change, the overall strategic vision for the company needs to remain stable and consistent.

The 5-Step Process of Continuous Planning

The fundamental components of the continuous planning process are similar to traditional planning, with the main difference being the frequency of the process. Here’s an outline of the steps you need to take to implement continuous planning.

1. Integrate Data

Access to real-time data is a requirement for this form of dynamic planning to be effective. Without that, there’s no way to know where things are right now and what needs to change. It’s hugely beneficial to have an accurate and current overview of your company’s financial performance and cash position both for continuous planning and beyond.

But while having access to this data at your fingertips can be a major competitive advantage, making that happen isn’t easy. Or at least, not until tools like Mosaic have allowed it to be done in a way that doesn’t require hours of manual data collection and organization every week.

2. Create Plan

FP&A teams can then use that real-time data to create the plan. This process will look very similar to a traditional planning approach. You’ll set the budget based on the method you’ve decided on, such as zero-based budgeting for example.

3. Reassess Continuously

The key differentiator in a continuous planning approach is this plan doesn’t become set in stone for a year or a quarter. Constant reassessments of a company’s current position and growth objectives are conducted whenever there is new information. Any time there is a change in circumstances, the plan needs to be reviewed and assessed for suitability. Updating your plan monthly is most common.

It’s similar to using a GPS navigation device as opposed to an old-school paper map. The route created with the paper map doesn’t change, regardless of traffic or weather conditions. A GPS, on the other hand, constantly reassesses the route and makes changes on the fly to get you there as quickly and safely as possible.

4. Utilize Automation and Technology

Automation and technology should be used wherever possible in the continuous planning process. The continuous planning process is data and resource intensive. Automation can allow for adjustments that don’t need a complete manual tear down of the original plan.

That’s why continuous planning goes hand in hand with the integration of technology in the FP&A and strategic planning process. The less manual work involved in the continuous planning process, the more agile and effective it can be.

5. Anticipate Future Changes

An important aspect of continuous planning is the need to look ahead. The whole strategy is based on changing plans when new information arises, and this necessitates looking at how this new information could impact the company roadmap.

Keeping a constant eye on the future helps a business stay ahead of the competition, who may be more focused on hitting targets that were last relevant up to a year ago.

Why Continuous Planning Matters More Now Than Ever

Static. Stable. Consistent. Boring. Those are not words that anyone would use to describe the economic or geopolitical environment of the past few years. It’s a cliche to say, but there is just so much change — all the time.

Five years ago, TikTok had only just launched in the US, inflation was under 2%, most people outside of Silicon Valley had never heard the term generative AI, and the word “pandemic” was one we all thought had been left behind 100 years ago. We’re dealing with constant geopolitical tensions, wars, market volatility, domestic political issues, and always-expanding technological advances.

All that is to say that businesses need to be adaptable. They need to have a planning strategy that can change in the new face of new information, new challenges, or new opportunities. Continuous planning accepts that change will happen, and sets in place business processes to deal with it.

The Shortcomings of Traditional Tools in the Continuous Planning Era

For decades, the world has run on spreadsheets. They’ve come a long way since the days of paper and pencil, but even with the use of sophisticated formulas and macros, there are some serious limitations and inefficiencies inherent to Excel and Google Sheets when it comes to continuous planning.

Lack of Direct Integrations

Spreadsheets require manual data collection. Sure, there are ways to minimize this, but it can’t be eliminated completely. That leads to a significant amount of time wasted in low-value data entry tasks, moving numbers from one system or spreadsheet and copying them over to another.

The time cost itself is a problem, but it also means the data being used is always out of date. If a financial model or spreadsheet database takes a week to fully update, that means it’s a week behind reality. Even just a few days can make a big difference at the pace business moves.

Increased Risk

Going hand-in-hand with this manual process is an increased risk to the business. Manual data entry introduces many opportunities for typos or transcription errors and formulas can break. This can cause errors in the data that aren’t immediately noticeable, meaning leaders end up basing their strategic decisions on incorrect data.

Not only that, but the way spreadsheets are shared via links and email attachments exposes sensitive financial data to security risks.

Reactive Planning

With data that is always out of date and a process that relies heavily on manual work, spreadsheet-based planning is generally only able to identify issues or opportunities after they become very clear.

Spotting trends or anomalies in the data is difficult, if not impossible, unless analysts are already specifically looking for them. This is a significant drawback when compared to modern planning tools, which utilize technology like generative AI to highlight emerging trends or data irregularities that warrant a closer look.

Continuous Planning in the SaaS Universe with Mosaic

We’ve talked a lot about the need for the right software tools and technology to enable effective use of continuous planning. The first step in this process is to choose a central source of truth for all of your corporate data.

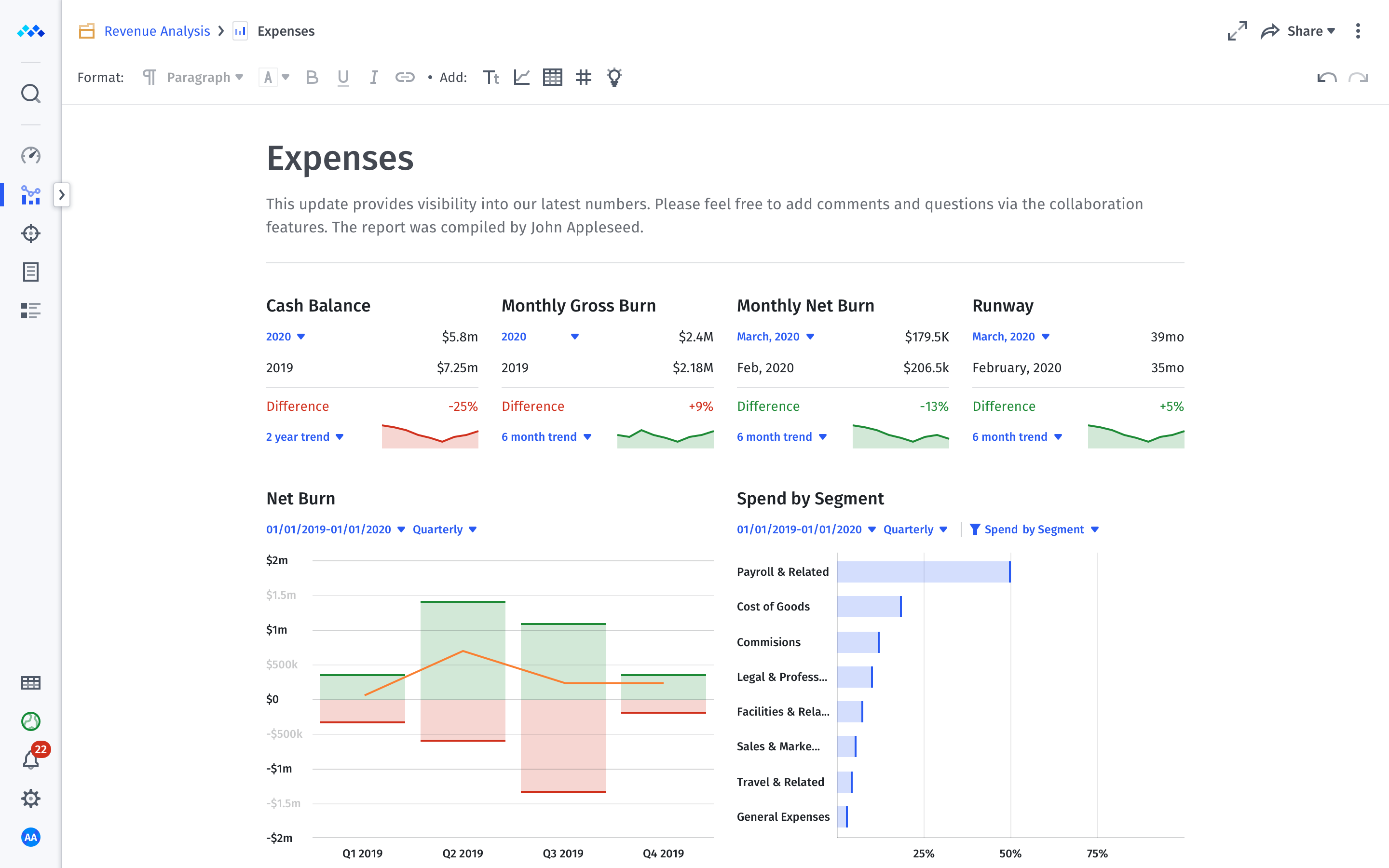

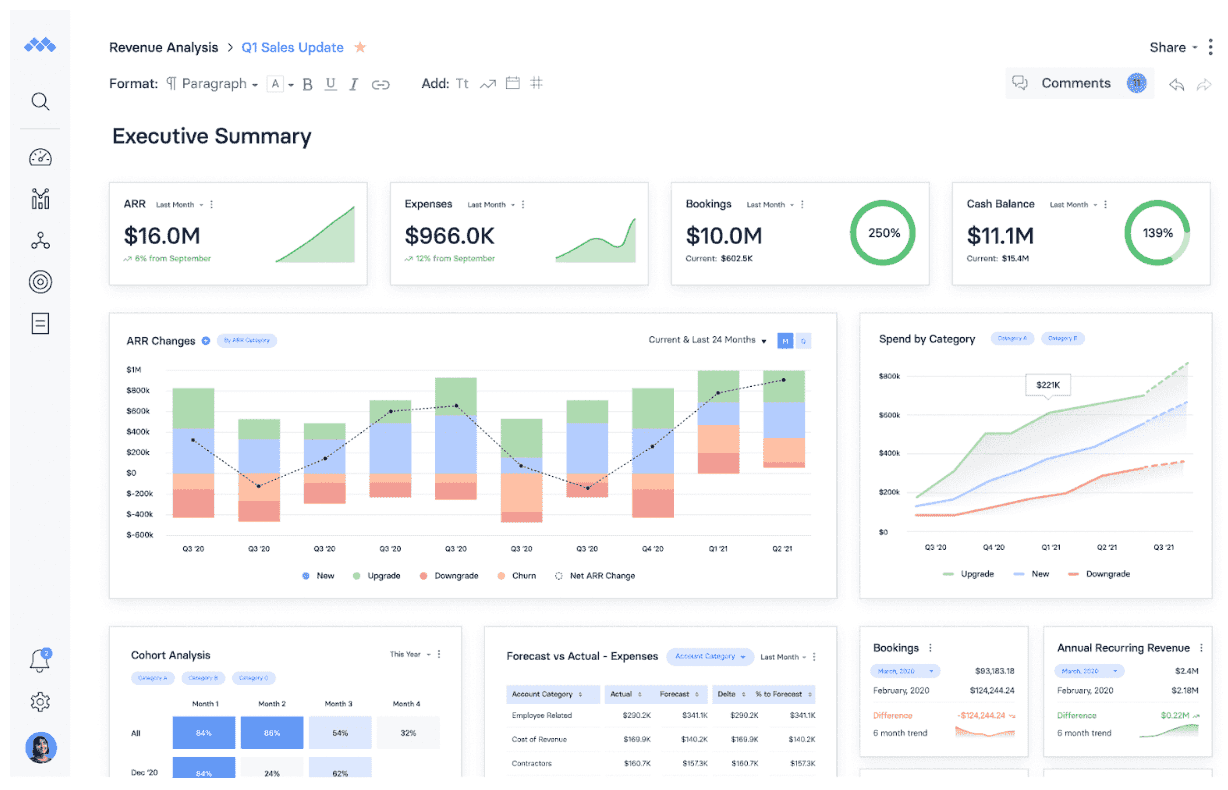

That’s exactly what we’ve built with Mosaic, a centralized hub with real-time data capabilities, sophisticated modeling and scenario planning tools, and customizable visual dashboards that keep your most important metrics at your fingertips.

By connecting your real-time data sources directly with tools that allow you to manipulate, review, and forecast your data in just about any way possible, continuous planning becomes a natural way to operate.

By changing just a few assumptions for these forward projections, you can quickly see side-by-side the impact of those changes. This removes the need to create complex manual models in spreadsheets and gives decision-makers the capability to iterate quickly and easily.

Mosaic’s Role in Cross-Departmental Collaboration

Mosaic enables teams to easily see the impact of their work on the broader business.

Executives can draw direct lines between the performance of individual departments and the business as a whole, and teams can utilize the data to draw up accurate and realistic strategies to reach their own individual targets.

For example, accurate forecasting from the marketing department can help the sales team plan better, ensuring they have sufficient headcount and customer service resources to meet expected demand. A cloud-based, rather than spreadsheet-based approach also makes sharing this information substantially easier.

As Enrique Esclusa, Co-Founder at Assemble, put it, “The biggest (pain point when using spreadsheets) is the misalignment and lack of collaboration. And I think a big reason for this is that when you’re living in a spreadsheet, there’s one owner and not everybody can access the real-time version.”

Not only that, but leaders have complete control over the data, giving direct reports access to information that they need to see without overwhelming them with data that isn’t relevant to their department or business unit.

Navigating the Future with Continuous Planning

SaaS businesses, in particular, are facing a more difficult environment than they have for a long time. With that comes the need to remain agile in the planning process. SaaS businesses need the flexibility to change tactics and strategy when the situation calls for it.

Continuous planning embeds change as a normal part of the way a company operates and empowers all levels of the company to constantly look for ways to improve or course-correct. With the right cash flow forecasting software, not only can this planning methodology be more effective, it can also be more efficient, which allows teams to spend less time on low-value data manipulation, and more time on high-value strategic work.

To see how Mosaic can facilitate continuous planning in your business, provide centralized real-time access to all of your financial data, and provide access to sophisticated forecasting and scenario planning tools, book a demo today.

Continuous Planning FAQs

What is continuous planning and how does it differ from traditional planning?

Continuous planning is a business planning technique that relies on regular strategic and tactical reviews. Where traditional planning is done in a static way, annually or quarterly, continuous planning is done on an ongoing basis as circumstances change.

Can smaller businesses also benefit from continuous planning, or is it only suitable for larger enterprises?

How do tools like Mosaic streamline the continuous planning process?

Own the of your business.