The Snowball Effect of Financial Assumptions

Joe Garafalo

Founder and COO

The way you manage financial assumptions could make or break your business. Your financial assumptions are the levers you pull to project how strategic finance plans will impact revenue, expenses and cash flow forecasts. They’re the bedrock of financial planning that drives growth and efficient operations.

But staying in control of key assumptions as they evolve in volume and complexity is easier said than done.

Entrepreneurs can’t afford to let financial assumptions snowball out of control. Take a more agile approach to financial planning to make your forecasting more flexible and scalable.

Table of Contents

How Financial Assumptions Snowball Out of Control

Financial assumptions snowball out of control when they’re overly complex and intertwined. You might be able to get away with creating financial models with granular assumptions at a small business or early-stage startup. But over time and as a company grows, hyper-specific assumptions become unwieldy and ruin financial forecasts. Assumptions tied to 3 or 4 different dependencies may sound sophisticated but often lead to false precision.

Take assumptions about travel expenses as an example. With a granular approach, you might decide to base your travel expense assumption on historical financial data for every employee. You start building the financial model with assumptions like “Employee 1 will spend $X per month on travel,” “Employee 2 will spend $Y per month on travel,” and so on until you’ve accounted for all of your staff.

But unless you only have a handful of employees, you’ll have to manage a massive amount of transaction data to maintain those assumptions at the individual level. Any time you wanted to update the financial model after the initial setup, you’d have to pull new data for every employee and get stuck in Excel for hours reworking one small piece of a much larger model.

Overly precise financial assumptions just don’t scale.

Multiply that one example by dozens or even hundreds of assumptions across the 50+ spreadsheets that house all your different financial models, and it’s easy to see how it can all snowball out of control.

And yet, many finance leaders continue to take the granular approach to financial assumptions. Why? Because it seems to create the most accurate representation of how the business operates.

But your business is constantly evolving. When those financial assumptions no longer accurately represent the business one, three, six, or twelve months down the road, you’re left with two options—rebuild the entire financial model from scratch or waste countless hours in Excel hell trying to update existing spreadsheets.

Neither option gives you the right level of flexibility to change financial assumptions. So, when the C-suite or your board asks you a question, you can’t actually give them an answer. They might think the question was fairly simple. But the reality is that tweaking the financial model could take you hours or days—and by then, your answer to the question may not even be relevant anymore.

How to Make Key Assumptions for Scalable, Dynamic Financial Projections

There are two things you need to do to make financial assumptions that support more scalable, dynamic financial projections. First, you need to deeply understand your business, including how it’s currently operating and what its strategic plans are. And second, you need to identify the right level of sophistication for individual assumptions.

These tasks might sound basic. But there’s no one-size-fits-all answer to what financial assumptions you should add to your models. They’ll be different for every business. And it’s your job as the finance lead to build the model that represents the business—not just in a way that you can understand, but in a way that helps business stakeholders truly understand financial data.

Creating sustainable, dynamic financial projections is all about marrying intuition with data in your key assumptions. When you strike the right balance, you’ll be able to give your CEO a roadmap for running the business better.

Take the Time to Collaborate and Understand Your Business

The only way you can create a model that represents the business is to step out from behind the spreadsheets and collaborate deeply with your stakeholders. Even though you have full control over which assumptions to put into the model, the only way they’ll be valuable to anyone in the business is if business leaders can understand the financial data.

According to Kalor Lewis, VP of Finance at Fivetran, “building an effective financial model requires a really strong bottom-up understanding of the business . . . You need to know what the sales capacity model looks like, how the marketing team spends its budget, and how the company makes money. Getting that understanding requires deep collaboration with leaders across the company.”

Your business leaders don’t want to get bogged down in financial statements. The cash flow statement, the income statement, accounts payable and accounts receivable data in the balance sheet, tax rates—they’re all critical to building your financial model. But it’s your job to go beyond the financial statements and look through the lens of what matters to the business.

“Building an effective financial model requires a really strong bottom-up understanding of the business . . . Getting that understanding requires deep collaboration with leaders across the company.”

Think of your financial assumptions as the levers business leaders can use to forecast the financial performance of your business plan and answer strategic questions. They care most about answering questions like:

- How can we drive more revenue growth?

- How do we create a faster path to profitability?

- How will strategic plans impact gross profit and gross margins?

- How do our operating expense projections impact how much working capital we will need?

Model your assumptions with a clear focus on answering strategic business questions like these and others that you find are most important to your stakeholders.

Find the Right Level of Sophistication for Your Assumptions

Instead of getting the most granular data possible for your financial assumptions, focus on finding the right level of sophistication for them. That means finding the point of “good enough.” Strike a balance between accounting for 80% or 90% of expenses with maintaining the flexibility to change assumptions quickly.

Grouping expenses is the best way to strike a balance between granular financial data and financial model flexibility.

Start by rolling up as many related expenses as possible into your financial assumptions for headcount planning. This category will account for as much as 70% to 80% of total expenses for a SaaS startup. Do you really need vendor-level assumptions for every GL account, such as software licenses or office expenses? Probably not, because managing these will get unwieldy as your business scales. Simplify your model by grouping these expenses into a broader headcount category and assigning a per employee expense assumption.

Then, pull out your biggest drivers of spend in each category and get granular on things that move the needle. For example, you might find there are certain aspects of your cost of sales that require a dedicated assumption in your financial model. You might need granular insight into large hosting costs from Amazon Web Services (AWS). But maybe you could simplify the model with a three-month or six-month average for generic software licenses. We’re not saying you should ignore the detail of who you’re actually spending money with, but you don’t need a bespoke, manually updated forecast for every single vendor within your business.

Grouping expenses keeps you from getting overly precise with your financial assumptions. The simpler you keep the model (without losing accuracy), the easier it will be to run dynamic forecasts that empower business leaders.

Build Financial Forecasts & Models with Real-Time Data

Take an Agile Approach to Financial Forecasting and Planning

Your financial assumptions should be so flexible that you’re able to take an agile approach to financial planning and forecasting. That means getting out of the familiar monthly or quarterly cycle of going into your financial model, running a budget variance analysis, figuring out where your forecast went wrong, and spending hours updating assumptions.

But the only way to break that cycle is to stop relying on Excel to build your models. A tool like Mosaic can help.

Mosaic Planning is financial modeling software that connects to all of your underlying business systems to collect financial analytics data in real-time. And it’s preloaded with best-practice financial modeling, driver-based planning, and forecasting methodologies. This combination eliminates the back-office Excel work that financial analysts would have to do to keep models and rolling forecasts up to date.

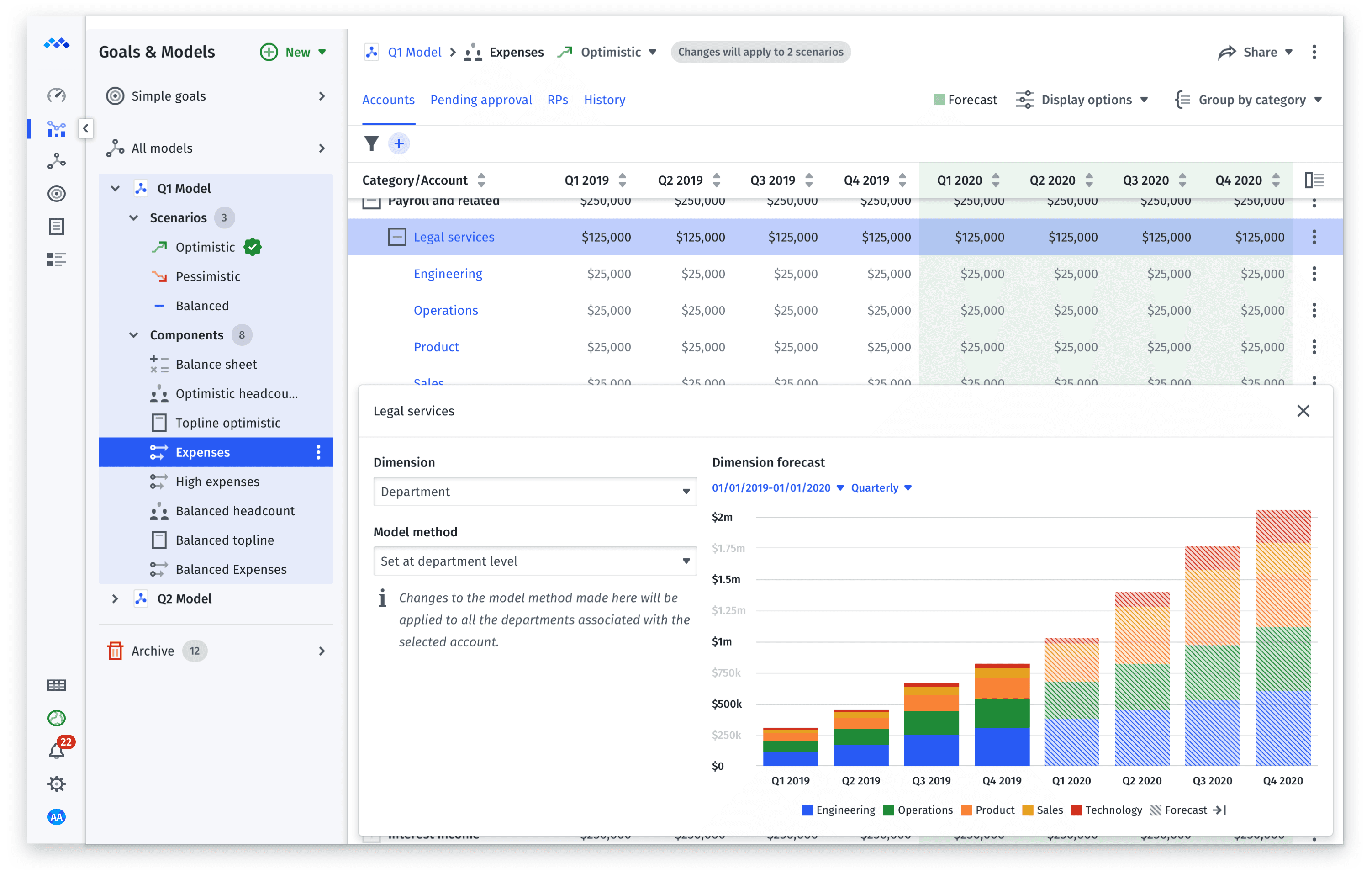

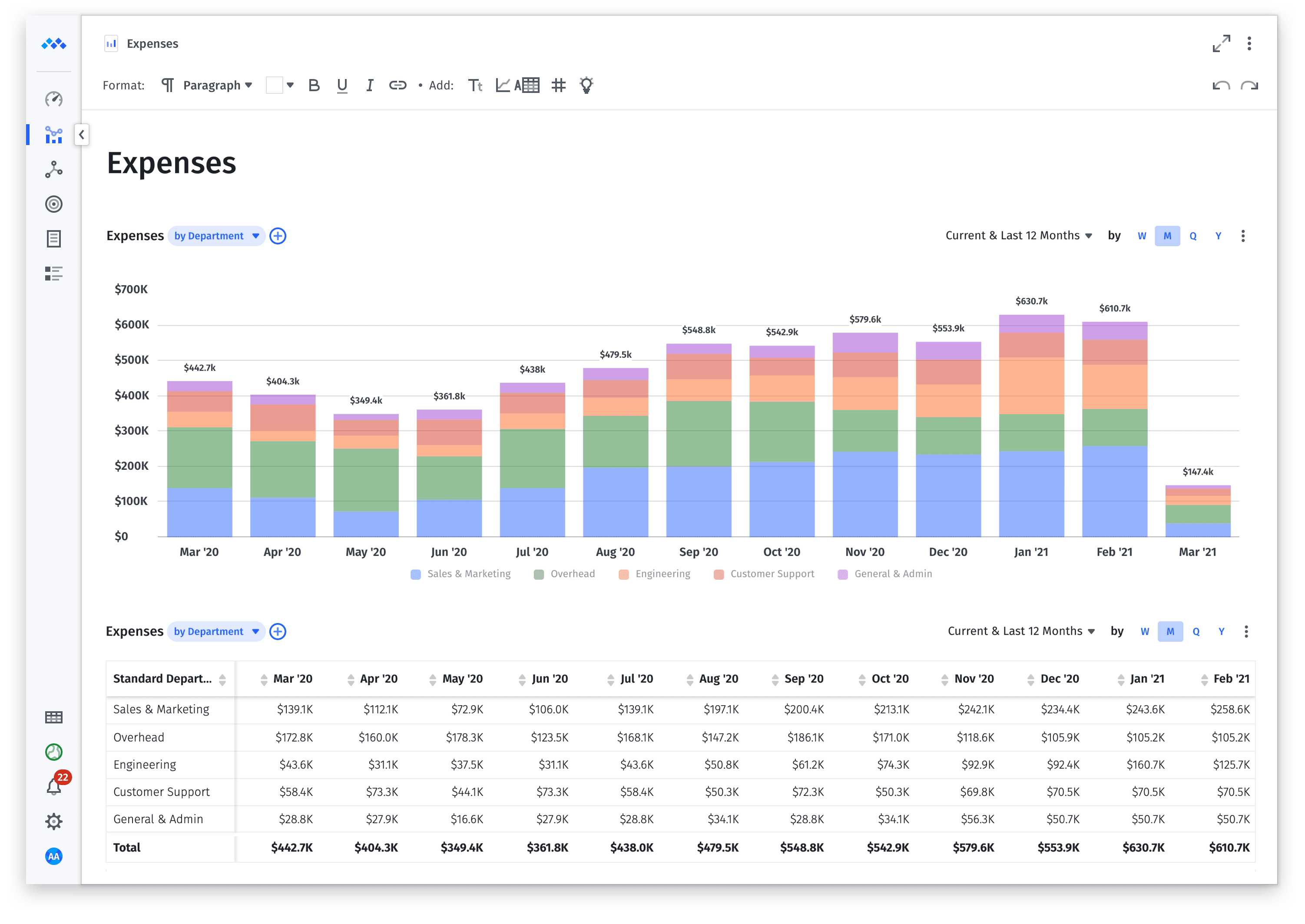

With Mosaic, you no longer have to worry about whether or not you’ve made your financial assumptions too granular. You can model different scenarios quickly—and, as you can see in this image, visualize them in a way that your business leaders will actually understand.

With Mosaic’s financial forecasting software, you can forecast new scenarios in just a few clicks and provide real-time answers to strategic questions from your C-suite or board members.

If your CEO wants to see travel expenses broken down by department, you can do that with a quick filter. If a board member wants to see how a more aggressive hiring plan for the sales team impacts runway, you can quickly visualize the financial data with an expense and cash flow analysis. The image below shows how simple it is to update financial assumptions and forecasts with Mosaic.

The process in this picture might take an analyst a few hours of work in an Excel spreadsheet. And that’s just one of 50+ analyses they have to do to keep the forecast up to date.

Modern CFOs and other finance leaders don’t need to power through the snowball effect of financial assumptions anymore. Get a personalized demo of Mosaic today and learn how you can take a more agile, continuous approach to your financial planning.

Financial Assumption FAQs

What are financial assumptions?

Financial assumptions are hypotheses you make about your financial future while conducting business forecasting. They are the foundation of developing a business plan. CFOs and finance teams may make financial assumptions regarding the impact on sales volume, revenue, liabilities, cash flows, and other financial benchmarks to ensure efficient operations and drive business growth.